Saudi Arabia Pre-Engineered Buildings Market Size, Share, Trends and Forecast by Product, End User, and Region, 2026-2034

Saudi Arabia Pre-Engineered Buildings Market Overview:

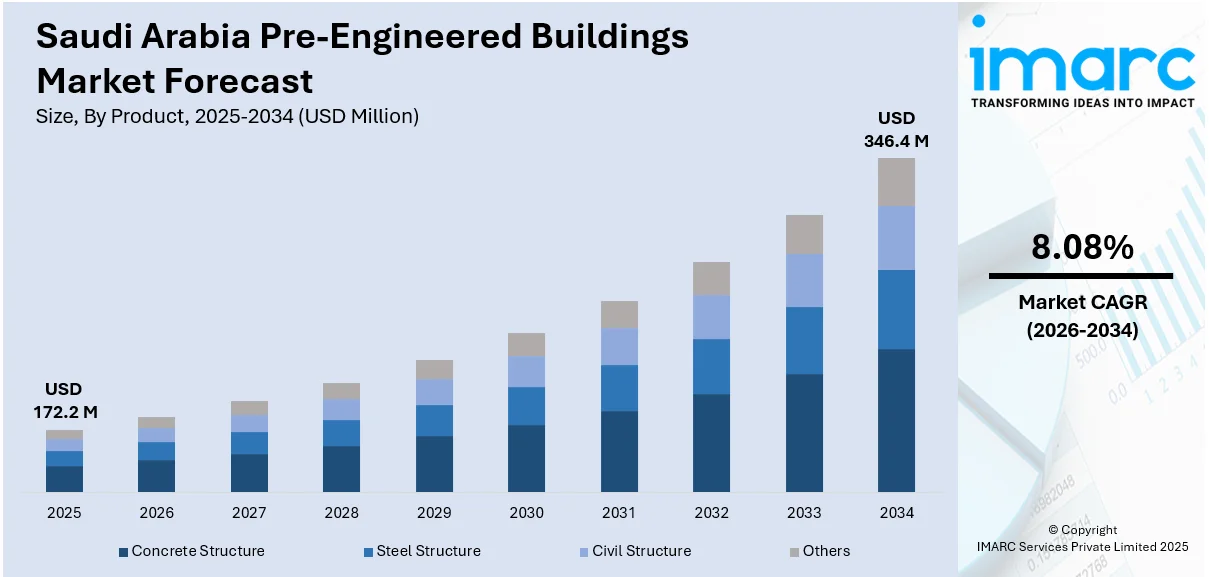

The Saudi Arabia pre-engineered buildings market size reached USD 172.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 346.4 Million by 2034, exhibiting a growth rate (CAGR) of 8.08% during 2026-2034. Saudi Arabia’s strategic focus on infrastructure development under Vision 2030, along with sustained investments in the education sector, is supporting the growth of the market. These structures offer advantages, such as rapid assembly, cost efficiency, and design adaptability, making them well-suited for sectors including logistics, housing, and public services. Their modular nature enables timely implementation across both urban and remote regions, which is contributing to a notable increase in the Saudi Arabia pre-engineered buildings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 172.2 Million |

| Market Forecast in 2034 | USD 346.4 Million |

| Market Growth Rate 2026-2034 | 8.08% |

Saudi Arabia Pre-Engineered Buildings Market Trends:

Government-Led Infrastructure and Economic Diversification Plans

Saudi Arabia's economic diversification initiative through Vision 2030 is a major factor driving the demand for pre-engineered buildings, particularly in sectors that require swift infrastructure growth. As Saudi Arabia transitions from oil to sectors, such as logistics, manufacturing, tourism, and housing, there is a rise in focus on affordable, rapidly implementable construction methods. Pre-engineered buildings provide a distinct benefit in this context owing to their pre-fabricated parts, shorter construction duration, and streamlined scalability. This method corresponds with the larger national goal of speeding up project completion while ensuring structural dependability and managing expenses. A notable instance is the $2.66 billion funding revealed in 2024 for the creation of 18 new logistics zones, intended to establish Saudi Arabia as a worldwide logistics center. Launched during the sixth Supply Chain Conference in Riyadh, this initiative aimed to expand the total count of logistics zones to 59 by 2030. The implementation of these zones, which requires storage facilities, transportation hubs, and auxiliary infrastructure, naturally advantages modular construction methods, including pre-engineered buildings. Their capability to adhere to strict deadlines while providing design adaptability renders them a valuable option for large-scale, deadline-critical initiatives. Reforms initiated by the governing body regarding permitting procedures, along with incentives for developers, are further promoting the adoption of pre-engineered buildings in both urban and regional projects. With the expansion of logistics and industrial presence under Vision 2030, pre-engineered buildings are pivotal in providing infrastructure that is efficient, flexible, and in sync with Saudi Arabia's swift development goals.

