Saudi Arabia Palletized Cargo Market Size, Share, Trends and Forecast by Pallet Type, Cargo Type, Mode of Transportation, End Use Industry, and Region, 2026-2034

Saudi Arabia Palletized Cargo Market Summary:

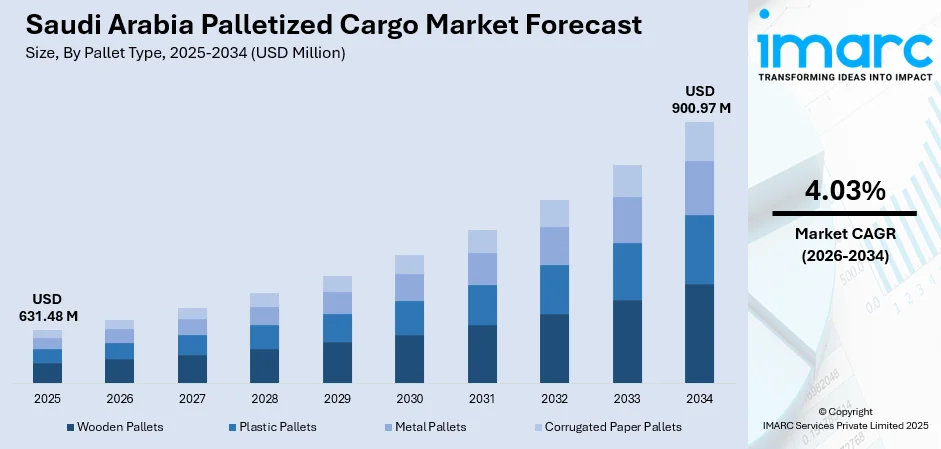

The Saudi Arabia palletized cargo market size was valued at USD 631.48 Million in 2025 and is projected to reach USD 900.97 Million by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

The Saudi Arabia palletized cargo market is witnessing robust expansion driven by the rapid growth of e-commerce and increasing demand for efficient bulk logistics solutions. Government initiatives under Vision 2030 are significantly enhancing port and road infrastructure, enabling seamless movement of palletized freight across the Kingdom. The shift toward sustainable palletizing solutions, supported by the Saudi Green Initiative, is optimizing operational costs while reducing environmental impact. Advancements in automated pallet-handling systems and warehouse modernization are further strengthening the Saudi Arabia palletized cargo market share.

Key Takeaways and Insights:

-

By Pallet Type: Wooden pallets dominate the market with a share of 45% in 2025, owing to their cost-effectiveness, widespread availability, and compliance with international phytosanitary standards for cross-border cargo movement.

-

By Cargo Type: Dry cargo leads the market with a share of 51% in 2025, driven by the extensive movement of consumer goods, industrial materials, and e-commerce shipments across domestic and regional corridors.

-

By Mode of Transportation: Road transport represents the largest segment with a market share of 49% in 2025, reflecting the Kingdom's well-developed highway network connecting major consumption centers and industrial hubs.

-

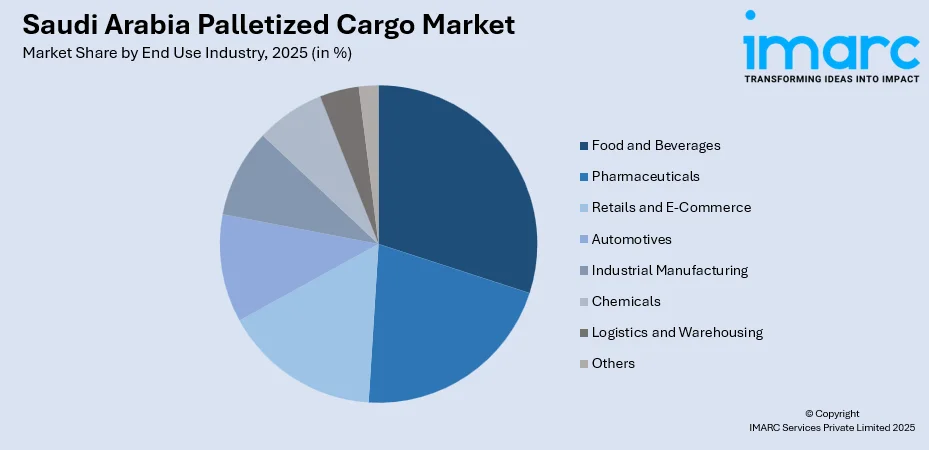

By End Use Industry: Food and beverages hold the largest share of 26% in 2025, supported by the growing demand for efficient cold chain logistics and temperature-controlled palletized shipments.

