Saudi Arabia Sexual Wellness Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Region, 2026-2034

Saudi Arabia Sexual Wellness Market Summary:

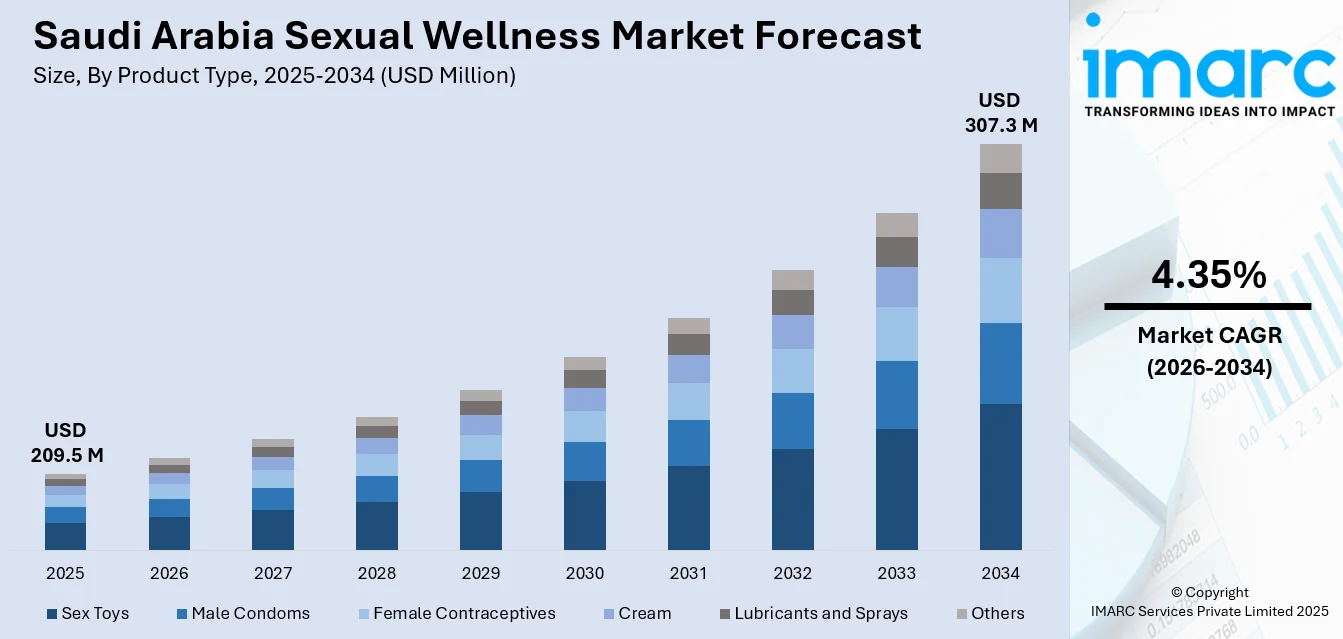

The Saudi Arabia sexual wellness market size was valued at USD 209.5 Million in 2025 and is projected to reach USD 307.3 Million by 2034, growing at a compound annual growth rate of 4.35% from 2026 to 2034.

The Saudi Arabia sexual wellness market is experiencing growth driven by increasing health awareness, changing individual attitudes, and gradual expansion of discreet retail and digital sales channels. Demand is supported by a growing focus on personal well-being, marital health, and preventive healthcare practices. E-commerce platforms and private consultation services are improving product accessibility while maintaining confidentiality. Additionally, a young population, rising disposable income, and exposure to global wellness trends are contributing to greater acceptance of sexual wellness products, supporting steady market expansion within a regulated environment.

Key Takeaways and Insights:

- By Product Type: Male condoms dominate the market with a share of 46% in 2025, driven by widespread availability across pharmacy networks, established brand recognition, and their role as the primary contraceptive method preferred by male users across the Kingdom.

