Saudi Arabia Prepaid Cards Market Size, Share, Trends and Forecast by Card Type, Purpose, Vertical, and Region, 2026-2034

Saudi Arabia Prepaid Cards Market Overview:

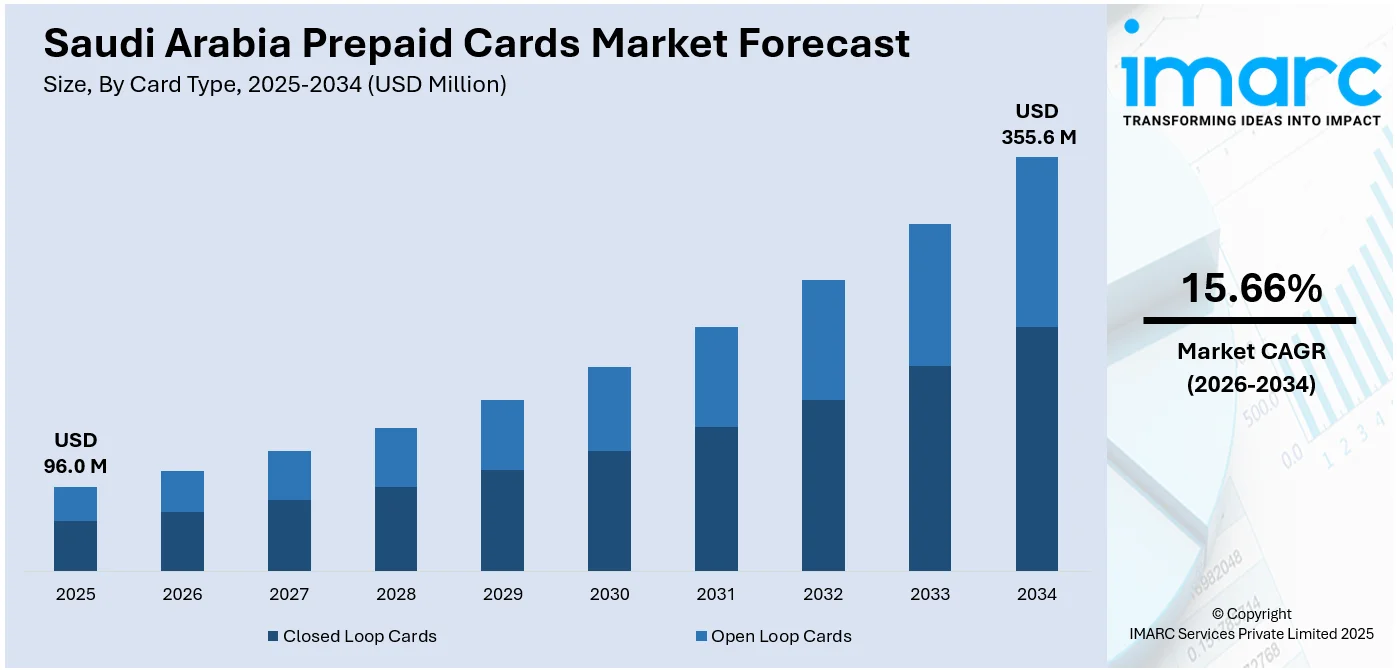

The Saudi Arabia prepaid cards market size reached USD 96.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 355.6 Million by 2034, exhibiting a growth rate (CAGR) of 15.66% during 2026-2034. The market is driven by rising digital payment adoption, increasing financial inclusion initiatives, a youthful tech-savvy population, government-backed cashless economy programs, and growing demand for travel, gift, and payroll cards. Additionally, the rise of e-commerce and contactless payment infrastructure supports sustained market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 96.0 Million |

| Market Forecast in 2034 | USD 355.6 Million |

| Market Growth Rate 2026-2034 | 15.66% |

Saudi Arabia Prepaid Cards Market Trends:

Expansion of Sector-Specific Prepaid Card Programs

Saudi Arabia is witnessing a rise in sector-specific prepaid card programs tailored to industries such as retail, hospitality, and transportation. These use cases go beyond general-purpose spending and focus on controlled, pre-defined utility, enhancing budget management and operational efficiency. Retailers and businesses are leveraging these cards to foster customer loyalty, implement targeted discounts, and track consumer behavior more accurately. The government is also using sector-linked prepaid cards to disburse aid or benefits in education and public health. This specialization reflects a maturing market with increasingly customized solutions aligned to consumer and institutional demands. For instance, in September 2024, stc pay launched its Corporate Prepaid Card, expanding its business offerings to serve corporate clients. The card provides companies with better control over expenses, enhanced financial management, and real-time transaction visibility. Key features include digital onboarding, instant cashback on every transaction, advanced security, and global acceptance. It also supports co-branded programs and offers value-added services like loyalty rewards.

To get more information on this market Request Sample

Growth of Virtual and Mobile-Based Prepaid Card Solutions

Another emerging trend in the Saudi prepaid cards market is the proliferation of virtual prepaid cards and mobile wallet-linked prepaid solutions. Fintech companies and traditional banks alike are launching digital-only prepaid cards that can be instantly issued and used through smartphones. These cards cater to online shoppers, gig economy workers, and young users who prefer app-based financial tools. Virtual prepaid cards often come with real-time control features, including spend limits, freeze/unfreeze options, and merchant-specific restrictions. They also support rapid integration with e-commerce platforms and NFC-enabled payments. With increasing smartphone penetration and digital-native consumer behavior, this segment is growing rapidly. These solutions offer enhanced flexibility, security, and convenience, particularly in a market that is prioritizing contactless and cashless transactions. For instance, in November 2023, PayTabs Group launched PayTabs Issuance, a secure prepaid card issuing platform aimed at expanding its presence across the Middle East and Africa. This move responds to growing regional demand for digital payment solutions as economies shift toward card-based systems. The platform enables banks, retailers, and corporates to issue cobranded Visa, Mastercard, and local debit cards in multiple currencies. Integrated with Banking-as-a-Service (BaaS), it offers services like virtual card issuance, personalization, loyalty programs, and full lifecycle management—positioning PayTabs to streamline prepaid card issuance and reduce cost barriers for large-scale users.

