Saudi Arabia Ride Hailing Market Size, Share, Trends and Forecast by Vehicle Type, Booking Type, End-Use, and Region, 2026-2034

Saudi Arabia Ride Hailing Market Overview:

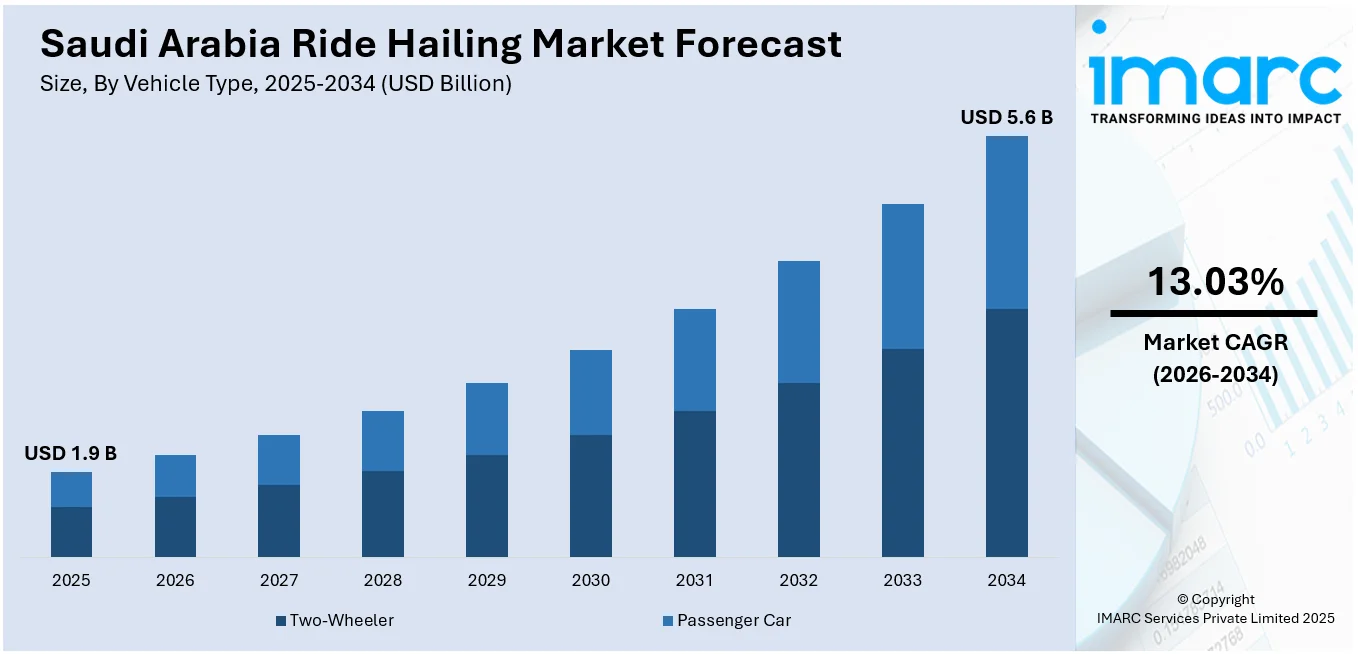

The Saudi Arabia ride hailing market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.6 Billion by 2034, exhibiting a growth rate (CAGR) of 13.03% during 2026-2034. Application of Vision 2030 reforms, rapid urbanization, high smartphone usage, a young digital-native population, rising female workforce participation, surging tech integration, increasing traffic congestion, and growing demand for flexible transport are some of the factors boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.9 Billion |

| Market Forecast in 2034 | USD 5.6 Billion |

| Market Growth Rate 2026-2034 | 13.03% |

Saudi Arabia Ride Hailing Market Trends:

