Saudi Arabia Pharmaceuticals Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region 2026-2034

Saudi Arabia Pharmaceuticals Market Summary:

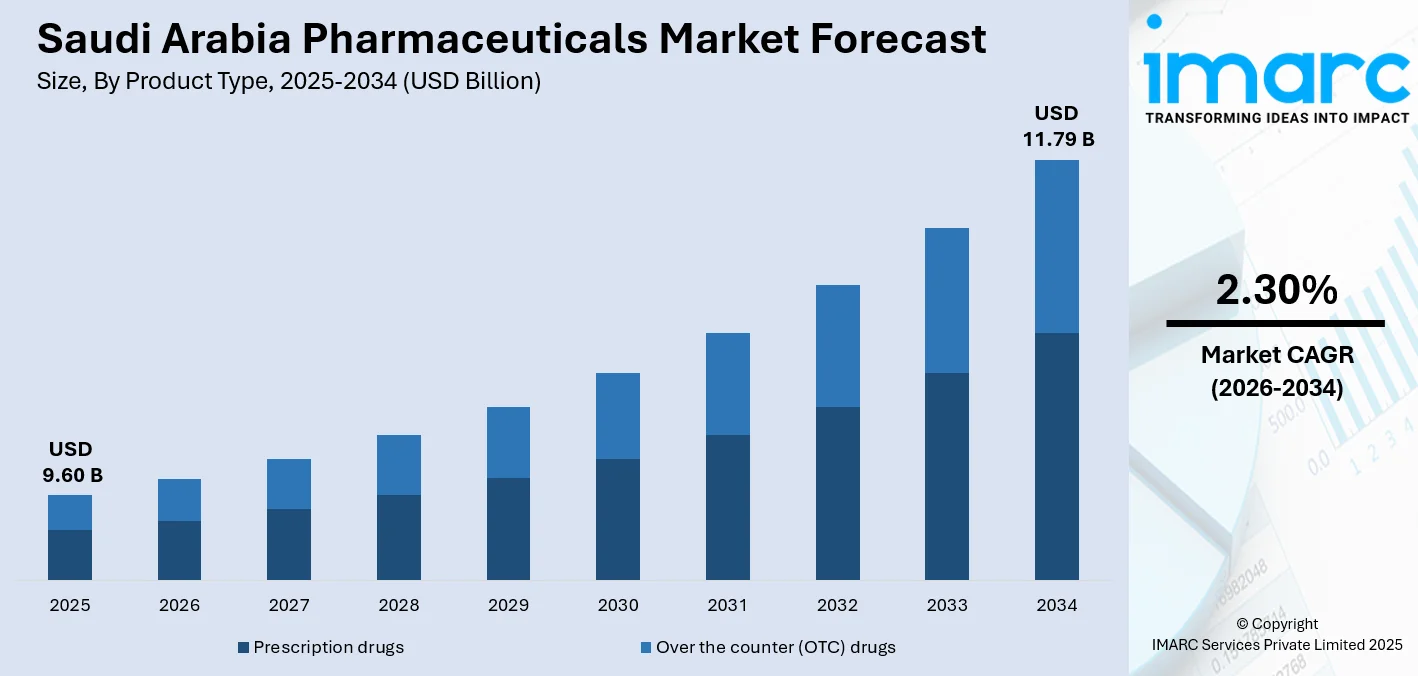

The Saudi Arabia pharmaceuticals market size was valued at USD 9.60 Billion in 2025 and is projected to reach USD 11.79 Billion by 2034, growing at a compound annual growth rate of 2.30% from 2026-2034.

The Saudi Arabia pharmaceuticals market is witnessing growth, influenced by strategic government efforts in line with Vision 2030, focusing on transforming the healthcare sector and localizing pharmaceuticals. Increasing incidence of chronic illnesses, such as diabetes and cardiovascular conditions, is driving the need for prescription drugs in various therapeutic areas. The dedication of the governing body in boosting local pharmaceutical manufacturing from current levels to satisfy national health needs is drawing significant investments from global firms looking for technology transfer collaborations. The expansion of healthcare infrastructure, increasing population demographics, improved health insurance coverage, and reinforced regulatory frameworks, are further contributing to the market growth in the Kingdom.