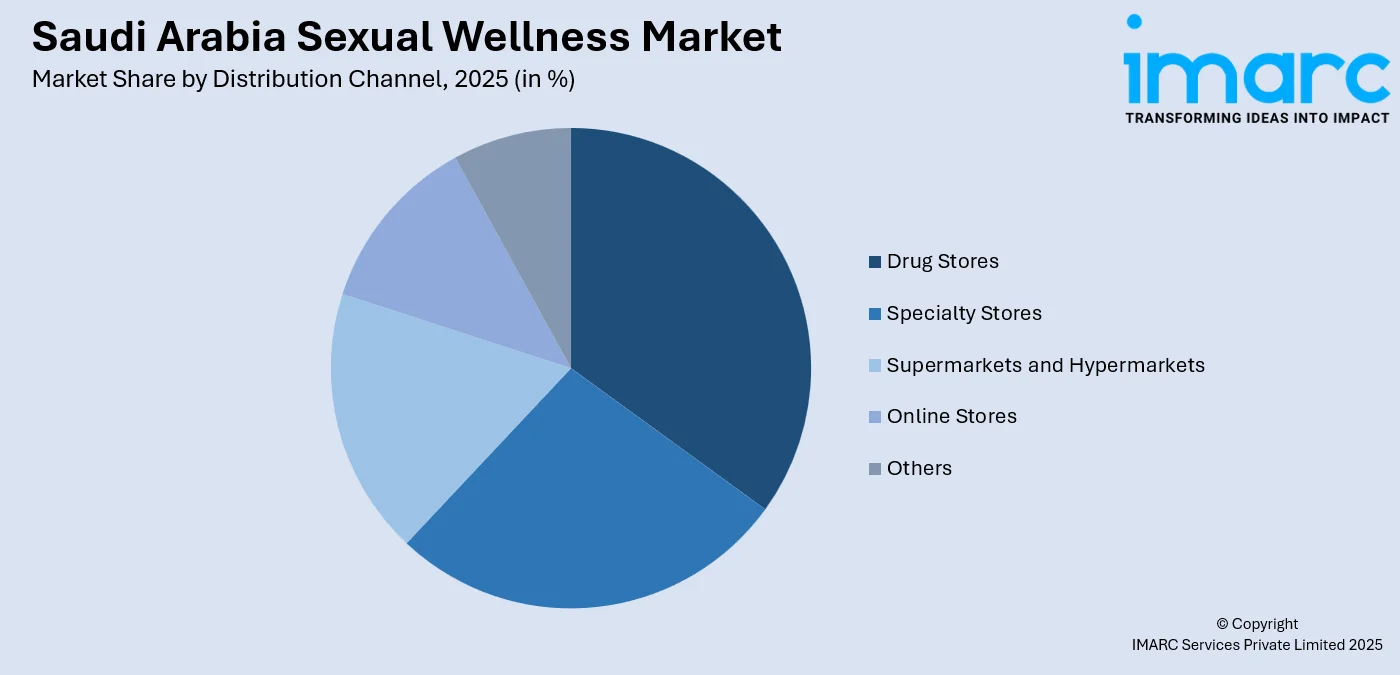

- By Distribution Channel: Drug stores lead the market with a share of 24% in 2025, benefiting from healthcare-related trust associations, extensive geographic coverage, and consumer preference for pharmacy-based purchases that offer professional guidance and discretion.

- By Application: Men represent the largest segment with a market share of 64% in 2025, reflecting dominant utilization patterns for male-oriented products, including condoms and enhancement supplements, supported by greater product awareness and purchasing confidence among male demographics.

- By Region: Northern and Central Region dominates the market with a share of 37% in 2025, owing to concentrated population, superior retail infrastructure, higher disposable incomes, and advanced e-commerce penetration.

- Key Players: The Saudi Arabia sexual wellness market exhibits moderate competitive intensity, with multinational consumer healthcare corporations competing alongside regional distributors across product categories and distribution channels.

To get more information on this market Request Sample

The Saudi Arabia sexual wellness market is driven by rising health awareness, favorable demographics, and expanding access through regulated physical and digital healthcare channels. The growing emphasis on marital health, preventive care, and family planning is catalyzing the demand for medically approved products. Licensed pharmacies continue to play a central role, while discreet digital platforms are improving accessibility and privacy. This shift toward online healthcare is reflected in the Saudi Arabia e-pharmacy market, which reached a value of USD 969.3 Million in 2024, as per the IMARC Group, highlighting strong user acceptance of digital health purchasing. Urbanization, higher education levels, and improved health literacy are further encouraging informed utilization. A large expatriate population also contributes to baseline demand and product familiarity. Together with clearer regulatory oversight and controlled distribution, these factors are enabling steady market growth while aligning sexual wellness usage with broader personal and reproductive health practices.

