Saudi Arabia Organic Snack Foods Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Flavor, and Region, 2026-2034

Saudi Arabia Organic Snack Foods Market Summary:

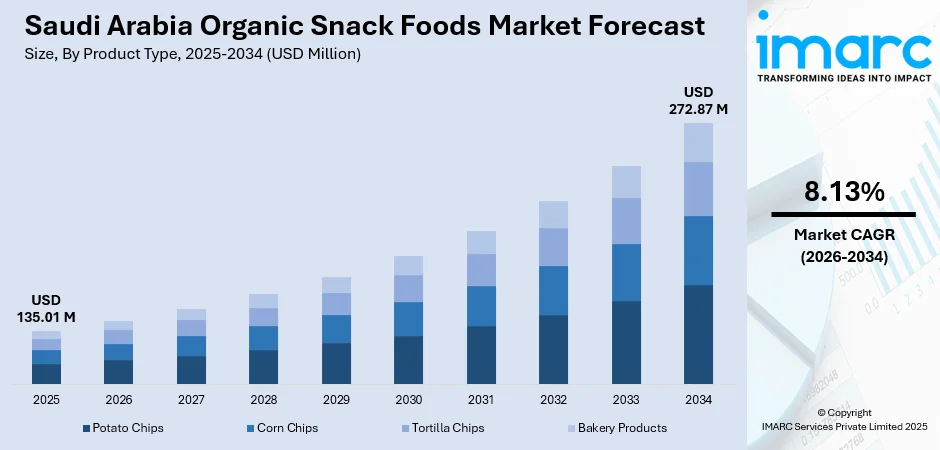

The Saudi Arabia organic snack foods market size was valued at USD 135.01 Million in 2025 and is projected to reach USD 272.87 Million by 2034, growing at a compound annual growth rate of 8.13% from 2026-2034.

The Saudi Arabia organic snack foods market is experiencing expansion as health-conscious consumers increasingly prioritize clean-label products free from synthetic additives. Rising disposable incomes, particularly among the Kingdom's youthful population, are driving demand for premium organic alternatives that align with modern wellness trends. Government initiatives promoting sustainable agriculture and organic farming practices are strengthening domestic production capabilities and consumer awareness. The proliferation of modern retail formats and e-commerce platforms is enhancing product accessibility, while urbanization and busy lifestyles fuel the demand for convenient yet nutritious snacking options, collectively contributing to the Saudi Arabia organic snack foods market share.

Key Takeaways and Insights:

-

By Product Type: Potato chips dominate the market with a share of 36% in 2025, owing to its widespread popularity as a convenient snacking option among Saudi consumers and the introduction of organic variants featuring reduced fat content, natural seasonings, and locally inspired flavors that appeal to health-conscious buyers seeking guilt-free indulgence.

-

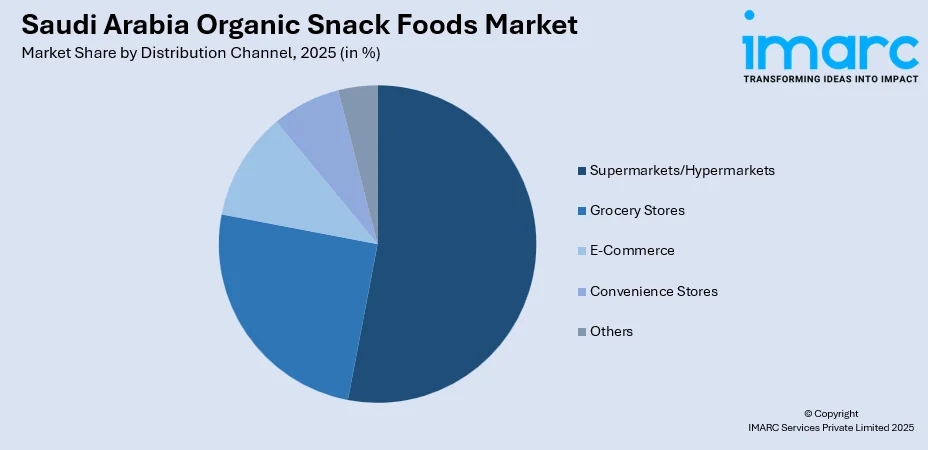

By Distribution Channel: Supermarkets/Hypermarkets lead the market with a share of 52% in 2025. This dominance is driven by the expansion of modern retail chains offering dedicated organic product sections, competitive pricing strategies, promotional activities, and one-stop shopping convenience that attracts families seeking quality organic snack options.

