Saudi Arabia Poultry Feed Market Size, Share, Trends and Forecast by Nature, Form, Additives, Animal Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Poultry Feed Market Overview:

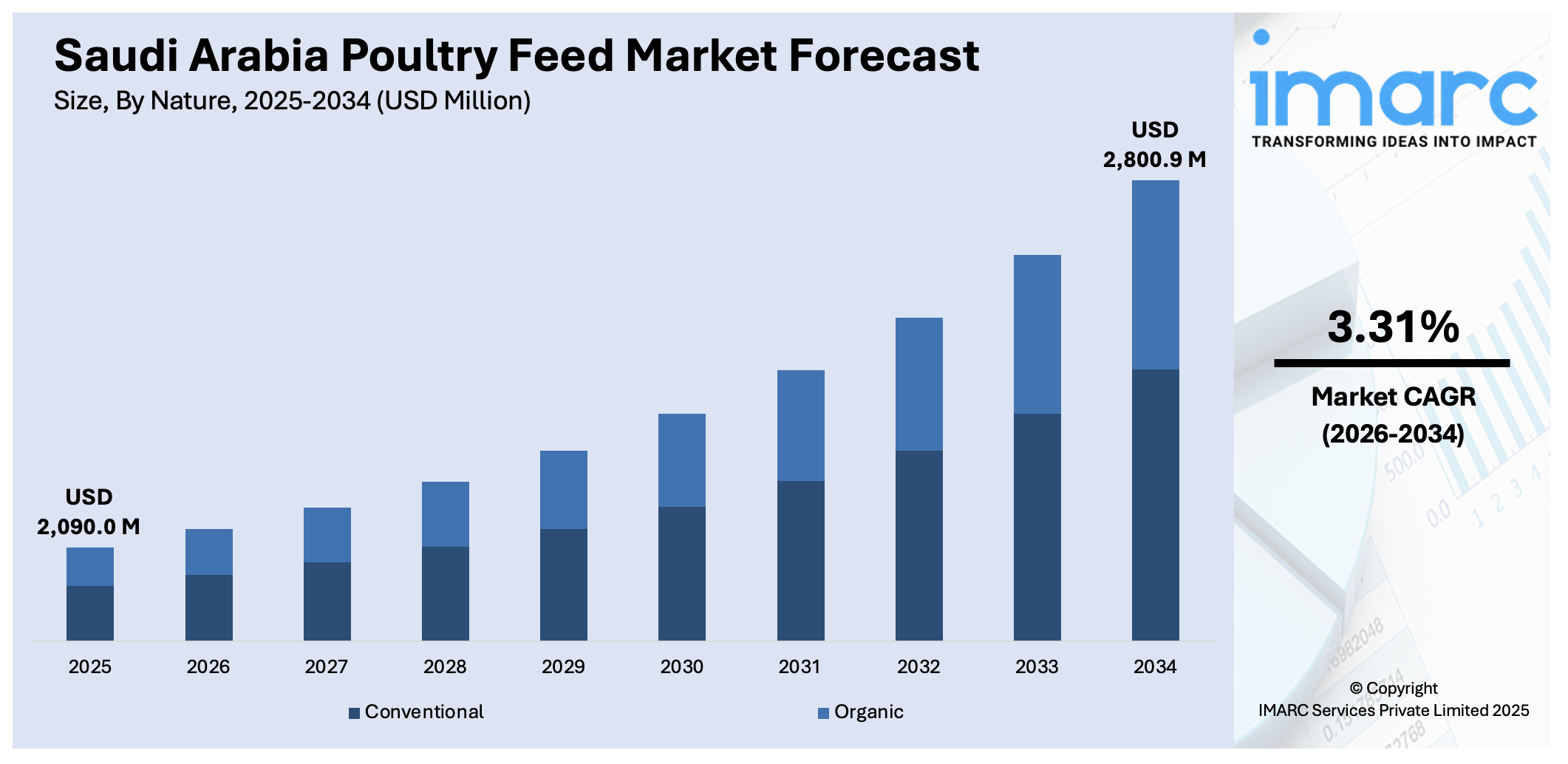

The Saudi Arabia poultry feed market size reached USD 2,090.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,800.9 Million by 2034, exhibiting a growth rate (CAGR) of 3.31% during 2026-2034. The government-led food-security and import-substitution policies boosting local feed production, rapidly expanding poultry consumption, technological adoption of precision nutrition and functional feed additives, and sustainability efforts incorporating alternative proteins and digital feed-management platforms are among the key factors fueling the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,090.0 Million |

| Market Forecast in 2034 | USD 2,800.9 Million |

| Market Growth Rate 2026-2034 | 3.31% |

Saudi Arabia Poultry Feed Market Trends:

