Saudi Arabia Paint Market Size, Share, Trends and Forecast by Technology, Type of Paint, Resin, End User, and Region, 2026-2034

Saudi Arabia Paint Market Overview:

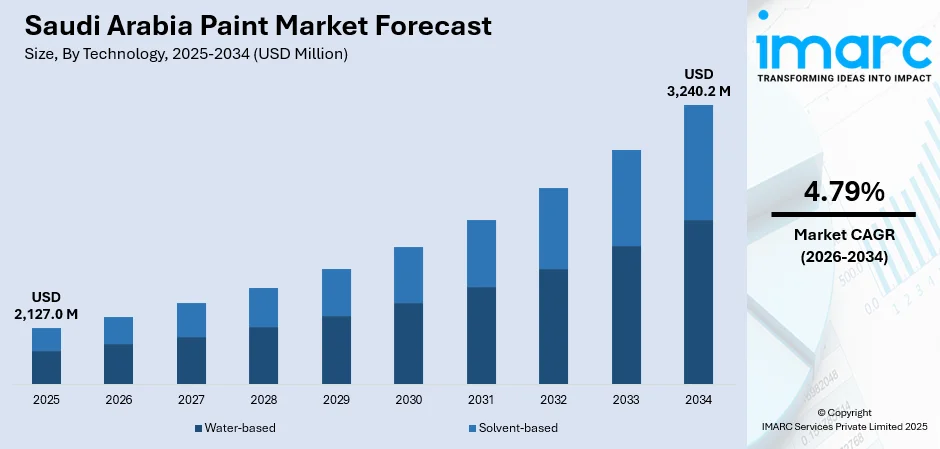

The Saudi Arabia paint market size reached USD 2,127.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,240.2 Million by 2034, exhibiting a growth rate (CAGR) of 4.79% during 2026-2034. The market growth is supported by the tourism and hospitality sectors, improved retail and distribution channels, and government incentives for local manufacturing. The rising construction and real estate demand, advancements in sustainable and technological paint solutions, and increasing disposable income further contribute to the Saudi Arabia paint market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,127.0 Million |

| Market Forecast in 2034 | USD 3,240.2 Million |

| Market Growth Rate 2026-2034 | 4.79% |

Saudi Arabia Paint Market Trends:

Rising Construction and Real Estate Demand

The roust construction and real estate industries in Saudi Arabia significantly influencing the paint market, with ongoing growth driven by elements like population increase and government-supported housing programs. With the Kingdom's focus on expanding infrastructure and the development of new residential, commercial, and hospitality properties, there is a higher demand for paint products that improve both functionality and appearance. These sectors receive backing from initiatives such as affordable housing programs, designed to address the needs of the expanding population. A noteworthy development bolstering this trend is Retal Urban Development’s announcement of a $160 million real estate fund in 2025, intended for constructing a 28-story residential building in Makkah’s Masar region. With the rise of residential and commercial projects, the need for paints, coatings, and finishes to safeguard, enhance, and elevate the worth of buildings becomes essential.

To get more information on this market, Request Sample

Technological Advancements and Sustainability Trends

With increasing environmental awareness, the need for sustainable paints and coatings with low volatile organic compounds (VOCs) and minimal environmental effects is growing considerably. Paint producers are adapting by creating more eco-friendly products that comply with local and international environmental regulations. Technological advancements like digital color blending, automated application systems, and sophisticated coating techniques are enhancing the accuracy, speed, and effectiveness of paint application. These technological improvements lead to enhanced finishes, savings in cost, and less waste, benefiting individuals and producers alike. Furthermore, there is a rise in the inclination towards long-lasting paints that provide excellent defense against severe weather conditions, particularly in an area such as Saudi Arabia with its temperature extremes. As a result, the implementation of these advanced technologies addresses environmental issues while simultaneously improving the overall quality and effectiveness of paint products available in the market.

Rising Disposable Income

The rising disposable income of Saudi Arabia’s populace, especially within the middle and upper classes, is driving the need for high-end paint products. The Mid-Year Economic and Fiscal Performance Report FY 2024 indicated that private consumption expenditures saw a real growth of 2.4% in the first half of FY2024 relative to the same timeframe of the prior year. With increasing wealth, people are more willing to invest in premium paints that provide enhanced durability, performance, and design options. There is a higher preference for products that provide long-lasting results, superior finishes, and advanced features, such as antibacterial properties and enhanced ultraviolet (UV) resistance, reflecting a shift toward more premium, value-driven choices. This trend is especially noticeable in the growing demand for paints in high-end residential and commercial properties, where buyers look for upscale brands and tailored finishes. With the improvement of living standards and an increasing preference for personalized spaces, there is a noticeable shift in consumer behavior toward higher-quality and aesthetically pleasing paint solutions.

Saudi Arabia Paint Market Growth Drivers:

Rising Tourism and Hospitality Development

The swift growth of the tourism and hospitality industries in Saudi Arabia, propelled by government programs like Vision 2030, is positively influencing the market. With extensive projects focused on establishing the Kingdom as a leading international tourism destination, there is a higher need for paints that improve both the visual attractiveness and longevity of tourism-related structures, such as hotels, resorts, and recreational facilities. According to insights from the IMARC Group, Saudi Arabia's luxury travel market reached USD 12.9 Billion in 2024, indicating significant growth in high-end hospitality investments. Paint is essential for designing vibrant and attractive environments, ranging from opulent interior surfaces to durable exteriors that endure the region's harsh climate. Moreover, the focus on providing immersive experiences for international visitors is resulting in increased demand for specialty decorative paints and coatings that enhance contemporary architectural styles and new trends.

