Saudi Arabia Online Grocery Market Size, Share, Trends and Forecast by Product Type, Business Model, Platform, Purchase Type, and Region, 2026-2034

Saudi Arabia Online Grocery Market Summary:

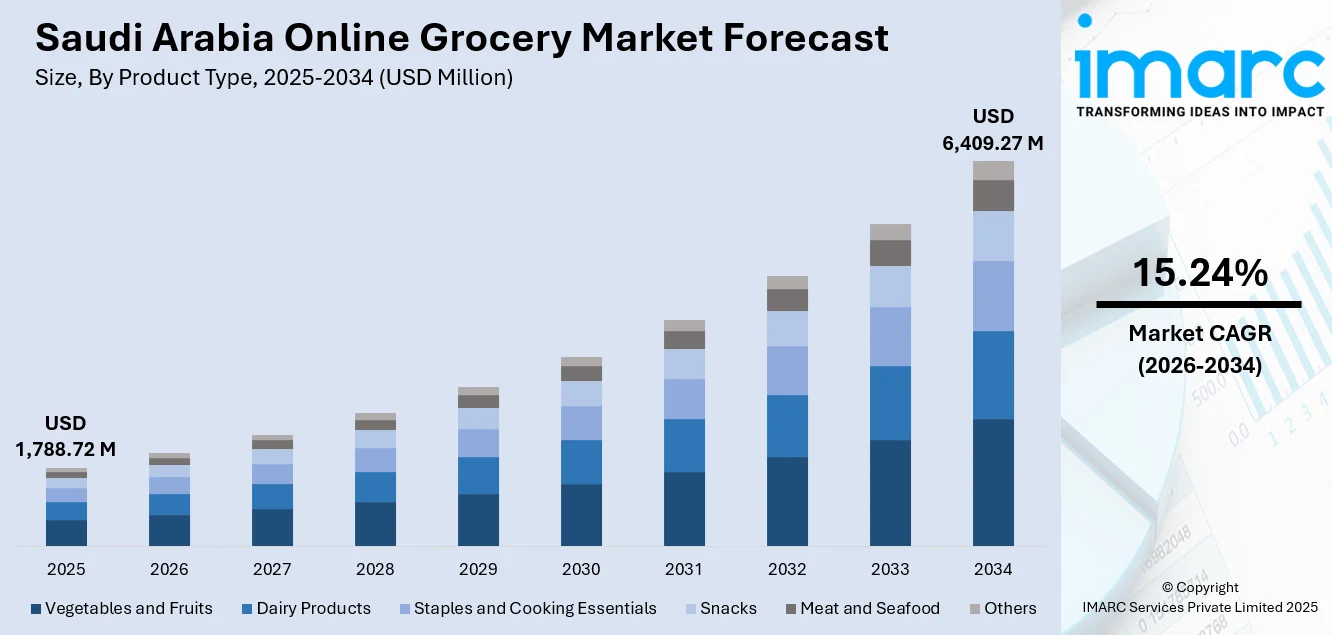

The Saudi Arabia online grocery market size was valued at USD 1,788.72 Million in 2025 and is projected to reach USD 6,409.27 Million by 2034, growing at a compound annual growth rate of 15.24% from 2026-2034.

Rapid digital change, increased smartphone penetration, and changing customer preferences toward convenience-oriented shopping solutions are driving the market's substantial rise. Purchase habits are still changing due to urbanization trends, an increase in dual-income households, and government-led programs promoting the development of e-commerce infrastructure. Strategic investments in cold chain capabilities, logistics networks, and last-mile delivery options enhance market positioning in the Kingdom's largest cities.

Key Takeaways and Insights:

- By Product Type: Vegetables and fruits dominate the market with a share of 31.92% in 2025, driven by rising health consciousness among consumers seeking fresh, organic produce through convenient digital channels. Growing preference for doorstep delivery of perishable items and expanding cold chain infrastructure supports segment growth.