-

By Flavor: Chocolate exhibits a clear dominance in the market with 37% share in 2025, reflecting strong consumer preference for indulgent organic treats that combine health benefits with satisfying taste profiles, particularly among younger demographics drawn to premium cocoa-based organic snacks.

-

By Region: Northern and Central Region represents the largest segment with 42% share in 2025, driven by the concentration of affluent urban consumers in Riyadh metropolitan area, higher purchasing power, greater health awareness, and superior access to premium retail outlets stocking diverse organic snack portfolios.

-

Key Players: Key players drive the Saudi Arabia organic snack foods market by expanding product portfolios, investing in clean-label formulations, and strengthening distribution networks across modern retail and e-commerce channels. Their focus on innovative flavors, sustainable sourcing practices, and strategic partnerships with health-focused retailers accelerates market penetration and consumer adoption.

To get more information on this market Request Sample

The Saudi Arabia organic snack foods market is advancing as government initiatives, rising health awareness, and evolving consumer preferences converge to reshape the snacking landscape. National health programs promoting wellness and disease prevention are encouraging healthier dietary choices among the population, driving consumers toward organic alternatives. Shoppers are increasingly scrutinizing nutritional labels and ingredient lists before purchasing snack products, seeking transparency and clean-label credentials. This behavioral shift is compelling manufacturers to innovate with organic formulations featuring natural ingredients, reduced additives, and enhanced nutritional profiles that align with wellness-oriented lifestyles. The market benefits from expanding modern retail infrastructure, with hypermarkets, supermarkets, and specialty organic stores extending their presence across major urban centers. Stringent quality regulations enforced by regulatory authorities ensure product authenticity and compliance with organic standards, building consumer trust and confidence. These converging factors collectively support the Saudi Arabia organic snack foods market growth trajectory throughout the forecast period.

Saudi Arabia Organic Snack Foods Market Trends:

Rising Demand for Clean-Label and Natural Ingredients

Saudi consumers are increasingly prioritizing organic snacks made with transparent, recognizable ingredients free from artificial preservatives, colors, and flavors. This clean-label movement reflects heightened awareness of food safety and nutritional quality among health-conscious shoppers seeking trustworthy product options. Manufacturers are responding by reformulating products with organic certifications, plant-based ingredients, and minimal processing techniques that preserve nutritional integrity. The Saudi Food and Drug Authority's trans-fat ban implemented several years ago is further compelling brands to adopt healthier ingredient profiles that resonate with wellness-oriented consumers across the Kingdom.

Digital Transformation and E-Commerce Expansion

The proliferation of online grocery platforms is transforming how Saudi consumers access organic snack products. E-commerce channels offer convenience, doorstep delivery, and access to diverse organic product ranges previously unavailable in traditional retail settings. Major retailers are expanding their organic product offerings online, while subscription-based organic snack delivery services are gaining traction among busy urban professionals. The Ministry of Commerce reported e-commerce businesses in Saudi Arabia reaching 40,953 registered entities in the fourth quarter of 2024, reflecting the digital channel's expanding influence.

Premiumization and Gourmet Organic Offerings

Affluent Saudi consumers are demonstrating growing appetite for premium, artisanal organic snacks that deliver superior taste experiences alongside health benefits. This premiumization trend encompasses organic snacks featuring exotic ingredients, sophisticated flavor combinations, and sustainable packaging. Rising disposable incomes among the Kingdom's young population, with rising average monthly household disposable income, support demand for gourmet organic products that serve as lifestyle statements. Brands are capitalizing on this trend by introducing limited-edition organic snacks with unique regional flavors and premium positioning.

