Saudi Arabia Ship Repairing Market Size, Share, Trends and Forecast by Vessel Type, Application, End User, and Region, 2026-2034

Saudi Arabia Ship Repairing Market Overview:

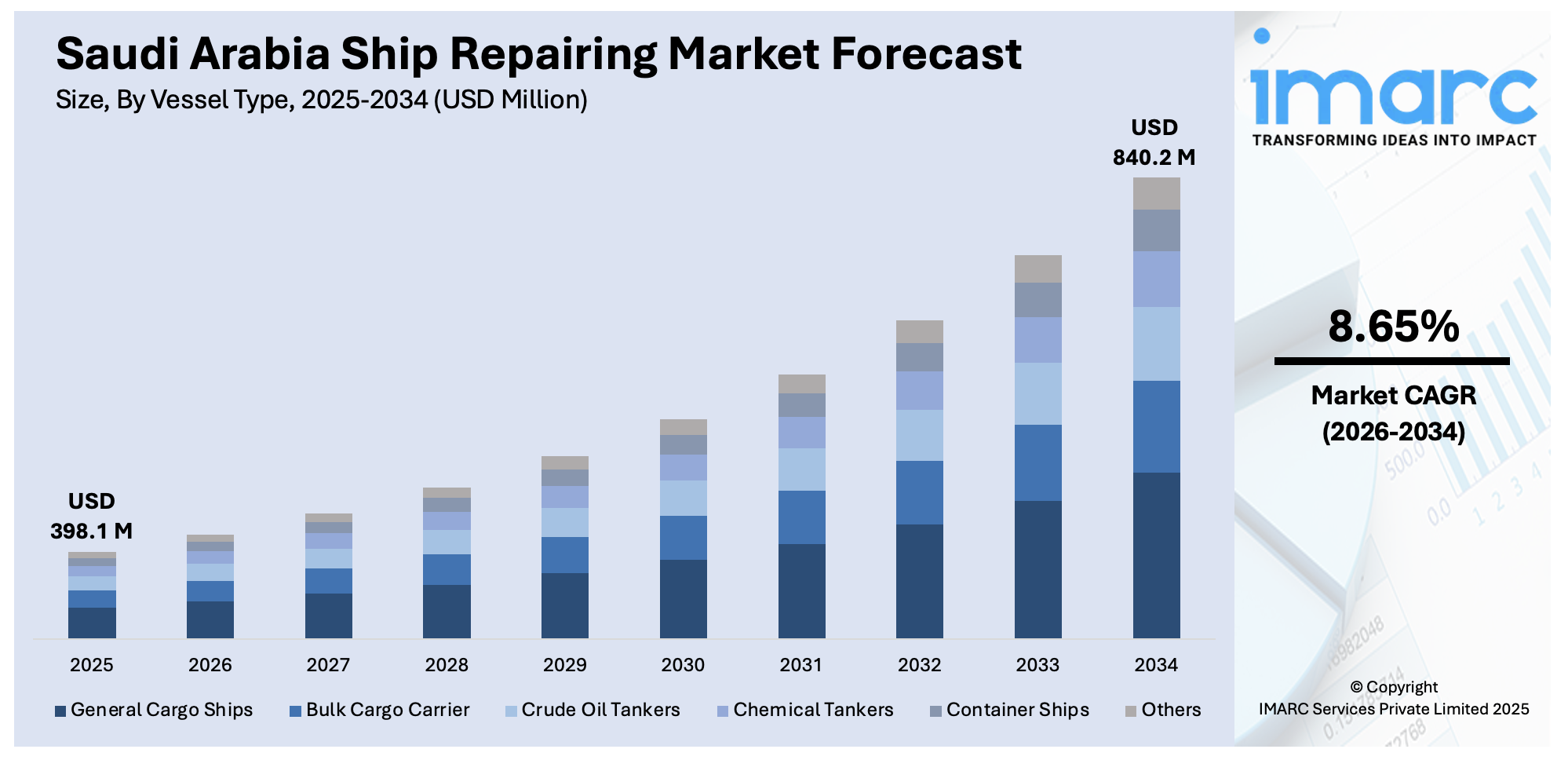

The Saudi Arabia ship repairing market size reached USD 398.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 840.2 Million by 2034, exhibiting a growth rate (CAGR) of 8.65% during 2026-2034. The market is growing as a result of more strategic alliances, technological innovations, and an emphasis on localizing maritime services. These trends spur innovation and operational efficiency, which contribute to the Saudi Arabia ship repairing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 398.1 Million |

| Market Forecast in 2034 | USD 840.2 Million |

| Market Growth Rate 2026-2034 | 8.65% |

Saudi Arabia Ship Repairing Market Trends:

