Saudi Arabia Pesticides Market Size, Share, Trends and Forecast by Product Type, Segment, Formulation, Crop Type, and Region, 2026-2034

Saudi Arabia Pesticides Market Overview:

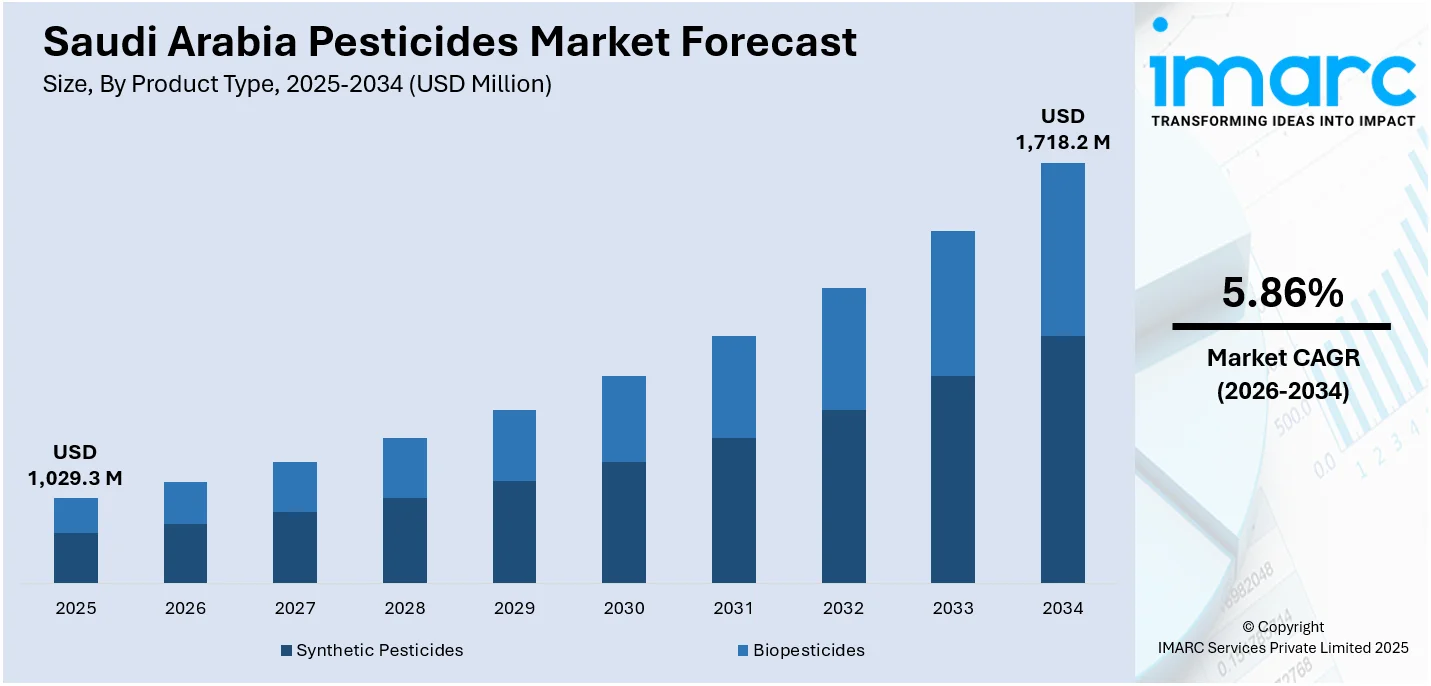

The Saudi Arabia pesticides market size reached USD 1,029.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,718.2 Million by 2034, exhibiting a growth rate (CAGR) of 5.86% during 2026-2034. The increasing food demand due to population growth, government support through subsidies and favorable policies, adoption of sustainable farming practices, advancements in agricultural technology, and rising awareness among farmers about the benefits of pesticides are the among the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,029.3 Million |

| Market Forecast in 2034 | USD 1,718.2 Million |

| Market Growth Rate 2026-2034 | 5.86% |

Saudi Arabia Pesticides Market Trends:

Technological Integration through Precision Agriculture and IPM

Saudi Arabia has rapidly advanced its adoption of precision agriculture and Integrated Pest Management (IPM) technologies to enhance pesticide efficiency, reduce environmental harm, and improve crop yields. In 2023, the government launched a USD 200 million Precision Farming Initiative, deploying AI-powered drones, satellite monitoring, and soil sensors across 15,000 hectares of pilot farms. These farms recorded an average 12% increase in yields and an 18% reduction in pesticide usage compared to traditional spraying methods. Enabled by Vision 2030’s focus on food security and digital transformation, these efforts align with global trends toward IoT, big-data analytics, and autonomous equipment in agriculture. Technologies driving this shift include drones and robotic sprayers with multispectral cameras for targeted treatments, adaptive controllers linked to soil-moisture and nutrient sensors, and machine-learning models that optimize pesticide timing based on weather and pest data. As cooperatives and private farms scale these pilots, precision farming is poised to become central to Saudi Arabia’s sustainable pesticide strategy.

To get more information on this market Request Sample

Shift toward Sustainable, Eco-friendly Pesticide Solutions

Rising consumer awareness and stricter regulatory scrutiny around food safety are accelerating demand for bio-based and low-residue pesticide alternatives in Saudi Arabia. In response, government agencies and agribusinesses are increasingly promoting organic, microbial, and botanical pesticides that offer reduced environmental impact and improved health safety. Saudi producers are leveraging this trend through joint ventures and local manufacturing partnerships. The domestic pesticide residue testing market is also expanding, driven by the need to validate low-residue claims and ensure product quality. Key enablers of this sustainability shift include fast-tracked approvals and subsidies for certified biopesticides, R&D collaborations between institutions like King Abdullah University and global agrochemical firms, and the growth of greenhouse and vertical farming sectors catering to export markets with strict residue limits.

