Saudi Arabia Pharmacy Retail Market Size, Share, Trends and Forecast by Market Structure, Product Type, Therapeutic Area, Drug Type, Pharmacy Location, and Region, 2026-2034

Saudi Arabia Pharmacy Retail Market Summary:

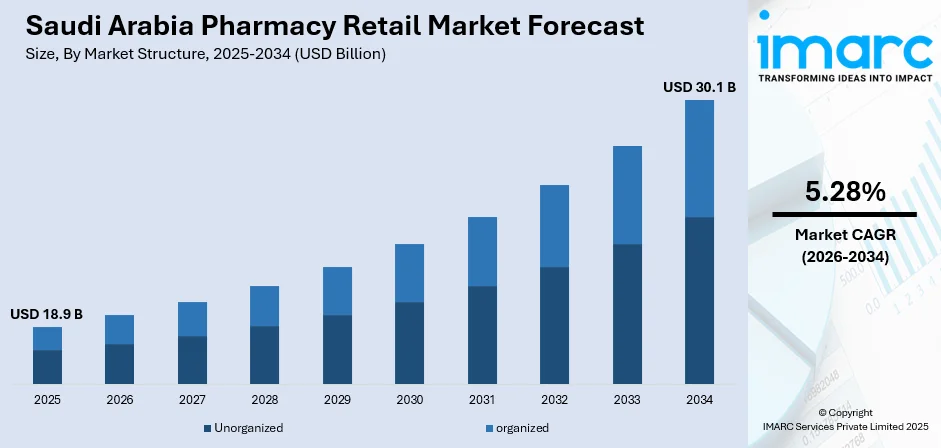

The Saudi Arabia pharmacy retail market size was valued at USD 18.9 Billion in 2025 and is projected to reach USD 30.1 Billion by 2034, growing at a compound annual growth rate of 5.28% from 2026-2034.

The market is experiencing robust expansion driven by the convergence of demographic shifts, healthcare infrastructure modernization under Vision 2030, and accelerating digital transformation across pharmaceutical retail channels. Growing prevalence of chronic conditions including diabetes and cardiovascular diseases, coupled with an aging population structure, is creating sustained demand for prescription medications and specialized therapeutic products. Government initiatives promoting healthcare accessibility through regulatory reforms and substantial infrastructure investments are fundamentally reshaping retail pharmacy operations, while the integration of digital platforms, e-prescription systems, and telemedicine services is expanding the Saudi Arabia pharmacy retail market share.

Key Takeaways and Insights:

- By Market Structure: Organized dominates the market with a share of 77% in 2025, driven by superior supply chain efficiency and comprehensive product assortment.

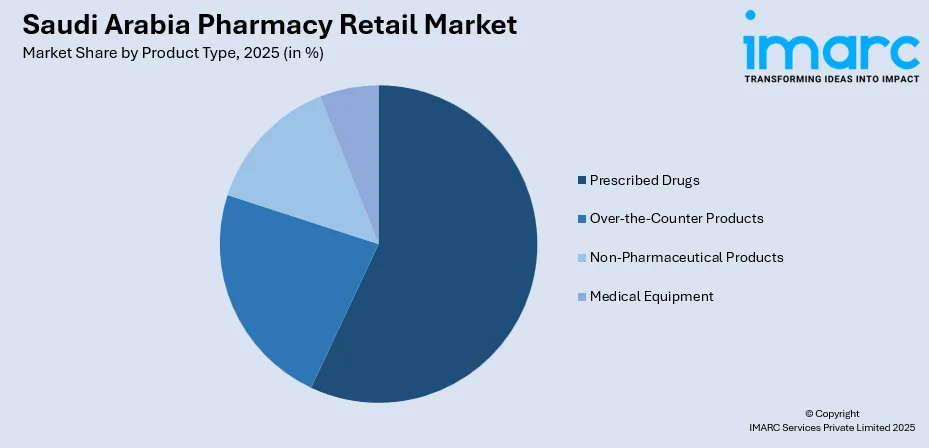

- By Product Type: Prescribed drugs lead the market with a share of 58% in 2025, reflecting rising chronic disease prevalence and expanding healthcare coverage.

- By Therapeutic Area: Cardiovascular represents the largest segment with a market share of 24% in 2025, addressing high hypertension and heart disease rates among the masses in the country.

- By Drug Type: Generic leads the market with a share of 57% in 2025, supported by affordability considerations and government promotion initiatives.

