Saudi Arabia Personal Luxury Goods Market Size, Share, Trends and Forecast by Type, Gender, Distribution Channel, and Region, 2026-2034

Saudi Arabia Personal Luxury Goods Market Overview:

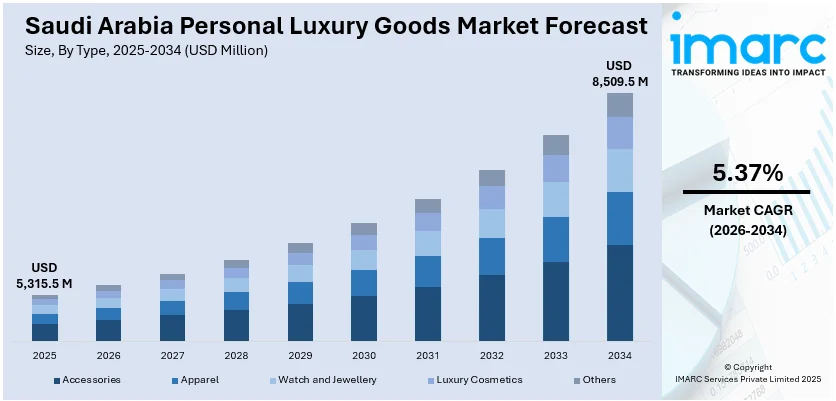

The Saudi Arabia personal luxury goods market size reached USD 5,315.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 8,509.5 Million by 2034, exhibiting a growth rate (CAGR) of 5.37% during 2026-2034. The market is being driven by a rising population of high-net-worth individuals seeking exclusive products and transformative social reforms under Vision 2030 that are reshaping consumer behavior, expanding women's participation in the consumer economy, and fostering a modern, fashion-forward culture aligned with global luxury trends and experiential retail expectations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5,315.5 Million |

| Market Forecast in 2034 | USD 8,509.5 Million |

| Market Growth Rate 2026-2034 | 5.37% |

Saudi Arabia Personal Luxury Goods Market Trends:

Rising Number of High-Net-Worth Individuals (HNWIs) and Wealth Expansion

Saudi Arabia is seeing a significant growth in its number of high-net-worth individuals, fueled by economic diversification, increased oil revenues, and development in sectors such as finance, technology, and property. The Kingdom's millionaires are growing in numbers, as many have accumulated their fortunes through investments in business portfolios and government-sponsored initiatives in the Vision 2030 economic diversification strategy. The growth in this wealthy population has resulted in an upsurge in demand for luxury, high-end, status-driven, and exclusive products such as expensive watches, designer clothing, leather products, high-end jewellery, and luxury perfumes. HNWIs in Saudi Arabia also appreciate exclusivity and individualization, something that is highly compatible with personal luxury goods brands' offerings. The Kingdom’s high-spending consumers are now more often looking for made-to-order or limited-production items that provide an element of singularity and social status.

To get more information on this market Request Sample

Cultural Liberalization and Evolving Consumer Lifestyles Under Vision 2030

Another driver of Saudi Arabia's individual luxury goods market is the wide-ranging cultural liberalization underway under the government's Vision 2030 program. Traditionally, public consumption of luxury fashion and lifestyle products was constrained by cultural and social convention, especially for women. Yet the Vision 2030 initiative, designed to turn the Kingdom into an open, world-connected society, has ushered in broad social reforms. These encompass loosening dress codes, widening women's rights (including the right to drive and travel alone), and driving female workforce participation. This revolution has unleashed a forceful new generation of luxury consumers, particularly younger Saudis and women, who now have the freedom to use fashion and lifestyle as a means of expressing individuality. As public spaces like cinemas, restaurants, shopping centers, and entertainment complexes thrive, there is a wide demand for personal luxury goods that complement these new, outward-looking lifestyles.

Saudi Arabia Personal Luxury Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, gender, and distribution channel.

Type Insights:

- Accessories

- Apparel

- Watch and Jewellery

- Luxury Cosmetics

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes accessories, apparel, watch and jewellery, luxury cosmetics, and others.

Gender Insights:

- Female

- Male

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes female and male.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Mono-brand Stores

- Specialty Stores

- Departmental Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mono-brand stores, specialty stores, departmental stores, online stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Personal Luxury Goods Market News:

- April 2025: Saudia Airlines partnered with luxury fashion house ELIE SAAB to introduce exclusive amenity kits for First and Business Class passengers. These kits feature designer vanity cases and voyager bags containing premium ELIE SAAB skincare products and Eau de Toilette. Emphasizing sustainability, the kits include eco-friendly items like toothbrushes and socks made from recycled materials, blending luxury with environmental responsibility.

- December 2024: Dolce & Gabbana inaugurated a flagship brand center at Al Bujairi Terrace in Diriyah, a UNESCO World Heritage site. Spanning 1,500 square meters, this boutique is among the brand’s largest globally, offering a comprehensive range of products including fashion, fine jewellery, watches, fragrances, beauty items, and the Dolce & Gabbana Casa home collection. The space also houses the DG Caffè, blending Italian and Saudi hospitality traditions.

Saudi Arabia Personal Luxury Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Accessories, Apparel, Watch and Jewellery, Luxury Cosmetics, Others |

| Genders Covered | Female, Male |

| Distribution Channels Covered | Mono-brand Stores, Specialty Stores, Departmental Stores, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia personal luxury goods market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia personal luxury goods market on the basis of type?

- What is the breakup of the Saudi Arabia personal luxury goods market on the basis of gender?

- What is the breakup of the Saudi Arabia personal luxury goods market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia personal luxury goods market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia personal luxury goods market?

- What are the key driving factors and challenges in the Saudi Arabia personal luxury goods market?

- What is the structure of the Saudi Arabia personal luxury goods market and who are the key players?

- What is the degree of competition in the Saudi Arabia personal luxury goods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia personal luxury goods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia personal luxury goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia personal luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)