Government-Driven Feed-Mill Expansion and Food-Security Initiatives

In the first half of 2024, Saudi Arabia achieved a record poultry meat production of 558,000 metric tons, marking a 9% year-on-year increase, according to the Saudi Press Agency (SPA). This growth is underpinned by transformative developments in the poultry-feed sector, aligned with Vision 2030 objectives aimed at strengthening food security and reducing import dependency. The government’s supportive measures, such as reduced land-lease fees and subsidized energy tariffs have significantly boosted domestic feed-mill capacity. Consequently, local poultry-feed production has risen substantially, lowering reliance on imports by nearly one-third compared to 2020 levels. Strategic joint ventures between Saudi firms like Al-Watania and Tanmiah and global integrators have further accelerated this progress by establishing advanced facilities featuring automated batching systems and on-site quality laboratories. These advancements not only enhance supply chain efficiency and traceability but also help safeguard the industry from global grain price fluctuations and currency risks, ensuring stable and resilient feed availability.

To get more information on this market Request Sample

Precision Nutrition through Advanced Feed Additives

To improve feed-conversion ratios and comply with strict residue-free standards, poultry integrators in Saudi Arabia are increasingly utilizing high-value feed additives such as amino acids, enzymes, probiotics, and phytogenic in tailored premixes. The strategic use of amino acids reflects a growing focus on precise nutrient balancing, enabling lower crude-protein inclusion without compromising growth performance. In line with a broader move toward natural antibiotic alternatives, organic acidifiers and botanicals like neem and thyme rose are also gaining traction. Digital feed-management platforms now facilitate real-time monitoring of additive efficacy, enabling timely adjustments that help maintain profitability amid fluctuating grain prices. Supporting this modernization, the Agricultural Development Fund offers up to 70% financial backing on loans for poultry projects that adopt advanced technologies. Furthermore, collaborations between international firms such as ADM, Cargill, and Alltech with Saudi research institutions are driving the development of region-specific feed solutions, advancing both the economic efficiency and sustainability of the Kingdom’s poultry sector.

Saudi Arabia Poultry Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on nature, form, additives, animal type, and distribution channel

Nature Insights:

- Conventional

- Organic

The report has provided a detailed breakup and analysis of the market based on the nature. This includes conventional and organic.

Form Insights:

- Mashed

- Pellets

- Crumbles

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes mashed, pellets, crumbles, and others.

Additives Insights:

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acid

- Feed Enzymes

- Feed Acidifiers

- Others

The report has provided a detailed breakup and analysis of the market based on the additives. This includes antibiotics, vitamins, antioxidants, amino acid, feed enzymes, feed acidifiers, and others.

Animal Type Insights:

- Layers

- Broilers

- Turkey

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes layers, broilers, turkey, and others.

