Saudi Arabia Quick Service Restaurants Market Size, Share, Trends and Forecast by Cuisine, Outlet, Location, and Region, 2026-2034

Saudi Arabia Quick Service Restaurants Market Overview:

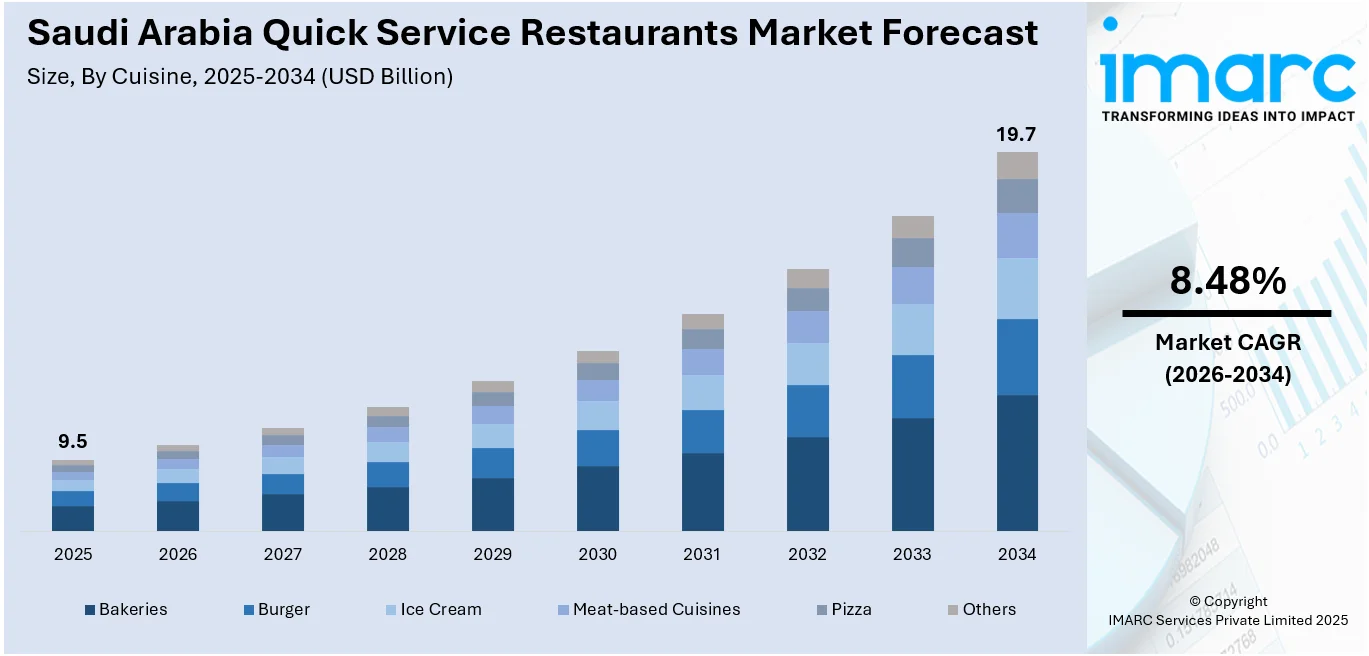

The Saudi Arabia quick service restaurants market size reached USD 9.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 19.7 Billion by 2034, exhibiting a growth rate (CAGR) of 8.48% during 2026-2034. The market is expanding, driven by rising urbanization, growing disposable incomes, digital ordering trends, and stronger loyalty to local brands. Regional investments, technological innovation, and evolving consumer preferences continue to shape a competitive and fast-evolving QSR landscape across the Kingdom, strengthening the Saudi Arabia quick service restaurants market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.5 Billion |

| Market Forecast in 2034 | USD 19.7 Billion |

| Market Growth Rate 2026-2034 | 8.48% |

Saudi Arabia Quick Service Restaurants Market Trends:

Rising Regional Investment and Expansion Activities

The market is witnessing strong momentum driven by regional players investing heavily to expand their footprint. Increased funding and brand development are creating new competition and diversifying consumer choices. Regional companies are no longer limiting themselves to traditional markets but are actively entering Saudi Arabia’s fast-growing QSR segment to capture the growing consumer base. In November 2024, UAE-based Epik Foods secured USD 15.5 Million to support its expansion plans in Saudi Arabia. Managing a portfolio of 60 food and beverage concepts, including a strong focus on quick-service dining formats, Epik Foods further strengthened its presence in the Saudi market, bringing innovative offerings such as digital-first brands, meal kits, catering solutions, and dine-in options. This expansion reflects the growing appeal of Saudi Arabia’s QSR sector among regional players, who see the Kingdom’s young population, rising disposable incomes, and evolving dining habits as key growth drivers. As more regional food and restaurant companies look to tap into this opportunity, the competitive intensity in Saudi Arabia’s QSR sector is expected to rise. Increased regional participation is pushing brands toward technological innovation, menu diversification, and better customer experiences, ensuring that the market becomes broader, more dynamic, and increasingly aligned with global service standards.

