Saudi Arabia Power Grids Market Size, Share, Trends and Forecast by Type, Energy Source, and Region, 2026-2034

Saudi Arabia Power Grids Market Overview:

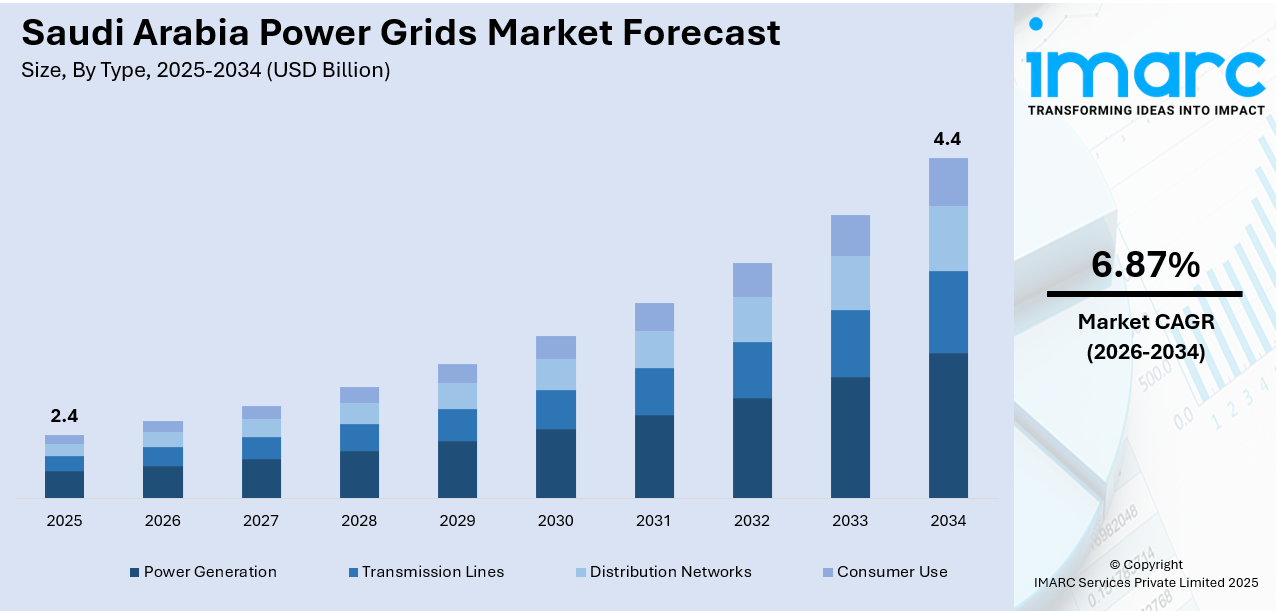

The Saudi Arabia power grids market size reached USD 2.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.4 Billion by 2034, exhibiting a growth rate (CAGR) of 6.87% during 2026-2034. The demand for energy is growing, and government investment in infrastructure and demand for renewable sources of energy are the drivers in the market. Industrialization, urbanization, and a growing population drive the efficient power distribution. The Vision 2030 plan of the country also speeds up the growth of advanced power grids, further boosting the Saudi Arabia power grids market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.4 Billion |

| Market Forecast in 2034 | USD 4.4 Billion |

| Market Growth Rate 2026-2034 | 6.87% |

Saudi Arabia Power Grids Market Trends:

Expansion of Renewable Energy Integration

The Saudi power grids market is turning its attention more and more towards incorporating solar and wind as renewable sources of energy. This is because the government has an ambitious vision under Vision 2030 to achieve renewable energy targets. Integration of large solar projects such as the Mohammed bin Rashid Al Maktoum Solar Park is set to transform the energy sector. These efforts include high-voltage grid infrastructure for efficient transmission and supply of power, thus necessitating advanced grid technologies. With the country seeking sustainability, integration of renewable energy into the power grid is vital to reduce fossil fuel reliance. This development is fueling the Saudi Arabia power grids market growth by offering new opportunities for grid modernization. For instance, in February 2025, BYD Energy Storage signed contracts for the world's largest grid-scale battery storage projects in Saudi Arabia, totaling 12.5GWh, with a total capacity of 15.1GWh including previous projects. This initiative supports Saudi Arabia's Vision 2030, advancing the country's renewable energy goals. The projects will enhance grid stability and support renewable energy integration across five sites using BYD's advanced energy storage systems.

To get more information on this market Request Sample

Smart Grid Adoption for Improved Efficiency

Smart grid technology is becoming increasingly popular in Saudi Arabia as it enhances the efficiency, reliability, and flexibility of power distribution. These smart grids utilize advanced communication technologies to optimize the management and monitoring of energy flow. They allow for real-time data collection, which improves grid performance and reduces energy losses. By enabling better demand response and more efficient energy use, smart grids support the integration of intermittent renewable energy sources like wind and solar. Additionally, they provide consumers with more control over their energy usage. The Saudi Arabia power grids market growth is significantly boosted by the widespread adoption of these technologies, helping the country modernize its energy infrastructure. For instance, in December 2024, SPARK Utilities and the Saudi Electricity Project Development Company entered a strategic partnership to enhance utility services in Saudi Arabia. The MoU, signed during the Saudi Smart Grid Conference, focuses on improving grid resilience, customer connections, and technical support. The collaboration aims to streamline utility service access and contribute to the development of Saudi Arabia's energy infrastructure.

