Saudi Arabia Outdoor Advertising Market Size, Share, Trends and Forecast by Type, Segment, and Region, 2026-2034

Saudi Arabia Outdoor Advertising Market Overview:

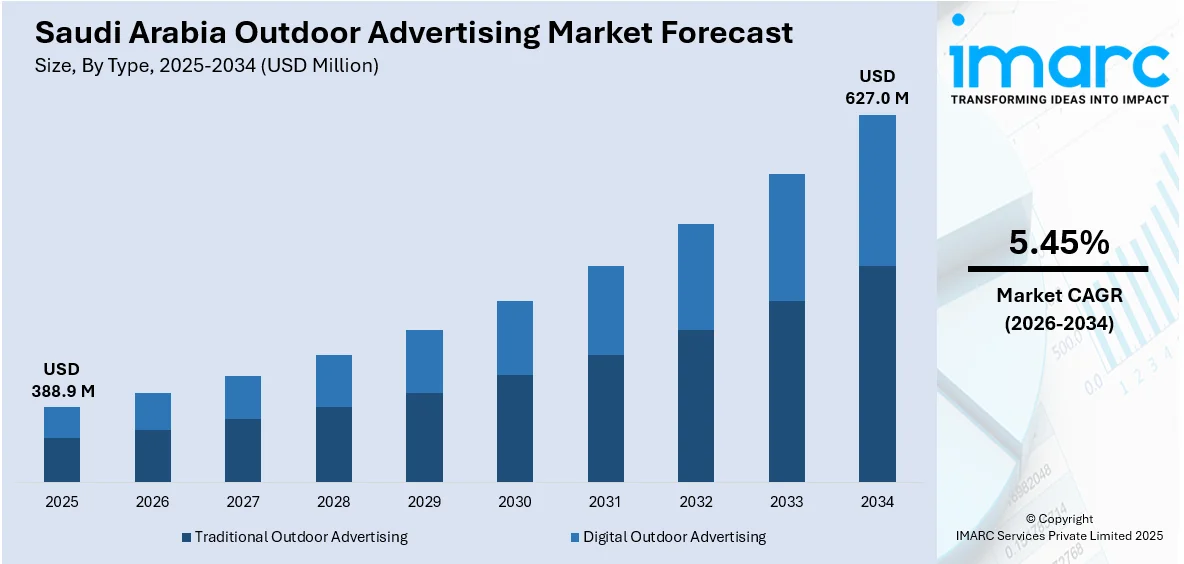

The Saudi Arabia outdoor advertising market size reached USD 388.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 627.0 Million by 2034, exhibiting a growth rate (CAGR) of 5.45% during 2026-2034. The market is driven by government initiative to urbanize city landscapes with investment in smart city solutions, rising spending habits and a young demographic, and technological advancements in digital out-of-home (DOOH) advertising like light emitting diode (LED) billboards, interactive kiosks, and dynamic transit displays.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 388.9 Million |

| Market Forecast in 2034 | USD 627.0 Million |

| Market Growth Rate 2026-2034 | 5.45% |

Saudi Arabia Outdoor Advertising Market Trends:

Vision 2030 and Urban Infrastructure Development

Saudi Arabia's Vision 2030 program is a powerful driver in transforming the kingdom's urban environment and infrastructure. This change is driving the demand for new outdoor advertising mediums. Large-scale urban development projects are producing high-traffic areas perfect for out-of-home (OOH) advertising. As new highways, airports, entertainment areas, and commercial centers are constructed, they offer optimal locations for billboards, digital displays, and transit media. Additionally, the government initiative to urbanize city landscapes involves investment in smart city solutions, which are increasingly incorporating digital out-of-home (DOOH) technologies. With the growing public and private sector investment in infrastructure, there is a growing network of physical locations that can accommodate advertising assets. In 2024, the Smart Cities Saudi Expo was conducted to improvise urban development. These shifts are not only enhancing visibility and reach.