How Vision 2030 is Transforming the Saudi Arabia Organic Snack Foods Market:

Saudi Arabia's Vision 2030 initiative is fundamentally reshaping the organic snack foods landscape through comprehensive support for sustainable agriculture and health-conscious consumption patterns. The Ministry of Environment, Water and Agriculture has established a target to increase organic production, while the Sustainable Agricultural Rural Development Program provides incentives for expanding organic food production projects. The Agricultural Development Fund offers financing instruments supporting technology purchases and organic farming investments. In November 2024, the Ministry of Environment, Water and Agriculture launched a public awareness campaign for Organic Food Day, highlighting the significance of organic foods as safer, healthier dietary systems. These coordinated government efforts are creating an enabling environment where organic snack manufacturers can access subsidies, certification support, and market development assistance, accelerating the transition toward a more health-oriented snacking culture aligned with the Kingdom's wellness objectives.

Market Outlook 2026-2034:

The Saudi Arabia organic snack foods market outlook remains highly positive as consumer health consciousness intensifies and retail infrastructure expands. The market generated a revenue of USD 135.01 Million in 2025 and is projected to reach a revenue of USD 272.87 Million by 2034, growing at a compound annual growth rate of 8.13% from 2026-2034. Continued government support, expanding organic certification programs, and rising urbanization will sustain demand growth. The entry of international organic brands alongside domestic manufacturers' innovation efforts will diversify product offerings. E-commerce channel expansion and modern retail proliferation will enhance accessibility, driving broader consumer adoption across demographic segments throughout the forecast period.

Saudi Arabia Organic Snack Foods Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Potato Chips | 36% |

| Distribution Channel | Supermarkets/Hypermarkets | 52% |

| Flavor | Chocolate | 37% |

| Region | Northern and Central Region | 42% |

Product Type Insights:

- Potato Chips

- Corn Chips

- Tortilla Chips

- Bakery Products

Potato chips dominate with a market share of 36% of the total Saudi Arabia organic snack foods market in 2025.

Organic potato chips have emerged as the preferred choice among Saudi consumers seeking convenient, flavorful snacks that align with their health objectives. The segment benefits from continuous product innovation featuring baked variants, reduced sodium formulations, and organic seasonings that differentiate offerings from conventional alternatives. Manufacturers are introducing locally inspired flavors such as za'atar and kabsa-seasoned organic chips, resonating with regional taste preferences while maintaining clean-label credentials that appeal to wellness-focused buyers across the Kingdom.

The Saudi Arabia potato chips market is influenced by organic variants capturing growing share as health awareness intensifies. Major retailers are expanding shelf space dedicated to organic potato chip offerings, while brand innovations in portion-controlled packaging support mindful snacking trends. The segment's accessibility across modern retail formats and convenience stores ensures widespread consumer reach, with premium organic variants commanding higher price points that reflect superior ingredient quality and certification standards.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Grocery Stores

- E-Commerce

- Convenience Stores

- Others

Supermarkets/Hypermarkets leads with a share of 52% of the total Saudi Arabia organic snack foods market in 2025.

Supermarkets/Hypermarkets dominate organic snack distribution through their extensive store networks, dedicated organic product sections, and competitive pricing strategies that attract value-conscious health seekers. Leading retail chains across the Kingdom have expanded organic product assortments to meet growing consumer demand for certified clean-label snacking options. These retailers leverage promotional activities, loyalty programs, and strategic shelf positioning to drive organic snack sales while offering the product variety and shopping convenience that Saudi families prefer when seeking healthier alternatives.