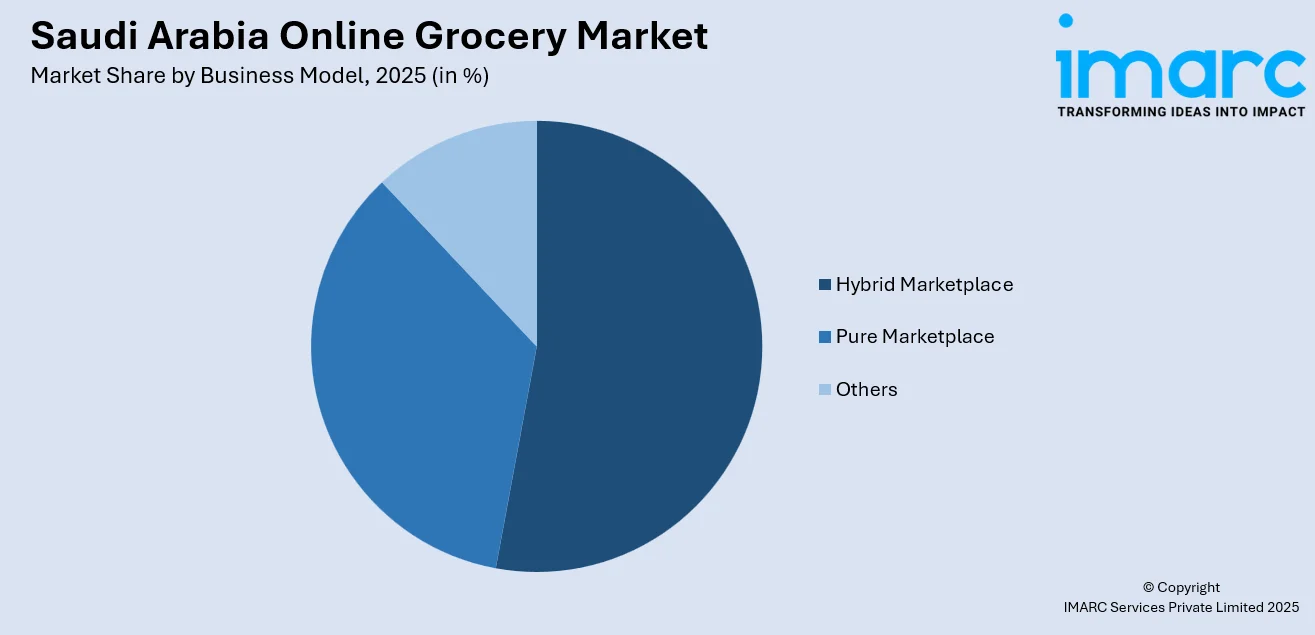

- By Business Model: Hybrid marketplace leads the market with a share of 52.8% in 2025, reflecting consumer preference for platforms combining inventory management with third-party vendor partnerships. This model offers diverse product selections while maintaining quality control and efficient delivery coordination across urban centers.

- By Platform: App-based exhibits clear dominance in the market with 68.02% share in 2025, fueled by widespread smartphone penetration exceeding ninety percent and mobile-first consumer behaviors. User-friendly interfaces, personalized recommendations, and seamless digital payment integration enhance customer engagement and retention.

- By Purchase Type: One-time represents the biggest segment with a market share of 82.86% in 2025, indicating consumer preference for immediate, on-demand grocery purchases without long-term commitments. Quick commerce models enabling rapid delivery times align well with spontaneous purchasing patterns and convenience-seeking behaviors.

- By Region: Northern and Central Region is the largest region with 50% share in 2025, driven by Riyadh's substantial population concentration, superior digital infrastructure, and high proportion of dual-income households demanding time-efficient shopping solutions.

- Key Players: Major companies are strengthening market positions through strategic investments in dark store networks, AI-driven logistics optimization, and expanded delivery coverage. Their focus on technology integration, customer experience enhancement, and partnership development accelerates innovation across the competitive landscape.

To get more information on this market Request Sample

The Saudi Arabia online grocery market demonstrates exceptional growth potential underpinned by the Kingdom's advanced digital ecosystem and progressive economic transformation agenda. High internet penetration rates approaching universal coverage combined with smartphone ownership exceeding ninety percent create optimal conditions for sustained e-commerce expansion. The market benefits significantly from Vision 2030 initiatives promoting cashless transactions, with electronic payments representing seventy-nine percent of total retail payments in 2024 according to the Saudi Central Bank (SAMA), marking a substantial increase from seventy percent recorded in the previous year. Consumer demographics strongly favor market growth, with over seventy-three percent of the population within working age and concentrated in major urban centers demanding convenient, time-saving solutions. Strategic investments by domestic and international platforms in micro-fulfillment centers, automated warehousing, and last-mile delivery optimization continue strengthening operational capabilities. The convergence of favorable demographics, robust digital infrastructure, supportive regulatory frameworks, and evolving lifestyle preferences positions the market for sustained double-digit growth throughout the forecast period.