To get more information on this market Request Sample

Rising Spending Habits and a Young Demographic

Saudi Arabia's population is unusually young and expanding with more than 60% of its population below the age of 35. According to the Global Data, in 2025, 21.6% of the population was between the ages of 25 and 34. Its youthful population is urban, technologically savvy, and open to visual and experiential marketing tactics. Outdoor advertising resonates with this segment by providing movement, high-impact visuals in the areas it inhabits, including shopping malls, entertainment centers, and transport points. Moreover, young demographics with high disposable incomes also show high spending habits, particularly in fashion, electronics, automotive, and fast food, categories that are highly dependent on outdoor advertising. Advertisers are therefore putting more money into OOH media to drive purchase decisions at high-traffic locations.

Technological Advancements in Digital Out-of-Home (DOOH) Advertising

The use of digital technology in out-of-home advertising is contributing to the market growth. DOOH formats, such as light emitting diode (LED) billboards, interactive kiosks, and dynamic transit displays are on the rise because they are flexible, high-definition, and can be used to offer real-time, data-driven content. With these technologies, advertisers can personalize messages according to the time of day, weather, or demographics using programmatic platforms. Additionally, the use of 5G networks and the Internet of Things (IoT) increases the capability for real-time interactivity and geolocation-targeting. Within retail areas and transport hubs, such as metro stations and airports, digital signage is becoming a replacement for fixed billboards, providing greater engagement. In 2024, Saudi General Authority for Roads made a statement about introducing an outdoor advertisement project on intercity highways, with the purpose of opening investment opportunities through in-house collaboration.

Key Growth Drivers of Saudi Arabia Outdoor Advertising Market:

Expanding Retail and Consumer Markets

The thriving retail sector is a major factor driving the demand for outdoor advertising. With the opening of new shopping malls, supermarkets, and retail hubs across urban centers, outdoor ads serve as a primary channel to attract foot traffic and boost sales. Both international and local retailers rely heavily on high-visibility billboards and signage to create brand recognition and announce promotions. The consumer market is increasingly competitive, and businesses need large-scale advertising platforms to differentiate themselves. Moreover, with the rising popularity of lifestyle and luxury brands, outdoor ads are positioned as premium marketing tools to influence purchasing decisions. Seasonal shopping festivals, such as Ramadan promotions, are further catalyzing the demand for outdoor campaigns.

Strategic Location Advantage for Outdoor Ads

Saudi Arabia’s unique geography and transportation routes make outdoor advertising particularly effective. Highways connecting major cities like Riyadh, Jeddah, and Makkah witness heavy traffic, providing ideal locations for large billboards and roadside ads. Pilgrimage routes to holy cities also attract millions of visitors annually, making outdoor advertising highly impactful for religious tourism-related promotions. Similarly, airports, seaports, and metro systems provide strategic locations for brands targeting both local users and international travelers. With high exposure in key travel and commercial corridors, advertisers achieve unmatched visibility. This location-driven advantage ensures that outdoor advertising is not only a mass-reach tool but also a strategic channel for segment-specific targeting. As the Kingdom continues to expand its transportation networks, advertisers are gaining more opportunities to strategically place campaigns where they capture maximum audience attention and engagement.

Rising User Engagement through Innovations

Innovations in outdoor advertising formats are significantly enhancing user engagement in Saudi Arabia. Beyond traditional billboards, advertisers are adopting interactive screens, augmented reality displays, and 3D billboards to captivate audiences. These innovations create memorable experiences that increase consumer recall and brand affinity. Younger generations, in particular, are drawn to creative campaigns that blend entertainment with marketing. Global brands entering Saudi Arabia are leveraging innovative outdoor formats to differentiate themselves in the competitive market. Lifestyle, fashion, and beverage companies often experiment with immersive visual campaigns to stand out. With advancements in design, lighting, and digital integration, outdoor ads go beyond visibility, influencing consumer emotions and purchasing behavior. This focus on innovative engagement is not only attracting premium advertisers but also strengthening the perception of outdoor advertising as a modern and high-value marketing medium in Saudi Arabia.

Saudi Arabia Outdoor Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type and segment.

Type Insights:

- Traditional Outdoor Advertising

- Digital Outdoor Advertising

The report has provided a detailed breakup and analysis of the market based on the type. This includes traditional outdoor advertising and digital outdoor advertising.

