Saudi Arabia Organic Food and Beverages Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Organic Food and Beverages Market Overview:

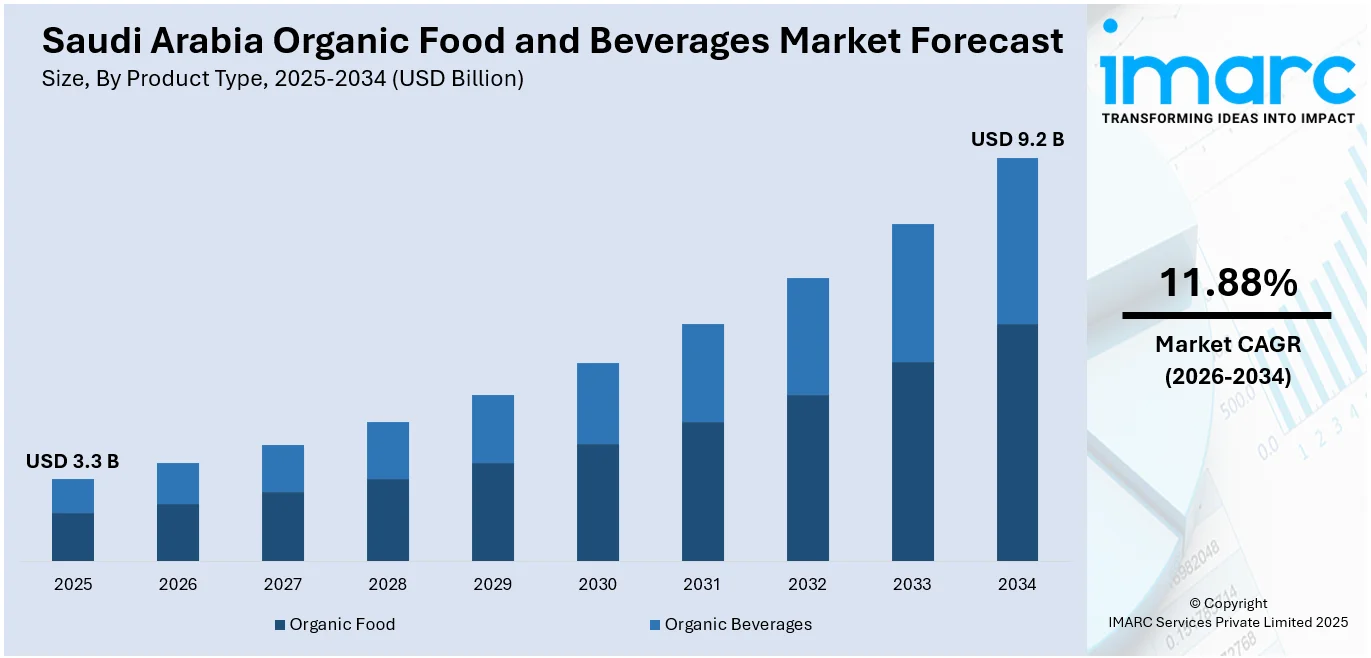

The Saudi Arabia organic food and beverages market size reached USD 3.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.2 Billion by 2034, exhibiting a growth rate (CAGR) of 11.88% during 2026-2034. The market is spurred by increasing health consciousness, heightened food safety concerns, government initiatives promoting the adoption of sustainable agriculture, and escalating demand for clean-label products. Rapid urbanization and shifting inclination toward organic products that provide convenience without diminishing the health benefits also drive the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.3 Billion |

| Market Forecast in 2034 | USD 9.2 Billion |

| Market Growth Rate 2026-2034 | 11.88% |

Saudi Arabia Organic Food and Beverages Market Trends:

Health and Sustainability Fueling Demand for Organic Foods

The Saudi Arabia organic food and beverages market growth is fueled by the growing health and environmental consciousness of consumers. As lifestyle-determined health complications intensify, customers are seeking out foods free of synthetic pesticides, fertilizers, and genetically modified organisms (GMOs) in growing numbers. Organic food is viewed as healthier and safer, as people increasingly seek more nutritious and clean-label foods. This movement towards healthful consumption is complemented by a wider awareness of the environmental implications of conventional agricultural practices. Organic farming, which places greater importance on sustainability and responsible stewardship of the environment, is thus perceived as an adequate answer to these issues. The synergy of health and environmental incentives is driving the organic food industry ahead, with consumers increasingly valuing products that promote their own health as well as the health of the planet.

To get more information on this market Request Sample

Government Initiatives and Technological Advancements

The government plays a crucial role in pushing the Saudi Arabia organic food and beverages market share forward through different initiatives and support programs. In Vision 2030, the government has come up with policies to diversify the economy and encourage sustainable agriculture. These include subsidies, research, and certification schemes to boost organic production and enhance market access for organic farmers. The Saudi Press Agency reported that the Ministry of Environment, Water and Agriculture recently launched public awareness campaign for Organic Food Day 2024 in Saudi Arabia. The initiative is a component of a larger strategy aimed at encouraging organic food consumption across Saudi society. Moreover, technology in agriculture, including precision farming and hydroponics, is being embraced to boost the efficiency and output of organic farming. These innovations in technology allow farmers to maximize production while conserving the environment, further advancing the organic food market. Synergy between technology and government backing is providing an enabling environment for the organic food industry to prosper in Saudi Arabia.