Saudi Arabia Online Grocery Market Trends:

Quick Commerce Revolution Transforming Consumer Expectations

Quick commerce is transforming the internet-based grocery home delivery market with increasing customer demands for super-fast delivery, such as within thirty minutes. This is spreading at a rapid pace, especially within urban settings that need immediate fulfillment with a huge consumer base embracing new-age technologies. Extensive investments are being made within localized logistics such as dark stores and micro fulfillment centers strategically located within prime customer-demand neighborhoods. Today, most of the major e-commerce companies have a network of home delivery connectivity for most urban cities with sub-hour delivery timelines, thus modifying the traditional grocery shopping behavior.

Artificial Intelligence Integration Enhancing Operational Efficiency

Artificial intelligence-based systems are transforming the online grocery industry in terms of sophisticated inventory management, demand prediction, and customer experience. Machine learning algorithms forecast the demand for products during cultural activities such as Ramadan to optimize the number of products without increasing unnecessary wastage. AI recommendation engines optimize customer buying based on their behavior to increase the average order value. Route optimization systems allow the management of the grocery delivery fleets more effectively to optimize efficiency, thus reducing the cost of operations and ensuring improved reliability despite the geographical zones.

Digital Payment Ecosystem Expansion Accelerating Adoption

The Kingdom's robust digital payment infrastructure continues strengthening online grocery adoption through seamless transaction experiences. Digital wallets including STC Pay, Apple Pay, and Samsung Pay provide frictionless checkout processes that enhance consumer confidence and reduce cart abandonment rates. The national Mada payment network facilitates secure transactions while buy-now-pay-later options appeal to younger demographics managing household budgets. This comprehensive payment ecosystem, supported by regulatory frameworks ensuring consumer protection, removes traditional barriers to online purchasing and encourages first-time digital grocery shoppers.

How Vision 2030 is Transforming the Saudi Arabia Online Grocery Market:

Vision 2030 serves as a powerful catalyst for the online grocery sector's evolution in Saudi Arabia, fundamentally reshaping the retail ecosystem through strategic digitalization initiatives and comprehensive infrastructure development. The ambitious national transformation program accelerates e-commerce adoption by promoting cashless transactions and fostering a digitally enabled economy. Government-led efforts to diversify beyond oil dependence create favorable conditions for retail innovation, including advanced payment technologies and streamlined digital transaction processes. Strategic investments in logistics networks, smart city development, and telecommunications infrastructure directly benefit online grocery operations. Regulatory frameworks supporting entrepreneurship, foreign investment, and consumer protection strengthen market confidence while encouraging platform innovation. The program's emphasis on workforce development and female economic participation expands the consumer base seeking convenience-oriented shopping solutions, positioning online grocery platforms as essential components of modern Saudi retail.

Market Outlook 2026-2034:

The Saudi Arabia online grocery market outlook remains exceptionally positive as the sector transitions from emerging to mainstream retail channel status. Continued government investment in digital infrastructure, logistics networks, and smart city development creates favorable conditions for sustained expansion. Consumer adoption rates accelerate across demographic segments as platforms enhance service offerings, expand geographic coverage, and improve delivery reliability. The market generated a revenue of USD 1,788.72 Million in 2025 and is projected to reach a revenue of USD 6,409.27 Million by 2034, growing at a compound annual growth rate of 15.24% from 2026-2034. Strategic partnerships between technology providers, retailers, and logistics companies strengthen ecosystem capabilities while new market entrants intensify competition and drive innovation. The convergence of demographic advantages, infrastructure development, and evolving consumer preferences establishes strong foundations for long-term market maturation and value creation throughout the forecast period.

Saudi Arabia Online Grocery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Vegetables and Fruits |

31.92% |

|

Business Model |

Hybrid Marketplace |

52.8% |

|

Platform |

App-Based |

68.02% |

|

Purchase Type |

One-Time |

82.86% |

|

Region |

Northern and Central Region |

50% |

Product Type Insights:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Vegetables and fruits dominate with a market share of 31.92% of the total Saudi Arabia online grocery market in 2025.

