Saudi Arabia Power Cables Market Size, Share, Trends and Forecast by Installation, Voltage, Material, End-Use Sector, and Region, 2026-2034

Saudi Arabia Power Cables Market Overview:

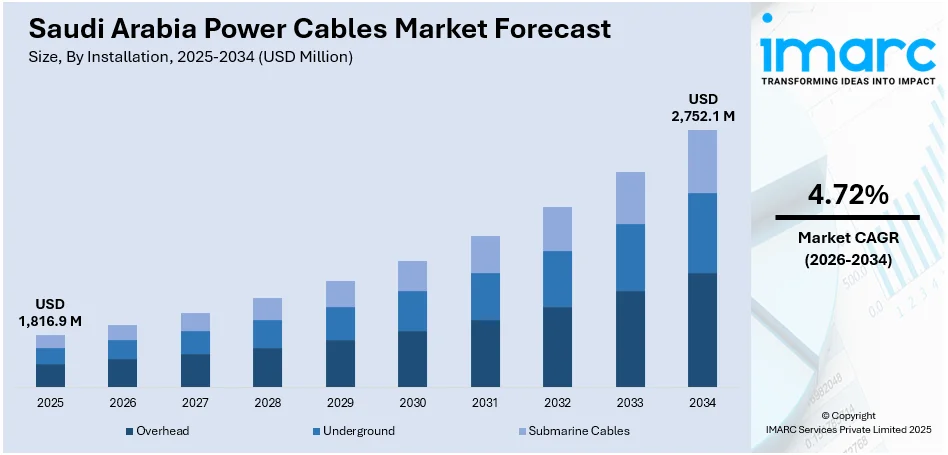

The Saudi Arabia power cables market size reached USD 1,816.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,752.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.72% during 2026-2034. The Saudi Arabia power cables market is being driven by large-scale infrastructure projects under Vision 2030, rapid expansion of renewable energy initiatives, modernization of electrical grids, rapid urbanization, and substantial investments in smart cities, all contributing to escalating demand for reliable, efficient, and technologically advanced power transmission and distribution solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,816.9 Million |

| Market Forecast in 2034 | USD 2,752.1 Million |

| Market Growth Rate 2026-2034 | 4.72% |

Saudi Arabia Power Cables Market Trends:

Rapid Expansion of Infrastructure and Urban Development Projects

One of the strongest drivers of the Saudi Arabia power cables market is the country's ambitious drive towards urban and infrastructure development. As part of Vision 2030, Saudi Arabia is going through a massive overhaul with the goal of weaning itself off oil and diversifying the economy. This involves the creation of large-scale urban infrastructure schemes like NEOM, The Line, Red Sea Project, and Qiddiya, requiring huge power transmission and distribution networks. These giga-projects are intended to incorporate cutting-edge smart city technologies, renewable energy sources, and cutting-edge transportation systems — all of which demand highly efficient and reliable power cable systems. Since these projects cover enormous geographical distances, the demand for high-voltage underground and overhead power cables has increased manifold. Additionally, the development of contemporary residential complexes, commercial centers, and public infrastructure like airports, hospitals, and metro lines contributes to the demand as well.

To get more information on this market Request Sample

Integration of Renewable Energy into the National Grid

Another dominant driver is the integration of renewable energy sources into the power matrix of Saudi Arabia. As the nation moves toward sustainable energy, huge investments are being directed into solar and wind projects like the Sakaka PV Solar Power Plant, the Dumat Al Jandal Wind Farm, and the Sudair Solar Project. These projects are under the National Renewable Energy Program (NREP), which targets the generation of 58.7 GW of renewable energy by 2030. In contrast to conventional fossil-fuel-based grids, renewable energy projects bring in intermittent and decentralized energy sources that demand a highly responsive and flexible transmission infrastructure. This has created a growing need for specialized power cables that can endure changing environmental conditions, provide higher efficiency, and enable grid balancing and smart energy management. Renewable projects usually take place in rugged desert environments or off-shore locations requiring high insulation, heat tolerance, and durability cables. Furthermore, green energy initiatives require long-distance electrical transmission to common grid stations, leading to the need for extra-high voltage (EHV) and high-voltage direct current (HVDC) cables.