Government Investment in Grid Infrastructure Modernization

The Saudi Arabian government is heavily investing in the modernization of the power grid infrastructure to meet the rising demand for electricity and improve grid stability. The focus is on upgrading aging infrastructure and incorporating advanced technologies such as high-voltage transmission systems and digital grid management solutions. These investments aim to reduce power outages and enhance the overall reliability of the power grid. Furthermore, the push for efficient energy consumption and sustainable practices is propelling the market towards smarter, more resilient power grids. These investments are essential for handling the future energy needs of a rapidly growing nation. The ongoing infrastructure projects are set to drive the Saudi Arabia power grids market share expansion in the coming years. For instance, as per industry reports, Saudi Arabia and the UAE are heavily investing in smart grids in 2025, using AI to manage power fluctuations and boost solar and wind energy integration. Saudi Arabia has automated 32% of its grid and installed over 10 million smart meters. These developments align with Vision 2030, driving innovation and foreign investment in grid infrastructure.

Saudi Arabia Power Grids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and energy source.

Type Insights:

- Power Generation

- Transmission Lines

- Distribution Networks

- Consumer Use

The report has provided a detailed breakup and analysis of the market based on the type. This includes power generation, transmission lines, distribution networks, and consumer use.

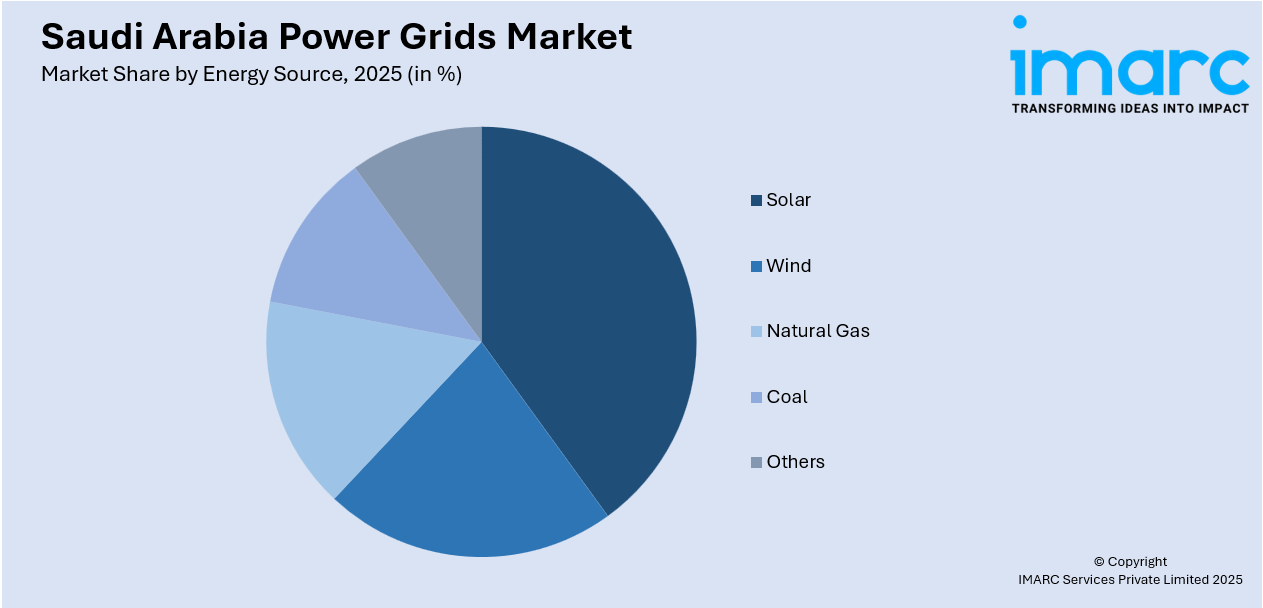

Energy Source Insights:

Access the comprehensive market breakdown Request Sample

- Solar

- Wind

- Natural Gas

- Coal

- Others

The report has provided a detailed breakup and analysis of the market based on the energy source. This includes solar, wind, natural gas, coal, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Power Grids Market News:

- In April 2025, Hitachi Energy, in collaboration with Larsen & Toubro (L&T), supplied a 380 kV gas-insulated switchgear (GIS) to Saudi Arabia’s National Grid. The GIS will enhance grid resilience and power distribution in northern Saudi Arabia, supporting the country's growing electricity demand.

- In February 2025, Pfisterer expanded its presence in the Middle East with a new site in Saudi Arabia. This strategic move aims to support the growing demand for high-quality electrical components in the region, offering enhanced services for energy infrastructure projects. The new location strengthens Pfisterer's commitment to the Middle East market.

- In November 2024, Hyundai E&C secured a KRW 1 trillion project in Saudi Arabia to build the 500kV HVDC transmission line between Riyadh and Kudmi, marking the largest project in its history. The line will span 1,089 km, with Hyundai E&C responsible for the initial 369 km. This advanced transmission technology, known for lower energy losses and superior reliability, strengthens Hyundai E&C’s leadership in Saudi power grid projects. The project, expected to be completed by 2027, showcases Hyundai E&C's expertise and advances Saudi Arabia’s power grid infrastructure.

- In September 2024, Huawei completed the construction of the world’s largest microgrid power station in Saudi Arabia, designed to support the Red Sea New City project. With a capacity of 400MW of photovoltaic power and 1.3 GWh of energy storage, the facility will help the project, which aims to run entirely on renewable energy, align with Saudi Arabia's Vision 2030.

Saudi Arabia Power Grids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Generation, Transmission Lines, Distribution Networks, Consumer Use |

| Energy Sources Covered | Solar, Wind, Natural Gas, Coal, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia power grids market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia power grids market on the basis of type?

- What is the breakup of the Saudi Arabia power grids market on the basis of energy source?

- What is the breakup of the Saudi Arabia power grids market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia power grids market?

- What are the key driving factors and challenges in the Saudi Arabia power grids market?

- What is the structure of the Saudi Arabia power grids market and who are the key players?

- What is the degree of competition in the Saudi Arabia power grids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia power grids market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia power grids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia power grids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)