-

By Region: Northern and Central Region represents the largest revenue share of 38% in 2025, anchored by Riyadh's strategic position as the primary distribution and logistics hub serving domestic consumption centers.

-

Key Players: The Saudi Arabia palletized cargo market exhibits moderate competitive intensity, with multinational logistics corporations competing alongside regional freight operators. Companies are focusing on expanding automated warehousing capabilities, improving fleet efficiency, and forming strategic partnerships to enhance service offerings and capture growing demand across diverse industry verticals.

To get more information on this market Request Sample

The Saudi Arabia palletized cargo market is undergoing significant transformation as the Kingdom positions itself as a global logistics hub under Vision 2030. The National Transport and Logistics Strategy has allocated USD 133 billion for developing roads, ports, airports, and 59 logistics centers spanning 100 million square meters to be operational by 2030. The government's ambitious infrastructure investments are enhancing multimodal connectivity, reducing transit times, and lowering logistics costs for palletized freight operations. The rapid growth of e-commerce is driving demand for efficient palletized cargo services to support the Kingdom's several online stores. The Saudi Arabia E-commerce market size reached USD 222.9 Billion in 2024. The market is projected to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033.

Saudi Arabia Palletized Cargo Market Trends:

Integration of Smart Pallet Technologies and IoT-Enabled Tracking Systems

The adoption of smart pallet technologies embedded with sensors and RFID tracking is transforming supply chain visibility across Saudi Arabia’s logistics sector. These IoT-enabled solutions allow real-time monitoring of inventory location, temperature conditions, and handling status, helping to minimize loading errors and reduce product spoilage. Recent regulatory measures have reinforced the use of standardized pallets for containerized cargo, improving handling efficiency across ports and warehouses. This digital transformation, aligned with Vision 2030’s focus on technological innovation, is driving growth in the palletized cargo market as operators invest in connected and intelligent logistics infrastructure.

Expansion of Automated Warehousing and Pallet-Handling Facilities

The surge in e-commerce and industrial activity is accelerating investments in automated warehousing solutions across the Kingdom. Modern distribution centers are deploying advanced shuttle systems, robotics, and automated storage and retrieval systems to enhance picking productivity and operational efficiency for palletized cargo. In November 2024, DHL Supply Chain announced a EUR 130 million investment to establish a new 53,000 square meter regional logistics hub at the Special Integrated Logistics Zone in Riyadh, featuring state-of-the-art multi-user warehouse capabilities for diverse sectors including technology, retail, and consumer goods.

Growing Emphasis on Sustainable and Eco-Friendly Palletizing Solutions

Environmental sustainability is reshaping palletizing practices as companies shift from traditional wooden pallets to eco-friendly alternatives including recycled plastic, composite materials, and reusable pallet pooling systems. The Saudi Green Initiative is encouraging businesses to adopt greener logistics practices, optimize pallet loading to reduce carbon emissions, and invest in energy-efficient fleet operations. This sustainability focus, combined with international shipping standards requiring compliant packaging materials, is driving innovation in pallet design and materials, with HDPE and polypropylene pallets gaining significant traction in food and beverage, pharmaceutical, and e-commerce sectors.

How Vision 2030 is Transforming the Saudi Arabia Palletized Cargo Market:

Saudi Arabia’s Vision 2030 is driving a transformative shift in the palletized cargo market by prioritizing logistics modernization, trade facilitation, and industrial diversification. Investments in smart ports, rail networks, and road infrastructure are enhancing cargo handling efficiency, reducing turnaround times, and expanding storage and distribution capabilities. Government initiatives promoting local manufacturing and export-oriented industries are increasing demand for standardized pallet solutions to streamline supply chains. Advanced warehouse management systems, automated handling technologies, and digital tracking platforms are being adopted to improve operational accuracy and security. Collectively, these efforts are fostering a more resilient, integrated, and technology-driven palletized cargo sector aligned with the Kingdom’s economic and trade ambitions.

Market Outlook 2026-2034:

The Saudi Arabia palletized cargo market outlook remains positive, underpinned by sustained infrastructure investments, expanding trade volumes, and growing industrial activity across diverse sectors. The Kingdom's strategic positioning as a tri-continental gateway connecting Asia, Europe, and Africa presents significant opportunities for palletized freight operations serving regional redistribution networks. Continued investments in port expansions, railway network development targeting 8,000 kilometers, and the establishment of special economic zones will strengthen logistics capabilities. The market generated a revenue of USD 631.48 Million in 2025 and is projected to reach a revenue of USD 900.97 Million by 2034, growing at a compound annual growth rate of 4.03% from 2026-2034.