Government Initiatives: Vision 2030 and Smart Mobility Integration

The market has received significant momentum from government-led transformation programs, most notably Vision 2030. This long-term national roadmap prioritizes reducing the Kingdom's reliance on oil, boosting private sector involvement, and embracing smart city infrastructure. As part of this, the government has actively encouraged the integration of digital platforms into urban mobility, providing a supportive environment for ride-hailing operators to scale, which is driving the Saudi Arabia's ride-hailing market growth. Additionally, licensing frameworks have been revised to ease entry for local and international players, while subsidies and public-private partnerships are being explored to enhance last-mile connectivity. Moreover, large-scale urban infrastructure projects are designed with digital transport ecosystems in mind, offering growth potential for app-based mobility services, further accelerating the market growth. According to the sources, in 2024, Madinah completed 70 km of bicycle paths across key roads and neighborhoods as part of its "Humanization of the City" program, aiming to promote sustainable transport and healthier lifestyles. The municipality targets 220 km of safe, accessible bike lanes by 2025, supported by 165+ Careem Bike stations citywide.

To get more information on this market Request Sample

Expanding Cityscapes and Transit Demand

According to the Saudi Arabia ride-hailing market forecast, rapid urban expansion is reshaping transportation needs across major cities such as Riyadh, Jeddah, and Dammam. These urban centers are experiencing steady population growth and internal migration, increasing the demand for flexible, on-demand mobility solutions. A notable example is Riyadh’s New Murabba project, launched under Vision 2030, which includes The Mukaab—an iconic cube-shaped skyscraper—as part of a USD 13 billion initiative to establish a modern downtown featuring commercial, residential, and green spaces. Traditional public transportation remains under development in many regions, and private vehicle ownership poses challenges such as parking shortages, traffic congestion, and high fuel consumption. In line with this, ride-hailing platforms offer a scalable solution that supports commuting needs without further straining urban infrastructure, which is creating a positive Saudi Arabia ride hailing market outlook. Furthermore, urban development initiatives are also encouraging mixed-use zoning, which increases short-distance travel demand, which is an ideal use case for ride-hailing. Apart from this, the rise in urban population density correlates with higher user adoption rates, supporting strong market fundamentals in key Saudi cities, which is another factor propelling the market growth.

Rapid Smartphone Penetration

Saudi Arabia has one of the highest smartphone penetration rates in the Middle East, creating a fertile environment for digital-first transportation solutions. The proliferation of affordable smartphones, along with widespread forth-generation (4G) and expanding fifth-generation (5G) coverage, has empowered consumers to access ride-hailing services with minimal friction, which is boosting the Saudi Arabia ride hailing share. Moreover, the high engagement levels among Saudi users on mobile apps, especially among youth, have led to rapid onboarding and consistent usage patterns for services like Uber, Careem, and local alternatives, which is fostering the market growth. Apart from this, the convenience of digital interaction is further reinforced by integrated payment options, including e-wallets and bank cards, which support seamless transactions and bolsters the market growth.

Saudi Arabia Ride Hailing Market Growth Drivers:

Infrastructure Development and Smart City Initiatives

Saudi Arabia's investment in infrastructure and smart city initiatives is a key factor influencing the market growth, providing the digital and physical groundwork essential for contemporary mobility services. A notable instance is the Heart of Khobar smart city project, initiated in 2024 by Tilal Real Estates in the Eastern Province. With an estimated worth of $1.6 billion (6 billion SAR) and covering 268,000 square meters, the mixed-use project featured residential zones, office spaces, hotels, parks, shopping centers, and entertainment options. These extensive urban projects embody the Kingdom’s overarching smart city vision, directly facilitating the growth and incorporation of ride hailing services into daily urban life. Smart city projects also improve road connectivity, optimize traffic flow, and embed digital technologies within urban planning, enabling ride-hailing platforms to function more effectively and provide enhanced user experiences.

