Saudi Arabia Payment Gateways Market Size, Share, Trends and Forecast by Application, Mode of Interaction, and Region, 2026-2034

Saudi Arabia Payment Gateways Market Overview:

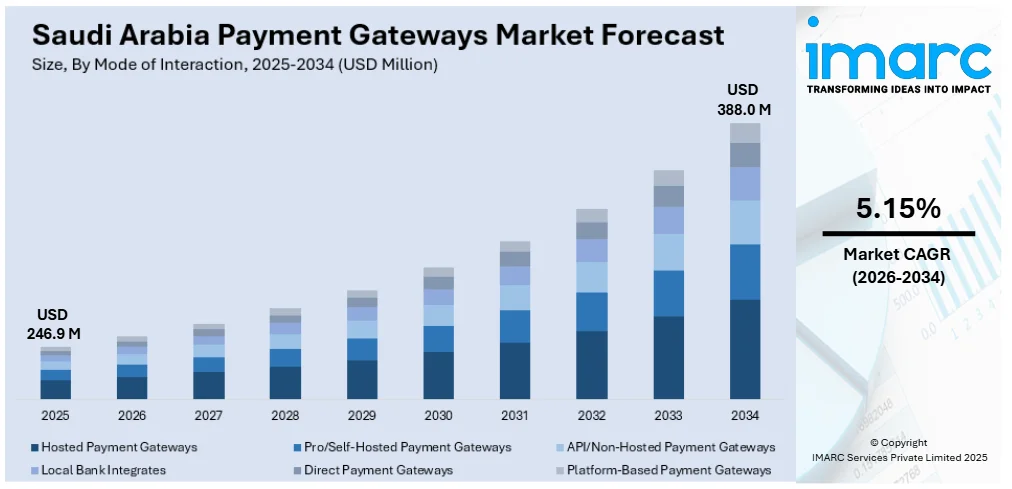

The Saudi Arabia payment gateways market size reached USD 246.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 388.0 Million by 2034, exhibiting a growth rate (CAGR) of 5.15% during 2026-2034. Vision 2030 digitalization goals, SAMA-led regulatory reforms, PSP licensing, mada network integration, e-commerce expansion, digital wallet adoption, real-time settlement, fraud prevention compliance, Sharia-compliant tools, social commerce growth, and rising SME digitization are some of the factors positively impacting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 246.9 Million |

| Market Forecast in 2034 | USD 388.0 Million |

| Market Growth Rate 2026-2034 | 5.15% |

Saudi Arabia Payment Gateways Market Trends:

National Digitalization Strategies and Regulatory Alignment

Saudi Arabia’s Vision 2030 agenda have prioritized digital transformation across sectors, with payments and fintech receiving focused regulatory support. Under the supervision of the Saudi Central Bank (SAMA), the country has developed frameworks to enhance payment gateway interoperability, security, and domestic innovation. Licensing models, such as the Payment Services Provider (PSP) license, have structured market entry, while regulations for tokenization, e-invoicing, and fraud prevention have set uniform standards. These initiatives have led to a reconfiguration of the Saudi Arabia payment gateways market share, with domestic firms gaining ground alongside multinational players that localize infrastructure to comply with regulatory expectations. The launch of SADAD and the mada system—Saudi Arabia’s national payment network—has also reduced dependency on international card schemes. Gateways are now required to integrate with mada and support real-time authorization protocols to remain competitive. As e-commerce grows and more SMEs digitize operations, gateway solutions offering localized language support, Sharia-compliant financial tools, and seamless reconciliation are attracting merchant adoption. In 2024, e-payments accounted for 79% of all retail transactions in Saudi Arabia, according to data released by the Saudi Central Bank (SAMA). Regulatory alignment is no longer a barrier to entry but a competitive differentiator, especially for providers targeting enterprise retail, government contractors, and fintech partnerships. Vendors that maintain data sovereignty and comply with cybersecurity mandates are increasingly favored in public and private procurement environments.

To get more information on this market Request Sample

Rapid Growth of E-Commerce and Digital Wallet Ecosystem

The e-commerce sector in Saudi Arabia has expanded significantly, driven by increased mobile penetration, consumer preference for digital-first experiences, and government investments in digital infrastructure. Consumers are demanding faster checkouts, support for local payment methods, and integration with digital wallets such as STC Pay, Apple Pay, and urpay. This has elevated the role of payment gateways, particularly those that can support dynamic currency conversion, fraud analytics, and compatibility with multiple wallet ecosystems. These conditions are fueling Saudi Arabia payment gateways market growth, particularly in verticals such as travel, online groceries, apparel, and on-demand services. As digital wallet adoption expands, payment gateways are evolving into orchestration layers—managing not just payments, but also identity verification, tax compliance, and chargeback handling. FinTechs and established banks are increasingly entering this space with modular solutions that can be tailored to different merchant needs. As per IMARC Group, the Saudi Arabia buy now pay later services market size reached USD 89.1 Million in 2024 and is expected to reach USD 548.5 Million by 2033, exhibiting a CAGR of 22.4% during 2025-2033. In parallel, social commerce and influencer-led selling are creating demand for micro-gateway integrations via platforms such as Instagram, Snapchat, and TikTok. The broader Saudi Arabia payment gateways market outlook is influenced by demographic factors, especially a young, tech-savvy population and growing female participation in online commerce. These shifts are establishing long-term demand for versatile, secure, and locally attuned gateway infrastructure.