Saudi Arabia Prepaid Cards Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on card type, purpose, and vertical.

Card Type Insights:

- Closed Loop Cards

- Open Loop Cards

The report has provided a detailed breakup and analysis of the market based on the card type. This includes closed loop cards and open loop cards.

Purpose Insights:

- Payroll/Incentive Cards

- Travel Cards

- General Purpose Reloadable (GPR) Cards

- Remittance Cards

- Others

A detailed breakup and analysis of the market based on the purpose have also been provided in the report. This includes payroll/incentive cards, travel cards, general purpose reloadable (GPR) cards, remittance cards, and others.

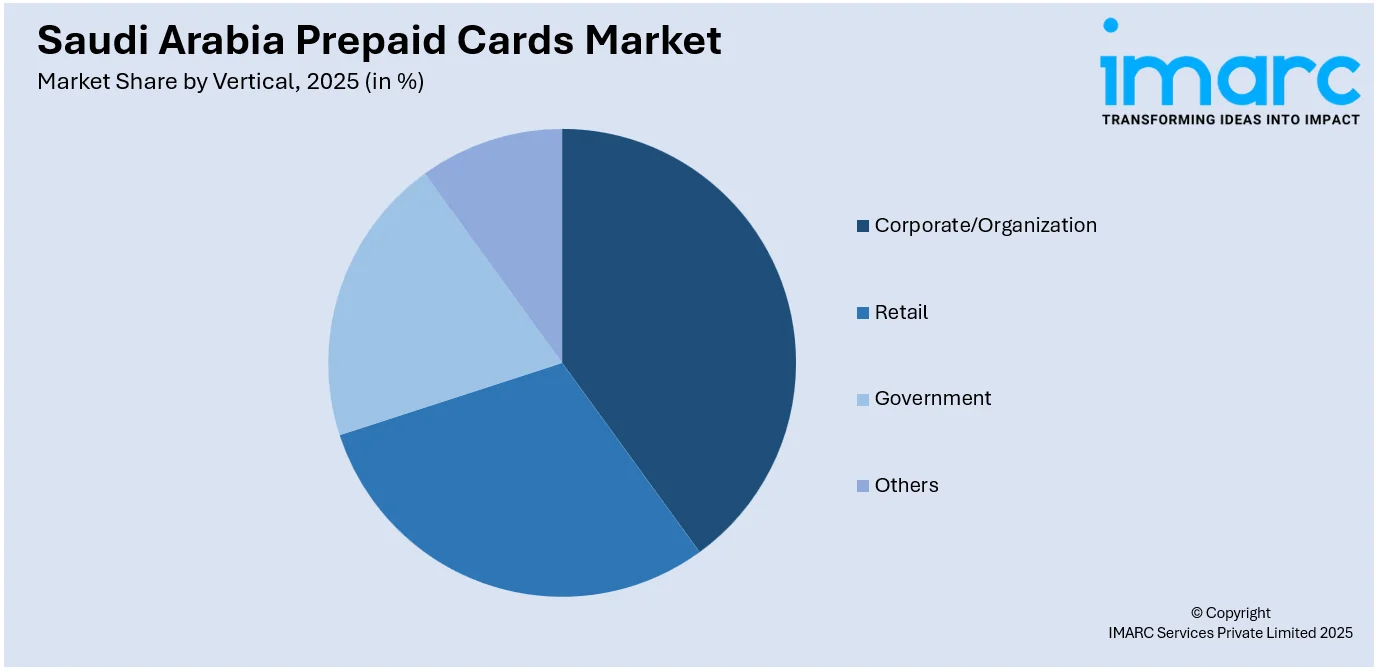

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Corporate/Organization

- Retail

- Government

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes corporate/organization, retail, government, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Prepaid Cards Market News:

- In January 2024, Saudi fintech firm tiqmo signed an exclusive agreement with Mastercard to launch prepaid cards through its mobile app in Saudi Arabia. Licensed by the Saudi Central Bank (SAMA), tiqmo will use Mastercard’s cross-border payments and tokenization technology to expand its digital payment offerings. The partnership supports Saudi Arabia’s Vision 2030 goal of achieving a 70% cashless society and aims to deliver secure, modern financial services across sectors like e-commerce, gaming, and education. This move strengthens tiqmo’s product portfolio and aligns with broader efforts to accelerate the Kingdom’s digital financial transformation.

Saudi Arabia Prepaid Cards Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Card Types Covered | Closed Loop Cards, Open Loop Cards |

| Purposes Covered | Payroll/Incentive Cards, Travel Cards, General Purpose Reloadable (GPR) Cards, Remittance Cards, Others |

| Verticals Covered | Corporate/Organization, Retail, Government, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia prepaid cards market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia prepaid cards market on the basis of card type?

- What is the breakup of the Saudi Arabia prepaid cards market on the basis of purpose?

- What is the breakup of the Saudi Arabia prepaid cards market on the basis of vertical?

- What is the breakup of the Saudi Arabia prepaid cards market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia prepaid cards market?

- What are the key driving factors and challenges in the Saudi Arabia prepaid cards market?

- What is the structure of the Saudi Arabia prepaid cards market and who are the key players?

- What is the degree of competition in the Saudi Arabia prepaid cards market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia prepaid cards market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia prepaid cards market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia prepaid cards industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)