Supermarkets and hypermarkets have established themselves as primary touchpoints for consumers seeking organic snack products across Saudi Arabia. These large-format retailers integrate digital innovations including click-and-collect services and mobile applications, streamlining the shopping experience while promoting cross-selling of organic snack products. The organized retail space continues its steady growth trajectory with new shopping centers and mall developments planned across major cities, further strengthening the channel's dominant position in organic snack distribution throughout the Kingdom.

Flavor Insights:

- Chocolate

- Vanilla

- Strawberry

- Others

Chocolate exhibits a clear dominance with a 37% share of the total Saudi Arabia organic snack foods market in 2025.

Chocolate represents the largest flavor segment, reflecting Saudi consumers' strong preference for indulgent treats that combine sensory satisfaction with health credentials. The segment benefits from growing awareness of dark chocolate's health benefits including antioxidant properties and lower sugar content compared to conventional confectionery. Premium chocolate-coated organic snack bars and biscuits appeal to younger demographics seeking guilt-free indulgence, with consumers demonstrating willingness to pay premium prices for organic cocoa-based products featuring clean-label certifications.

Chocolate-flavored organic snacks attract significant consumer interest, particularly among the Kingdom's youthful population drawn to products that combine taste appeal with wellness positioning. The strong cultural tradition of gifting during festive occasions including Ramadan and Eid celebrations creates seasonal consumption peaks that organic chocolate snack manufacturers actively capitalize upon. Rising disposable incomes and exposure to international confectionery trends further support demand for premium organic chocolate snacks across modern retail and e-commerce channels throughout Saudi Arabia.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represent the leading segment with a 42% share of the total Saudi Arabia organic snack foods market in 2025.

The Northern and Central Region, anchored by Riyadh metropolitan area, leads organic snack consumption driven by higher disposable incomes, greater health awareness, and superior retail infrastructure. The region's concentration of affluent urban consumers with appreciation for premium, health-oriented products supports strong demand for organic snack offerings. Riyadh-based online grocery retailers provide same-day delivery services, while specialty organic stores including dedicated health food outlets cater to discerning consumers seeking certified organic products and extensive wellness-focused selections.

The Riyadh region is projected to remain Saudi Arabia's largest consumer market throughout the forecast period, driven by population density and economic activity concentration. The region benefits from established retail chains actively expanding organic product sections across their store networks, with major grocery operators maintaining strong regional headquarters presence. Urban professionals' busy lifestyles drive demand for convenient organic snacking options available through extensive modern retail formats and expanding delivery networks that ensure product accessibility across residential and commercial areas.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Organic Snack Foods Market Growing?

Increasing Health Consciousness and Lifestyle Disease Prevalence

Rising awareness of health and wellness is fundamentally transforming Saudi consumer preferences toward organic snack alternatives. The Kingdom faces significant lifestyle disease challenges, with obesity and diabetes affecting substantial portions of the adult population, compelling consumers to adopt healthier dietary choices. Government health programs promoting wellness and disease prevention are driving initiatives that encourage organic food consumption as part of broader public health strategies. Consumers increasingly scrutinize nutritional labels, seeking products with reduced sugar, lower sodium, and natural ingredients that support their health objectives. The expanding health and wellness sector in Saudi Arabia continues capturing growing consumer interest, with organic snacks gaining share as health-conscious shoppers prioritize nutritional value over mere convenience when selecting snacking options for themselves and their families.

Young Demographic Profile and Rapid Urbanization

Saudi Arabia's youthful population structure and accelerating urbanization are driving organic snack consumption as younger consumers demonstrate stronger preferences for health-oriented products. Urban centers including Riyadh, Jeddah, and Dammam concentrate populations with busy lifestyles demanding convenient yet nutritious snacking solutions. The fast-paced urban lifestyle among working professionals, students, and dual-income households fuels demand for portable organic snacks requiring minimal preparation. Average monthly household disposable income is increasing, which enables premium organic product purchases among this demographic, while exposure to international food trends through travel and digital platforms accelerates adoption of organic snacking habits.

