Saudi Arabia Semiconductor Market Size, Share, Trends and Forecast by Components, Material Used, End User, and Region, 2025-2033

Saudi Arabia Semiconductor Market Size and Share:

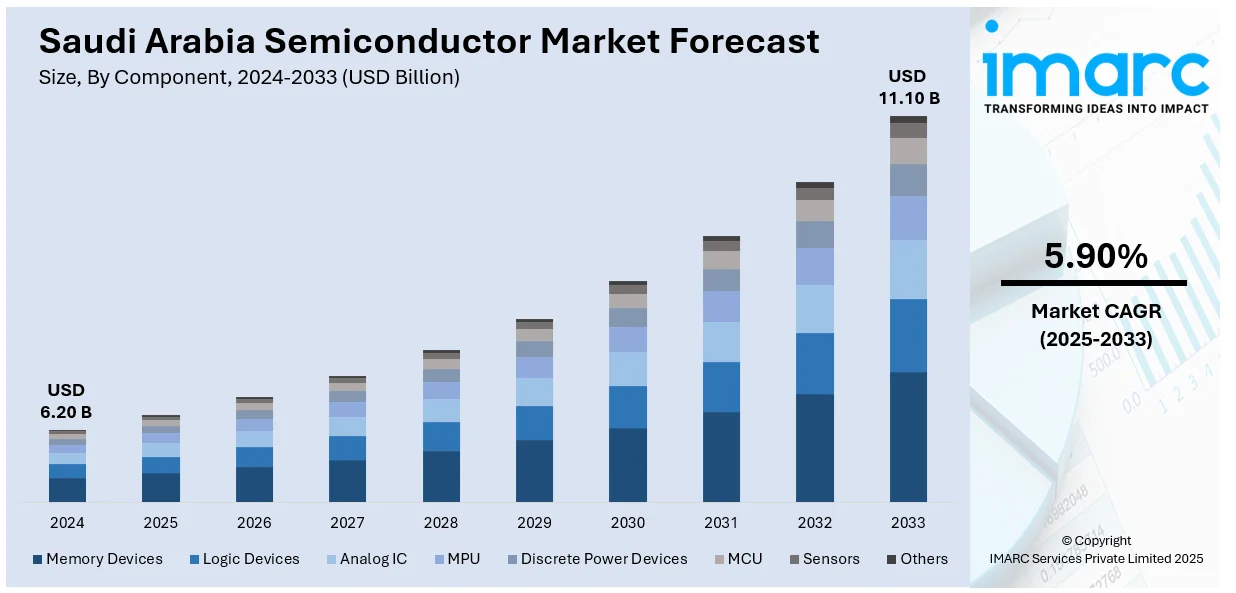

The Saudi Arabia semiconductor market size was valued at USD 6.20 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.10 Billion by 2033, exhibiting a CAGR of 5.90% during 2025-2033. Northern and Central region currently dominate the market, holding a significant market share of around 40.0% in 2024. The growing demand for electronic devices, such as smartphones, tablets, and laptops, rising integration of advanced systems in modern vehicles for navigation, safety, and entertainment, and the increasing adoption of solar cells for the conversion of renewable energy into electricity represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.20 Billion |

|

Market Forecast in 2033

|

USD 11.10 Billion |

| Market Growth Rate 2025-2033 | 5.90% |

The Saudi Arabia semiconductor market is majorly driven by the country's Vision 2030 initiatives, which aims to reduce dependence on oil and diversify the economy. This strategy emphasizes technological advancement, fostering demand for semiconductors in sectors such as telecommunications, automotive, and smart infrastructure. The rapid adoption of 5G networks, IoT devices, and AI-driven solutions further accelerates Saudi Arabia semiconductor market demand. Among all the GCC nations, Saudi Arabia is the frontrunner for 5G adoption, with 90 percent coverage in the major urban locations and speeds of up to 370.12 Mbps on average. It is mainly due to STC Group's rollout to over 75 cities. It depends on 45 million IoT devices and is estimated to add up to USD 12 Billion worth of market by the year 2030. It follows, however rapid, that the adoption falls in line with the development of the Kingdom's smart technology and semiconductor sectors in accordance with Vision 2030. Additionally, government investments in mega-projects such as NEOM and smart cities are creating a robust demand for advanced chips. The push for local manufacturing and partnerships with global tech firms also strengthens the semiconductor ecosystem, positioning Saudi Arabia as a growing hub for technology innovation in the region.