Saudi Arabia Power Cables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on installation, voltage, material, end-use sector, and region.

Installation Insights:

- Overhead

- Underground

- Submarine Cables

The report has provided a detailed breakup and analysis of the market based on the installation. This includes overhead, underground, and submarine cables.

Voltage Insights:

- High

- Medium

- Low

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes high, medium, and low.

Material Insights:

- Copper

- Aluminum

The report has provided a detailed breakup and analysis of the market based on the material. This includes copper and aluminum.

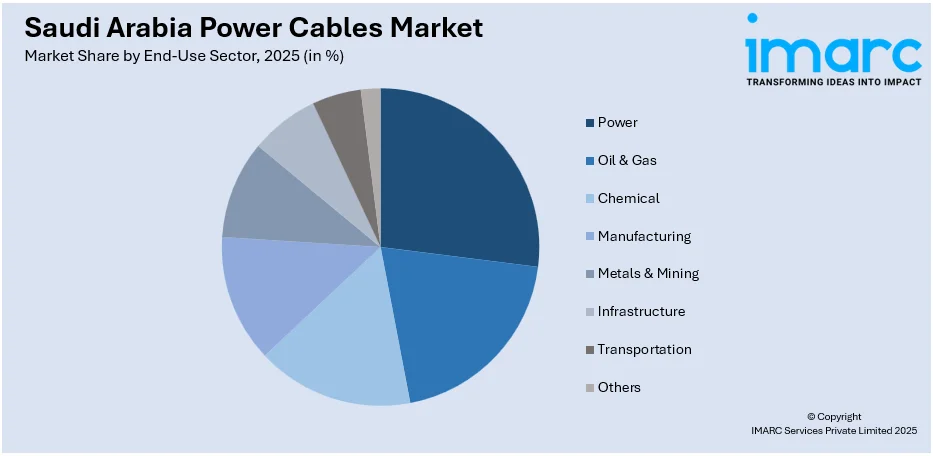

End-Use Sector Insights:

Access the comprehensive market breakdown Request Sample

- Power

- Oil & Gas

- Chemical

- Manufacturing

- Metals & Mining

- Infrastructure

- Transportation

- Others

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes power, oil & gas, chemical, manufacturing, metals & mining, infrastructure, transportation, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Power Cables Market News:

- January 2025: Leviton introduced two new steel tape armored ADVENTUM™ fiber optic cables for the EMEA, LAC, and APAC regions. These cables feature gel-free, water-blocking technology and are designed for both indoor and outdoor applications, offering enhanced mechanical protection and fire resistance. Leviton has had an office in Saudi Arabia since 2009.

- January 2025: Italy and Saudi Arabia signed a five-year energy cooperation agreement focusing on renewable energy, hydrogen, and power interconnections, which implied significant investments in transmission infrastructure, including high-voltage power cables. This collaboration positions Italy as a strategic entry point for Saudi-produced hydrogen and ammonia into Europe, necessitating robust power cable networks to support the increased energy flow and integration.

- November 2023: Elsewedy Cables KSA announced an SAR 1.2 billion investment to establish two new factories in Yanbu Industrial City: a Special Cables factory and a Copper Rod factory. The Special Cables facility will produce a variety of cables for industries such as construction, power generation, and oil and gas, while the Copper Rod factory will supply essential raw materials for electrical products.

Saudi Arabia Power Cables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Overhead, Underground, Submarine Cables |

| Voltages Covered | High, Medium, Low |

| Materials Covered | Copper, Aluminum |

| End-Use Sectors Covered | Power, Oil & Gas, Chemical, Manufacturing, Metals & Mining, Infrastructure, Transportation, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia power cables market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia power cables market on the basis of installation?

- What is the breakup of the Saudi Arabia power cables market on the basis of voltage?

- What is the breakup of the Saudi Arabia power cables market on the basis of material?

- What is the breakup of the Saudi Arabia power cables market on the basis of end-use sector?

- What is the breakup of the Saudi Arabia power cables market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia power cables market?

- What are the key driving factors and challenges in the Saudi Arabia power cables market?

- What is the structure of the Saudi Arabia power cables market and who are the key players?

- What is the degree of competition in the Saudi Arabia power cables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia power cables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia power cables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia power cables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)