Saudi Arabia Pain Management Drugs Market Size, Share, Trends and Forecast by Drug Class, Indication, Distribution Channel, and Region, 2026-2034

Saudi Arabia Pain Management Drugs Market Overview:

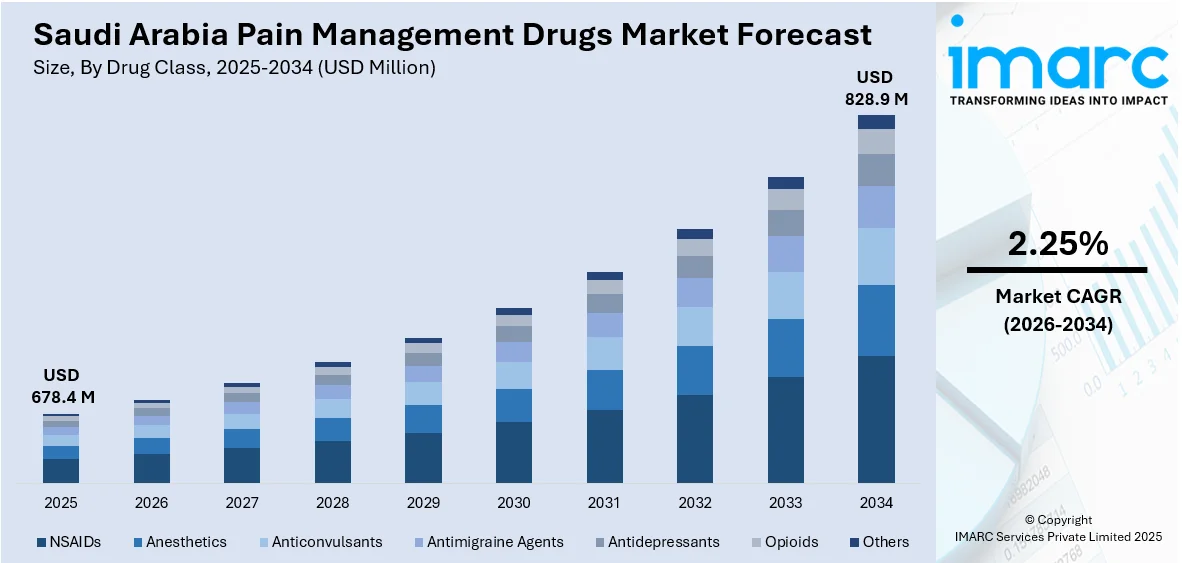

The Saudi Arabia pain management drugs market size reached USD 678.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 828.9 Million by 2034, exhibiting a growth rate (CAGR) of 2.25% during 2026-2034. The market is driven by a high prevalence of chronic pain, increasing aging population, advancements in non-opioid drug therapies, and increased government investment in healthcare infrastructure, all of which boost demand and access to effective pain relief treatments across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 678.4 Million |

| Market Forecast in 2034 | USD 828.9 Million |

| Market Growth Rate 2026-2034 | 2.25% |

Saudi Arabia Pain Management Drugs Market Trends:

High Prevalence of Chronic Pain Disorders

Chronic pain is a common health concern in Saudi Arabia, with many individuals affected by conditions such as arthritis, migraines, and musculoskeletal disorders. A cross-sectional study found that out of 4,943 participants, 1,333 (26.77%) experienced migraines in Saudi Arabia. Contributing factors like sedentary lifestyles, poor posture, and metabolic diseases have increased the frequency of persistent pain. The expanding pain burden reduces personal efficiency and life quality, thus motivating people to find effective pharmaceutical treatment. The understanding of pain relief alternatives among healthcare providers and patients leads to an increasing market demand for prescription and over-the-counter pain medications. This creates strong momentum for the Saudi Arabia pain management drugs market growth and encourages further development and distribution of various therapeutic solutions.

To get more information on this market Request Sample

Advancements in Drug Development and Non-Opioid Alternatives

Pharmaceutical advancements have expanded the range of available pain management therapies in Saudi Arabia. There is a growing preference for non-opioid medications and innovative drug formulations that offer effective relief with fewer side effects. These include anti-inflammatory drugs, antidepressants, topical treatments, and other targeted therapies. Healthcare providers are increasingly choosing alternatives to traditional opioids due to concerns about dependency and tolerance. This shift in clinical practice is driving demand for new drug classes and encouraging investment in research and development. The availability of more diverse and safer treatment options is fueling the Saudi Arabia pain management drugs market share and benefiting both providers and patients. For instance, in February 2024, Hikma Pharmaceuticals PLC (Hikma), the global pharmaceutical firm, revealed that it had entered an exclusive licensing deal with AFT Pharmaceuticals (AFT) for the registration and marketing of Combogesic IV, an intravenous, opioid-free pain relief medication intended for short-term symptomatic management of acute pain in adults and fever reduction, in Saudi Arabia, Jordan, and Iraq. It is a patented intravenous solution for infusion containing Paracetamol 1000mg + Ibuprofen 300mg.