The vegetables and fruits segment maintains commanding market position driven by rising health consciousness and growing consumer preference for fresh, organic produce accessed through convenient digital channels. Platforms offer extensive selections including locally grown and imported varieties, seasonal specialties, and exotic produce catering to diverse culinary preferences. Enhanced cold chain logistics ensure product freshness during delivery while competitive pricing strategies and promotional offers strengthen customer acquisition. The Saudi Agricultural Development Fund is projected to approve USD 2 Billion in April 2025 to support technologically advanced farming, thereby ensuring food security and reducing dependency on imports.

Consumer demand for doorstep delivery of perishable items continues accelerating as working professionals and dual-income households prioritize convenience over traditional market visits. Digital platforms enable quality verification through detailed product descriptions, customer reviews, and satisfaction guarantees that build purchasing confidence. Same-day and express delivery options address freshness concerns while subscription models for regular produce deliveries gain traction among health-conscious households. Investments in controlled-environment agriculture including hydroponics and vertical farming enhance year-round availability of premium fresh produce, supporting sustained segment growth throughout the forecast period.

Business Model Insights:

Access the comprehensive market breakdown Request Sample

- Pure Marketplace

- Hybrid Marketplace

- Others

Hybrid marketplace leads with a share of 52.8% of the total Saudi Arabia online grocery market in 2025.

The hybrid marketplace model demonstrates superior market performance by combining owned inventory management with third-party vendor partnerships, delivering optimal product variety and quality assurance. This approach enables platforms to maintain control over critical categories including fresh produce while leveraging partner networks for expanded assortment depth. Leading retail conglomerates have made substantial investments in hub infrastructure that merges store and dark-store inventory, exemplifying the strategic advantages of hybrid operations. The model facilitates efficient fulfillment through centralized warehousing complemented by distributed inventory positioning across urban markets, enabling faster delivery times and improved product availability for consumers across metropolitan areas.

Hybrid market achieves competitive advantages through integrated supply chain management enabling better inventory optimization, reduced stockouts, and improved delivery reliability. The business model supports diverse revenue streams including direct sales margins, commission fees from partner vendors, and delivery charges while spreading operational risks across multiple channels. Technology integration enables seamless coordination between owned and partner inventory systems, providing customers unified shopping experiences regardless of product source. Strategic partnerships with established supermarket chains extend geographic reach and product credibility while maintaining the convenience and service levels expected by digital-native consumers.

Platform Insights:

- Web-Based

- App-Based

App-based exhibits a clear dominance with 68.02% share of the total Saudi Arabia online grocery market in 2025.

The app-based platform segment commands substantial market share reflecting Saudi Arabia's mobile-first consumer culture and widespread smartphone adoption exceeding ninety percent of the population. Mobile applications deliver superior user experiences through intuitive interfaces, personalized recommendations, and streamlined checkout processes optimized for smaller screens. Push notifications enable targeted marketing communications driving repeat purchases while location-based services facilitate accurate delivery scheduling. The Communications, Space and Technology Commission reported that more than 99% of internet usage in Saudi Arabia occurs through smartphones, underscoring the critical importance of mobile-optimized platforms.

Mobile applications leverage device capabilities including cameras for barcode scanning, GPS for delivery tracking, and biometric authentication for secure payments, enhancing functionality beyond traditional web interfaces. App-based platforms achieve higher customer retention through loyalty programs, exclusive discounts, and gamification features that encourage regular engagement. Integration with digital wallet systems enables one-tap payment processing that reduces transaction friction and cart abandonment rates. The young, digitally connected population prefers mobile shopping convenience, with app-based ordering becoming the default purchasing behavior for everyday grocery needs across metropolitan areas.

Purchase Type Insights:

- One-Time

- Subscription

One-time represents the leading segment with 82.86% share of the total Saudi Arabia online grocery market in 2025.

The one-time purchase segment dominates market activity reflecting consumer preference for flexible, on-demand grocery shopping without recurring commitments. This purchasing pattern aligns with quick commerce growth as consumers increasingly expect immediate fulfillment of spontaneous grocery needs. Platforms optimize for impulse purchases through streamlined checkout processes, minimal order requirements, and rapid delivery options meeting instant gratification expectations. The segment benefits from cultural shopping patterns where consumers prefer fresh, frequent purchases over bulk buying, maintaining product freshness while avoiding storage constraints.