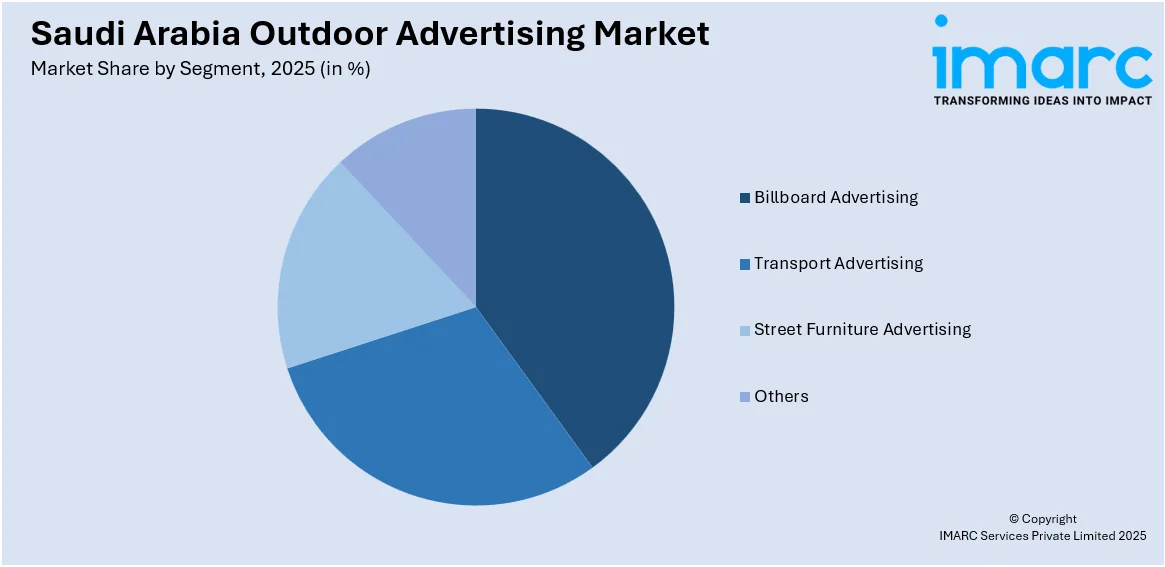

Segment Insights:

Access the comprehensive market breakdown Request Sample

- Billboard Advertising

- Transport Advertising

- Street Furniture Advertising

- Others

A detailed breakup and analysis of the market based on the segment have also been provided in the report. This includes billboard advertising, transport advertising, street furniture advertising, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Outdoor Advertising Market News:

- April 2025: Al Arabia Outdoor Advertising entered into a Memorandum of Understanding (MoU) with the media division of Multiply Group PJSC, aiming to establish a collaborative entity focused on investing in the worldwide out-of-home (OOH) advertising industry, enhancing international footprint. The MoU featured a significant clause for examining collaborative investments in advertising technology and AI in the OOH sector, stressing the creation of sophisticated advertising platforms, such as supply-side platforms (SSP).

- January 2025: Kingdom Centre, a representative of Riyadh, was set to showcase a cutting-edge screen that could transform outdoor advertising. This centerpiece enhanced Saudi Arabia’s position as a worldwide center for creativity and advertising. The initiative offered a revolutionary advertising experience, engaging visitors’ interest in the capital and aligning with a strategic goal to deliver innovative platforms for both local and international markets.

Saudi Arabia Outdoor Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Traditional Outdoor Advertising, Digital Outdoor Advertising |

| Segments Covered | Billboard Advertising, Transport Advertising, Street Furniture Advertising, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia outdoor advertising market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia outdoor advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia outdoor advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The outdoor advertising market in Saudi Arabia was valued at USD 388.9 Million in 2025.

The Saudi Arabia outdoor advertising market is projected to exhibit a CAGR of 5.45% during 2026-2034, reaching a value of USD 627.0 Million by 2034.

With a growing number of shopping malls, airports, highways, and metro stations, advertisers have more physical spaces to capture audience attention. The shift towards DOOH advertising, supported by smart displays, is also transforming the sector by enabling interactive and targeted campaigns. Moreover, brands in retail, telecom, and entertainment are allocating budgets to outdoor promotions to strengthen visibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)