Key Takeaways and Insights:

- By Product Type: Prescription drugs dominate the market with a share of 64% in 2025, owing to the escalating burden of chronic diseases requiring long-term therapeutic interventions, government support for advanced treatment protocols, and increasing physician preference for branded and generic prescription medications across healthcare facilities.

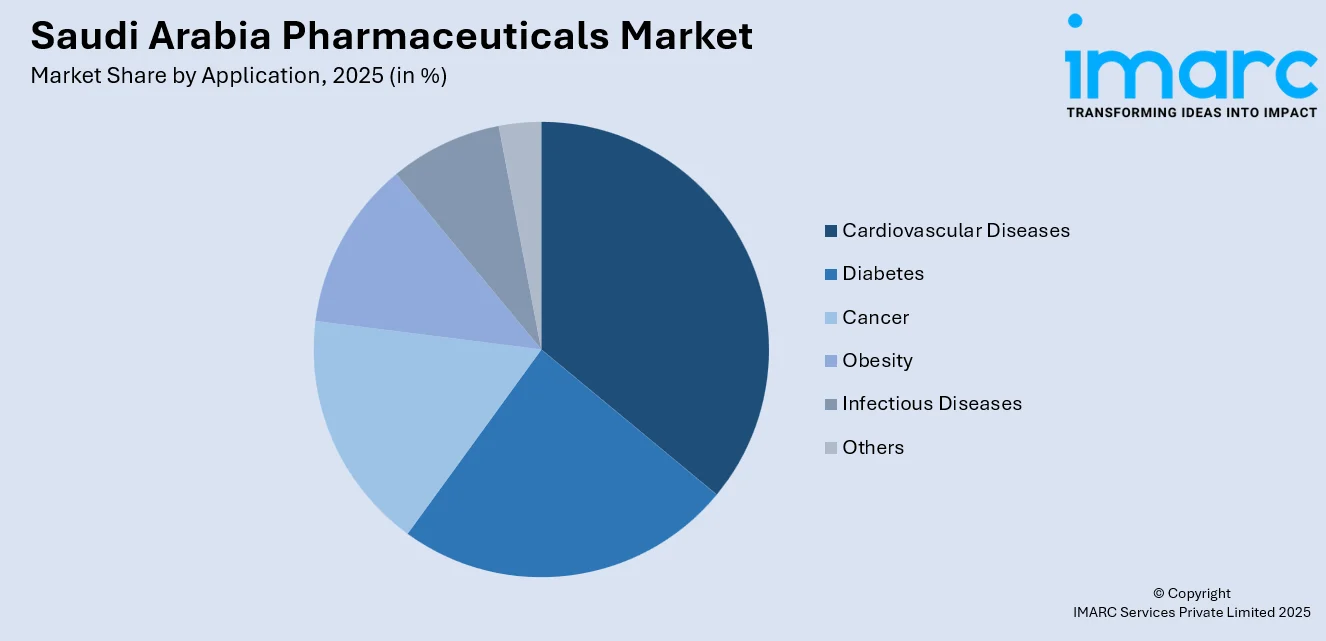

- By Application: Cardiovascular diseases lead the market with a share of 30% in 2025, reflecting the significant health burden posed by heart-related conditions in Saudi Arabia, supported by comprehensive national screening programs and increasing adoption of advanced cardiovascular treatment protocols.

- By Distribution Channel: Retail pharmacy represents the largest segment with a market share of 57% in 2025, driven by widespread accessibility, expanding pharmacy networks across urban and suburban areas, consumer convenience preferences, and the growing adoption of modern retail practices.

- By Region: Northern and Central Region dominate the market with a share of 38% in 2025, supported by Riyadh's concentration of premier healthcare facilities, research centers, corporate headquarters, and advanced medical infrastructure serving the largest urban population base.