Government Healthcare Initiatives and Infrastructure Expansion

Saudi Arabia’s healthcare sector is undergoing rapid transformation driven by national policies aimed at improving service access and quality. The government is investing heavily in healthcare infrastructure, including hospitals, clinics, and pharmaceutical distribution networks. For instance, in February 2025, significant medical projects aimed at enhancing Saudi Arabia's healthcare system were introduced this week, featuring a cutting-edge oncology facility and a large-scale expansion of pharmacy chains. These initiatives indicate an increasing engagement of the private sector in the Kingdom. The statements – delivered on the sidelines of Arab Health 2024 in Dubai – signify significant advancement in the Kingdom’s initiatives to overhaul its healthcare sector as part of Vision 2030. These efforts are improving the availability of pain management drugs across urban and rural areas. Public health campaigns and healthcare professional training programs are also helping to raise awareness about proper pain management. Additionally, supportive regulatory frameworks are facilitating the approval and distribution of new medications. These combined initiatives are making it easier for patients to obtain the treatments they need and creating a positive impact on the Saudi Arabia pain management drugs market outlook.

Saudi Arabia Pain Management Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on drug class, indication, and distribution channel.

Drug Class Insights:

- NSAIDs

- Anesthetics

- Anticonvulsants

- Antimigraine Agents

- Antidepressants

- Opioids

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes NSAIDs, anesthetics, anticonvulsants, antimigraine agents, antidepressants, opioids, and others.

Indication Insights:

- Musculoskeletal Pain

- Surgical and Trauma Pain

- Cancer Pain

- Neuropathic Pain

- Migraine Pain

- Obstetrical Pain

- Fibromyalgia Pain

- Burn Pain

- Dental/Facial Pain

- Pediatric Pain

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes musculoskeletal pain, surgical and trauma pain, cancer pain, neuropathic pain, migraine pain, obstetrical pain, fibromyalgia pain, burn pain, dental/facial pain, pediatric pain, and others.

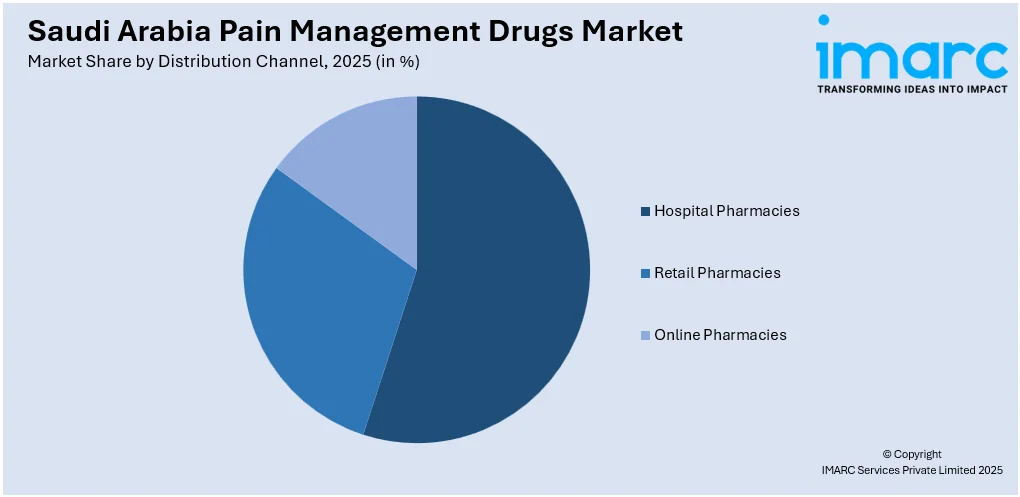

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacies, retail pharmacies, and online pharmacies.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Pain Management Drugs Market News:

- In March 2024, Scilex Holding Company, a pioneering revenue-generating firm dedicated to the acquisition, development, and commercialization of non-opioid pain relief products for managing acute and chronic pain, announced that its commercial product ZTlido received Halal Certification, signifying that ZTlido passed a thorough evaluation to confirm that it meets Islamic standards for permissibility or acceptability. The Halal certification was granted by Circle H International, Inc. and gives the Company the chance to supply ZTlido to Islamic markets worldwide. This announcement reinforces Scilex's strategy for global expansion, which the company expects will involve establishing a presence in the Middle East and North Africa (MENA) region, initially prioritizing the UAE and Saudi Arabia.

Saudi Arabia Pain Management Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | NSAIDs, Anesthetics, Anticonvulsants, Antimigraine Agents, Antidepressants, Opioids, Others |

| Indications Covered | Musculoskeletal Pain, Surgical and Trauma Pain, Cancer Pain, Neuropathic Pain, Migraine Pain, Obstetrical Pain, Fibromyalgia Pain, Burn Pain, Dental/Facial Pain, Pediatric Pain, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia pain management drugs market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia pain management drugs market on the basis of drug class?

- What is the breakup of the Saudi Arabia pain management drugs market on the basis of indication?

- What is the breakup of the Saudi Arabia pain management drugs market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia pain management drugs market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia pain management drugs market?

- What are the key driving factors and challenges in the Saudi Arabia pain management drugs market?

- What is the structure of the Saudi Arabia pain management drugs market and who are the key players?

- What is the degree of competition in the Saudi Arabia pain management drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia pain management drugs market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia pain management drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia pain management drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)