To get more information on this market, Request Sample

In addition, the increasing digital transformation across industries, including healthcare, finance, and energy, which relies heavily on semiconductor components, is also favoring the market. The rise of electric vehicles (EVs) and renewable energy projects improves demand for power-efficient chips. As per a 2024 survey, roughly 70 percent of drivers in Saudi Arabia are interested in battery-electric vehicles (BEVs) at present, and an estimated 85 percent of drivers in Saudi Arabia will continue preferring BEVs until the year 2035. Saudi consumers exhibit the highest global awareness of Chinese electric vehicle brands at 93%, in addition to possessing the largest number of Saudi participants who are stated to be accepting of a worldwide plug-in hybrid electric vehicle (PHEV). Electric vehicles have been propelling a steady rise in demand from the Saudi Arabian semiconductor industry, which is central to the development of smart mobility in harmony with Vision 2030. Moreover, Saudi Arabia’s strategic location and favorable policies attract foreign investments, enhancing semiconductor supply chains. The growing consumer electronics market, driven by a young, tech-savvy population, further propels demand. With initiatives to develop local talent and R&D capabilities, the country is poised to become a significant player in the global semiconductor industry, supported by both domestic needs and export opportunities.

Saudi Arabia Semiconductor Market Trends:

Digital Penetration and Smart Technology Adoption Driving Semiconductor Demand

Saudi Arabia’s increasing digitalization is a major growth catalyst for the semiconductor market. According to Ubuy, approximately 92% of the Saudi population owned or had access to a smartphone in 2024, highlighting the country’s high digital penetration. This widespread use of consumer electronics, including smartphones, tablets, and laptops has significantly raised demand for advanced semiconductor components, which are essential for the functioning of these devices. Furthermore, the expanding application of smart technologies across industries is creating a positive Saudi Arabia semiconductor market outlook. This trend is bolstered by government-backed digitization programs, positioning semiconductors as critical enablers of digital innovation, automation, and connectivity in both consumer and industrial applications throughout the Kingdom.

National Policies Fueling Local Semiconductor Manufacturing and Innovation

Saudi Arabia is taking strategic steps to reduce dependency on imported semiconductors by fostering domestic manufacturing capabilities. According to Arab News, the Kingdom aims to commence at least 50 semiconductor design companies by 2030. This ambitious goal is supported by a deep tech venture capital fund exceeding USD 266 Million, launched under the National Semiconductor Hub initiative. Simultaneously, the government is forming partnerships with leading international semiconductor manufacturers to develop fabrication facilities within the country. These initiatives align with Digital Policy Alert’s note that Saudi Arabia’s digital economy policy seeks to expand the ICT sector by 50% and increase the digital economy’s contribution to GDP from 15.8%. These developments are further expanding the Saudi Arabia semiconductor market share.

Emerging Technologies and Green Energy Trends Accelerating Semiconductor Usage

The Saudi semiconductor market is benefiting from robust investments in emerging technologies such as artificial intelligence (AI), Internet of Things (IoT), and 5G telecommunications. These advanced systems require sophisticated semiconductor solutions for efficient operation. Additionally, semiconductors are increasingly integrated into modern vehicles, supporting functions including navigation, safety, and entertainment. The rise of green energy projects is also shaping demand, with semiconductor devices being used in solar and wind power systems for energy conversion. A research report from the IMARC Group indicates that the green energy market in Saudi Arabia was valued at USD 1.02 Billion in 2024. It is projected to grow to USD 2.24 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 9.10% from 2025 to 2033.This shift toward sustainable energy is promoting the adoption of specialized power semiconductors. Moreover, the healthcare sector is incorporating semiconductors in medical imaging and diagnostic tools, while smart city and infrastructure initiatives rely on semiconductor-based systems for data processing, connectivity, and automated control.

Saudi Arabia Semiconductor Market Growth Drivers:

Talent Development and Localization of Expertise

A significant emphasis on developing talented professionals is propelling the Saudi Arabia semiconductor industry growth, by creating a workforce of engineers and experts in chip design, electronics, and associated areas. Training programs designed for semiconductor technologies lessen dependence on foreign knowledge and cultivate a local talent base equipped to assist in advanced projects. This not only meets current workforce requirements but also promotes innovation, facilitating the creation of solutions tailored to local and international needs. Enhancing local talent boosts the competitiveness of Saudi Arabia's technology sector, establishing it as a center for semiconductor research, design, and application across various industries. In 2024, Saudi Arabia’s Research, Development, and Innovation Authority (RDIA) launched an advanced training program to strengthen the Kingdom’s semiconductor sector. This initiative aimed to localize digital chip design technologies and empower national talent in the field. The program, running from September 29, 2024 to May 29, 2025, targeted graduates in electrical and computer engineering to contribute to domestic semiconductor projects.