- Key Players: The Saudi Arabia pharmaceuticals market exhibits competitive intensity with multinational corporations and regional manufacturers competing across therapeutic segments through product innovation, strategic partnerships, and distribution network expansion. Some of the key players operating in the market include AstraZeneca, GSK plc, Hikma Pharmaceuticals PLC, Jamjoom Pharma, Julphar, Novartis AG, Pfizer Saudi Limited Corporate (Pfizer Inc.), Sanofi KSA (Sanofi S.A.), Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), and Tabuk Pharmaceuticals (ASTRA Industrial Group).

To get more information on this market Request Sample

The Saudi Arabia pharmaceuticals market is driven by rising chronic disease prevalence, sustained public healthcare spending, expanding insurance coverage, regulatory efficiency, and strong policy support for localization under Vision 2030. The increasing adoption of specialty therapies, improved diagnosis rates, and expanding private healthcare capacity in major cities, further contribute to the market growth. Government procurement ensures steady volumes, while private providers encourage uptake of advanced and branded medicines. Local manufacturing incentives and faster product approvals are improving market access for international players seeking direct presence. In 2024, Eisai Co., Ltd. has begun full operations at its new Saudi Arabian subsidiary, Eisai Pharmaceuticals Single Person LLC in Riyadh. The subsidiary handled sales and marketing of Eisai’s drugs, including Methycobal®, Fycompa®, and Lenvima®, aiming to expand local access. This move strengthened Eisai’s direct presence in Saudi Arabia’s largest Middle Eastern pharmaceutical market and aligns with Vision 2030 healthcare goals, reflecting how global firms are responding to structural demand growth and long-term market stability.

Saudi Arabia Pharmaceuticals Market Trends:

Rising Burden of Disease

Urbanization and lifestyle changes are increasing the burden of chronic diseases, supporting higher pharmaceutical demand in Saudi Arabia. Reduced physical activity and dietary shifts are raising long term treatment needs, while seasonal pilgrimage inflows add short term pressure on medicine consumption. According to the National Health Survey and Woman and Child Health Survey released in 2024, about 18.95% of adults reported at least one chronic condition, including diabetes at 9.1% and hypertension at 7.9%. Improved diagnostics and wider screening programs are expanding treated populations, driving growth in prescriptions, over the counter medicines, and sustained therapy adherence across healthcare channels nationwide.

Demographic Shifts and Ageing Population

Continued improvement in healthcare outcomes is increasing life expectancy, gradually expanding the elderly population with long term treatment needs. According to the Elderly Survey 2025, around 1.7 million people aged 60 years and above represented 4.8% of the total population, underscoring the rising senior segment. Age related conditions, including cardiovascular disorders, arthritis, metabolic diseases, and neurological illnesses require continuous medication. Expanding geriatric care facilities and home healthcare services are reinforcing regular medicine use, strengthening demand stability and predictable prescription volumes across public and private healthcare systems nationwide.

Local Manufacturing and Industrial Policy

National industrial policy is accelerating pharmaceutical manufacturing and localization across Saudi Arabia. Vision 2030 incentives are supporting investments in formulation facilities, biotechnology, and vaccine production, while procurement preference for locally manufactured medicines is improving commercial viability. In 2025, Pfizer Saudi Arabia and PIF-owned Lifera signed a Memorandum of Understanding at the Global Health Exhibition in Riyadh to explore local drug manufacturing, technology transfer, and workforce development, strengthening domestic capabilities. Such collaborations reduce import reliance, enhance supply security, and improve medicine availability. Localization initiatives are expanding production capacity, attracting private capital, and positioning Saudi Arabia as a regional pharmaceutical manufacturing and export base.

