Saudi Arabia Organic Baby Skincare Market Size, Share, Trends and Forecast by Skin Type, Product Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Organic Baby Skincare Market Overview:

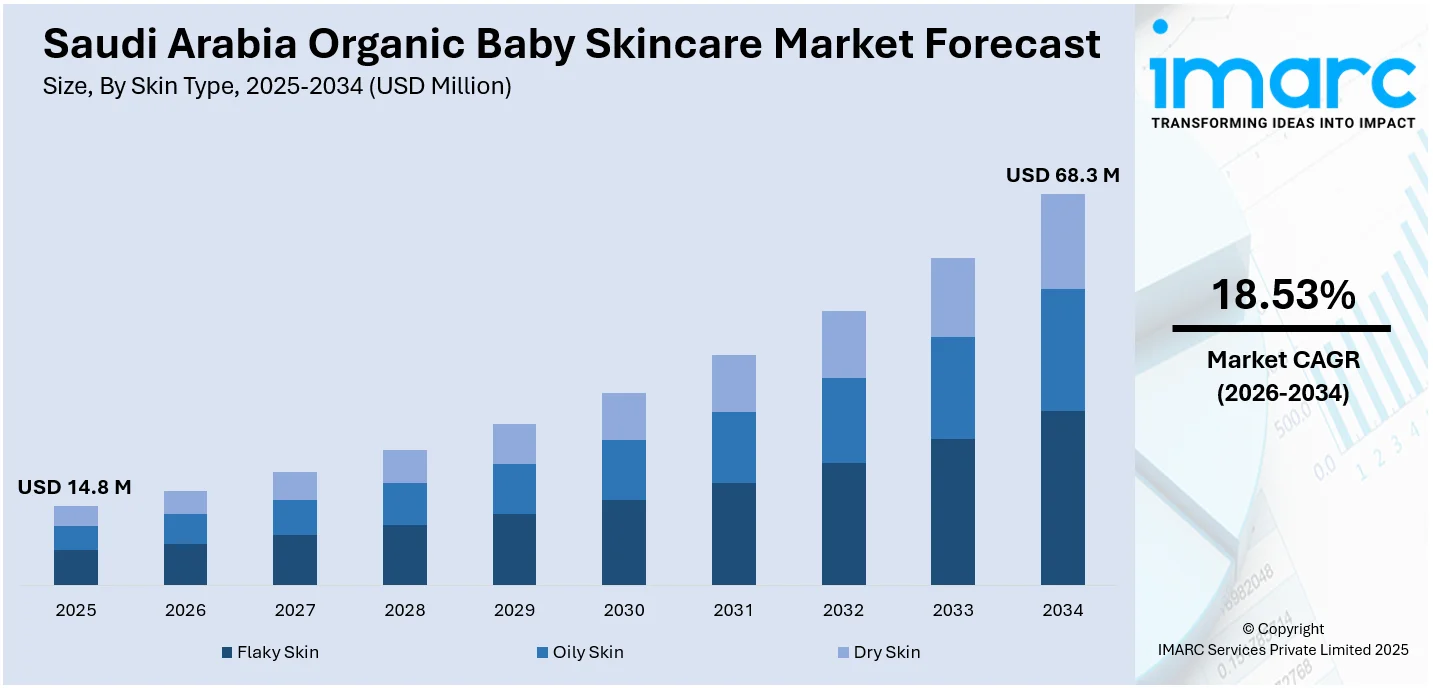

The Saudi Arabia organic baby skincare market size reached USD 14.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 68.3 Million by 2034, exhibiting a growth rate (CAGR) of 18.53% during 2026-2034. The concerns among parents about the ill effects of synthetic chemicals in traditional baby care products, heightened premiumization trends, and implementation of regulatory changes for building consumer confidence, which is influencing the entry barrier for low-quality, chemically-based products, are some of the factors contributing to the Saudi Arabia organic baby skincare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.8 Million |

| Market Forecast in 2034 | USD 68.3 Million |

| Market Growth Rate 2026-2034 | 18.53% |

Saudi Arabia Organic Baby Skincare Market Trends:

Growing Parental Awareness About Infant Health and Product Safety

The growing concerns among parents about the ill effects of synthetic chemicals in traditional baby care products is positively influencing the market in Saudi Arabia. Parents are becoming increasingly aware about the long-term consequences of exposure to parabens, phthalates, sulfates, and artificial fragrances, particularly for newborns and infants with extremely sensitive skin. Underpinning this user behavior change is universal availability of world health information and increasing leverage by online parenting communities, who frequently stress the advantages of natural alternatives. In addition, pediatricians' health campaigns, wellness influencers' promotions, and government campaigns highlighting child health are driving the demand for chemical-free, dermatologically tested, and environmentally certified products. Parents are often willing to pay a premium for skincare products that not only come with gentle, hypoallergenic credentials but also have environmentally friendly credentials. This trend is changing brand positioning strategies and spurring innovation across local and foreign entrants to the Saudi market.

To get more information on this market Request Sample

Rise in Premiumization Trends

Heightened premiumization trends Saudi Arabia are creating a need for organic and premium baby skincare products, thereby propelling the Saudi Arabia organic baby skincare market growth. Urbanization, combined with a relatively youth-based population and a growing number of dual-income households, is leading to high spending power on premium-quality child care products. People are looking for functionality but are also attaching importance to brand reputation, product certification and attractive packaging, which are all key characteristics of high-end organic products. This trend is part of a larger user shift in the Kingdom towards wellness and ethical consumption, with parents being prepared to spend on the best that is available for their children. International brands with organic certifications and cruelty-free status are quickly gaining popularity, particularly through upscale retail channels and niche e-commerce websites. The IMARC Group predicts that the Saudi Arabia e-commerce market size is expected to reach USD 708.7 Billion by 2033.

Government Support for Organic Agriculture and Regulatory Reforms

Saudi Arabia's Vision 2030 economic diversification strategy includes sustainable agriculture and domestic organic production support initiatives, thereby offering a favorable Saudi Arabia organic baby skincare market outlook. The Ministry of Environment, Water and Agriculture (MEWA) has come up with subsidies and certification mechanisms for organic agriculture, which will reduce the expense of domestic procurement of organic raw materials. in 2024, MEWA initiated Organic Food Day 2024 to highlight the importance of organic products and food items. These initiatives are facilitating de-dependency on imports and promoting the establishment of a domestic value chain of organic skincare products. In addition, the Saudi Food and Drug Authority (SFDA) has introduced more stringent guidelines in terms of product labeling, ingredient declarations, and quality control for baby care products. The regulatory changes are building consumer confidence and escalating the entry barrier for low-quality, chemically-based products. As transparency becomes a regulatory necessity, certified organic and clinically tested products offered by brands are gaining market advantage. Such enabling environment is creating innovation, inviting foreign investment, and increasing local entrepreneurial activity in the baby care category.

Saudi Arabia Organic Baby Skincare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on skin type, product type, and distribution channel.

Skin Type Insights:

- Flaky Skin

- Oily Skin

- Dry Skin

The report has provided a detailed breakup and analysis of the market based on the skin type. This includes flaky skin, oily skin, and dry skin.

Product Type Insights:

- Baby Oil

- Baby Powder

- Baby Soaps

- Petroleum Jelly

- Baby Lotion

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes baby oil, baby powder, baby soaps, petroleum jelly, baby lotion, and others.