- By Pharmacy Location: Street/mall based represents the largest segment with a market share of 72% in 2025, ensuring convenient accessibility across urban centers.

- By Region: Northern and central region lead the market with a share of 32% in 2025, owing to the presence of Riyadh's efficient healthcare infrastructure and population density.

- Key Players: Key players in the Saudi Arabian pharmacy retail market are expanding their physical and digital footprints, enhancing customer experience through e-commerce platforms, offering loyalty programs, and diversifying product offerings. Partnerships and technological advancements are also being leveraged to strengthen market presence.

To get more information on this market Request Sample

The retail pharmacy landscape is in a profound state of transformation, anchored on Vision 2030's healthcare modernization agenda, which has pledged significant capital toward developing advanced medical infrastructure, upgrading hospital networks, and increasing outpatient service capacity across the Kingdom. In 2020, Saudi Arabia spent US$49.1 billion on healthcare, which will rise to US$77.1 billion by 2027. In February 2025, Riyadh - Aster Pharmacy, part of Aster DM Healthcare, has launched in the Kingdom of Saudi Arabia with 15 locations in Riyadh, with its main store at Trio Plaza. The launch of 'Trio' is another milestone for Aster Pharmacy, as it introduces a unique drive-through concept that would be the go-to health and wellness destination in Riyadh for health, beauty, fitness, and lifestyle needs of the populous Ryadh. Containing 711 square meters, Trio is located at one of North Riyadh's most dynamic areas and will introduce Aster Pharmacy's largest store ever to open in the GCC. It brings an assortment of more than 13,000 SKUs with specialized services tailored for everyday needs.

Saudi Arabia Pharmacy Retail Market Trends:

Accelerating Digital Health Ecosystem Integration

The pharmacy retail sector is witnessing rapid transformation through comprehensive digital health platform adoption, fundamentally altering how consumers access pharmaceutical products and healthcare services. National e-prescription infrastructure including the Wasfaty system connects government and private pharmacies with healthcare providers, enabling seamless prescription transmission and medication fulfillment while reducing dispensing errors and patient wait times. E-pharmacy platforms are proliferating with capabilities spanning home delivery, subscription-based refill programs, and artificial intelligence (AI)-powered medication adherence monitoring, appealing particularly to urban professionals seeking convenience and time efficiency. Robotic dispensing systems and automated inventory management technologies deployed by major chains ensure enhanced stock accuracy and operational efficiency, while mobile health applications facilitate remote pharmacist consultations and virtual medication counseling. The Digital Health Forum took place in Riyadh as a segment of the Global Health Exhibition 2025, currently in its eighth edition, conducted under the aegis of the Ministry of Health and backed by the Health Sector Transformation Program, which originates from Saudi Vision 2030. The forum operates under the theme “Inclusive Digital Health: Enhancing Vision, Strategy, and Scalable Impact”, uniting leaders, innovators, and specialists from the Kingdom and overseas to explore the future of digital transformation in healthcare and its significance in developing smarter, more sustainable health systems.

Vision 2030-Driven Infrastructure Expansion and Modernization

Government healthcare reform initiatives under Vision 2030 are catalyzing unprecedented infrastructure development and regulatory evolution across the pharmacy retail landscape. Public sector allocations exceeding USD 65 billion target development of advanced medical cities, hospital network upgrades, and comprehensive outpatient service expansion, creating expanded demand channels for pharmaceutical retail operations throughout the Kingdom. Regulatory liberalization measures including revised foreign ownership frameworks are attracting multinational pharmacy chains and encouraging domestic capacity expansion, intensifying market competition while elevating service standards and operational benchmarks. Major retailers are responding through aggressive network expansion strategies, with established players pursuing both organic growth and strategic acquisitions to strengthen market positions. Large-format pharmacy concepts integrating wellness services, preventive care offerings, and comprehensive health product assortments are emerging as differentiation strategies, reflecting evolving consumer preferences toward holistic health management and one-stop healthcare destinations that transcend traditional pharmaceutical dispensing functions.

