Saudi Arabia Positive Displacement Pumps Market Size, Share, Trends and Forecast by Product Type, Capacity, Pump Characteristic, Raw Material, End Use Industry, and Region, 2026-2034

Saudi Arabia Positive Displacement Pumps Market Overview:

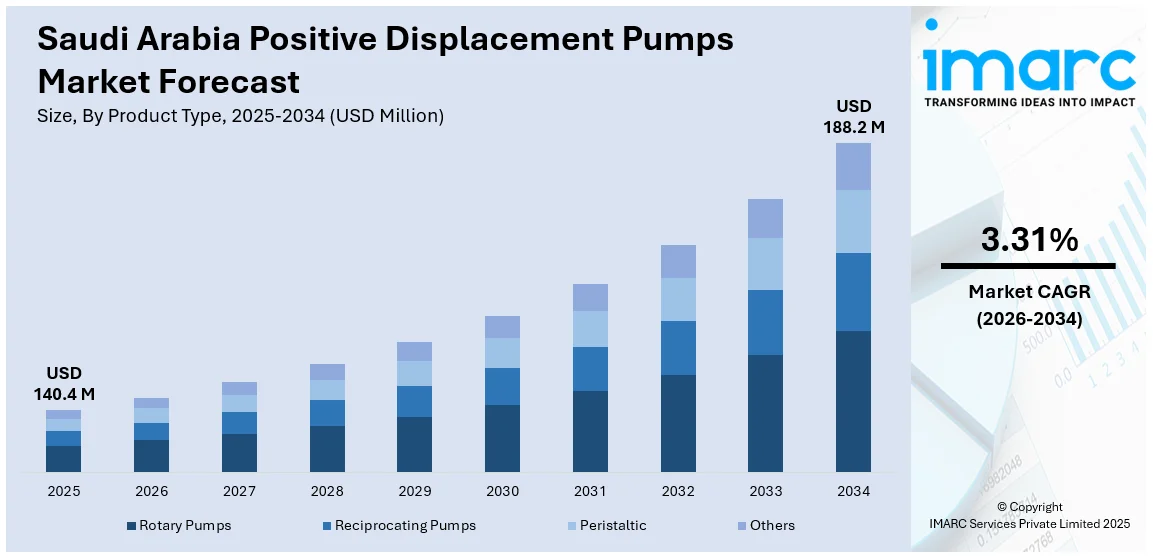

The Saudi Arabia positive displacement pumps market size reached USD 140.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 188.2 Million by 2034, exhibiting a growth rate (CAGR) of 3.31% during 2026-2034. Rapid expansion of the oil and gas sector, coupled with increasing investments in water infrastructure projects such as desalination and sewage treatment, is driving demand for positive displacement pumps in Saudi Arabia due to their efficiency in handling high-viscosity fluids, precise flow control, and reliability in harsh industrial environments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 140.4 Million |

| Market Forecast in 2034 | USD 188.2 Million |

| Market Growth Rate 2026-2034 | 3.31% |

Saudi Arabia Positive Displacement Pumps Market Trends:

Industrial Water Management and Desalination Needs

Saudi Arabia is facing a severe shortage of freshwater due to its arid climate and limited natural freshwater resources. In such conditions, positive displacement pumps (PDPs) are essential for water management systems because of their ability to handle high-viscosity fluids, accommodate varying flow rates, and provide precise volume control. Desalination processes, such as reverse osmosis (RO) and multi-stage flash distillation, require stable pressure and flow, which PDPs are uniquely capable of providing. In RO facilities, for example, PDPs are crucial during pre-treatment for the precise dosing of chemicals and for transferring concentrated brine. Their ability to manage corrosive and abrasive fluids, commonly found in seawater and chemical treatment processes, without losing efficiency is a significant advantage. As part of the Vision 2030 initiative, the Saudi government is focused on expanding desalination projects and upgrading water infrastructure to improve sustainability.

To get more information on this market Request Sample

Expansion of the Oil and Gas Sector and Petrochemical Processing

Saudi Arabia’s economy is largely driven by its oil and gas sector, with the Kingdom being one of the world’s leading producers and exporters of petroleum. The demand for positive displacement pumps in the country is closely tied to the needs of upstream, midstream, and downstream oil and gas operations. PDPs are well-suited to this industry due to their ability to handle viscous liquids, slurries, and chemicals under high pressure, often in challenging environments. In upstream activities, such as chemical injection, crude oil transfer, and enhanced oil recovery (EOR) methods like polymer or CO₂ flooding, PDPs provide precise flow rate control, ensuring accurate chemical dosing, which is crucial for both efficiency and safety in these high-risk operations. In downstream processes, such as refining and petrochemical production, these pumps are vital for handling process fluids that demand consistent, contamination-free treatment.

Saudi Arabia Positive Displacement Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, capacity, pump characteristic, raw material, and end use industry.

Product Type Insights:

- Rotary Pumps

- Vane

- Screw

- Lobe

- Gear

- Progressing Cavity (PC)

- Others

- Reciprocating Pumps

- Piston

- Diaphragm

- Plunger

- Others

- Peristaltic

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes rotary pumps (vane, screw, lobe, gear, progressing cavity (PC), and others), reciprocating pumps (piston, diaphragm, plunger, and others), peristaltic, and others.