One-time purchases support higher average order frequencies as consumers engage platforms multiple times weekly rather than consolidating needs into periodic bulk orders. This transaction pattern generates consistent platform engagement while providing rich behavioral data enabling personalized marketing and inventory optimization. Promotional strategies including flash sales, limited-time offers, and dynamic pricing effectively drive conversion among price-sensitive shoppers making individual purchase decisions. While subscription models gain traction for specific product categories, the flexibility and immediacy of one-time purchasing remains strongly preferred across broad consumer segments.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominate the market with share of 50% of the total Saudi Arabia online grocery market in 2025.

The Northern and Central Region, anchored by Riyadh, commands the largest market share driven by exceptional population concentration, superior digital infrastructure, and high household income levels supporting premium service adoption. The capital city benefits from extensive internet connectivity approaching universal coverage and hosts headquarters for major platform operators enabling operational efficiencies and faster delivery times. Leading platforms have established extensive dark store networks with numerous micro-fulfillment facilities operational across key neighborhoods, enabling rapid order fulfillment. Smart city initiatives under Vision 2030 including expanded public transportation systems strengthen logistics capabilities supporting sustained e-commerce growth throughout the region.

The region's demographic profile strongly favors online grocery adoption with high proportions of dual-income households, young professionals, and expatriate communities seeking convenience-oriented solutions. Intense platform competition drives continuous service innovation including same-day delivery guarantees, extended operating hours, and expanded product selections. Corporate headquarters concentration generates substantial business-to-business demand for office provisioning and employee benefit programs. Regional dominance is expected to strengthen as platforms prioritize infrastructure investments and service enhancements in the Kingdom's largest consumer market.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Online Grocery Market Growing?

Exceptional Digital Infrastructure and Connectivity

Saudi Arabia's world-class digital infrastructure creates optimal conditions for sustained online grocery market expansion. Internet penetration approaches universal coverage with nearly the entire population accessing high-speed connectivity through fixed and mobile networks. Nationwide fifth-generation network deployment covering substantial portions of the population enables data-intensive applications including real-time delivery tracking and high-resolution product visualization. The Communications, Space and Technology Commission continues expanding digital access to underserved areas through fiber optic and fixed wireless solutions, narrowing urban-rural connectivity gaps. This comprehensive connectivity foundation enables seamless platform engagement across devices while supporting advanced features including video consultations with personal shoppers and augmented reality product previews. Strong digital infrastructure attracts platform investment and encourages technology innovation, creating virtuous cycles of capability enhancement and consumer adoption. The Kingdom's position among global leaders in broadband speed and reliability reinforces competitive advantages for e-commerce operators while meeting increasingly sophisticated consumer expectations for digital shopping experiences.

Expansion of Quick Commerce and Dark Store Networks

The rapid proliferation of quick commerce models and micro-fulfillment infrastructure creates powerful momentum for online grocery market acceleration. Leading platforms are strategically deploying dark store networks throughout metropolitan areas, enabling ultra-fast delivery windows that fundamentally reshape consumer expectations and purchasing behaviors. HungerStation's Quick Market network achieves coverage serving nearly ninety-five percent of the Kingdom with delivery times under one hour. These localized fulfillment centers position inventory closer to consumers, dramatically reducing last-mile distances while improving product freshness for perishable categories. Advanced warehouse automation technologies including AI-driven picking systems and intelligent inventory management optimize operational efficiency and reduce fulfillment costs. The dark store model enables platforms to serve high-density urban neighborhoods with minimal real estate investment compared to traditional retail formats, accelerating geographic expansion and market penetration. International entrants bring proven quick commerce expertise from competitive markets, intensifying innovation cycles and raising service standards across the sector. This infrastructure investment wave establishes structural advantages that strengthen platform capabilities while creating entry barriers for potential competitors lacking comparable fulfillment networks.