Saudi Arabia Payment Gateways Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on application and mode of interaction.

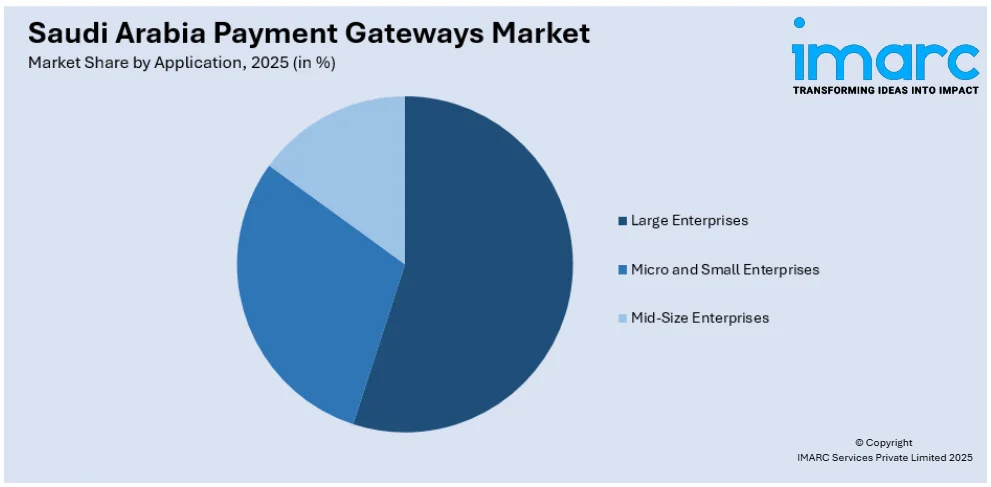

Application Insights:

Access the comprehensive market breakdown Request Sample

- Large Enterprises

- Micro and Small Enterprises

- Mid-Size Enterprises

The report has provided a detailed breakup and analysis of the market based on the application. This includes large enterprises, micro and small enterprises, and mid-size enterprises.

Mode of Interaction Insights:

- Hosted Payment Gateways

- Pro/Self-Hosted Payment Gateways

- API/Non-Hosted Payment Gateways

- Local Bank Integrates

- Direct Payment Gateways

- Platform-Based Payment Gateways

The report has provided a detailed breakup and analysis of the market based on the mode of interaction. This includes hosted payment gateways, pro/self-hosted payment gateways, API/non-hosted payment gateways, local bank integrates, direct payment gateways, and platform-based payment gateways.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Payment Gateways Market News:

- On October 22, 2024, Mastercard launched a local technology infrastructure in Saudi Arabia to enhance the efficiency, resilience, and security of the country’s digital payment ecosystem. This localized setup enables faster transaction processing and aligns with Saudi Vision 2030’s goal of expanding domestic fintech capabilities. The initiative strengthens the Saudi Arabia payment gateways market by supporting real-time authorization, reducing reliance on cross-border infrastructure, and improving service continuity for banks, merchants, and fintech providers.

- On April 16, 2024, Telr announced its collaboration with Saudi Awwal Bank (SAB) to expand its banking network and enhance e-commerce payment services across Saudi Arabia. The partnership provides merchants with direct integration to SAB, enabling faster settlements and localized digital transaction processing.

Saudi Arabia Payment Gateways Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Large Enterprises, Micro and Small Enterprises, Mid-Size Enterprises |

| Modes of Interaction Covered | Hosted Payment Gateways, Pro/Self-Hosted Payment Gateways, API/Non-Hosted Payment Gateways, Local Bank Integrates, Direct Payment Gateways, Platform-Based Payment Gateways |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia payment gateways market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia payment gateways market on the basis of application?

- What is the breakup of the Saudi Arabia payment gateways market on the basis of mode of interaction?

- What is the breakup of the Saudi Arabia payment gateways market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia payment gateways market?

- What are the key driving factors and challenges in the Saudi Arabia payment gateways?

- What is the structure of the Saudi Arabia payment gateways market and who are the key players?

- What is the degree of competition in the Saudi Arabia payment gateways market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia payment gateways market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia payment gateways market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia payment gateways industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)