Saudi Arabia Road Freight Transport Market Report by Temperature Control (Controlled, Non-Controlled), Product Type (Liquid Goods, Solid Goods), Distance (Long Haul, Short Haul), Containerization (Containerized, Non-Containerized), Destination (Domestic, International), End User (Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Region 2025-2033

Market Overview:

Saudi Arabia road freight transport market size reached USD 6.4 Billion in 2024. Looking forward, the market is expected to reach USD 10.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The increasing advancements in technology, including telematics, GPS, and fleet management systems, which have improved the efficiency of road freight operations, are primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.4 Billion |

| Market Forecast in 2033 | USD 10.7 Billion |

| Market Growth Rate (2025-2033) | 5.30% |

Road freight transport, also known as trucking or haulage, is a crucial component of the logistics and transportation industry. It involves the movement of cargo and goods by road using various types of vehicles, including trucks, lorries, and vans. Road freight transport plays a pivotal role in the supply chain, facilitating the distribution of goods over short and long distances. It offers flexibility, accessibility, and reliability, making it a preferred mode of transportation for a wide range of industries. Road transport is particularly well-suited for transporting perishable goods, consumer products, raw materials, and industrial equipment. The industry has evolved significantly over time, with advancements in vehicle technology, logistics management, and infrastructure development. Efficient road freight transport contributes to economic growth by connecting producers, manufacturers, and consumers.

Saudi Arabia Road Freight Transport Market Trends:

Development and Expansion of Infrastructure and Road Networks

The government of Saudi Arabia is heavily investing in the growth and development of its road infrastructure, which is having a positive impact on the sector of road freight transport. New highways, bridges, and logistics centers are being built, making transport within the country smoother and more efficient. These initiatives are considerably cutting journey time, making freight movement more reliable, and boosting connectivity between industrial areas and major cities. The growth of the logistics and warehousing industries is also being augmented by this expansion, as better roads are allowing companies to rationalize supply chains. The development of Saudi Vision 2030 initiative's numerous infrastructure projects is continuously enhancing the capacity and efficiency of road freight transport, drawing both local and foreign logistics companies to invest in the market. The road freight transport sector, as a result, is experiencing steady growth. In 2025, with an investment of approximately 7.5 billion SAR ($2 billion) in new tourism initiatives and improvements to the Tabuk region’s connectivity through an 8,000 km road network and more than 200 bridges, the Kingdom is ready for significant advancement.

Growth of Retail and E-commerce Sector

The current expansion in retail and e-commerce activities is propelling the growth of market in Saudi arabia. With growing dependence on online shopping, companies are demanding swift and effective delivery services to satisfy customers. Growth in the operations of e-commerce companies is increasing the amount of goods being transported throughout the nation. Also, retailers are always adjusting to cope with increasing demand for on-time deliveries, which is increasing the demand for a good road freight network. With digital platforms gaining popularity and changing consumer behavior, logistics players are always increasing their fleets and streamlining operations to manage more small-sized shipments. This trend is playing a major role in the growth of the road freight transport industry, as increasing numbers of delivery vehicles are being put on the road to serve the needs of the retail and e-commerce industries. The IMARC Group predicts that the Saudi e-commerce market is projected to attain USD 708.7 Billion by 2033.

Growing Industrial Production and Export Activity

Saudi Arabia's continued emphasis on industrial diversification is creating the need for road freight transport services. The nation is aggressively developing its non-oil sectors, including manufacturing, construction, and mining, which are producing a greater volume of goods that need to be efficiently transported. Industrial zones are spreading all around the country, leading to an increased demand for bulk transportation of raw material and finished goods. This is also driving the demand for more complex and quick transport solutions is Saudi Arabia's rising export operations, most notably in industries such as petrochemicals, machinery, and consumer goods. This development is encouraging logistics providers to upgrade fleet capabilities and make new technologies available that enable an expansion of road freight solutions. The higher industrial production is guaranteeing a consistent flow of goods, supporting the general demand for road freight transportation in the nation. According to Minister of Economy and Planning Faisal Al-Ibrahim, Saudi Arabia's non-oil economy is projected to expand by 4.8% in 2025 and 6.2% in 2026, fueled by investments in human capital and increased activity in the private sector.

Saudi Arabia Road Freight Transport Market Drivers:

Technological Advancements in Freight Management

Technological advancements in freight management are playing a crucial role in the supporting the market growth. The continuous adoption of technologies such as global positioning system (GPS) tracking, real-time monitoring systems, and automated route planning is enabling logistics companies to enhance efficiency and reduce operational costs. These technologies are improving visibility across the entire supply chain, allowing businesses to better manage deliveries, reduce delays, and optimize routes. The heightened use of digital platforms and transportation management systems is helping to streamline processes, enabling faster decision-making and more efficient management of freight operations. Additionally, the integration of artificial intelligence (AI) and data analytics is further improving predictive maintenance, fleet management, and inventory control, ensuring that goods are delivered on time and at lower costs.