Saudi Arabia Sexual Wellness Market Trends:

Young Population and Favorable Demographics

Saudi Arabia’s youthful population structure remains a key factor propelling the sexual wellness market growth, as a significant share of the population falls within reproductive and marital age groups. Younger individuals tend to be more health-aware, digitally engaged, and receptive to medical guidance related to family planning and personal care. This demographic strength is highlighted by GASTAT's 2024 report, which indicated that 71 percent of Saudi citizens are below the age of 35, with an average age of 26.6 years. Rising health literacy within this age group supports sustained demand for approved sexual wellness products and underpins long-term market growth.

Expansion of Regulated Pharmacy and Healthcare Channels

The extensive network of licensed pharmacies and regulated healthcare outlets plays a central role in supporting accessibility and user trust in sexual wellness products across Saudi Arabia. Pharmacies provide a controlled retail environment that ensures product authenticity, quality compliance, and discreet professional guidance. This distribution strength is reinforced by recent sector expansion, including Aster DM Healthcare’s 2024 entry into the Saudi market through a joint venture with Al Hokair Holding Group, with plans to establish more than 250 Aster Pharmacies nationwide over five years. Expansion of pharmacy networks across urban and semi-urban areas improves geographic reach, supporting steady sales volumes while aligning with cultural and regulatory expectations.

Rising Disposable Income and Urban Lifestyle Changes

Improving income levels and evolving urban lifestyles in Saudi Arabia are supporting higher spending on personal health products, including sexual wellness items. Urban dwellers increasingly prioritize quality, branded, and medically endorsed products, supported by access to modern healthcare facilities and organized retail formats. This spending momentum is reflected in private consumption expenditures, which recorded a real increase of 2.4 percent in the first half of FY2024 compared with the same period of the previous year, according to the Mid-Year Economic and Fiscal Performance Report. Greater health awareness, education, and exposure to global wellness practices continue to encourage informed purchasing behavior, strengthening both market value and growth.

How Vision 2030 is Transforming the Saudi Arabia Sexual Wellness Market:

Vision 2030 is transforming the Saudi Arabia sexual wellness market by reshaping healthcare priorities, retail structures, and user access within a regulated setting. National reforms promoting preventive healthcare, quality of life, and private sector growth are indirectly supporting the demand for wellness products. Expansion of licensed pharmacies, telehealth services, and secure e-commerce platforms are improving access while maintaining privacy and cultural compliance. Increased participation of international wellness brands and improved regulatory clarity are strengthening product availability. In addition, public health campaigns, rising health literacy, and changing lifestyle expectations among younger demographics are contributing to gradual market normalization, positioning sexual wellness as part of broader personal and family health awareness initiatives.

Market Outlook 2026-2034:

The Saudi Arabia sexual wellness market demonstrates steady growth potential throughout the forecast period, underpinned by favorable demographic trends and gradually shifting user preferences toward personal health and well-being. Demand is supported by a young population, rising health awareness, and expanding access through regulated pharmacies and discreet digital channels. The market generated a revenue of USD 209.5 Million in 2025 and is projected to reach a revenue of USD 307.3 Million by 2034, growing at a compound annual growth rate of 4.35% from 2026-2034.

Saudi Arabia Sexual Wellness Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Male Condoms |

46% |

|

Distribution Channel |

Drug Stores |

24% |

|

Application |

Men |

64% |

|

Region |

Northern and Central Region |

37% |

Product Type Insights:

- Sex Toys

- Male Condoms

- Natural Latex Condoms

- Female Contraceptives

- Cream

- Waist/Hip Lightening Cream

- Hair Removal Foam/cream

- Lubricants and Sprays

- Gels

- Lubes

- Massage Oil

- Others

- Intimate Wash, Foam, Wipes

- Intimate Fragrances, Sprays, Pockets

Male condoms dominate with a market share of 46% of the total Saudi Arabia sexual wellness market in 2025.