Capacity Insights:

- Low Capacity Pumps

- Medium Capacity Pumps

- High Capacity Pumps

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes low capacity pumps, medium capacity pumps, and high capacity pumps.

Pump Characteristic Insights:

- Standard Pumps

- Engineered Pumps

- Special Purpose Pumps

The report has provided a detailed breakup and analysis of the market based on the pump characteristic. This includes standard pumps, engineered pumps, and special purpose pumps.

Raw Material Insights:

- Bronze

- Cast Iron

- Polycarbonate

- Stainless Steel

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes bronze, cast iron, polycarbonate, stainless steel, and others.

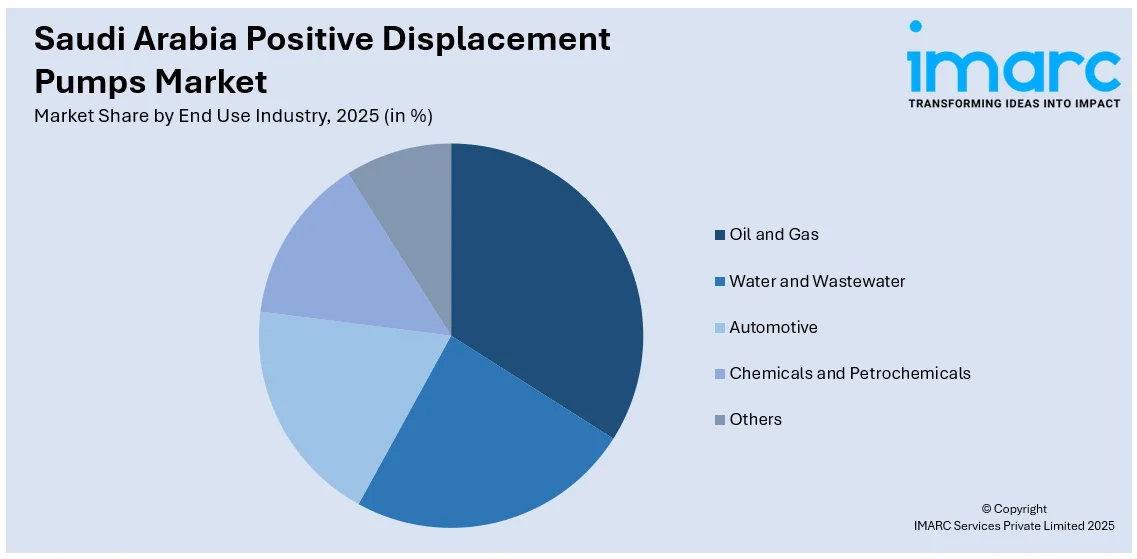

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Water and Wastewater

- Automotive

- Chemicals and Petrochemicals

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil and gas, water and wastewater, automotive, chemicals and petrochemicals, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Positive Displacement Pumps Market News:

- April 2025: Saudi Aramco discovered 14 new oil and gas fields across the Eastern Province and Empty Quarter, including Ayfan-2 and Ghizlan-1. These fields are expected to increase national energy reserves and support Saudi Arabia’s economic goals. Moreover, their development is poised to drive demand for positive displacement pumps, owing to complex fluid handling needs.

- February 2025: Wabag secured an INR 3,251 crore order to build a 400 MLD sewage treatment plant in Riyadh, Saudi Arabia. The project aims to support wastewater recycling and reuse for sustainable urban development. In such projects, positive displacement pumps support precise sludge handling, chemical dosing, and high-viscosity fluid transfer in the treatment process.

Saudi Arabia Positive Displacement Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Capacities Covered | Low Capacity Pumps, Medium Capacity Pumps, High Capacity Pumps |

| Pump Characteristics Covered | Standard Pumps, Engineered Pumps, Special Purpose Pumps |

| Raw Materials Covered | Bronze, Cast Iron, Polycarbonate, Stainless Steel, Others |

| End Use Industries Covered | Oil and Gas, Water and Wastewater, Automotive, Chemicals and Petrochemicals, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia positive displacement pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia positive displacement pumps market on the basis of product type?

- What is the breakup of the Saudi Arabia positive displacement pumps market on the basis of capacity?

- What is the breakup of the Saudi Arabia positive displacement pumps market on the basis of pump characteristic?

- What is the breakup of the Saudi Arabia positive displacement pumps market on the basis of raw material?

- What is the breakup of the Saudi Arabia positive displacement pumps market on the basis of end use industry?

- What is the breakup of the Saudi Arabia positive displacement pumps market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia positive displacement pumps market?

- What are the key driving factors and challenges in the Saudi Arabia positive displacement pumps market?

- What is the structure of the Saudi Arabia positive displacement pumps market and who are the key players?

- What is the degree of competition in the Saudi Arabia positive displacement pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia positive displacement pumps market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia positive displacement pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia positive displacement pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)