Strategic Location and Cross-Border Trade

Saudi Arabia's strategic location is a significant driver of the market. The country is serving as a key logistics hub, facilitating cross-border trade, especially within the Gulf Cooperation Council (GCC) countries and the broader Middle East and North Africa (MENA) region. This positioning is allowing logistics companies to capitalize on the flow of goods to and from international markets, with road freight being a key method of transportation for both domestic and regional trade. The improvement in road connectivity with neighboring countries, combined with the development of customs facilities and trade agreements, is boosting the efficiency of cross-border logistics. These factors are helping Saudi Arabia establish itself as a central node in global supply chains. The growing role of the kingdom in facilitating trade and commerce is encouraging investment in road freight infrastructure.

Increasing Demand for Temperature-Controlled Transport

The growing need for temperature-sensitive goods is driving the demand for specialized road freight services in Saudi Arabia. Industries such as pharmaceuticals, food and beverages (F&B), and chemicals are driving the need for refrigerated and temperature-controlled transport to preserve the quality of their products during transit. With a large portion of the population relying on fresh and perishable food, the demand for temperature-sensitive logistics is becoming more prominent. The pharmaceutical sector, too, is growing due to the rising demand for medical products, including vaccines and medicines, which require strict temperature control during transportation. Road freight companies are investing in advanced refrigerated vehicles and cold storage facilities to meet this specific need, ensuring that goods are transported efficiently while maintaining the necessary conditions.

Saudi Arabia Road Freight Transport Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on temperature control, product type, distance, containerization, destination, and end user.

Temperature Control Insights:

- Controlled

- Non-Controlled

The report has provided a detailed breakup and analysis of the market based on the temperature control. This includes controlled and non-controlled.

Product Type Insights:

- Liquid Goods

- Solid Goods

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes liquid goods and solid goods.

Distance Insights:

- Long Haul

- Short Haul

The report has provided a detailed breakup and analysis of the market based on the distance. This includes long haul and short haul.

Containerization Insights:

- Containerized

- Non-Containerized

A detailed breakup and analysis of the market based on the containerization have also been provided in the report. This includes containerized and non-containerized.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

End User Insights:

- Agriculture, Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas, Mining and Quarrying

- Wholesale and Retail Trade

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others.

