Saudi Arabia On-the-go Healthy Snacks Market Size, Share, Trends and Forecast by Product Type, Nutritional Content, Packaging Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia On-the-go Healthy Snacks Market Overview:

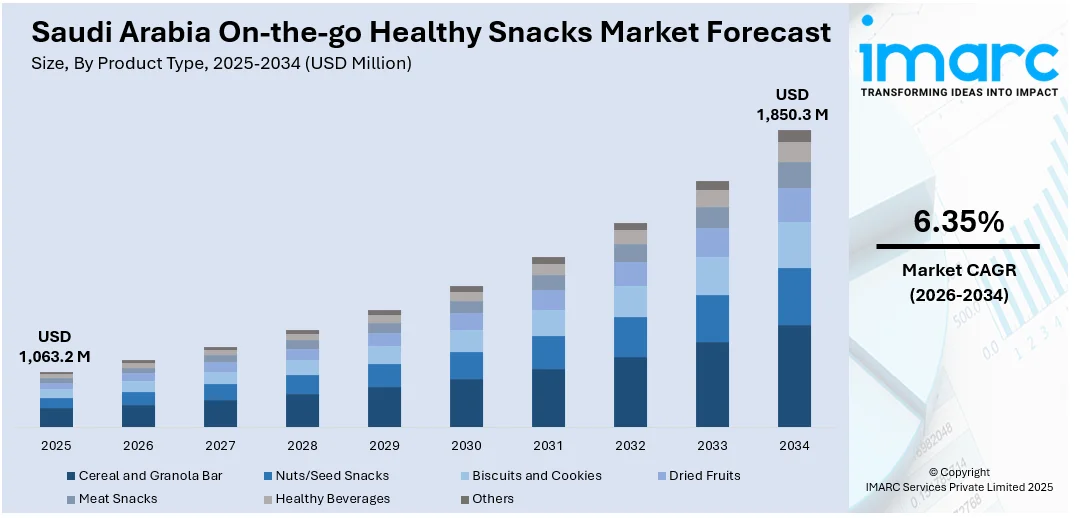

The Saudi Arabia on-the-go healthy snacks market size reached USD 1,063.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,850.3 Million by 2034, exhibiting a growth rate (CAGR) of 6.35% during 2026-2034. The market is witnessing significant growth mainly driven by the rising health awareness, fitness trends, and demand for functional, low-sugar, and protein-rich options. Moreover, convenience, clean-label ingredients, and regional product innovations are driving consumer adoption across urban centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,063.2 Million |

| Market Forecast in 2034 | USD 1,850.3 Million |

| Market Growth Rate 2026-2034 | 6.35% |

Saudi Arabia On-the-go Healthy Snacks Market Trends:

Rising Health Consciousness and Lifestyle Diseases

Rising health consciousness in Saudi Arabia is reshaping consumer snacking habits, particularly in response to increasing cases of obesity, diabetes, and cardiovascular diseases. This shift is contributing significantly to Saudi Arabia on-the-go healthy snacks market growth, as more people seek functional and nutritious alternatives that align with health goals. Consumers are actively choosing low-calorie, sugar-free, gluten-free, and high-fiber snacks to support weight control and overall wellness. Government-led health awareness initiatives, such as Vision 2030’s focus on preventive healthcare, are further encouraging healthier lifestyles. For instance, in November 2024, the Saudi Food and Nutrition Authority launched a campaign to raise awareness about the dangers of added sugar, coinciding with Diabetes Awareness Week. It celebrates companies reducing sugar in products and emphasizes collaboration with manufacturers to promote healthier options, addressing significant public health concerns related to high sugar consumption. The demand spans across demographics from fitness-focused youth to older adults managing chronic conditions. In response, local and international brands are expanding product lines to include healthier versions of traditional favorites, as well as globally inspired wellness snacks. This health-driven shift is expected to continue accelerating and enhance Saudi Arabia on-the-go healthy snacks market share in the coming years.

To get more information on this market Request Sample

Growing Popularity of Protein and Functional Snacks

The demand for protein and functional snacks is growing rapidly in Saudi Arabia, fueled by a surge in fitness culture and wellness-focused lifestyles. Consumers are increasingly looking for snacks that go beyond basic nutrition, opting for high-protein bars, energy bites, and products enhanced with superfoods, vitamins, and minerals. For instance, in February 2025, iPRO announced the launch of its healthy hydration beverages in Saudi Arabia, partnering with Al Rabie to enhance market reach. iPRO Hydrate features natural ingredients, added vitamins, and electrolytes for optimal hydration. This collaboration aligns with the Kingdom's wellness goals, marking a significant milestone in iPRO's global expansion strategy. These snacks are particularly popular among gym-goers, athletes, and health-conscious individuals seeking convenient yet nutrient-dense options to support muscle recovery, sustained energy, and overall well-being. Brands are innovating with plant-based proteins, collagen-infused formulations, and low-carb options to meet diverse dietary needs. Convenience is key, with single-serve and resealable packs catering to active, on-the-go routines. Retailers are dedicating more shelf space to these functional products across gyms, supermarkets, and online platforms. With growing health awareness and evolving consumer preferences, this segment is set to play a pivotal role on the Saudi Arabia on-the-go healthy snacks market outlook.