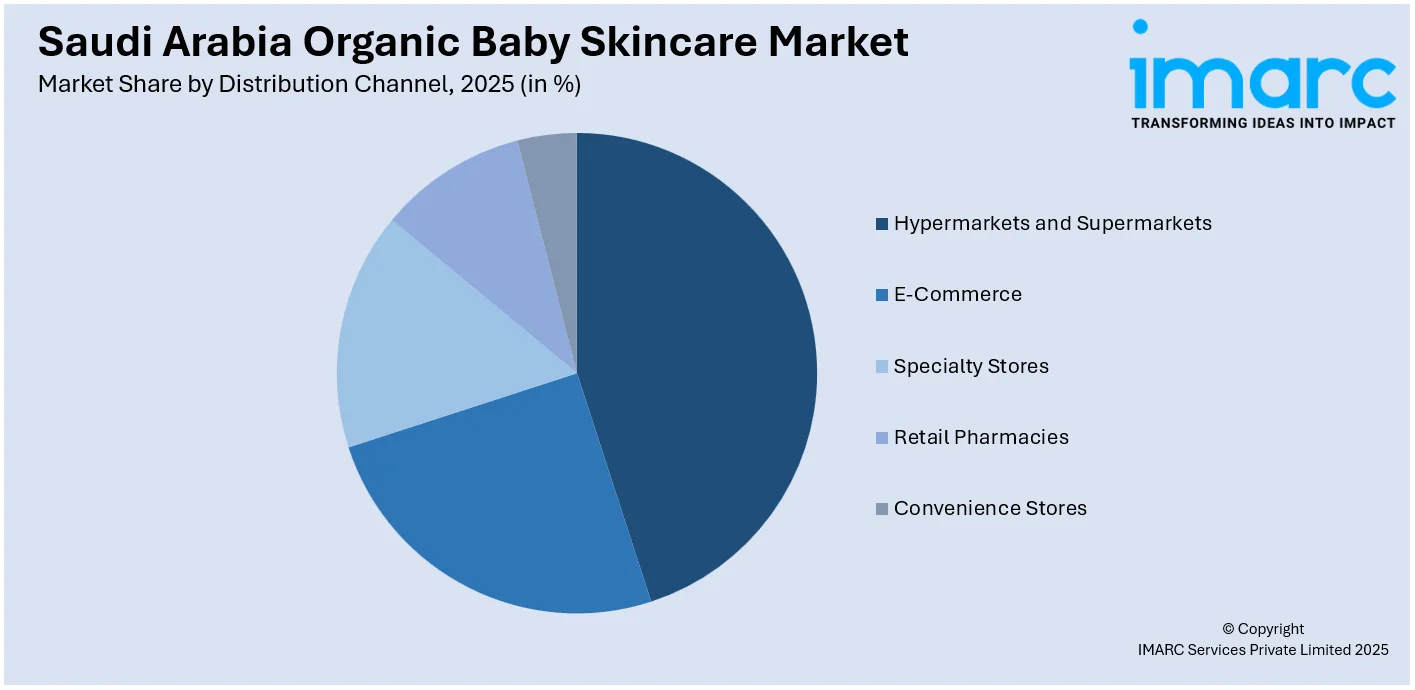

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets and Supermarkets

- E-Commerce

- Specialty Stores

- Retail Pharmacies

- Convenience Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, e-commerce, specialty stores, retail pharmacies, and convenience stores.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Organic Baby Skincare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Skin Types Covered | Flaky Skin, Oily Skin, Dry Skin |

| Product Types Covered | Baby Oil, Baby Powder, Baby Soaps, Petroleum Jelly, Baby Lotion, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, E-Commerce, Specialty Stores, Retail Pharmacies, Convenience Stores |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia organic baby skincare market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia organic baby skincare market on the basis of skin type?

- What is the breakup of the Saudi Arabia organic baby skincare market on the basis of product type?

- What is the breakup of the Saudi Arabia organic baby skincare market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia organic baby skincare market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia organic baby skincare market?

- What are the key driving factors and challenges in the Saudi Arabia organic baby skincare market?

- What is the structure of the Saudi Arabia organic baby skincare market and who are the key players?

- What is the degree of competition in the Saudi Arabia organic baby skincare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, Saudi Arabia organic baby skincare market forecasts, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia organic baby skincare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia organic baby skincare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)