Tourism Growth and International Mobility

The rapid expansion of Saudi Arabia’s tourism sector is a key factor driving the demand for ride hailing services. Under Vision 2030, the Kingdom is opening to international visitors, leading to a substantial increase in tourists and business travelers who require accessible, reliable, and user-friendly transportation options. Ride hailing platforms offer significant advantages to non-residents through ease of use, language accessibility, and transparent pricing, making them an essential part of the travel experience. According to an announcement by UN Tourism in December 2024, Saudi Arabia ranked third globally in the growth rate of international tourist arrivals, recording a 61% increase in the first eight to nine months of 2024 compared to the same period in 2019. This rise highlights the growing influx of visitors who rely on flexible transport solutions. By bridging gaps in existing public transit and providing convenient, door-to-door mobility, ride-hailing services are well-positioned to capitalize on the expanding tourism market, thereby contributing to their sustained growth and profitability.

Growing Adoption of Digital Mobility Platforms

The rapid rise in ride-hailing usage across Saudi Arabia reflects a fundamental shift toward digital mobility solutions, driven by both individuals demand and technological integration. In 2025, the acting President of the Transport General Authority (TGA) reported that ride-hailing apps enabled 80.5 million trips in 2024, which is a 26% rise compared to the prior year. This increase shows a growing dependence on app-based transportation to address daily mobility requirements effectively and adaptively, particularly in urban settings where convenience is paramount. The rise in digitally registered drivers that increased by 27% to 332,000, which includes 22,000 women from Saudi Arabia, is highlighting the sector's expanding ecosystem and inclusiveness. A 48% year-over-year rise in women drivers highlights both social advancement and the attractiveness of ride-hailing as a practical revenue option. This trend illustrates how smart transportation technologies are changing the mobility landscape in the Kingdom, facilitating scalable, accessible, and technology-driven growth in the ride hailing industry.

Saudi Arabia Ride Hailing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on vehicle type, booking type, and end-use.

Vehicle Type Insights:

- Two-Wheeler

- Passenger Car

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes two-wheeler and passenger car.

Booking Type Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the booking type have also been provided in the report. This includes online and offline.