Strategic Collaborations

Partnership-driven growth is influencing the semiconductor industry in Saudi Arabia by attracting global technology leaders to collaborate with local entities, transfer expertise, and accelerate domestic manufacturing capabilities. By forging agreements with international and regional players, Saudi Arabia is securing access to advanced technologies, technical expertise, and investment capital that can accelerate local ecosystem development. These collaborations allow knowledge transfer, joint research initiatives, and co-establishment of facilities that strengthen domestic capabilities in chip design, testing, and production. Beyond technology, such partnerships enhance credibility, making Saudi Arabia a more attractive destination for further investment in high-tech industries. The alignment between local institutions and global leaders ensures faster integration of cutting-edge processes, helping the kingdom position itself as a competitive hub for semiconductors. In 2024, King Abdulaziz City for Science and Technology (KACST) signed 13 strategic partnerships to advance Saudi Arabia's semiconductor industry and emerging technologies. These collaborations included efforts in AI, 5G/6G communications, Web 3.0, and digital health. KACST aimed to boost innovation, localize key technologies, and enhance national talent development as part of Saudi Vision 2030.

Healthcare Technology Expansion

The rapid adoption of digital health solutions is emerging as a significant driver of semiconductor demand in Saudi Arabia, reflecting the broader commitment to advancing healthcare innovation. The Kingdom is steadily increasing investments in telemedicine platforms, connected medical devices, and AI-enabled diagnostic systems, all of which require powerful semiconductors to ensure seamless processing, reliable connectivity, and accurate real-time data management. Devices, such as wearable health monitors, advanced imaging equipment, and robotic surgical tools, depend on highly sophisticated chips to operate with precision and efficiency. In addition, government-led initiatives aimed at expanding access to quality healthcare through the establishment of smart hospitals and the promotion of remote care platforms are catalyzing the demand for semiconductor technologies. As Saudi Arabia positions itself to become a regional hub for medical innovation, the applications of semiconductors in healthcare continue to broaden, spanning both personalized patient care and large-scale health data analytics. This growing reliance on advanced healthcare technologies is playing a pivotal role in accelerating Saudi Arabia semiconductor industry development.

Saudi Arabia Semiconductor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia semiconductor market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on components, material used, and end user.

Analysis by Component:

- Memory Devices

- Logic Devices

- Analog IC

- MPU

- Discrete Power Devices

- MCU

- Sensors

- Others

Memory devices stand as the largest component in 2024, holding around 26.8% of the market, driven by the country’s expanding digital infrastructure and data-centric applications. The rise in big data analytics, cloud computing, and AI adoption has heightened demand for high-performance DRAM and NAND flash memory in data centers and enterprise storage solutions. Additionally, the proliferation of 5G networks, IoT devices, and consumer electronics fuels the need for efficient memory solutions. Government-led smart city projects, such as NEOM and the King Abdullah Economic City, further amplify this demand by requiring advanced memory technologies for real-time data processing. With local and global tech firms investing in Saudi Arabia’s digital transformation, memory devices remain critical to supporting the Kingdom’s growing technological ecosystem, further favoring the Saudi Arabia semiconductor market growth.

Analysis by Material Used:

- Silicon Carbide

- Gallium Manganese Arsenide

- Copper Indium Gallium Selenide

- Molybdenum Disulfide

- Others

Silicon carbide leads the market with around 37.8% of market share in 2024, driven by its superior properties such as high thermal conductivity, energy efficiency, and durability in extreme conditions. The growing demand for SiC-based semiconductors stems from their critical role in renewable energy systems, electric vehicles (EVs), and power electronics—key focus areas under Vision 2030. Saudi Arabia’s push for clean energy and smart infrastructure, including solar power plants and EV manufacturing, further accelerates SiC adoption. Additionally, global semiconductor leaders are partnering with local firms to establish SiC production facilities, leveraging the Kingdom’s strategic investments in advanced technologies. As industries prioritize energy-efficient solutions, SiC’s dominance in the semiconductor market is set to expand, reinforcing Saudi Arabia’s position in next-generation electronics and sustainable innovation.