Chronic Disease Management and Therapeutic Specialization

Rising prevalence of non-communicable diseases is reshaping product mix strategies and service delivery models across pharmacy retail operations. Diabetes affects approximately 23.1 percent of Saudi adults, while cardiovascular conditions including hypertension and hypercholesterolemia impact substantial population segments, driving sustained demand for chronic disease medications, monitoring devices, and disease management support services. Pharmacies are evolving from pure dispensing operations toward integrated healthcare service providers offering specialized consultations, disease state management programs, and preventive care initiatives. This therapeutic focus is influencing store layout optimization, staff training protocols, and inventory management systems to accommodate specialized product categories and enhanced clinical service delivery. Pharmacy chains are establishing dedicated chronic care sections, implementing patient education programs, and developing partnerships with healthcare providers to create coordinated care pathways.

How Vision 2030 is Transforming the Saudi Arabia Pharmacy Retail Market:

Saudi Arabia’s Vision 2030 is significantly transforming the pharmacy retail market by fostering a more diversified and tech-driven healthcare landscape. The government's focus on improving healthcare access and services has led to increased investment in the pharmacy sector. One of the key objectives is to enhance the availability of pharmaceutical services through both physical stores and online platforms, making healthcare products more accessible to the public. The Vision also encourages the integration of technology, with a growing emphasis on digital pharmacies and e-health solutions. This shift enables pharmacies to offer home delivery services, online consultations, and easier access to medications, all of which are in line with the Vision's goal of modernizing the healthcare system. Additionally, the expansion of private sector participation in healthcare, coupled with regulatory reforms, is paving the way for pharmacies to diversify their offerings, including health and wellness products, thus contributing to a more holistic healthcare ecosystem.

Market Outlook 2026-2034:

The pharmacy retail sector is positioned for sustained expansion through 2032, underpinned by converging demographic, technological, and regulatory catalysts. Vision 2030 healthcare investments will continue modernizing infrastructure and expanding service capacity, while digital platform proliferation accelerates omnichannel retail model adoption. The chronic disease burden is projected to intensify, creating expanding therapeutic markets particularly in cardiovascular, diabetes, and oncology segments. The market generated a revenue of USD 18.9 Billion in 2025 and is projected to reach a revenue of USD 30.1 Billion by 2034, growing at a compound annual growth rate of 5.28% from 2026-2034. Regulatory frameworks governing e-pharmacy operations, foreign investment participation, and quality standards are expected to mature, providing clarity for strategic planning and capital deployment.

Saudi Arabia Pharmacy Retail Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Market Structure |

Organized |

77% |

|

Product Type |

Prescribed Drugs |

58% |

|

Therapeutic Area |

Cardiovascular |

24% |

|

Drug Type |

Generic |

57% |

|

Pharmacy Location |

Street/Mall Based |

72% |

|

Region |

Northern and Central Region |

32% |

Market Structure Insights:

- Unorganized

- Organized

Organized dominates with a market share of 77% of the total Saudi Arabia pharmacy retail market in 2025.

Organized pharmacy chains command market leadership through superior operational infrastructure, comprehensive supply chain networks, and established consumer trust frameworks. Major operators including Nahdi Medical Company and Al-Dawaa Medical Services leverage economies of scale to negotiate favorable procurement terms, maintain extensive product assortments spanning prescription medications to wellness products, and implement advanced inventory management systems ensuring consistent product availability. These chains deploy standardized store formats, professional training protocols, and quality assurance systems that enhance patient safety and service consistency across locations.

Organized retailers are pioneering digital integration initiatives including e-commerce platforms, mobile applications, and loyalty programs that deepen customer relationships and capture evolving consumer preferences. Their financial strength enables investment in prime retail locations, modern store designs, and comprehensive service offerings including clinical consultations and disease management programs. The professional workforce capabilities, regulatory compliance infrastructure, and brand recognition advantages position organized chains to capitalize on market growth opportunities while maintaining operational efficiency and profitability margins that sustain continued expansion investments.

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Over-the-Counter Products

- Prescribed Drugs

- Non-Pharmaceutical Products

- Medical Equipment

Prescribed drugs lead with a share of 58% of the total Saudi Arabia pharmacy retail market in 2025.

Prescribed medications constitute the dominant revenue stream, driven by escalating chronic disease prevalence and expanding health insurance coverage mandating prescription medication access. The therapeutic landscape is characterized by high cardiovascular medication volumes addressing hypertension affecting women and men, diabetes treatments serving the 23.1 percent adult prevalence rate, and respiratory medications for conditions including chronic obstructive pulmonary disease. Government e-prescription infrastructure including the Wasfaty platform, which connects healthcare providers with pharmacy networks, is streamlining prescription transmission and fulfillment processes while improving medication adherence tracking and reducing dispensing errors that could compromise patient safety and therapeutic outcomes.

