Saudi Arabia Risk Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Industry Vertical, and Region, 2026-2034

Saudi Arabia Risk Management Market Overview:

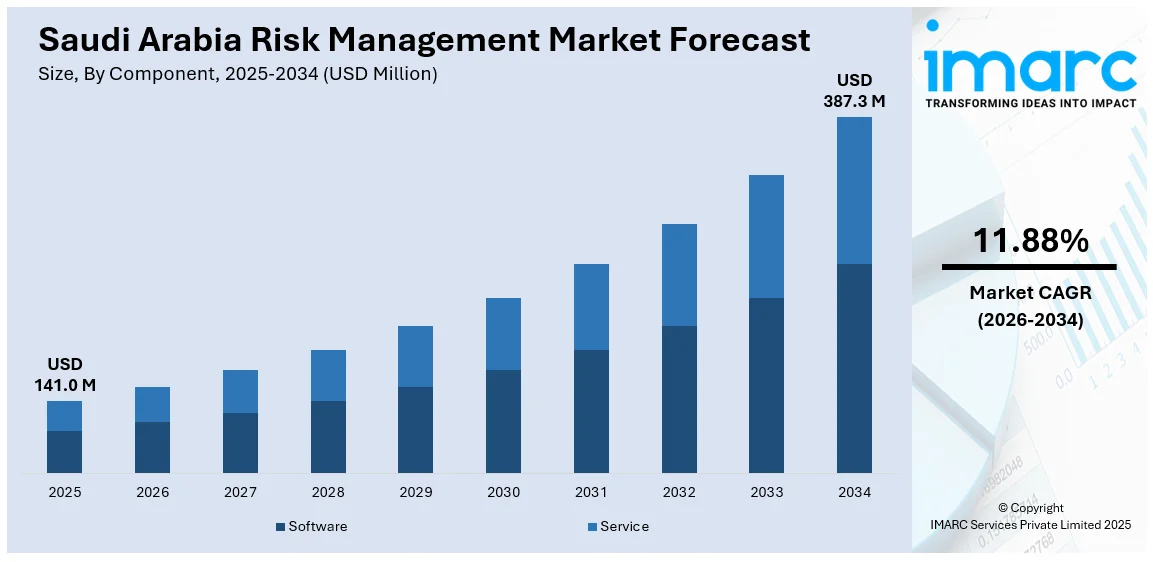

The Saudi Arabia risk management market size reached USD 141.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 387.3 Million by 2034, exhibiting a growth rate (CAGR) of 11.88% during 2026-2034. Vision 2030–driven digital transformation and mega-projects boosting demand for enterprise GRC platforms, stringent regulatory mandates, escalating cybersecurity threats, and the rise in nearshoring-led operational and vendor-risk complexities are among the key factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 141.0 Million |

| Market Forecast in 2034 | USD 387.3 Million |

| Market Growth Rate 2026-2034 | 11.88% |

Saudi Arabia Risk Management Market Trends:

Escalating Cybersecurity Threats amid Rapid Digitalization

Saudi Arabia is boosting its digital transformation efforts, embracing cloud migration, artificial intelligence (AI)-enabled services, the internet of things (IoT) deployments, and extensive remote-work infrastructures. Consequently, its corporate and public sectors are seeing a corresponding surge in sophisticated cyberattacks, from ransomware and business email compromise to supply-chain exploitation. According to Trend Micro's Annual Cybersecurity Report, 110 million threats were detected in Saudi Arabia in 2022. As a result, organizations are prioritizing AI-driven security information and event-management (SIEM) platforms, automated threat-intelligence feeds, and zero-trust network architectures to detect and remediate incidents in real time. Moreover, organizations are integrating GRC platforms, continuous risk assessment, third-party vendor due diligence, and cyber-insurance strategies. Enterprise risk teams leverage predictive analytics and scenario-based stress testing to quantify residual risk and inform board-level reporting, aligning cybersecurity initiatives with local regulatory frameworks to enhance operational resilience and compliance.