Male condoms lead the market due to their established role in family planning and protection against sexually transmitted infections. Strong public awareness, routine medical recommendation, and long-standing user acceptance support steady demand across age groups. Their non-invasive nature and immediate effectiveness further strengthen widespread usage.

This segment also benefits from broad availability through licensed pharmacies, hospitals, and regulated retail outlets nationwide. Discreet purchasing options, low cost, and inclusion in government-supported public health programs reinforce accessibility. Consistent supply chains and trust in established brands further support the dominant market position of male condoms.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty Stores

- Supermarkets and Hypermarkets

- Drug Stores

- Online Stores

- Others

Drug stores lead with a market share of 24% of the total Saudi Arabia sexual wellness market in 2025.

Drug stores hold the biggest market share owing to their regulated environment, professional oversight, and strong user trust. Licensed pharmacies ensure product authenticity, quality control, and compliance with safety standards while offering discreet purchasing conditions. Individuals value the reliability and confidentiality associated with pharmacy-based purchases.

This segment also benefits from wide geographic coverage and close integration with healthcare services. The increasing access to pharmacist guidance, trusted product recommendations, and privacy-focused retail layouts are resulting in continued preference for drug stores when purchasing sexual wellness and related healthcare products.

Application Insights:

- Men

- Women

- LGBT Community

Men exhibit a clear dominance with a 64% share of the total Saudi Arabia sexual wellness market in 2025.

Men represent the largest segment, attributed to higher awareness and acceptance of preventive sexual health products among male users. Government statistics show males accounted for 70.8% of population growth between 2023 and 2024, mainly driven by non-Saudi males, supporting sustained demand. Greater emphasis on contraception, personal responsibility, and medical guidance further strengthens participation.

This segment also benefits from higher purchasing autonomy and broader product availability designed to meet male preferences. Easy, discreet access through pharmacies and digital platforms reduces hesitation. Strong brand familiarity, privacy assurances, and consistent availability continue to encourage regular adoption of sexual wellness products among men.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominates with a market share of 37% of the total Saudi Arabia sexual wellness market in 2025.

Northern and Central Region lead the market, driven by higher population density, advanced urbanization, and strong access to licensed healthcare and pharmacy networks. Major cities such as Riyadh exemplify higher product visibility, where people readily access specialized products through hospitals, pharmacies, and modern retail outlets, supporting awareness and consistent purchasing behavior.

This region also benefits from higher disposable incomes and wider exposure to healthcare education initiatives. Well-developed retail infrastructure and discreet digital purchasing channels strengthen the market demand. People increasingly use online pharmacies and grocery apps for discreet purchases. By Q4 2024, the Ministry of Commerce reported 40,953 registered e-commerce companies, reflecting 10% annual growth, strengthening access and supporting consistent market growth.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Sexual Wellness Market Growing?

Growth of Discreet Digital and Telehealth Platforms

The expansion of secure e-commerce and telehealth services is enhancing access to sexual wellness products in Saudi Arabia while preserving user privacy. Online pharmacies and digital consultation platforms enable discreet information-seeking and purchasing, reducing social barriers associated with traditional retail channels. This transition is supported by strong digital adoption, with the International Trade Administration projecting 33.6 million internet users participating in e-commerce by 2024. The growing use of digital health platforms supports informed decision-making and repeat purchases. As convenience and confidentiality become priorities, especially among younger and urban individuals, digital distribution channels are emerging as a significant driver of sustained market demand.

Rising Influence of Expatriate Population

Saudi Arabia’s large expatriate population plays an important role in driving the demand for sexual wellness products through diverse healthcare practices and prior familiarity with such categories. Expatriates often act as early adopters, contributing to consistent baseline demand and encouraging wider product availability through licensed pharmacies and regulated channels. This influence is reinforced by government data showing that non-Saudi residents reached approximately 15.7 million in 2024, up from 14.5 million in 2023, accounting for 75.6% of national population growth. Their sustained presence supports market continuity and gradual expansion within approved distribution frameworks.