How Vision 2030 is Transforming the Saudi Arabia Pharmaceuticals Market:

Vision 2030 is transforming the Saudi Arabia pharmaceuticals market by strengthening local manufacturing, improving supply security, and encouraging innovation across the healthcare value chain. National programs promote domestic production of essential medicines, reduce import reliance, and attract global pharmaceutical companies through investment incentives and partnerships. Regulatory modernization and faster approval pathways are improving market efficiency and product availability. Increased healthcare spending and focus on preventive care are expanding demand for advanced therapies. Furthermore, support for research, biotechnology, and digital integration is enhancing development capabilities, positioning the pharmaceutical sector as a strategic pillar within the Kingdom’s long-term healthcare and industrial growth agenda.

Market Outlook 2026-2034:

The Saudi Arabia pharmaceuticals market demonstrates sustained revenue growth potential throughout the forecast period, supported by expansion of healthcare infrastructure, rising demand for essential medicines, and ongoing regulatory modernization. Increased focus on local manufacturing, supply chain resilience, and preventive healthcare is strengthening market stability. The growing population needs, improved access to healthcare services, and wider availability of branded and generic drugs further contribute to the market demand. Investment in research, biotechnology, and digital integration is also contributing to gradual market advancement. The market generated a revenue of USD 9.60 Billion in 2025 and is projected to reach a revenue of USD 11.79 Billion by 2034, growing at a compound annual growth rate of 2.30% from 2026-2034.

Saudi Arabia Pharmaceuticals Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Prescription Drugs | 64% |

| Application | Cardiovascular Diseases | 30% |

| Distribution Channel | Retail Pharmacy | 57% |

| Region | Northern and Central Region | 38% |

Product Type Insights:

- Prescription drugs

- Branded Drugs

- Generic Drugs

- Over the counter (OTC) drugs

Prescription drugs dominate with a market share of 64% of the total Saudi Arabia pharmaceuticals market in 2025.

Prescription drugs represent the largest segment due to the high prevalence of chronic and lifestyle-related conditions requiring long-term medical supervision. Diseases, such as diabetes, cardiovascular disorders, and respiratory illnesses, necessitate regulated therapies prescribed by healthcare professionals. For example, in 2025, the Saudi Food and Drug Authority (SFDA) approved Winrevair (Sotatercept) as an orphan drug for treating pulmonary arterial hypertension (PAH) in adults with WHO Functional Class II–III. Sotatercept works by inhibiting activin, reducing pulmonary blood vessel thickening, improving blood flow, and enhancing exercise capacity.

This dominance is further reinforced by strict regulatory controls governing drug dispensation and patient safety. Prescription medicines are central to public healthcare programs, insurance coverage, and hospital procurement systems. Expansion of healthcare infrastructure, rising physician access, and emphasis on evidence-based treatment continue to strengthen the role of prescription drugs within the market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Cardiovascular Diseases

- Diabetes

- Cancer

- Obesity

- Infectious Diseases

- Others

Cardiovascular diseases lead with a market share of 30% of the total Saudi Arabia pharmaceuticals market in 2025.

Cardiovascular diseases dominate the market owing to the high incidence of heart-related conditions linked to lifestyle patterns, aging population segments, and rising prevalence of risk factors. According to the 2024 Health Status Statistics, 1.5% of adults in Saudi Arabia are diagnosed with heart and vascular diseases. Long-term management of hypertension, coronary artery disease, and related conditions requires continuous pharmacological treatment, supporting sustained demand for cardiovascular medications across healthcare settings.

This segment is also supported by strong clinical focus on early diagnosis and ongoing disease management. Public health programs, hospital treatment protocols, and insurance-backed therapies prioritize cardiovascular care. Continuous use of prescription drugs for prevention, control, and post-treatment care reinforces the leading position of cardiovascular applications within the market.

Distribution Channel Insights:

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Retail pharmacy exhibits a clear dominance with a 57% share of the total Saudi Arabia pharmaceuticals market in 2025.

Retail pharmacy holds the biggest market share, driven by its extensive geographic presence, ease of access, and role as the primary point of contact for prescription fulfillment. People rely on retail pharmacies for routine medications, chronic disease management, and pharmacist guidance, supporting consistent footfall and repeat purchases across urban and semi-urban areas.