Expanding Strategic Partnerships for Ship Repairing

The market is witnessing a huge boom driven by increased strategic alliances and partnerships with the aim of enhancing local ship repair, shipbuilding, and maintenance capabilities. The country has made enormous progress in diversification of its maritime industry, where its quest to increase ship repair capacities has started yielding dividends. For instance, in February 2023, International Maritime Industries (IMI) signed agreements amounting to USD 350 Million, increasing its operations in ship repair, shipbuilding, and marine engineering. These alliances are not only for the establishment of technical operations but also include agreements with training centers to develop employee capabilities so that there is a sustainable human resource pipeline. The collaborations are in full support of Saudi Arabia's Vision 2030, with the localization of industries such as ship repair being a key issue. By building a robust network of strategic alliances with regional and international players, Saudi Arabia is positioning itself to become a competitive maritime services hub within the region. These strategic alliances are slated to drive innovation, improve the quality of services, and increase operating efficiency to enable the Kingdom's aim to emerge as a global leader in maritime repair and services. The current initiatives and associations are contributing directly to the Saudi Arabia ship repairing market growth, which will be sustainable in the long term and position it as the market leader.

To get more information on this market Request Sample

Technological Advancements in Maritime Services

The market is seeing a general upsurge of technological advancements that are restructuring shipyards, their operations, and service delivery. As the market continues to expand, technologies have become an indispensable element of improving efficiency and flexibility to international maritime standards. For example, in November 2024, the Saudi Arabian Military Industries (SAMI) participated as a strategic partner to the Third Saudi International Maritime Forum, where it showcased its cutting-edge maritime solutions, including high-tech maintenance, repair, and overhaul (MRO) services. The collaboration highlighted the significant role that emerging technologies, like advanced sensors, automated systems, and smart technologies, play in improving the speed, precision, and cost savings of ship repair. These advances in technology enable Saudi shipyards to keep ships better, particularly in light of increasing global competition and higher customer expectations. SAMI's participation underscored the Kingdom's desire to boost its maritime capabilities through technology to keep shipyards competitive and capable of performing complex repair and maintenance work. By incorporating further such innovations, Saudi Arabia is ready to modernize its ship repair services further and become a regional leader in the maritime industry.

Saudi Arabia Ship Repairing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on vessel type, application, and end user.

Vessel Type Insights:

- General Cargo Ships

- Bulk Cargo Carrier

- Crude Oil Tankers

- Chemical Tankers

- Container Ships

- Others

The report has provided a detailed breakup and analysis of the market based on the vessel type. This includes general cargo ships, bulk cargo carrier, crude oil tankers, chemical tankers, container ships, and others.