Saudi Arabia Pesticides Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, segment, formulation, and crop type.

Product Type Insights:

- Synthetic Pesticides

- Biopesticides

The report has provided a detailed breakup and analysis of the market based on the product type. This includes synthetic pesticides and biopesticides.

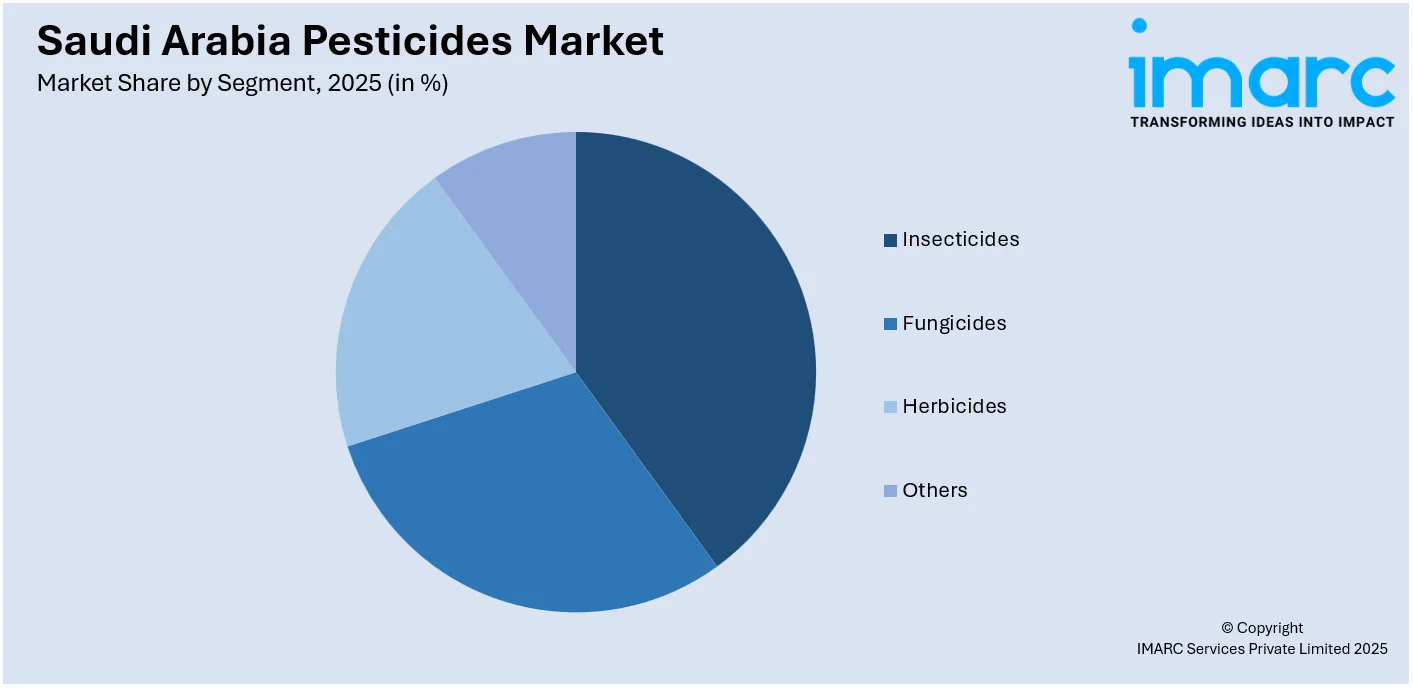

Segment Insights:

Access the comprehensive market breakdown Request Sample

- Insecticides

- Fungicides

- Herbicides

- Others

A detailed breakup and analysis of the market based on the segment have also been provided in the report. This includes insecticides, fungicides, herbicides, and others.

Formulation Insights:

- Liquid

- Dry

The report has provided a detailed breakup and analysis of the market based on the formulation. This includes liquid and dry.

Crop Type Insights:

- Cereals

- Fruits

- Vegetables

- Plantation Crops

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes cereals, fruits, vegetables, plantation crops, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Pesticides Market News:

- July 2024: The Saudi AgriFood Tech Alliance (SAFTA) was launched by the Vice Minister of Environment, Water, and Agriculture. The alliance focuses on deploying precision agriculture, biotechnology, nanotechnology, alternative foods, innovative fertilizers, and biopesticides to address challenges like pest control and food security.

- January 2023: Saudi Arabia's Ministry of Investment signed a USD 1 billion agreement with UPL Ltd. to establish a manufacturing facility for specialized agricultural chemicals, including pesticides, in the Kingdom. This collaboration aims to bolster local production capabilities, reduce reliance on imports, and enhance the efficiency and sustainability of agricultural practices in the region.

Saudi Arabia Pesticides Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Synthetic Pesticides, Biopesticides |

| Segments Covered | Insecticides, Fungicides, Herbicides, Others |

| Formulations Covered | Liquid, Dry |

| Crop Types Covered | Cereals, Fruits, Vegetables, Plantation Crops, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia pesticides market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia pesticides market on the basis of product type?

- What is the breakup of the Saudi Arabia pesticides market on the basis of segment?

- What is the breakup of the Saudi Arabia pesticides market on the basis of formulation?

- What is the breakup of the Saudi Arabia pesticides market on the basis of crop type?

- What is the breakup of the Saudi Arabia pesticides market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia pesticides market?

- What are the key driving factors and challenges in the Saudi Arabia pesticides market?

- What is the structure of the Saudi Arabia pesticides market and who are the key players?

- What is the degree of competition in the Saudi Arabia pesticides market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia pesticides market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia pesticides market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia pesticides industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)