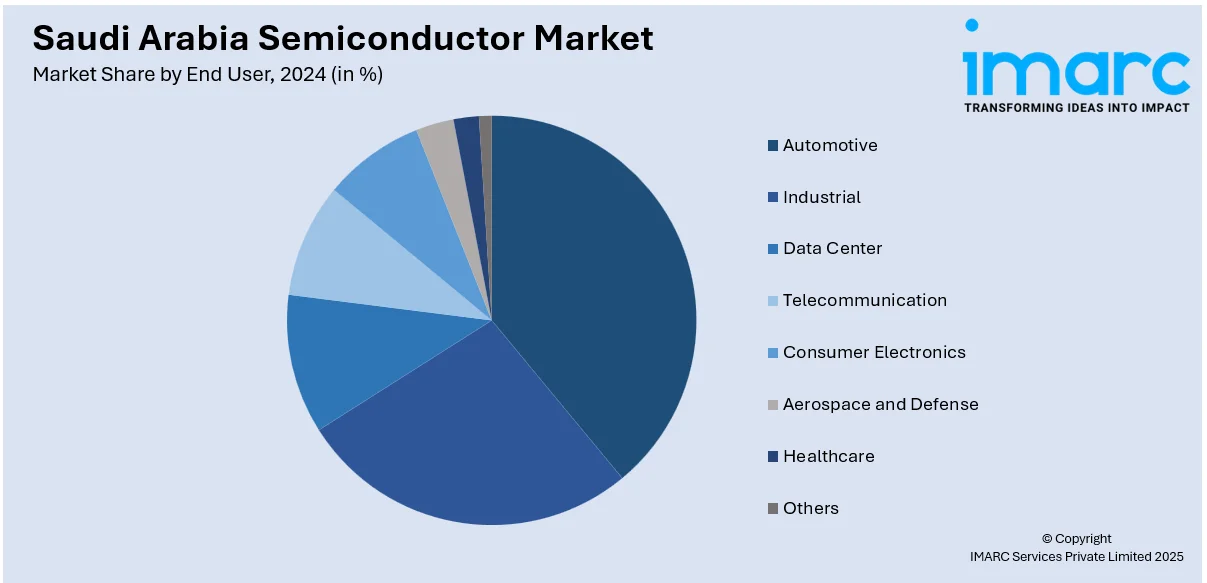

Analysis by End User:

- Automotive

- Industrial

- Data Center

- Telecommunication

- Consumer Electronics

- Aerospace and Defense

- Healthcare

- Others

Consumer electronics lead the market with around 35.1% of market share in 2024, fueled by the country’s tech-savvy population and rising disposable incomes. The demand for smartphones, tablets, smart home devices, and wearables continues to rise, driving the need for advanced semiconductor components, including memory chips, processors, and sensors. Government initiatives promoting digital transformation, coupled with widespread 5G adoption, further accelerate the growth of smart devices. Additionally, the expansion of e-commerce and local manufacturing incentives has made consumer electronics more accessible, enhancing semiconductor consumption. With Saudi Arabia’s young demographic increasingly embracing cutting-edge technology, the consumer electronics sector remains a key driver of semiconductor demand, reinforcing its dominance in the market and aligning with the Kingdom’s Vision 2030 goals for a diversified, innovation-driven economy.

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

In 2024, Northern and Central region accounted for the largest market share of over 40.0%, driven by concentrated economic activity, advanced infrastructure, and government-led technological initiatives. Riyadh, the capital in the Central region, serves as the nation’s commercial and technological hub, hosting major data centers, smart city projects, and a growing startup ecosystem that fuels semiconductor demand. Meanwhile, the Northern region, including cities such as NEOM and Tabuk, benefits from mega-projects focused on renewable energy and automation, which rely heavily on semiconductor components. Strong investment in 5G networks, IoT applications, and industrial automation across these regions further solidifies their leadership. With strategic geographic advantages and robust policy support, the Northern and Central regions remain pivotal in shaping Saudi Arabia’s semiconductor landscape, aligning with Vision 2030’s goals for economic diversification and digital transformation.

Competitive Landscape:

The competitive landscape of Saudi Arabia’s semiconductor market is characterized by aggressive investments, strategic partnerships, and technological innovations as key players vie for dominance. Leading firms are expanding their presence through local manufacturing facilities and joint ventures with domestic entities to align with Vision 2030’s localization goals. Many are focusing on R&D to develop energy-efficient chips tailored for renewable energy and smart infrastructure projects. Others are strengthening supply chains to meet rising demand from consumer electronics and automotive sectors. Collaborations with academic institutions for talent development and government-backed incentives further intensify competition. With the market poised for growth, companies are also leveraging advanced technologies including AI and IoT to differentiate their offerings, ensuring a dynamic and rapidly changing industry landscape in Saudi Arabia.