This dominance is reinforced by effective regulatory oversight that maintains medicine quality and patient safety, alongside rapid expansion of organized pharmacy networks. In 2025, Aster Pharmacy launched its flagship Trio store in Riyadh, introducing drive through pharmacy services and an integrated health and wellness retail model, with plans to establish up to 180 outlets nationwide. Improved supply chain efficiency, insurance integration, and digital prescription systems are enhancing consumer convenience and supporting higher retail pharmaceutical utilization across urban markets.

Regional Insights:

- Western Region

- Northern and Central Region

- Eastern Region

- Southern Region

Northern and Central Region dominate with a market share of 38% of the total Saudi Arabia pharmaceuticals market in 2025.

Northern and Central Region lead the market because of the concentration of major population centers, advanced healthcare infrastructure, and high density of hospitals and specialty clinics. These regions host leading medical institutions, diagnostic centers, and research facilities, driving higher prescription volumes and consistent pharmaceutical usage.

This regional dominance is further supported by higher disposable incomes, better insurance coverage, and strong presence of retail pharmacy networks. According to the Mid-Year Economic and Fiscal Performance Report FY 2024, private consumption expenditure grew by 2.4% in real terms during the first half of FY2024 compared to the same period a year earlier. Greater access to healthcare professionals and specialized treatment services increases medication uptake.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Pharmaceuticals Market Growing?

Digital Commerce and Online Pharmacy Adoption

Rapid digital adoption is expanding pharmaceutical market access across Saudi Arabia. High internet penetration and widespread smartphone use are encouraging growth of e-commerce platforms, including licensed online pharmacies and digital health marketplaces. According to the International Trade Administration, the number of internet users participating in e-commerce in Saudi Arabia is projected to reach 33.6 million by 2024, reflecting a large digitally engaged user base. This shift supports home delivery of medicines, repeat prescription fulfilment, and improved access for remote populations. Digital channels are increasing convenience, adherence, and retail pharmaceutical sales, while complementing traditional pharmacy networks and supporting sustained market growth.

Expansion of Biologics Manufacturing Capacity

The Saudi Arabia pharmaceuticals market is being driven by rising investment in advanced biologics manufacturing and local production capabilities. Establishment of high-value manufacturing facilities strengthens supply security, supports technology transfer, and enhances domestic expertise in complex therapies. This momentum is reflected in 2025, when MS Pharma launched a USD 50 million biologics manufacturing plant in Saudi Arabia, serving both local and international markets. The facility supports workforce development and strengthens the Kingdom’s biopharmaceutical capabilities. Such investments align with Vision 2030 objectives, accelerating sector modernization, expanding export potential, and supporting long-term growth across the pharmaceutical value chain.

Government-Led Innovation Partnerships and Investment

National authorities are using global platforms to attract investment, accelerate localizzation, and encourage adoption of advanced healthcare technologies. For example, in 2025, the Saudi Ministry of Health launched biotech and pharma partnerships at the 8th Global Health Exhibition 2025 in Riyadh, aiming to boost healthcare innovation and investment. The event, running from October 27–30, showcased deals in pharma localization, AI-driven health tech, and digital solutions, supporting Vision 2030’s health transformation goals. Such structured engagement enhances investor confidence, accelerates technology transfer, and expands the pharmaceutical ecosystem through sustained public sector leadership.

Market Restraints:

What Challenges the Saudi Arabia Pharmaceuticals Market is Facing?

Complex Regulatory Approval Processes

The Saudi Food and Drug Authority maintains rigorous regulatory requirements for pharmaceutical approvals, with examination timelines extending over several months for new medications and biological products. These comprehensive evaluation processes, while ensuring product safety and efficacy, create barriers for multinational companies seeking rapid market entry and may delay patient access to innovative therapeutics.

Import Dependency and Supply Chain Vulnerabilities

Despite ongoing localization initiatives, the Kingdom remains dependent on imports for many pharmaceutical needs, especially active pharmaceutical ingredients and complex biological products. This reliance exposes the supply chain to external risks, including global production disruptions, currency volatility, and logistical delays. Such vulnerabilities can affect pricing stability, inventory availability, and timely access to essential medicines.