Saudi Arabia On-the-go Healthy Snacks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, nutritional content, packaging type, and distribution channel.

Product Type Insights:

- Cereal and Granola Bar

- Nuts/Seed Snacks

- Biscuits and Cookies

- Dried Fruits

- Meat Snacks

- Healthy Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cereal and granola bar, nuts/seed snacks, biscuits and cookies, dried fruits, meat snacks, healthy beverages, and others.

Nutritional Content Insights:

- Gluten-Free

- Low-Fat

- Sugar-Free

- Others

A detailed breakup and analysis of the market based on the nutritional content have also been provided in the report. This includes gluten-free, low-fat, sugar-free, and others.

Packaging Type Insights:

- Boxes

- Pouches

- Wraps

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes boxes, pouches, wraps, and others.

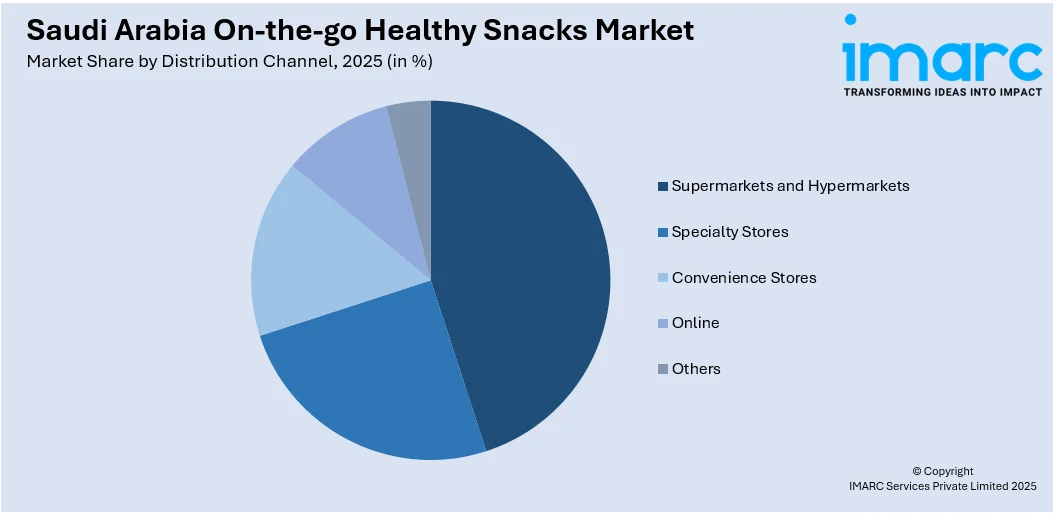

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia On-the-go Healthy Snacks Market News:

- In December 2024, Saudi Arabia introduced Milaf Cola, a sugar-free beverage aimed at promoting healthier options. Developed by Thurath Al Madina, this drink supports local agriculture and showcases the versatility of Saudi dates. The launch positions the country as a growing player in the global food industry, emphasizing nutritious products.

Saudi Arabia On-the-go Healthy Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cereal and Granola Bar, Nuts/Seed Snacks, Biscuits and Cookies, Dried Fruits, Meat Snacks, Healthy Beverages, Others |

| Nutritional Contents Covered | Gluten-Free, Low-Fat, Sugar-Free, Others |

| Packaging Types Covered | Boxes, Pouches, Wraps, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia on-the-go healthy snacks market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia on-the-go healthy snacks market on the basis of product type?

- What is the breakup of the Saudi Arabia on-the-go healthy snacks market on the basis of nutritional content?

- What is the breakup of the Saudi Arabia on-the-go healthy snacks market on the basis of packaging type?

- What is the breakup of the Saudi Arabia on-the-go healthy snacks market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia on-the-go healthy snacks market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia on-the-go healthy snacks market?

- What are the key driving factors and challenges in the Saudi Arabia on-the-go healthy snacks market?

- What is the structure of the Saudi Arabia on-the-go healthy snacks market and who are the key players?

- What is the degree of competition in the Saudi Arabia on-the-go healthy snacks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia on-the-go healthy snacks market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia on-the-go healthy snacks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia on-the-go healthy snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)