Changing Consumer Needs and Market Reach

Saudi Arabian consumer preferences are shifting toward organic products that provide convenience without diminishing the health benefits. Urban busy lifestyles have contributed to higher demand for convenient ready-to-eat organic food, organic snacks, and functional drinks. This trend is indicative of a general preference for healthy, on-the-move alternatives that resonate with healthy values. Retail and e-commerce growth is also making organic products more accessible, with supermarkets, specialty outlets, and websites frequently carrying a range of products labeled as organic. As per official data from the Ministry of Commerce, Saudi Arabia's e-commerce market sustained its strong expansion in the fourth quarter of 2024, with registered businesses totaling 40,953—an increase of 10% from the corresponding period in 2023. Moreover, the increased blending of organic ingredients with conventional foods and the popularity of organic spices and herbs also suggests a shift toward the inclusion of organic options in ordinary meals. With increasing consumer demand for organic foods, the Saudi Arabia organic food and beverages market outlook is witnessing significant evolutionary efforts which cater to such tastes, so that organic alternatives are made widely accessible to consumers.

Saudi Arabia Organic Food and Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Organic Food

- Organic Fruit and Vegetables

- Organic Meat, Fish and Poultry

- Organic Dairy Products

- Organic Frozen and Processed Foods

- Others

- Organic Beverages

- Fruit and Vegetable Juices

- Dairy

- Coffee

- Tea

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes organic food (organic fruits and vegetables, organic meat, fish and poultry, organic dairy products, organic frozen and processed foods, and others) and organic beverages (fruit and vegetable juices, dairy, coffee, tea, and others).

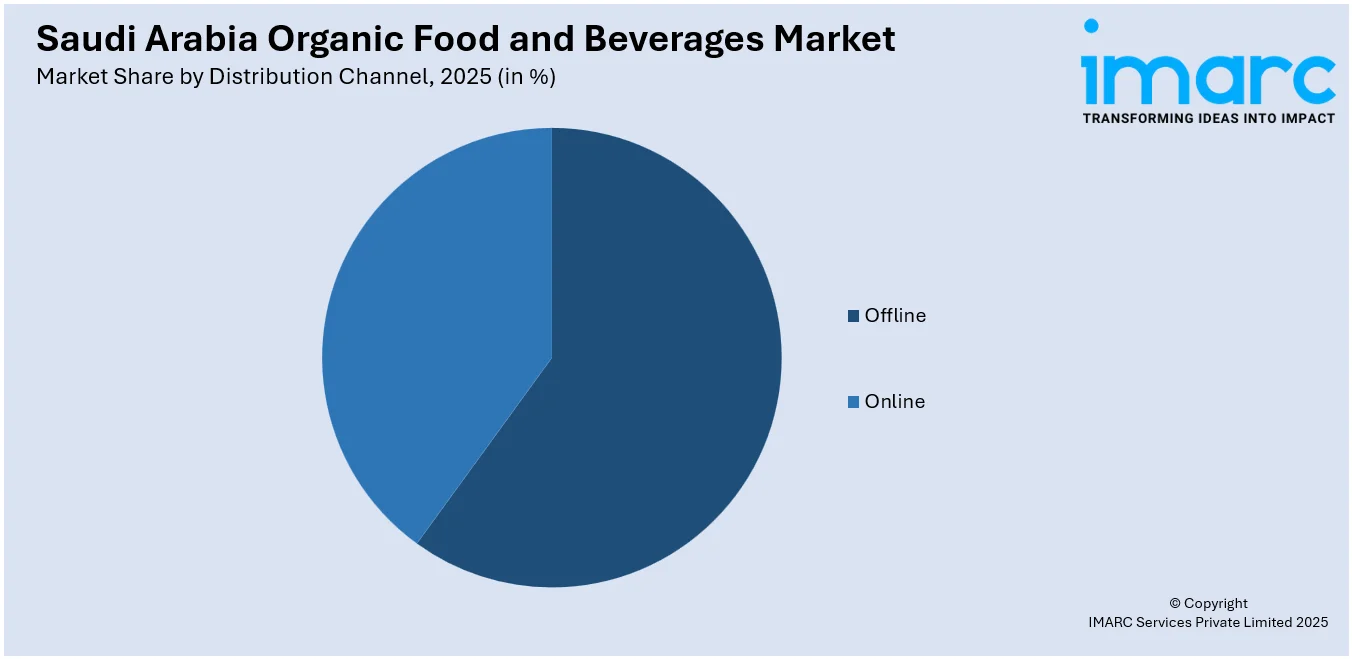

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Organic Food and Beverages Market News:

- In November 2024, The Ministry of Environment, Water and Agriculture launched a public awareness initiative for Organic Food Day 2024 in Saudi Arabia, according to Saudi Press Agency. The aim of this initiative is to highlight the significance of organic foods as a safer, healthier dietary system.

Saudi Arabia Organic Food and Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia organic food and beverages market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia organic food and beverages market on the basis of product type?

- What is the breakup of the Saudi Arabia organic food and beverages market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia organic food and beverages market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia organic food and beverages market?

- What are the key driving factors and challenges in the Saudi Arabia organic food and beverages market?

- What is the structure of the Saudi Arabia organic food and beverages market and who are the key players?

- What is the degree of competition in the Saudi Arabia organic food and beverages market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia organic food and beverages market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia organic food and beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia organic food and beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)