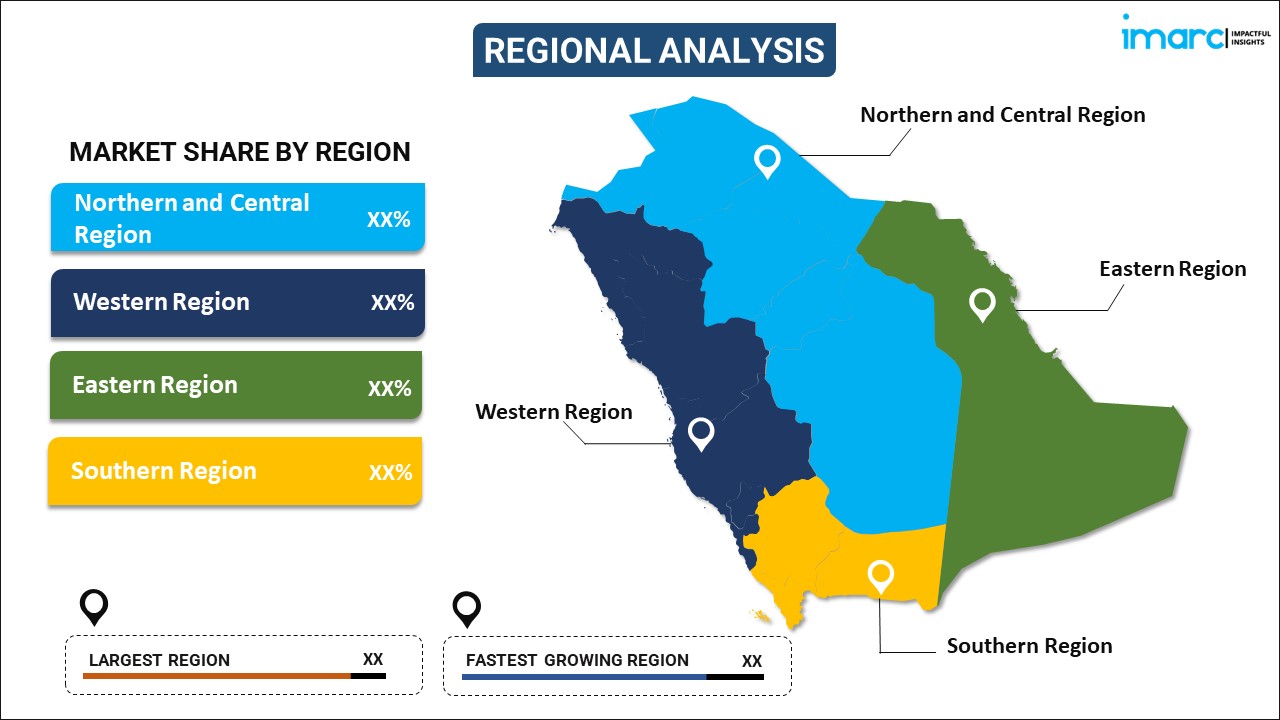

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Almajdouie Group

- AlRajhi Transport (AlRajhi Group)

- Al-Rashed Transport

- AMC Freight & Logistics

- Arabco Logistics

- Momentum Logistics

- Munawla Cargo Co. Ltd.

- SMSA Express Transportation Company Ltd.

- Wared Logistic

- Zajil Express

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Saudi Arabia Road Freight Transport Market News:

- June 2025: DHL Group announced its plans to invest over €500 million in the Middle East with strategic emphasis on the fast-growing Gulf markets of the Kingdom of Saudi Arabia (KSA) and the United Arab Emirates (UAE). The investment reaffirms commitment to the region and its future role in global trade, a company statement said. The company will grow its overall presence, invest in its fleet (electric trucks included) and engage in joint venture projects, like its recent partnership with Etihad Rail, to improve connectivity and logistics capabilities.

- June 2025: Gulf Arab states are to receive over $571 million from global logistics and parcel giant DHL Group to spend on infrastructure, vehicles and products up to 2030, pursuing additional business in a region that is seeing major trade expansion.

- June 2025: Tanmiah Food Company unveiled a fleet of electric trucks to aid its poultry delivery network as part of its shift to lower-emission transport resolutions. The trucks, designed with Quantron technology, are labeled as the first completely electric refrigerated vehicles for local fresh chicken delivery in Saudi Arabia.

- May 2025: Saudi Arabia has announced a comprehensive plan to revolutionize its transport sector with a promise of a multi-trillion-dollar investment in the creation of a new, integrated mobility system. At the center of this initiative is the "Future Mobility Sandbox," a 1.56 square kilometer complex on the campus of the King Abdullah University of Science and Technology (KAUST), which will test and hone groundbreaking solutions in land, sea, and air transport. Created by the Ministry of Transport and Logistic Services (MOTLS) in collaboration with KAUST and the Ministry of Industry and Mineral Resources (MIM), the Sandbox will be a controlled environment used to develop autonomous, sustainable, and connected transportation solutions.

- January 2025: Heavy transport and logistics solutions company, Roll Group, has greatly increased its footprint in Saudi Arabia with the inauguration of a new 15,000-square-meter complex in Jubail. This strategic expansion places Roll Group Middle East among the largest inland transport companies in the nation.

- May 2025: DHL Global Forwarding, the global market leader in air, ocean, and road freight services, signed a Memorandum of Understanding (MoU) with Hyperview Saudi, a pioneer in hydrogen mobility, to operate hydrogen-powered trucks in the Kingdom of Saudi Arabia. The partnership is an important milestone to decarbonize road freight in the kingdom and drive future-proof logistics innovation to support Saudi Vision 2030.

Saudi Arabia Road Freight Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Temperature Controls Covered | Controlled, Non-Controlled |

| Product Types Covered | Liquid Goods, Solid Goods |

| Distances Covered | Long Haul, Short Haul |

| Containerizations Covered | Containerized, Non-Containerized |

| Destinations Covered | Domestic, International |

| End Users Covered | Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Almajdouie Group, AlRajhi Transport (AlRajhi Group), Al-Rashed Transport, AMC Freight & Logistics, Arabco Logistics, Momentum Logistics, Munawla Cargo Co. Ltd., SMSA Express Transportation Company Ltd., Wared Logistic, Zajil Express, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia road freight transport market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia road freight transport market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia road freight transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Road freight transport involves the movement of goods by road using vehicles like trucks, lorries, and vans. It plays a crucial role in logistics, offering flexibility, accessibility, and reliability for transporting various types of goods over different distances.

The Saudi Arabia road freight transport market reached a size of USD 6.4 Billion in 2024.

The market is expected to grow at a compound annual growth rate (CAGR) of 5.30% from 2025-2033, reaching a value of USD 10.7 Billion by 2033.

Key factors driving the market include infrastructure development, growth in e-commerce and retail, industrial production, and export activities, along with advancements in technology like telematics and fleet management systems improving efficiency and reliability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)