Skilled Workforce Development Requirements

The pharmaceutical manufacturing sector faces workforce development challenges, as advanced biopharmaceutical production demands highly specialized technical skills. Strengthening domestic capabilities in aseptic processing, quality assurance, and research activities requires sustained investment in education, vocational training, and certification programs. Collaboration with international partners and structured knowledge transfer initiatives remains essential to build a competitive and skilled local workforce.

Competitive Landscape:

The Saudi Arabia pharmaceuticals market exhibits moderate competitive intensity characterized by the presence of multinational pharmaceutical corporations alongside established regional manufacturers competing across therapeutic segments and distribution channels. Market dynamics reflect strategic positioning, ranging from innovation-driven offerings emphasizing advanced therapeutic solutions to value-oriented products targeting cost-conscious healthcare providers. The competitive landscape is increasingly shaped by localization initiatives, regulatory compliance capabilities, and partnership development with government procurement agencies. Companies are differentiating through manufacturing facility investments, biosimilar development programs, and distribution network expansion to capture the growing market opportunities across prescription and specialty medication segments.

Some of the key players include:

- AstraZeneca

- GSK plc

- Hikma Pharmaceuticals PLC

- Jamjoom Pharma

- Julphar

- Novartis AG

- Pfizer Saudi Limited Corporate (Pfizer Inc.)

- Sanofi KSA (Sanofi S.A.)

- Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO)

- Tabuk Pharmaceuticals (ASTRA Industrial Group).

Recent Developments:

- October 2025: Lifera, a PIF-owned biopharmaceutical company, announced a potential joint venture with Jamjoom Pharma at the Global Health Exhibition in Riyadh. The proposed JV aimed to develop, manufacture, and commercialize vaccines, biologics, and biosimilars within Saudi Arabia. The initiative supported the National Biotechnology Strategy and Vision 2030 by strengthening local biopharma manufacturing and reducing reliance on imports.

- September 2025: Tabuk Pharmaceutical and Cumberland Pharmaceuticals launched Vibativ® (telavancin), an FDA-approved injectable antibiotic, in Saudi Arabia. The drug treats serious infections like hospital-acquired pneumonia and skin infections, including those caused by drug-resistant bacteria such as MRSA.

Saudi Arabia Pharmaceuticals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Cardiovascular Diseases, Diabetes, Cancer, Obesity, Infectious Diseases, Others |

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Pharmacy |

| Regions Covered | Western Region, Northern and Central Region, Eastern Region, Southern Reion |

| Companies Covered | AstraZeneca, GSK plc, Hikma Pharmaceuticals PLC, Jamjoom Pharma, Julphar, Novartis AG, Pfizer Saudi Limited Corporate (Pfizer Inc.), Sanofi KSA (Sanofi S.A.), Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO), Tabuk Pharmaceuticals (ASTRA Industrial Group), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia pharmaceuticals market size was valued at USD 9.60 Billion in 2025.

The Saudi Arabia pharmaceuticals market is expected to grow at a compound annual growth rate of 2.30% from 2026-2034 to reach USD 11.79 Billion by 2034.

Prescription drugs dominate the market with 64% revenue share in 2025, driven by rising chronic disease prevalence, government healthcare initiatives, and expanding insurance coverage supporting advanced treatment accessibility.

Key factors driving the Saudi Arabia pharmaceuticals market include Vision 2030–backed industrial policies that promote local manufacturing, biotechnology, and vaccine production. For example, Pfizer and PIF-owned Lifera’s 2025 agreement fosters local drug production, technology transfer, and workforce development, enhancing supply security and reducing import reliance.

Major challenges include complex regulatory approval processes, continued import dependency for active pharmaceutical ingredients and advanced biologics, skilled workforce development requirements for specialized manufacturing, and supply chain vulnerabilities affecting product availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)