Saudi Arabia Palletized Cargo Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Pallet Type | Wooden Pallets | 45% |

| Cargo Type | Dry Cargo | 51% |

| Mode of Transportation | Road Transport | 49% |

| End Use Industry | Food and Beverages | 26% |

| Region | Northern and Central Region | 38% |

Pallet Type Insights:

- Wooden Pallets

- Plastic Pallets

- Metal Pallets

- Corrugated Paper Pallets

Wooden pallets lead the market with a share of 45% of the total Saudi Arabia palletized cargo market in 2025.

Wooden pallets continue to dominate palletized cargo operations in Saudi Arabia, valued for their affordability, durability, and ready availability within the Kingdom’s manufacturing and logistics sectors. Their compliance with International Standards for Phytosanitary Measures No. 15 ensures suitability for cross-border shipments and export-oriented businesses. Key industries such as construction, manufacturing, and retail rely on wooden pallets to optimize storage, streamline handling, and facilitate smooth transportation of goods, reinforcing their central role in the domestic supply chain.

Sustainability considerations are further enhancing the appeal of wooden pallets, with heat-treated and recycled options gaining traction. These environmentally conscious alternatives reduce the ecological footprint of supply chain operations while preserving structural integrity and performance. As companies in Saudi Arabia increasingly integrate sustainable practices into logistics and warehousing, wooden pallets remain a practical and eco-friendly solution, balancing operational efficiency, regulatory compliance, and cost-effectiveness across diverse cargo handling and transportation applications.

Cargo Type Insights:

- Dry Cargo

- Perishable Cargo

- Hazardous Cargo

- Heavy Equipment and Machinery

Dry cargo leads the market with a share of 51% of the total Saudi Arabia palletized cargo market in 2025.

Dry cargo is the leading segment within the palletized cargo market, covering a wide range of goods including consumer products, industrial materials, automotive components, and e-commerce shipments. These items are increasingly transported through palletized systems across domestic and regional logistics networks. The rapid expansion of online retail and growing imports of consumer goods via Saudi ports are fueling ongoing demand for reliable and efficient palletized dry cargo services, enabling faster handling, safer transportation, and optimized warehouse operations.

Wholesale and retail sectors are major drivers of dry cargo palletization, relying on organized pallet systems for smooth distribution center workflows and cross-docking processes. Efficient palletized transport supports the timely movement of goods to the Kingdom’s key consumption hubs in Riyadh, Jeddah, and Dammam. This structured approach enhances supply chain visibility, reduces handling errors, and improves operational efficiency, making palletized dry cargo solutions essential for meeting the evolving demands of both businesses and consumers across Saudi Arabia.

Mode of Transportation Insights:

- Road Transport

- Rail Transport

- Air Transport

- Sea Transport

Road transport holds the largest share at 49% of the total Saudi Arabia palletized cargo market in 2025.

Road transport remains the backbone of palletized cargo movement in Saudi Arabia, supported by a vast highway network linking industrial hubs in the Eastern Province with major consumer markets in Riyadh and Jeddah. Curtain-sider and flatbed trucks efficiently carry a wide range of goods, including FMCG, appliances, and industrial materials, across national routes. In addition, expanding last-mile delivery networks cater to the growing e-commerce sector, ensuring timely distribution to urban and suburban areas while maintaining supply chain continuity.

The government’s emphasis on modernizing road freight is driving the adoption of digital solutions and operational efficiency measures. Freight-matching platforms, fleet management systems, and route optimization technologies are increasingly implemented to streamline cargo handling and reduce operational costs. Investments in infrastructure improvements, enhanced connectivity, and advanced logistics services are collectively strengthening the road transport segment, positioning it as a reliable and efficient channel for palletized cargo movement throughout the Kingdom.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Pharmaceuticals

- Retails and E-Commerce

- Automotives

- Industrial Manufacturing

- Chemicals

- Logistics and Warehousing

- Others

Food and beverages represent the highest revenue at 26% share of the total Saudi Arabia palletized cargo market in 2025.

The food and beverage sector is a major driver of palletized cargo demand in Saudi Arabia, fueled by the Kingdom’s high dependence on imported products and a rapidly expanding domestic food processing industry. Efficient palletized logistics play a critical role in maintaining supply chain continuity, ensuring timely delivery, and preserving product quality. Perishable goods require careful handling and integration into specialized transport systems to meet operational standards and minimize losses, highlighting the strategic importance of robust palletized cargo infrastructure. With up to 80% dependency on imports in certain food categories, a robust palletized logistics infrastructure is essential for maintaining supply chain efficiency and product freshness.