To get more information on this market Request Sample

Shifting Consumer Loyalty Towards Local Brands

Changing consumer behavior is playing a major role in reshaping Saudi Arabia’s QSR market, with a growing shift toward favoring local brands. Saudi consumers are increasingly seeking dining experiences that combine familiar flavors, local culture, and modern service formats. This growing preference for homegrown options is challenging the long-held dominance of American fast-food chains. In August 2024, it was observed that local Saudi brands outnumbered American chains within the Kingdom’s QSR sector, reflecting a visible change in market dynamics. Despite American brands maintaining strong revenues, consumer loyalty toward local chains such as Al Baik, Maestro Pizza, and Herfy highlighted how important cultural resonance and price-value balance have become. Saudi QSR brands have successfully expanded their presence by offering tailored menus, competitive pricing, and creative marketing strategies that appeal to the national identity and evolving tastes. This transition signals a deeper level of market maturity where customers prioritize relevance and authenticity alongside quality and speed. As local players continue to scale and invest in better technology, service quality, and brand experience, international chains are being pushed to rework their offerings and engagement models. The competition has intensified, leading to an overall healthier, more consumer-focused fast-food environment across Saudi Arabia, driving Saudi Arabia quick service restaurants market growth.

Saudi Arabia Quick Service Restaurants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on cuisine, outlet, and location.

Cuisine Insights:

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

The report has provided a detailed breakup and analysis of the market based on the cuisine. This includes bakeries, burger, ice cream, meat-based cuisines, pizza, and others.

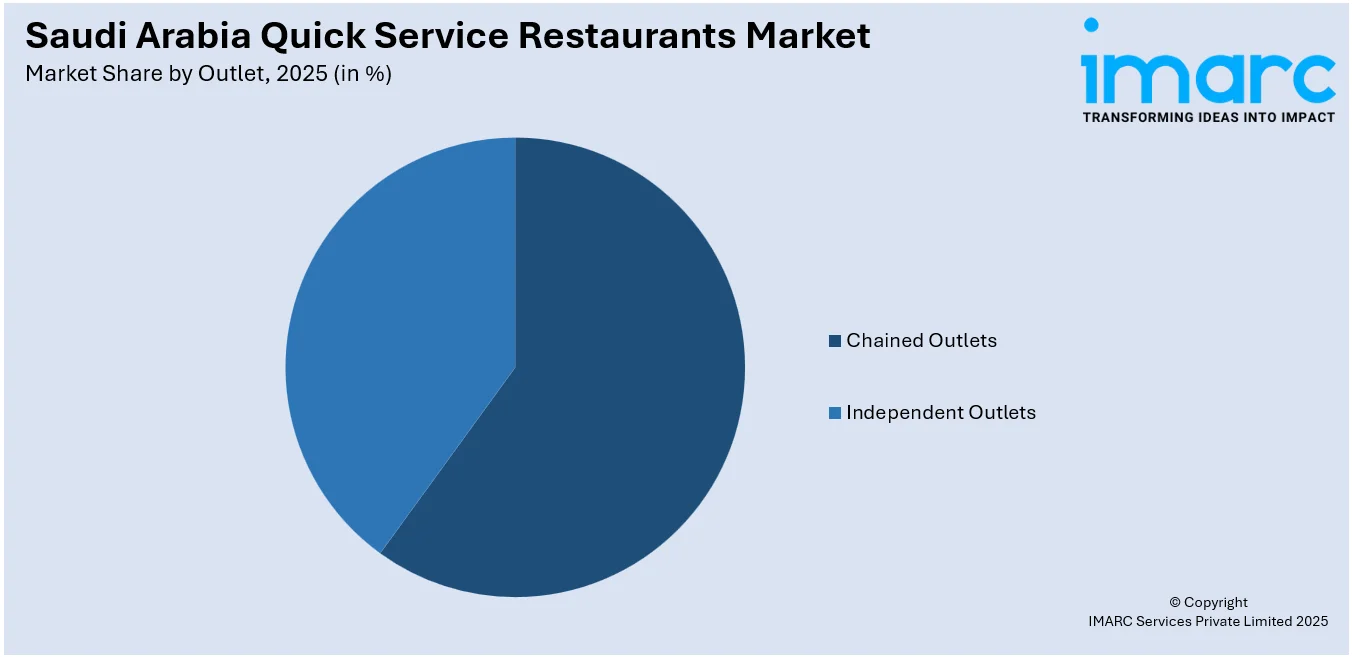

Outlet Insights:

Access the comprehensive market breakdown Request Sample

- Chained Outlets

- Independent Outlets

A detailed breakup and analysis of the market based on the outlet have also been provided in the report. This includes chained outlets and independent outlets.

Location Insights:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes leisure, lodging, retail, standalone, and travel.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Quick Service Restaurants Market News:

- April 2025: OOMCO partnered with Fresh Food Company Ltd., owner of "I'm Hungry," to open fast-food outlets at four Eastern Province service stations in Saudi Arabia. This collaboration expanded "I'm Hungry’s" presence, strengthening the kingdom’s quick service restaurants network and enhancing customer convenience.

- February 2025: Foodics’ COO Djamel Mohand stepped down after helping the platform expand to over 30,000 restaurants across 25 countries. Foodics, a major player in Saudi Arabia’s quick service restaurants sector, strengthened digital transformation and operational efficiency through cloud-based POS and fintech solutions.

Saudi Arabia Quick Service Restaurants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cuisines Covered | Bakeries, Burger, Ice Cream, Meat-based Cuisines, Pizza, Others |

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia quick service restaurants market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia quick service restaurants market on the basis of the cuisine?

- What is the breakup of the Saudi Arabia quick service restaurants market on the basis of the outlet?

- What is the breakup of the Saudi Arabia quick service restaurants market on the basis of location?

- What is the breakup of the Saudi Arabia quick service restaurants market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia quick service restaurants market?

- What are the key driving factors and challenges in the Saudi Arabia quick service restaurants market?

- What is the structure of the Saudi Arabia quick service restaurants market and who are the key players?

- What is the degree of competition in the Saudi Arabia quick service restaurants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia quick service restaurants market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia quick service restaurants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia quick service restaurants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)