Pharmacy chains are positioning prescription services as core business drivers through enhanced clinical capabilities, specialized chronic disease management programs, and pharmacist consultation services that differentiate offerings beyond pure medication dispensing. The regulatory environment mandates pharmacist oversight for prescription fulfillment, creating inherent competitive advantages for professionally managed chains with robust staff training and quality assurance protocols. As healthcare coverage expands and the aging population generates increasing prescription volumes, this segment is expected to maintain market leadership while chains invest in clinical service infrastructure to capture value beyond traditional dispensing margins.

Therapeutic Area Insights:

- Cardiovascular

- Pain Relief/Analgesics

- Vitamins/Minerals/Nutrients

- Anti-Infective

- Anti-Diabetic

- Others

Cardiovascular exhibits a clear dominance with a 24% share of the total Saudi Arabia pharmacy retail market in 2025.

Cardiovascular therapeutics represent the largest disease-specific medication category, reflecting the substantial burden of heart disease, hypertension, and related conditions across the Saudi population. Hypertension prevalence is increasing among the masses, while hypercholesterolemia affects a significant portion of surveyed populations, creating sustained demand for antihypertensive agents, statins, antiplatelet medications, and emerging cardiovascular therapies addressing atherosclerotic disease and heart failure. The therapeutic arsenal spans multiple drug classes including ACE inhibitors, beta-blockers, calcium channel blockers, and novel agents targeting specific cardiovascular pathways, requiring pharmacy staff expertise in medication counseling, drug interaction management, and patient adherence support.

Lifestyle factors including sedentary behavior patterns, dietary habits characterized by processed food consumption, and obesity rates exceeding nationally contribute to cardiovascular risk factor prevalence, amplifying medication demand and creating opportunities for pharmacy-based preventive care initiatives. Major chains are implementing cardiovascular health screening services, blood pressure monitoring stations, and lipid panel testing capabilities to identify at-risk populations and facilitate early therapeutic intervention. The aging demographic structure, with older adults experiencing disproportionate cardiovascular disease burden, further intensifies therapeutic demand and positions cardiovascular medications as a sustained market growth driver through the forecast period.

Drug Type Insights:

- Generic

- Patented

Generic leads with a share of 57% of the total Saudi Arabia pharmacy retail market in 2025.

Generic pharmaceuticals command market majority through affordability advantages and government policy support promoting accessible healthcare delivery. Generic medications typically offer cost savings compared to branded alternatives, addressing consumer price sensitivity while maintaining therapeutic equivalence through stringent regulatory approval processes. Government initiatives actively encourage generic substitution to control healthcare expenditures and expand treatment access across socioeconomic segments, creating favorable reimbursement frameworks and procurement policies that prioritize generic options in public healthcare facilities and insurance formularies.

Pharmacy chains benefit from superior generic procurement margins while offering patients affordable medication options that improve adherence rates and therapeutic outcomes. The Saudi Food and Drug Authority maintains rigorous bioequivalence standards ensuring generic product quality and efficacy, supporting patient and prescriber confidence in therapeutic substitution. As healthcare costs continue rising and budget constraints affect both government payers and individual consumers, generic medications provide sustainable value propositions that balance affordability with clinical effectiveness, positioning this segment for continued market leadership despite branded product innovation and specialty medication introductions across therapeutic categories.

Pharmacy Location Insights:

- Street/Mall Based

- Hospital Based

Street/mall based exhibits a clear dominance with a 72% share of the total Saudi Arabia pharmacy retail market in 2025.

Street and mall-based pharmacy formats dominate through superior accessibility, convenient operating hours, and comprehensive product assortments serving diverse consumer needs. These locations capitalize on high foot traffic in commercial districts and shopping centers, positioning pharmacies as convenient healthcare destinations integrated into daily shopping routines and errand patterns. Major chains strategically locate outlets to ensure proximity to residential neighborhoods, with operators like Nahdi Medical Company positioning stores within five-minute access for 90 percent of the Saudi population, exemplifying the geographic coverage strategies maximizing market penetration and customer convenience.