To get more information on this market Request Sample

Stringent Regulatory Mandates and Vision 2030–Driven GRC Adoption

Under Saudi Vision 2030, the Kingdom has enacted an array of regulatory frameworks, such as the Personal Data Protection Law (PDPL), SAMA cybersecurity controls, and forthcoming climate-risk financial disclosures that require enterprises to demonstrate robust governance, risk, and compliance (GRC) capabilities. To navigate this complexity, companies are implementing integrated GRC platforms that consolidate policy management, audit trails, risk assessments, and real-time compliance dashboards. This trend is mirrored by the Saudi GRC platform market, which reached USD 442.5 million in 2024 and is forecast to grow at an 11.5 % CAGR through 2033, as businesses seek automated solutions to reduce manual overhead, avoid fines, and maintain transparency across mega-project initiatives like NEOM and the Red Sea developments.

Saudi Arabia Risk Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on component, deployment mode, enterprise size, and industry vertical.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Mode Insights:

- On-Premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

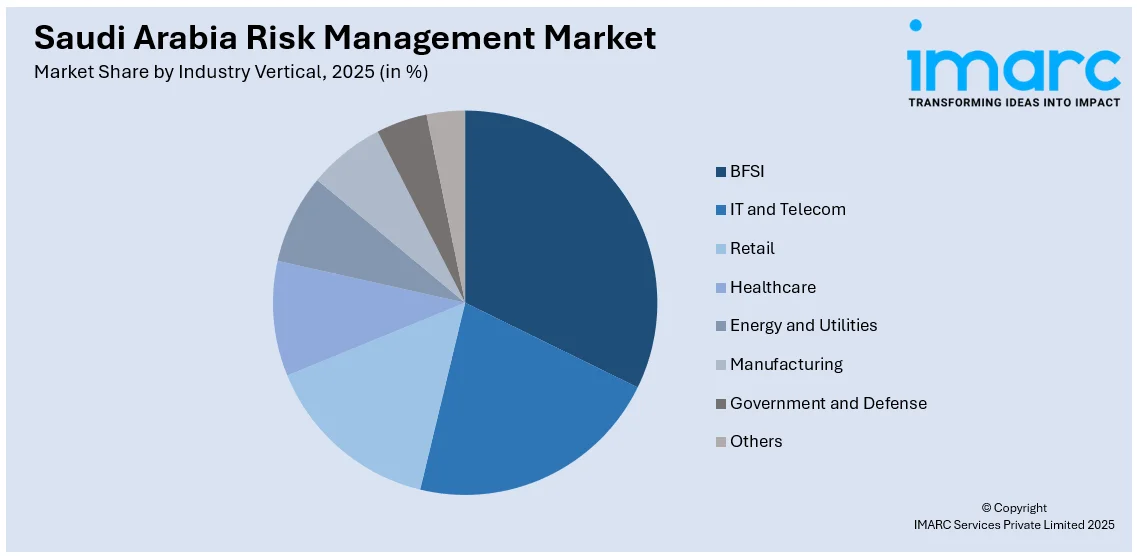

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Retail

- Healthcare

- Energy and Utilities

- Manufacturing

- Government and Defense

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, IT and telecom, retail, healthcare, energy and utilities, manufacturing, government and defense, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Risk Management Market News:

- May 2025: The Saudi Insurance Authority (IA) appointed Bayes Business School to support its regulatory initiatives. This collaboration aims to enhance the IA's capacity in risk assessment, regulatory compliance, and strategic development within the Kingdom's evolving insurance sector.

- May 2025: Mastercard launched a Cyber Resilience Center in Saudi Arabia, partnering with Riyad Bank to advance risk management through education, global standards, and real-time risk assessments. This initiative strengthens the Kingdom’s cybersecurity, supporting secure digital transformation and fostering local talent growth.

Saudi Arabia Risk Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-Premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecom, Retail, Healthcare, Energy and Utilities, Manufacturing, Government and Defense, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia risk management market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia risk management market on the basis of component?

- What is the breakup of the Saudi Arabia risk management market on the basis of deployment mode?

- What is the breakup of the Saudi Arabia risk management market on the basis of enterprise size?

- What is the breakup of the Saudi Arabia risk management market on the basis of industry vertical?

- What is the breakup of the Saudi Arabia risk management market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia risk management market?

- What are the key driving factors and challenges in the Saudi Arabia risk management market?

- What is the structure of the Saudi Arabia risk management market and who are the key players?

- What is the degree of competition in the Saudi Arabia risk management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia risk management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia risk management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia risk management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)