Regulatory requirements from the Saudi Food and Drug Authority mandate continuous temperature monitoring and adherence to good distribution practices (GDP) for sensitive products. This has prompted investments in temperature-controlled pallet systems and cold chain solutions to ensure compliance and product safety. Retail chains, supermarkets, and food service operators increasingly rely on palletized cargo for streamlined cross-docking, warehouse management, and distribution center operations, enhancing operational efficiency and supporting the growing demand for fresh and processed food across the Kingdom.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominates with a 38% share of the total Saudi Arabia palletized cargo market in 2025.

The Northern and Central region of Saudi Arabia is a key growth hub for the palletized cargo market, driven by a combination of demographic, industrial, and infrastructure factors. The region hosts major urban centers such as Riyadh and Qassim, which are characterized by high population density, strong consumer demand, and expanding industrial and commercial activity. This creates a substantial need for efficient freight movement, particularly for fast-moving consumer goods, white goods, and industrial materials, all of which rely heavily on palletized logistics for streamlined handling and storage.

Well-developed road and rail networks in the region enhance connectivity between manufacturing hubs, distribution centers, and retail outlets, enabling faster transit times and reducing operational costs for logistics providers. The adoption of digital freight platforms, warehouse automation, and advanced fleet management systems is improving operational efficiency and service reliability. Additionally, the presence of large-scale warehousing and distribution facilities, coupled with government initiatives promoting logistics modernization and smart city development, is further strengthening demand for palletized cargo services in the Northern and Central region of Saudi Arabia.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Palletized Cargo Market Growing?

Rapid Expansion of E-Commerce and Digital Retail Platforms

The exponential growth of e-commerce in Saudi Arabia is significantly driving demand for efficient palletized cargo services. The Kingdom’s expanding online commerce ecosystem is becoming a major catalyst for palletized logistics demand. As digital retail platforms scale and consumer adoption deepens, the volume of goods moving through fulfillment centers and last-mile networks continues to rise. A large share of merchandise is sourced from international suppliers, increasing reliance on standardized palletized handling for efficient port clearance, warehousing, and inland distribution. The growing number of online retailers and marketplace operators further strengthens the need for reliable palletized logistics solutions that support high-throughput order processing, inventory control, and rapid delivery across the country. Platforms such as Amazon.sa and Noon are driving investments in last-mile delivery infrastructure and micro-fulfillment centers. In May 2023, Amazon expanded its Saudi operations with a new 39,000 square foot fulfillment center in Riyadh, doubling local capacity and extending same-day Prime delivery to key cities, demonstrating the direct link between e-commerce growth and palletized cargo infrastructure development.

Government Infrastructure Investments Under Vision 2030

The Saudi government’s push to position the Kingdom as a global logistics hub is accelerating large-scale investments in transportation and warehousing infrastructure, creating a strong foundation for palletized cargo operations. Ongoing development of road networks, ports, airports, and integrated logistics zones is improving cargo movement efficiency and reducing handling bottlenecks. These infrastructure upgrades support smoother palletized freight flows across domestic and international supply chains, strengthen multimodal connectivity, and enhance warehouse automation and distribution capabilities, reinforcing long-term growth prospects for palletized cargo logistics across the Kingdom. The government aims to increase air cargo capacity to over 4.5 million tons annually. In February 2024, the Makkah region initiated 20 road projects valued at USD 373 million covering 385 kilometers of roadways, including a 24-kilometer direct route linking Jeddah to Makkah, enhancing connectivity for palletized freight movement across western Saudi Arabia.

Expanding Food and Pharmaceutical Logistics Requirements

The rising volume of food imports and pharmaceutical products is increasing demand for specialized palletized cargo solutions across Saudi Arabia’s supply chains. Pharmaceutical distribution requires reliable temperature-controlled pallet handling to protect product efficacy and ensure regulatory compliance throughout storage and transport. At the same time, the food and beverages sector relies heavily on palletized cargo to preserve quality, freshness, and shelf life for imported and domestically processed goods. Efficient palletized logistics support streamlined handling, warehousing, and distribution of perishable products while maintaining cold chain integrity. Growing collaboration among logistics providers is improving temperature-controlled transport and warehouse capabilities, strengthening overall operational performance. These developments are accelerating the adoption of palletized cargo solutions across food and pharmaceutical supply chains, ensuring consistent product standards and dependable delivery performance.