Street and mall-based formats offer operational flexibility enabling extended hours, weekend availability, and immediate medication access without hospital visit requirements, appealing to working professionals and families seeking efficient healthcare solutions. These locations support comprehensive service offerings beyond prescription dispensing, including wellness product sales, beauty and personal care assortments, and basic health screening services that drive incremental revenue and customer traffic. The retail environment facilitates impulse purchases and brand visibility while creating opportunities for customer education initiatives and loyalty program enrollment that strengthen competitive positions and customer retention metrics.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central region leads with a share of 32% of the total Saudi Arabia pharmacy retail market in 2025.

The Northern and Central regions command market leadership through Riyadh's concentration of population, healthcare infrastructure, and economic activity as the national capital. Riyadh hosts extensive hospital networks, specialized medical centers, and research institutions generating substantial prescription volumes and creating demand density that supports pharmacy proliferation and justifies investment in large-format store concepts. The region accounts for the majority of pharmaceutical market activity, reflecting population concentration and higher per capita healthcare expenditures associated with urban professional demographics and comprehensive health insurance coverage.

Infrastructure development initiatives under Vision 2030 are channeling substantial public and private investment into the region, including medical city construction, hospital expansion projects, and healthcare technology implementation that create expanding pharmaceutical retail opportunities. The demographic profile includes substantial expatriate populations with established healthcare consumption patterns and willingness to pay premium prices for quality products and services, supporting both mass-market and specialty pharmacy formats. Major chains maintain flagship stores and distribution centers in Riyadh to serve regional markets efficiently while capitalizing on the concentration of healthcare facilities, medical professionals, and health-conscious consumers that characterize this leading market segment.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Pharmacy Retail Market Growing?

Aging Population and Escalating Chronic Disease Burden

The demographic transition toward an aging society represents a fundamental growth catalyst. The population aged 60 years and over in the Kingdom of Saudi Arabia reached approximately 1.7 million in 2025, accounting for 4.8% of total population. Older adults experience elevated rates of chronic conditions including cardiovascular diseases, diabetes, arthritis, and cognitive decline, generating sustained demand for prescription medications, disease management products, and specialized pharmaceutical services. The chronic disease landscape is intensifying, affecting substantial population segments, creating expanding therapeutic markets that drive pharmacy utilization and medication spending. Multimorbidity patterns common among elderly populations require complex medication regimens involving multiple prescriptions, regular refills, and pharmacist monitoring to prevent adverse drug interactions and optimize therapeutic outcomes.

Government Healthcare Investment and Regulatory Modernization

Vision 2030 healthcare reform initiatives are channeling unprecedented public investment and regulatory evolution toward expanding healthcare access, modernizing infrastructure, and improving service quality across the Kingdom. Government allocations exceeding USD 65 billion target development of advanced medical cities, comprehensive hospital network upgrades, and expanded outpatient service capacity, creating expanding demand channels for pharmaceutical retail operations supporting the broader healthcare ecosystem. Regulatory liberalization measures including revised foreign ownership frameworks and streamlined licensing processes are attracting multinational pharmacy chains and encouraging domestic capacity expansion, intensifying market competition while elevating professional standards and operational benchmarks. These coordinated policy interventions create favorable operating environments for pharmacy retail expansion while addressing affordability concerns and quality standards that support sustainable market growth through enhanced consumer confidence and expanded healthcare utilization patterns.

Digital Transformation and Omnichannel Retail Evolution

Technology integration is revolutionizing pharmacy retail operations through e-commerce platforms, mobile health applications, and telemedicine services that expand market reach beyond traditional brick-and-mortar limitations. The Saudi Arabia e-health market is projected to reach USD 5.5 Billion by 2034, exhibiting a growth rate (CAGR) of 15.32% during 2026-2034 as per the predictions of the IMARC Group. This is primarily driven by national electronic health record implementation, telemedicine regulations introduced in 2023, and Ministry of Health-approved applications connecting patients with pharmacists for remote consultations and prescription fulfillment. Major retailers are investing in omnichannel capabilities integrating physical stores with digital platforms to offer click-and-collect services, virtual pharmacist consultations, and personalized medication management tools that deepen customer relationships and capture evolving consumer preferences for flexible, technology-enabled healthcare experiences.

Market Restraints:

What Challenges the Saudi Arabia Pharmacy Retail Market is Facing?