The report provides a comprehensive analysis of the competitive landscape in the Saudi Arabia semiconductor market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025: Saudi AI company Humain announced the construction of its first data centers in Riyadh and Dammam, set to launch in early 2026. The centers will use semiconductors from US-based Nvidia, with the purchase of 18,000 AI chips already approved. Humain aims to build AI infrastructure as part of Saudi Arabia's Vision 2030 to become a regional AI superpower.

- July 2025: Saudi Arabia, through the King Abdulaziz City for Science and Technology (KACST), announced the successful design and production of 25 advanced semiconductor chips as part of its Saudi Semiconductors Program (SSP). These chips support various applications like electronics and communications. The initiative aligns with Vision 2030, aiming to build local capabilities and foster technological self-reliance in the semiconductor sector.

- June 2025: Saudi Arabia launched the National Semiconductor Hub in Riyadh to establish a semiconductor design ecosystem, aiming for at least 50 companies by 2030. The initiative includes a SR1 billion venture capital fund and a SR150 million technology support program as part of Vision 2030. The hub also plans to train 5,000 engineers and attract global experts to foster innovation in the sector.

- May 2025: MemryX, a leading AI accelerator company, partnered with Saudi Arabia's National Semiconductor Hub (NSH) to boost AI development in the Kingdom. The partnership aligns with Saudi Arabia's Vision 2030 and aims to enhance the country's AI capabilities. MemryX plans to expand its operations, contributing to NEOM’s digital infrastructure and hiring local talent in Riyadh.

- April 2025: Saudi Arabia launched its first Chipathon in Riyadh, organized by KACST and KAUST to advance innovation in semiconductor integrated circuit design. Over 250 students from 25 universities participated, aiming to develop solutions for IoT applications and address real-world challenges in chip design. The initiative supports the Kingdom's Vision 2030 goal of developing national expertise and localizing semiconductor technologies.

- February 2025: Saudi Arabia’s Ministry of Investment announced that EdgeCortix Inc. would join the National Semiconductor Hub. The company launched a Riyadh-based subsidiary to advance edge AI and semiconductor engineering.

- January 2025: Kneron established a subsidiary in Riyadh with Saudi Arabia’s National Semiconductor Hub and NTDP. The move supported Vision 2030 and was backed by major investors.

- October 2024: Hithium partnered with Eng. Nabilah AlTunisi's MANAT to form Hithium MANAT and announced a new BESS manufacturing facility in Saudi Arabia with a 5 GWh annual capacity. They also unveiled desert-specific storage solutions at Solar & Storage Live KSA.

- March 2024: Nothing launched its Phone (2a) smartphone at LEAP 2024 in Riyadh. Featuring a Dimensity 7200 Pro chip co-developed with MediaTek, the phone offered enhanced efficiency, 50MP dual cameras, an AMOLED display, and 20GB RAM.

- March 2024: SEALSQ announced its plan to commence an Open Semiconductors Assembly and Test (OSAT) Center in Saudi Arabia. The initiative aimed to integrate AI and post-quantum cryptography, support Vision 2030 goals, and enhance local semiconductor manufacturing through partnerships with WISeKey and Juffali.

Saudi Arabia Semiconductor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Memory Devices, Logic Devices, Analog IC, MPU, Discrete Power Devices, MCU, Sensors, Others |

| Materials Used Covered | Silicon Carbide, Gallium Manganese Arsenide, Copper Indium Gallium Selenide, Molybdenum Disulfide, Others |

| End Users Covered | Automotive, Industrial, Data Center, Telecommunication, Consumer Electronics, Aerospace and Defense, Healthcare, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia semiconductor market from 2019-2033.

- The Saudi Arabia semiconductor market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia semiconductor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Saudi Arabia semiconductor market was valued at USD 6.20 Billion in 2024.

Rising digital transformation, increased adoption of 5G, IoT, and AI technologies, growing demand for consumer electronics and electric vehicles, and strong government initiatives under Vision 2030 are driving the market.

The Saudi Arabia semiconductor market is projected to exhibit a CAGR of 5.90% during 2025-2035, reaching a value of USD 11.10 Billion by 2033.

Silicon carbide accounted for the largest segment in the Saudi Arabia semiconductor market in 2024, with a market share of around 37.8%.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)