Market Restraints:

What Challenges the Saudi Arabia Palletized Cargo Market is Facing?

Infrastructure Gaps in Secondary Cities and Remote Areas

Despite substantial development in major metropolitan hubs, logistics infrastructure in secondary cities and remote regions remains relatively limited, posing operational challenges for palletized cargo movements. Distribution beyond the primary economic corridors faces higher costs and efficiency constraints due to extended transport distances and lower delivery concentration. In addition, insufficient warehousing availability and underdeveloped cold chain capabilities in outlying areas hinder the broader adoption of palletized freight solutions, restricting service reach and limiting market expansion across less urbanized parts of the country.

Skilled Workforce Shortages in Advanced Logistics Operations

A shortage of skilled professionals capable of managing advanced logistics technologies, automated pallet-handling systems, and warehouse management software remains a significant challenge. The rapid adoption of IoT-enabled tracking, robotic systems, and digital freight platforms requires specialized training that the current workforce pool cannot fully support. Saudization requirements and wage regulations further complicate talent acquisition for specialized logistics roles.

High Operating Costs and Fuel Price Volatility

Rising fuel costs and operational expenses continue to pressure margins for palletized cargo operators across the Kingdom. In January 2024, diesel prices increased by 53% to USD 0.31 per liter, marking the third increase since 2016. These escalating costs, combined with investments required for fleet modernization, temperature-controlled equipment, and regulatory compliance, create financial constraints particularly for smaller logistics providers competing in price-sensitive market segments.

Competitive Landscape:

The Saudi Arabia palletized cargo market features a moderately competitive landscape with multinational logistics corporations operating alongside regional freight operators and specialized cargo handlers. Companies are differentiating through technology investments in automated warehousing, IoT-enabled tracking systems, and sustainable logistics solutions. Strategic partnerships and joint ventures are reshaping competitive dynamics, with major players forming alliances to expand service capabilities and geographic coverage. Investment in cold chain infrastructure, last-mile delivery networks, and digital freight platforms has become essential for maintaining market position. The government's focus on attracting foreign investment and privatizing logistics operations continues to intensify competition while elevating service standards across the industry.

Recent Developments:

-

October 2024: CEVA Logistics and Almajdouie Logistics finalized their joint venture, establishing CEVA Almajdouie Logistics headquartered in Dammam with approximately 2,000 employees and over 2,000 assets. The partnership aims to enhance Saudi Arabia's cold chain and palletized cargo capabilities in alignment with Vision 2030 logistics development goals.

-

August 2024: Maersk inaugurated a logistics park at Jeddah Islamic Port, representing a USD 250 million investment on a 225,000 square meter site. Designed as the largest single-location logistics hub in the Middle East, the facility features solar-powered operations with 32,000 solar panels, bonded warehousing, cold storage, and multimodal integration supporting palletized cargo handling for FMCG, petrochemical, automotive, and pharmaceutical industries.

Saudi Arabia Palletized Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pallet Types Covered | Wooden Pallets, Plastic Pallets, Metal Pallets, Corrugated Paper Pallets |

| Cargo Types Covered | Dry Cargo, Perishable Cargo, Hazardous Cargo, Heavy Equipment and Machinery |

| Mode of Transportations Covered | Road Transport, Rail Transport, Air Transport, Sea Transport |

| End Use Industries Covered | Food and Beverages, Pharmaceuticals, Retail and E-Commerce, Automotive, Industrial Manufacturing, Chemicals, Logistics and Warehousing, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia palletized cargo market size was valued at USD 631.48 Million in 2025.

The Saudi Arabia palletized cargo market is expected to grow at a compound annual growth rate of 4.03% from 2026-2034 to reach USD 900.97 Million by 2034.

Wooden pallets held the largest market share at 45% in 2025, driven by their cost-effectiveness, structural strength, widespread availability, and compliance with international phytosanitary standards for cross-border cargo movement across the Kingdom's logistics networks.

Key factors driving the Saudi Arabia palletized cargo market include rapid e-commerce expansion, Vision 2030 infrastructure investments, growing food and pharmaceutical logistics requirements, expansion of automated warehousing facilities, and the Kingdom's strategic positioning as a regional logistics hub.

Major challenges include infrastructure gaps in secondary cities and remote areas, skilled workforce shortages in advanced logistics operations, high operating costs and fuel price volatility, regulatory compliance requirements, and the need for sustained technology investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)