Stringent Regulatory Compliance and Licensing Requirements

Pharmacy operations face complex regulatory frameworks governing licensing, quality standards, and operational protocols that impose substantial compliance costs and administrative burdens. The Saudi Food and Drug Authority maintains rigorous approval processes for pharmacy establishment, medication registration, and pharmacist credentialing that can create barriers to market entry and expansion, particularly for smaller operators lacking dedicated regulatory affairs capabilities. Quality assurance requirements mandate extensive documentation systems, regular audits, and adherence to storage and handling protocols for pharmaceutical products, necessitating investments in infrastructure, staff training, and compliance management systems.

Intense Market Competition and Margin Pressure

The pharmacy retail landscape exhibits increasing competitive intensity as major chains expand networks, digital platforms proliferate, and international operators enter the market through liberalized foreign investment frameworks. Price competition for generic medications and over-the-counter products erodes gross margins, while consumers demonstrate growing price sensitivity and willingness to compare offerings across multiple channels before purchasing decisions. Independent pharmacies struggle to compete against chain operators benefiting from economies of scale in procurement, marketing, and operational efficiency, leading to market consolidation and concentration among larger players.

Infrastructure Investment and Operational Complexity

Pharmacy retail expansion requires substantial capital investments in real estate, store construction, inventory systems, and technology infrastructure that can strain financial resources and extend payback periods. Prime retail locations in high-traffic commercial districts and shopping centers command premium rents, while comprehensive product assortments spanning prescription medications, over-the-counter products, wellness items, and beauty categories necessitate significant working capital commitments. Regulatory requirements for climate-controlled storage, security systems, and professional staffing add operational complexity and fixed cost structures that must be supported through sufficient transaction volumes and margins. Digital platform development encompassing e-commerce capabilities, mobile applications, and customer relationship management systems demands ongoing technology investments and specialized expertise that can challenge operators lacking scale advantages or access to capital markets for expansion financing.

Competitive Landscape:

In the Saudi Arabian pharmacy retail market, key players are adopting several strategies to strengthen their position and meet evolving customer demands. There is a notable expansion in both physical stores and online platforms, as companies enhance their digital presence through e-commerce solutions and mobile apps. This shift towards digital services enables customers to order medications and health products online, with convenient home delivery options. Retailers are also investing in customer loyalty programs, offering personalized discounts, rewards, and promotions to foster repeat business. Product diversification plays a significant role, as pharmacies extend their range to include not only pharmaceuticals but also health and wellness products, personal care items, and over-the-counter medicines. To further boost convenience and reach, partnerships with technology providers and healthcare organizations are increasingly common. These collaborations are enabling better inventory management, improved customer service, and innovative solutions, helping key players gain a competitive edge in the growing market.

Recent Developments:

- In January 2025, Aster DM Healthcare Group, based in the UAE, revealed Aster Pharmacy's retail and digital footprint and confirmed that its expansion into Saudi Arabia is progressing as planned.

Saudi Arabia Pharmacy Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Market Structures Covered | Unorganized, Organized |

| Product Types Covered | Over-the-Counter Products, Prescribed Drugs, Non-Pharmaceutical Products, Medical Equipment |

| Therapeutic Areas Covered | Cardiovascular, Pain Relief/Analgesics, Vitamins/Minerals/Nutrients, Anti-Infective, Anti-Diabetic, Others |

| Drug Types Covered | Generic, Patented |

| Pharmacy Locations Covered | Street/Mall Based, Hospital Based |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia pharmacy retail market size was valued at USD 18.9 Billion in 2025.

The Saudi Arabia pharmacy retail market is expected to grow at a compound annual growth rate of 5.28% from 2026-2034 to reach USD 30.1 Billion by 2034.

Organized retail pharmacies dominated the market with approximately 77% share in 2025, driven by superior supply chain infrastructure, comprehensive product assortments, established consumer trust, and economies of scale enabling competitive pricing and service differentiation across extensive store networks throughout urban and suburban locations.

Key factors driving the Saudi Arabia pharmacy retail market include the aging population structure creating sustained chronic disease medication demand, government Vision 2030 healthcare investments modernizing infrastructure and expanding service capacity, digital transformation through e-pharmacy platforms and telemedicine integration, rising diabetes and cardiovascular disease prevalence requiring continuous pharmaceutical care, and regulatory reforms attracting investment.

Major challenges include stringent regulatory compliance requirements creating operational complexity and licensing barriers, intense market competition from expanding chains and digital platforms pressuring profit margins, infrastructure investment costs for store expansion and technology systems, price sensitivity constraining revenue growth opportunities, and operational complexities managing diverse product categories across multiple locations while maintaining service quality.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)