To get more information on this market Request Sample

Demand from Educational and Healthcare Infrastructure Projects

Saudi Arabia's ongoing commitment to enhancing educational access is driving the need for infrastructure solutions that offer speed, durability, and scalability, qualities effectively delivered by pre-engineered buildings. Government and private organizations are participating in constructing schools and training centers, particularly in underserved and remote regions, which is catalyzing the demand for high quality building within tight deadlines. Pre-engineered buildings offer an effective solution with their pre-fabricated parts, modular designs, and swift setup, making them suitable for the educational sector's deployment needs. Their standardized but adaptable designs facilitate the efficient construction of classrooms, laboratories, and administrative areas, while also providing opportunities for future growth. In 2024, with the conclusion of the initial phase of Saudi Arabia's Wave 2 Public-Private Partnership (PPP) Education initiative. Conducted by BEC Arabia and MOBCO, this project entailed the construction and oversight of 60 public schools in Medina. The magnitude and immediacy of this project highlighted the necessity for efficient construction methods and modular solutions like pre-engineered buildings, which are ideally equipped to fulfill these requirements. Thus, the Saudi Arabia pre-engineered buildings market growth is driven by the rising emphasis on education as a cornerstone of sustainable economic development.

Saudi Arabia Pre-Engineered Buildings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product and end user.

Product Insights:

- Concrete Structure

- Steel Structure

- Civil Structure

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes concrete structure, steel structure, civil structure, and others.

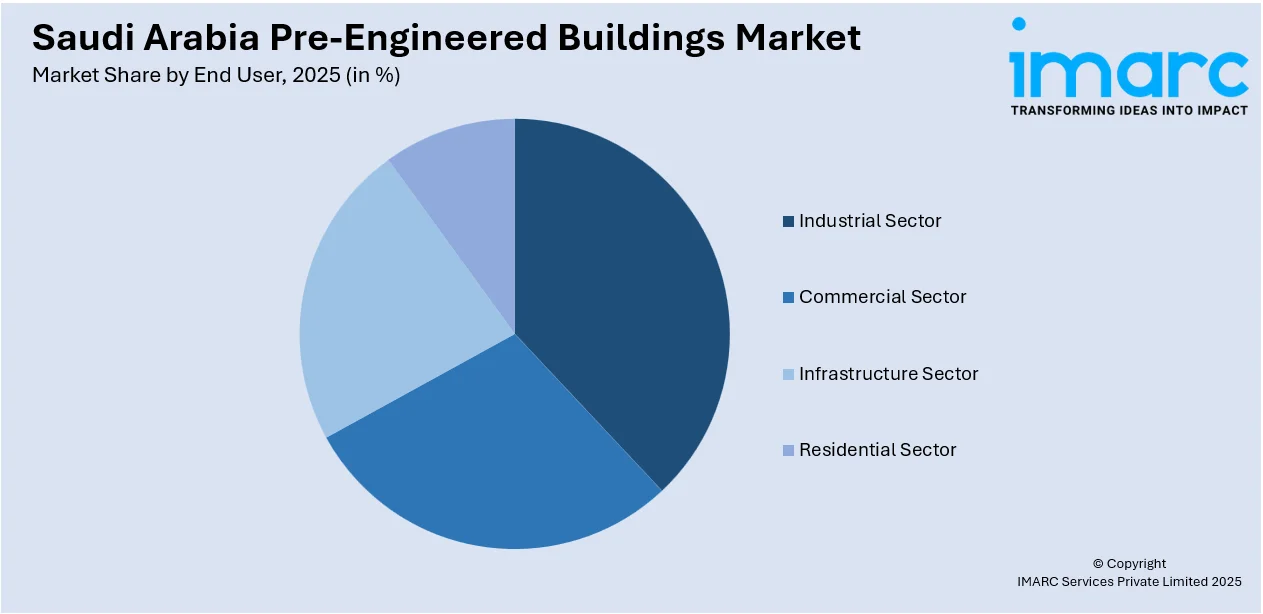

End User Insights:

Access the comprehensive market breakdown Request Sample

- Industrial Sector

- Commercial Sector

- Infrastructure Sector

- Residential Sector

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial sector, commercial sector, infrastructure sector, and residential sector.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Pre-Engineered Buildings Market News:

- In February 2025, Alghanim Industries broke ground on a new Kirby Building Systems facility in Sudair Industrial City, Saudi Arabia. Spanning 256,000 sqm, the plant will produce 200,000 metric tons annually of structural steel and pre-engineered buildings to boost exports. This project supports Saudi Vision 2030 by enhancing industrial capacity and global competitiveness.

Saudi Arabia Pre-Engineered Buildings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Concrete Structure, Steel Structure, Civil Structure, Others |

| End Users Covered | Industrial Sector, Commercial Sector, Infrastructure Sector, Residential Sector |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia pre-engineered buildings market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia pre-engineered buildings market on the basis of product?

- What is the breakup of the Saudi Arabia pre-engineered buildings market on the basis of end user?

- What is the breakup of the Saudi Arabia pre-engineered buildings market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia pre-engineered buildings market?

- What are the key driving factors and challenges in the Saudi Arabia pre-engineered buildings market?

- What is the structure of the Saudi Arabia pre-engineered buildings market and who are the key players?

- What is the degree of competition in the Saudi Arabia pre-engineered buildings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia pre-engineered buildings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia pre-engineered buildings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia pre-engineered buildings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)