Improved Distribution Channels and Retail Growth

The growth of retail, especially in home improvement and hardware stores, is making paint products more accessible to individuals, including both professional contractors and do-it-yourself (DIY) enthusiasts. The rise of e-commerce platforms in the Kingdom is making it easier for people to explore, buy, and obtain paint products, providing greater convenience and an expanded range of options. The International Trade Administration (ITA) forecasted that the count of internet users engaging in e-commerce in Saudi Arabia will reach 33.6 million by 2024, emphasizing the growing trend of online shopping. Additionally, retailers are progressively embracing hybrid models that combine online and offline channels, enabling them to meet the rising demand for tailored and specialized paint solutions. Moreover, the emergence of specialized retail shops and stores focused on paint and coatings is further influencing the market by providing buyers with expert advice and a selection of premium products designed for particular requirements.

Government Incentives and Subsidies for Local Manufacturing

The governing body is continuously introducing regulations and incentives to promote local manufacturing in various industries, including the paint sector, aiming to lessen reliance on imports and enhance domestic output. These initiatives involve providing subsidies, tax breaks, and various support measures for domestic paint manufacturers. By encouraging local production, the governing authority allows manufacturers to reduce operational expenses, invest in innovative technologies, and enhance product quality. These regional producers are now more equipped to satisfy the increasing need for paints driven by the growing construction, real estate, and infrastructure industries. Moreover, due to the emphasis of the governing body on industrial development and employment opportunities, the paint sector gains from a more competitive environment that encourages innovation and effectiveness. These incentives, along with supportive policies, are supporting the growth of Saudi Arabia's paint industry, making domestically manufactured paints more affordable and available for various uses.

Saudi Arabia Paint Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology, type of paint, resin, and end user.

Technology Insights:

- Water-based

- Solvent-based

The report has provided a detailed breakup and analysis of the market based on the technology. This includes water-based and solvent-based.

Type of Paint Insights:

- Emulsion

- Enamel

- Distemper

- Textures

- Others

A detailed breakup and analysis of the market based on the type of paint have also been provided in the report. This includes emulsion, enamel, distemper, textures, and others.

Resin Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

A detailed breakup and analysis of the market based on the resin have also been provided in the report. This includes acrylic, alkyd, polyurethane, epoxy, polyester, and others.

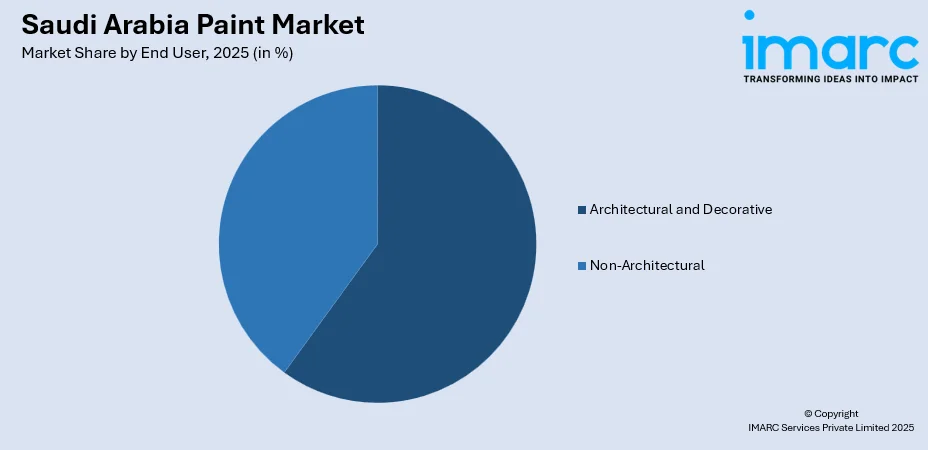

End User Insights:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes architectural and decorative and non-architectural (automotive and transportation, wood, general industrial, marine, and others).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Paint Market News:

- In March 2025, Saudi Industrial Paint Company (SIPCO), a subsidiary of Kaizen Paint Middle East, acquired Premium Paints Company to enhance its local production and expand its presence in the Saudi Arabia market. This acquisition supports Saudi Arabia’s Vision 2030, focusing on infrastructure and urban development. SIPCO aims to provide high-quality, climate-suited coatings while boosting economic self-sufficiency and job creation.

- In January 2025, Jazeera Paints unveiled its 25/26 Color Trends and the revolutionary "Jazeera Cantara" product at a launch event in Riyadh. The product introduces a new concept in modern paints, blending luxury and innovation to enhance interior design.

- In January 2025, Jazeera Paints inaugurated new showrooms in Jazan, Al-Madinah, Saihat, and Suwayr, enhancing its presence in Saudi Arabia. This expansion reflects the company’s commitment to customer service and innovation in the paints and construction sector, offering high-quality products and expert consultations to support diverse projects.

- In February 2024, Shaji Paints officially launched in Riyadh, Saudi Arabia, on February 12, marking its expansion into the Middle Eastern market. With over 31 years of experience, the brand will offer a range of high-quality paints, supported by its UAE facility. Collaborations with local distributors aim to meet Saudi customers' needs.

Saudi Arabia Paint Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Water-based, Solvent-based |

| Type of Paints Covered | Emulsion, Enamel, Distemper, Textures, Others |

| Resins Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| End Users Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia paint market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia paint market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia paint industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paint market in Saudi Arabia was valued at USD 2,127.0 Million in 2025.

The Saudi Arabia paint market is projected to exhibit a CAGR of 4.79% during 2026-2034, reaching a value of USD 3,240.2 Million by 2034.

The Saudi Arabia paint market is experiencing growth owing to the rising demand from the construction sector, government infrastructure projects, and the increasing focus on sustainability and eco-friendly solutions. Advances in paint technology, particularly in durability and energy efficiency, further influence the market, alongside a growing preference for high-quality, innovative products in both residential and commercial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)