Saudi Arabia Pre-School Market Size, Share, Trends and Forecast by Ownership, Age Group, and Region, 2026-2034

Saudi Arabia Pre-School Market Overview:

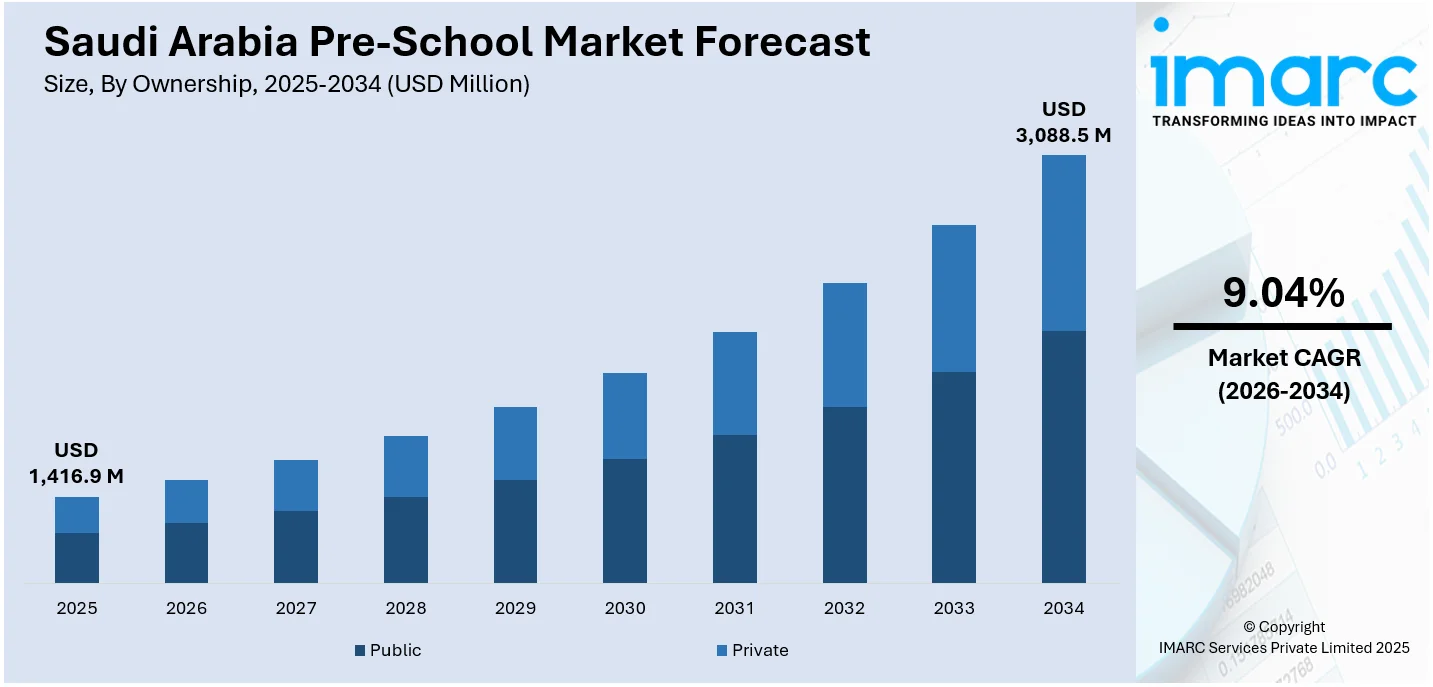

The Saudi Arabia pre-school market size reached USD 1,416.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,088.5 Million by 2034, exhibiting a growth rate (CAGR) of 9.04% during 2026-2034. The market share in Saudi Arabia is increasing because of demographic growth, technological innovation, and government reforms under Vision 2030, with a rising number of dual-income families, digital learning advancements, and policy changes that promote quality education, infrastructure, and private sector involvement, ensuring robust future expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,416.9 Million |

| Market Forecast in 2034 | USD 3,088.5 Million |

| Market Growth Rate 2026-2034 | 9.04% |

Saudi Arabia Pre-School Market Trends:

Demographic Growth

A swiftly increasing population in Saudi Arabia is a major factor fueling the growth of the market, especially as younger age segments consistently represent a substantial part of the demographic structure. As more families move to urban areas, the need for organized, dependable early education increases alongside the rapid city lifestyle. Parents are placing greater importance on early learning settings that foster the cognitive and social growth of their children while fitting into their work routines. A continual increase in dual-income families strengthens the demand for reliable childcare options, leading to notable investment and advancements in pre-school services. As per the CEIC, the total employed individuals in Saudi Arabia stood at 17,181,335 in September 2024. It pointed out an increase from the previous number of 16,864,059.000 individuals for June 2024. This demographic and social change is fundamentally transforming the demand for early education, rendering it one of the most dynamic areas within the education system. Given these trends, the Saudi Arabia pre-school market forecast indicates strong potential for continued expansion and investment opportunities in the coming years.

To get more information on this market Request Sample

Technological Integration and Digital Learning Trends

The incorporation of technology in education is profoundly transforming the pre-school sector, influenced by international trends and the digital transformation goals. In 2025, Saudi Arabia launched the Mustaqbalhum app, allowing over two million parents to access real-time performance data for more than 22,000 schools. The initiative aims to improve educational quality, transparency, and accountability by offering insights into student performance. Such advancements in digital tools are progressively being embraced, where interactive applications and intelligent classroom technologies are employed to enhance early learning experiences. Parents who emphasize technology are especially likely to look for schools that provide digital progress monitoring, instant communication, and online learning alternatives. These advancements open up new possibilities for both local and international education providers, enhancing access to high-quality early childhood education in Saudi Arabia. With the continued integration of technology, the Saudi Arabia pre-school market outlook remains positive, reflecting strong growth prospects driven by innovation and evolving parental expectations.