Demographic Advantages and Evolving Consumer Lifestyles

Saudi Arabia's demographic composition presents exceptional market opportunities with a young, digitally native population embracing e-commerce for everyday needs. Rising female workforce participation increases dual-income household prevalence, strengthening purchasing power while intensifying time pressures that favor online grocery solutions. Urbanization rates in metropolitan areas with superior delivery infrastructure and platform coverage. Changing lifestyle patterns including longer working hours, increased social commitments, and evolving family structures reduce time available for traditional shopping trips. Health consciousness growth drives demand for fresh produce, specialty ingredients, and organic products readily accessible through digital platforms. Expatriate communities representing substantial population segments demonstrate high receptivity to online grocery services familiar from home markets, accelerating adoption rates and platform sophistication expectations.

Market Restraints:

Limited Cold Chain Infrastructure Coverage

Cold chain logistics remain a critical challenge constraining online grocery market expansion, particularly for temperature-sensitive products. Refrigerated vehicle availability within delivery fleets remains below optimal levels, limiting capacity for fresh produce, dairy, and frozen product fulfillment. Urban and regional disparities in chilled storage and transportation infrastructure create service quality inconsistencies affecting consumer trust. Extreme climate conditions across the Kingdom intensify cold chain requirements, increasing operational complexity and costs for maintaining product integrity during last-mile delivery.

High Last-Mile Delivery Operational Costs

Last-mile delivery expenses represent substantial operational burdens. Delivery costs per order can reach significant levels due to geographic distances, low drop density in certain areas, and labor-intensive fulfillment models. Rising fuel prices, vehicle maintenance requirements, and competitive wage pressures compound cost challenges. Managing profitability while meeting consumer expectations for free or subsidized delivery creates persistent margin pressures requiring continuous operational optimization and efficiency improvements.

Intensifying Competitive Market Pressures

The market faces significant competitive pressures as domestic and international players intensify rivalry through aggressive pricing, promotional spending, and service innovation. Price wars and heavy customer acquisition investments compress profit margins while raising marketing expenditure requirements. Differentiation becomes increasingly challenging as platforms converge toward similar delivery speeds, product selections, and user experiences. New market entrants with substantial financial backing disrupt established competitive dynamics, forcing incumbents to continuously invest in capability enhancement and customer retention strategies.

Competitive Landscape:

The Saudi Arabia online grocery market exhibits dynamic competitive characteristics with established domestic platforms, regional operators, and international entrants vying for market share. Competition centers on delivery speed, geographic coverage, product assortment depth, and technology-enabled customer experiences. Leading players invest substantially in dark store networks, warehouse automation, and AI-driven logistics optimization to achieve operational excellence. Strategic partnerships between platforms, retailers, and logistics providers create integrated ecosystems strengthening competitive positioning. Market consolidation trends emerge as larger players acquire complementary capabilities while venture funding supports promising startups pursuing innovative business models. Differentiation strategies increasingly emphasize service quality, fresh product reliability, and personalized shopping experiences rather than pure price competition. The competitive landscape remains fluid as technology evolution and changing consumer expectations continuously reshape success factors.

Recent Developments:

- In April 2025, Rabbit, an Egyptian hyperlocal e-commerce firm, officially commenced operations in Saudi Arabia after establishing its regional headquarters in Riyadh. The company launched services through a network of dark stores in key neighborhoods and announced ambitious targets to deliver twenty million items across all major Saudi cities by 2026, expanding its successful model proven in the Egyptian market.

Saudi Arabia Online Grocery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Models Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platforms Covered | Web-Based, App-Based |

| Purchase Types Covered | One-Time, Subscription |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia online grocery market size was valued at USD 1,788.72 Million in 2025.

The Saudi Arabia online grocery market is expected to grow at a compound annual growth rate of 15.24% from 2026-2034 to reach USD 6,409.27 Million by 2034.

Vegetables and fruits dominated the market with a share of 31.92%, driven by rising health consciousness, growing demand for fresh organic produce, and enhanced cold chain infrastructure supporting doorstep delivery of perishable items.

Key factors driving the Saudi Arabia online grocery market include exceptional digital infrastructure with near-universal internet penetration, Vision 2030 economic transformation initiatives promoting cashless transactions, and favorable demographics with a young, urbanized, tech-savvy population.

Major challenges include limited cold chain infrastructure constraining perishable product delivery, high last-mile delivery operational costs accounting for substantial logistics expenses, intensifying competitive pressures compressing profit margins, and geographic coverage gaps in underserved regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)