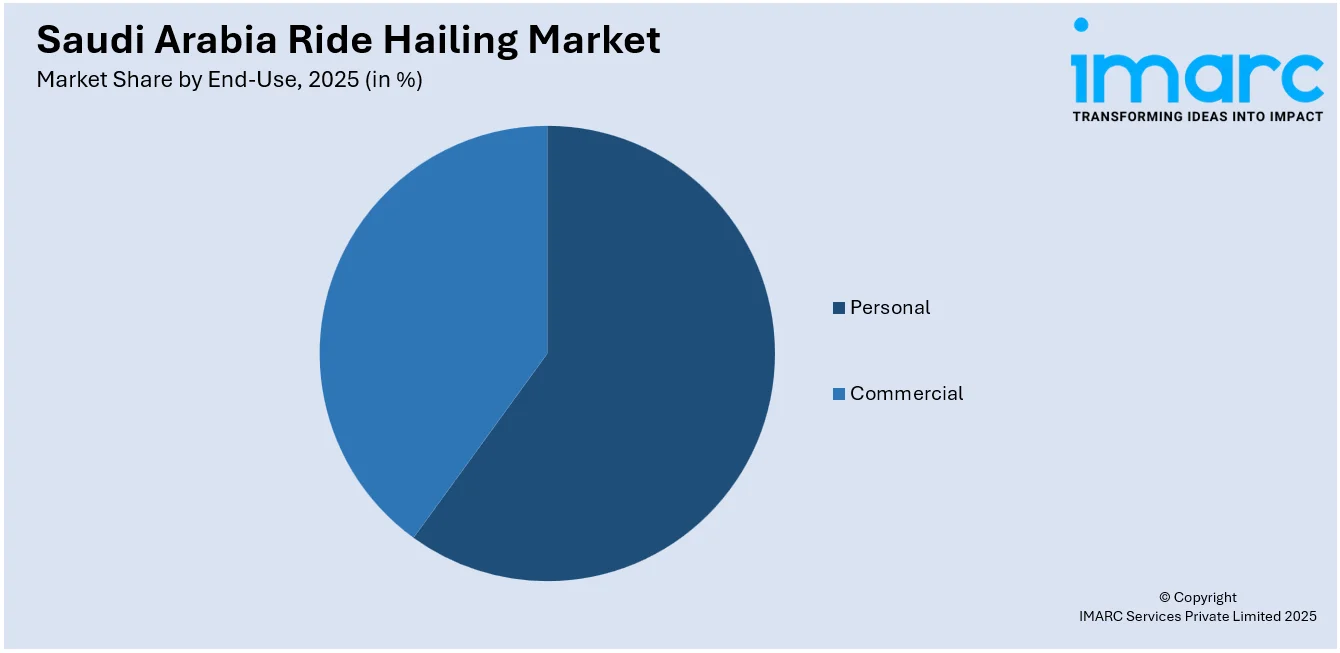

End-Use Insights:

Access the comprehensive market breakdown Request Sample

- Personal

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes personal and commercial.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Ride Hailing Market News:

- In July 2025, Lucid Motors, Nuro, and Uber, backed by Saudi Arabia's Public Investment Fund (PIF), revealed a partnership to launch a next-generation autonomous robotaxi service by late 2026. The program will feature 20,000 self-driving Lucid vehicles powered by Nuro’s Level 4 technology. This initiative aims to revolutionize urban mobility, offering sustainable and accessible transportation while supporting global adoption of driverless transport.

- In July 2025, Uber launched a "Women Drivers" feature in Saudi Arabia, allowing female riders to be matched exclusively with female drivers. This initiative, part of efforts to boost women's participation in the workforce. Uber also plans community-focused events like "GigSister" to support female drivers in the kingdom.

- In May 2025, Elon Musk expressed interest in launching robotaxis in Saudi Arabia, including autonomous vehicles, during the US-Saudi Investment Forum. This comes as Uber plans to introduce self-driving cars in the kingdom by 2025 in collaboration with Pony.AI.

- In May 2025, WeRide, a Chinese autonomous vehicle company, launched operations in Saudi Arabia, deploying autonomous taxis and buses across Riyadh and AlUla. The company plans to begin commercial robotaxi services by late 2025, in collaboration with Uber and supported by Saudi Arabia's Transport General Authority.

- In April 2025, inDrive, a global ride-hailing service, was granted a license to operate in Saudi Arabia, starting with Jeddah. The company offers a unique model where passengers and drivers negotiate prices directly, charging lower service fees compared to competitors.

- In 2025, Uber deepened its footprint in Saudi Arabia by teaming up with Aleph Group, a global digital advertising enabler. The collaboration aims to enhance in-app ad placements, offering brands localized outreach through Uber’s platform. This strategic move aligns with Saudi Arabia’s growing focus on digital innovation and e-commerce engagement.

- In 2024, Saudi Arabia entered talks with Archer Aviation to potentially deploy electric vertical takeoff and landing (eVTOL) aircraft in major cities like Riyadh and Jeddah. This futuristic transport concept aims to ease urban congestion, support Vision 2030's mobility goals, and position the Kingdom as a pioneer in next-gen air mobility.

Saudi Arabia Ride Hailing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Two-Wheeler, passenger cars |

| Booking Types Covered | Online, Offline |

| End-Uses Covered | Personal, Commercial |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia ride hailing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia ride hailing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia ride hailing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ride hailing market in Saudi Arabia was valued at USD 1.9 Billion in 2025.

The Saudi Arabia ride hailing market is projected to exhibit a CAGR of 13.03% during 2026-2034, reaching a value of USD 5.6 Billion by 2034.

The Saudi Arabia ride hailing market is driven by rapid urban growth, increasing smartphone use, and supportive government policies promoting smart mobility. Rising traffic congestion and demand for convenient transportation boost adoption. Additionally, evolving individual lifestyles and greater workforce participation encourage diverse usage, while technological advancements enhance service accessibility and efficiency across urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)