Growing Fitness Culture and Active Lifestyle Adoption

The rising fitness culture and active lifestyle adoption among Saudi consumers is significantly driving demand for organic snack alternatives that complement wellness-focused dietary regimens. Increasing participation in sports activities, gym memberships, and outdoor recreational pursuits is creating demand for nutritious snacking options that support active lifestyles without compromising health objectives. Health-conscious consumers engaged in fitness routines seek organic snacks offering clean ingredients, protein enrichment, and natural energy sources that align with their training and dietary goals. Government initiatives promoting physical activity and wellness awareness are encouraging broader population segments to adopt healthier eating habits including organic snack consumption. The proliferation of fitness centers, sports facilities, and wellness programs across major Saudi cities is cultivating consumer segments particularly receptive to organic snack products positioned as functional, health-supporting alternatives to conventional offerings.

Market Restraints:

What Challenges the Saudi Arabia Organic Snack Foods Market is Facing?

Premium Pricing and Affordability Constraints

Organic snack foods command significantly higher prices compared to conventional alternatives, limiting adoption among price-sensitive consumer segments. The premium pricing reflects higher organic ingredient costs, certification expenses, and specialized production requirements that manufacturers must absorb. While affluent urban consumers demonstrate willingness to pay for organic credentials, broader market penetration remains constrained by affordability concerns particularly affecting middle and lower-income households.

Limited Domestic Organic Production Capacity

Saudi Arabia faces significant constraints in domestic organic ingredient production due to arid climatic conditions, water scarcity, and limited arable land availability. The Kingdom relies heavily on imports to meet organic food demand, creating supply chain vulnerabilities and cost pressures. While government initiatives support organic farming expansion, the transition requires substantial investments in irrigation technologies, organic certification infrastructure, and farmer training programs that take time to yield results.

Consumer Awareness and Education Gaps

Despite growing health consciousness, significant consumer awareness gaps persist regarding organic product benefits, certification standards, and authenticity verification. Many consumers lack understanding of organic labeling requirements and struggle to differentiate genuinely certified organic products from conventional alternatives marketed with health-oriented positioning. This knowledge gap can undermine consumer trust and willingness to pay premium prices for authentic organic snack products.

Competitive Landscape:

The Saudi Arabia organic snack foods market features a competitive mix of international brands, regional players, and emerging local manufacturers. Competition centers on product innovation, clean-label formulations, distribution network expansion, and brand positioning around health and wellness attributes. Companies are differentiating through premium packaging, sustainable sourcing practices, and localized flavor profiles that resonate with Saudi consumer preferences. Strategic partnerships between manufacturers and modern retail chains are strengthening market presence, while investments in e-commerce capabilities enable broader consumer reach. Private label organic offerings from major retailers are intensifying competitive pressure, compelling branded manufacturers to emphasize quality differentiation and marketing investments.

Saudi Arabia Organic Snack Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Potato Chips, Corn Chips, Tortilla Chips, Bakery Products |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Grocery Stores, E-Commerce, Convenience Stores, Others |

| Flavors Covered | Chocolate, Vanilla, Strawberry, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia organic snack foods market size was valued at USD 135.01 Million in 2025.

The Saudi Arabia organic snack foods market is expected to grow at a compound annual growth rate of 8.13% from 2026-2034 to reach USD 272.87 Million by 2034.

Potato chips dominated the market with a share of 36%, driven by widespread consumer preference for convenient organic snacking options featuring reduced fat content, natural seasonings, and locally inspired flavors that appeal to health-conscious Saudi consumers.

Key factors driving the Saudi Arabia organic snack foods market include rising health consciousness, Vision 2030 government initiatives supporting organic agriculture, expanding modern retail infrastructure, increasing disposable incomes, growing e-commerce penetration, and heightened consumer awareness of clean-label products.

Major challenges include premium pricing limiting broader adoption, limited domestic organic production capacity due to climatic constraints, high import dependency for organic ingredients, consumer awareness gaps regarding certification standards, and competition from conventional snack alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)