Government Reforms and Vision 2030 Initiatives

Saudi Arabia’s Vision 2030 initiative is crucial for the development of the pre-school sector by emphasizing education at every level, particularly concentrating on early childhood education. In alignment with this strategy, the governing body is enacting policy changes that promote private sector involvement, expand licensing options for emerging institutions, and enhance the standards and curricula of current pre-schools. Funds are being allocated to enhance infrastructure, train teachers, and promote understanding of the importance of early education. In 2025, Saudi Arabia's Ministry of Education streamlined the kindergarten registration process for the 1446 AH academic year. The new system, accessible via the Noor platform, simplifies the steps for parents, ensuring a smoother enrollment experience. The initiative aims to enhance early childhood education in the Kingdom. Such reforms seek not only to foster a more informed society but also to promote human capital development from an early age. These initiatives are expected to significantly contribute to Saudi Arabia pre-school market growth, catalyzing the demand for improved facilities, curricula, and services across the sector.

Saudi Arabia Pre-School Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on ownership and age group.

Ownership Insights:

- Public

- Private

The report has provided a detailed breakup and analysis of the market based on the ownership. This includes public and private.

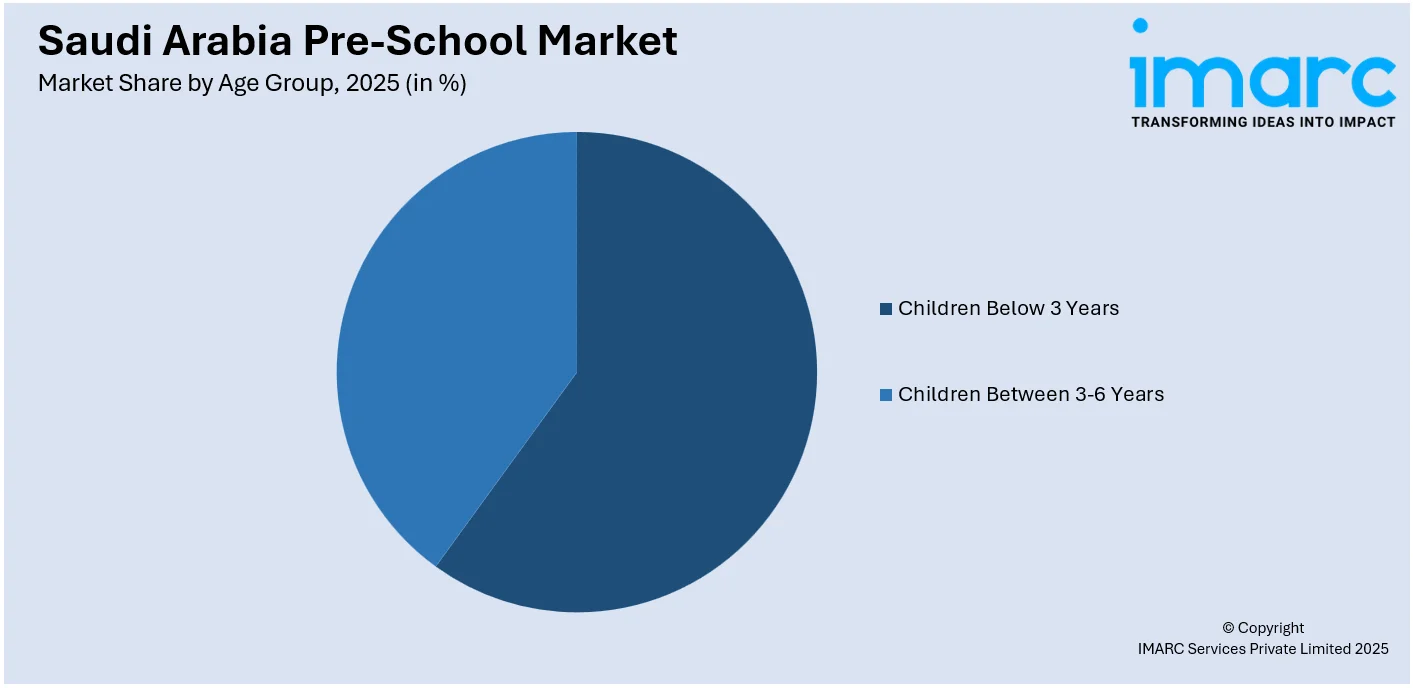

Age Group Insights:

Access the comprehensive market breakdown Request Sample

- Children Below 3 Years

- Children Between 3-6 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children below 3 years and children between 3-6 years.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Pre-School Market News:

- In August 2024, HEI Schools announced a partnership to open a new Early Years Center in Al Khobar, Saudi Arabia, bringing the Finnish early education model to the region. The center, which opened in March 2025, offered play-based, holistic learning aligned with Vision 2030. This marked HEI Schools' continued expansion across the Gulf.

Saudi Arabia Pre-School Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ownerships Covered | Public, Private |

| Age Groups Covered | Children Below 3 Years, Children Between 3-6 Years |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia pre-school market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia pre-school market on the basis of ownership?

- What is the breakup of the Saudi Arabia pre-school market on the basis of age group?

- What is the breakup of the Saudi Arabia pre-school market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia pre-school market?

- What are the key driving factors and challenges in the Saudi Arabia pre-school?

- What is the structure of the Saudi Arabia pre-school market and who are the key players?

- What is the degree of competition in the Saudi Arabia pre-school market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia pre-school market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia pre-school market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia pre-school industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)