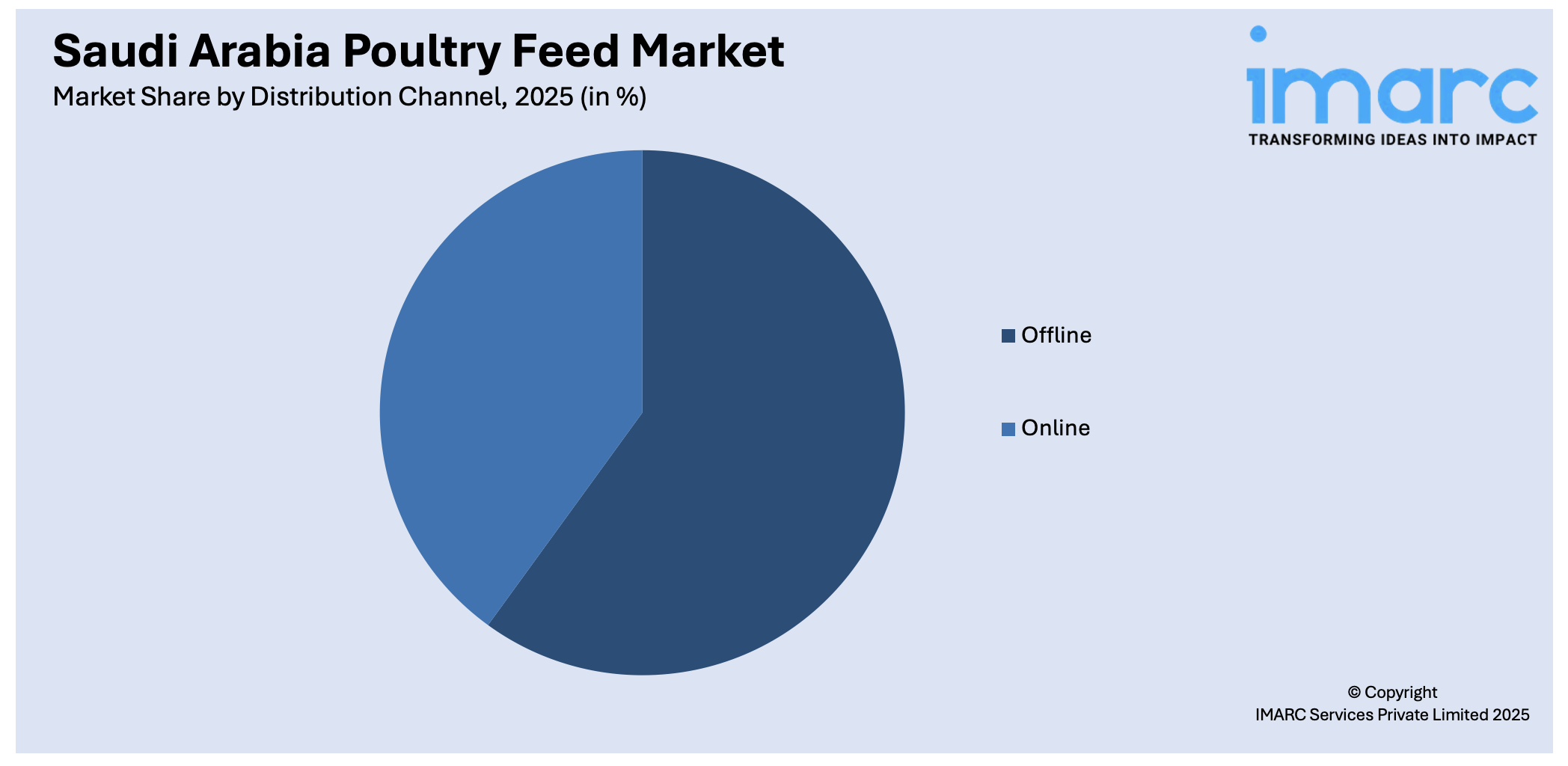

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Poultry Feed Market News:

- April 2025: Alwadi Poultry Farms commissioned ANDRITZ to build a high-capacity feed mill in Riyadh Province. Set to open in early 2026, the facility will produce 90 tons per hour—60 TPH for poultry feed and 30 TPH for ruminants—using advanced machinery.

- January 2025: Tanmiah Food Company’s subsidiary, Agricultural Development Company (ADC), partnered with Chengdu Design & Research Institute (CDI) to construct 100 advanced poultry broiler houses across Saudi Arabia. Equipped with automation and Industry 4.0 technologies, the project aims to enhance poultry production capacity, aligning with Saudi Vision 2030 goals for food security and sustainability.

Saudi Arabia Poultry Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Conventional, Organic |

| Forms Covered | Mashed, Pellets, Crumbles, Others |

| Additivess Covered | Antibiotics, Vitamins, Antioxidants, Amino Acid, Feed Enzymes, Feed Acidifiers, Others |

| Animal Types Covered | Layers, Broilers, Turkey, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia poultry feed market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia poultry feed market on the basis of nature?

- What is the breakup of the Saudi Arabia poultry feed market on the basis of form?

- What is the breakup of the Saudi Arabia poultry feed market on the basis of additives?

- What is the breakup of the Saudi Arabia poultry feed market on the basis of animal type?

- What is the breakup of the Saudi Arabia poultry feed market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia poultry feed market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia poultry feed market?

- What are the key driving factors and challenges in the Saudi Arabia poultry feed market?

- What is the structure of the Saudi Arabia poultry feed market and who are the key players?

- What is the degree of competition in the Saudi Arabia poultry feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia poultry feed market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia poultry feed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia poultry feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)