Fertility Trends Supporting Family Planning Demand

Fertility patterns in Saudi Arabia continue to support sustained demand for sexual wellness products linked to family planning and reproductive health. A growing focus on planned parenthood and medically guided contraception is shaping responsible usage within socially accepted frameworks. This is reflected in the Population Estimates Publication 2024, which reported a fertility rate of 2.7 births per 1,000 women among the Saudi population, compared with 0.8 per 1,000 women for the non-Saudi population and 2.1 births per 1,000 women overall. These dynamics highlight the ongoing relevance of contraception and reproductive health products, reinforcing steady demand through regulated healthcare and pharmacy channels.

Market Restraints:

What Challenges the Saudi Arabia Sexual Wellness Market is Facing?

Cultural Sensitivities and Social Stigma

Deep-rooted cultural conservatism surrounding discussions of sexual health continues to impede broader market adoption. Social stigma discourages open dialogue and delays product-seeking behavior among individuals who might benefit from sexual wellness solutions. This cultural barrier particularly affects in-store purchases, where privacy concerns reduce buyer comfort and limit impulse buying opportunities.

Regulatory and Advertising Restrictions

Restrictive advertising regulations limit brand visibility and user awareness regarding sexual wellness products. Marketing constraints prevent manufacturers from conducting widespread educational campaigns that could destigmatize product categories and inform buyers about available options. These limitations are hindering the market penetration and restricting competitive differentiation opportunities for industry participants in the market.

Limited Product Awareness in Remote Regions

Geographic disparities in retail infrastructure and digital connectivity create access barriers in rural and remote areas. Limited product availability and lower user awareness in underserved regions restrict adoption beyond major cities. Distribution inefficiencies, higher logistics costs, and fragmented last-mile networks further hinder expansion, making nationwide coverage difficult and slowing overall market penetration and long-term growth prospects nationwide efforts.

Competitive Landscape:

The Saudi Arabia sexual wellness market exhibits moderate competitive intensity characterized by the presence of multinational consumer healthcare corporations alongside regional distributors competing across product categories and distribution channels. Market dynamics reflect strategic positioning, ranging from premium, innovation-driven offerings emphasizing advanced product formulations to value-oriented products targeting cost-conscious consumers. The competitive landscape is increasingly shaped by e-commerce capabilities, brand reputation, and distribution network strength. Companies focus on product innovation, quality consistency, and discreet packaging to address cultural sensitivities while expanding market reach. Strategic partnerships with pharmacy chains and online platforms enhance market penetration capabilities.

Recent Developments:

- July 2024: Evofem Biosciences signed a licensing and supply agreement with UAE-based Pharma 1 to commercialize its hormone-free contraceptive Phexxi across the Middle East. Pharma 1 will handle regulatory approvals, distribution, and marketing in markets, including Saudi Arabia. The deal supported the growing regional demand for on-demand, non-hormonal contraception and marks a key step in Evofem’s international expansion strategy.

Saudi Arabia Sexual Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Drug Stores, Online Stores, Others |

| Applications Covered | Men, Women, LGBT Community |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia sexual wellness market size was valued at USD 209.5 Million in 2025.

The Saudi Arabia sexual wellness market is expected to grow at a compound annual growth rate of 4.35% from 2026-2034 to reach USD 307.3 Million by 2034.

Male condoms dominate the Saudi Arabia sexual wellness market with a share of 46% in 2025, driven by widespread availability across pharmacy networks, established brand recognition, and their primary role as the preferred contraceptive method among male consumers.

Key factors driving the Saudi Arabia sexual wellness market include a youthful, health-aware population, rising digital engagement, and greater receptiveness to medical guidance. GASTAT 2024 reports that 71% of Saudi citizens are below 35 years, with an average age of 26.6 years, supporting sustained demand and long-term market growth.

Major challenges include cultural sensitivities and social stigma surrounding sexual health discussions, regulatory and advertising restrictions limiting brand visibility, limited product awareness in remote regions, distribution challenges outside urban centers, and conservative consumer attitudes in certain demographic segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)