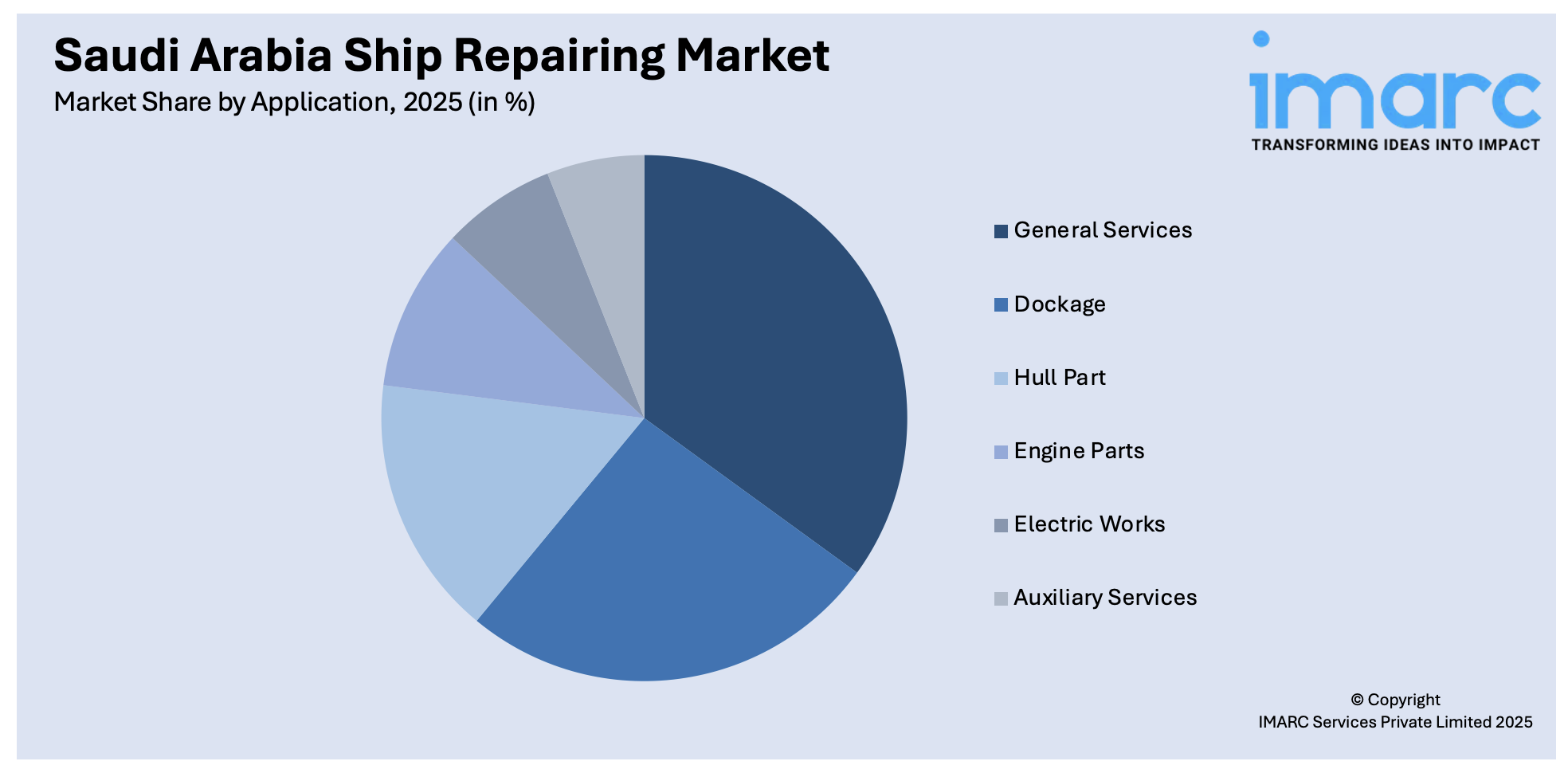

Application Insights:

Access the comprehensive market breakdown Request Sample

- General Services

- Dockage

- Hull Part

- Engine Parts

- Electric Works

- Auxiliary Services

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes general services, dockage, hull part, engine parts, electric works, and auxiliary services.

End User Insights:

- Transport Companies

- Military

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes transport companies, military, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Ship Repairing Market News:

- April 2025: L3Harris Technologies and its SAMI-L3Harris Joint Venture signed a Memorandum of Understanding with Zamil Shipyards to integrate autonomous technology into maritime vessels. This collaboration advanced the Saudi Arabia Ship Repairing Market by enhancing shipyard capabilities, focusing on autonomous platforms.

- April 2025: HEISCO expanded its shipyard operations into Saudi Arabia and Iraq, modernizing facilities and adopting new technologies. The company focused on ship repair and building services, strengthening its presence in the region. This expansion contributed to Saudi Arabia's growing ship repairing market, aligning with Vision 2035.

Saudi Arabia Ship Repairing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vessel Types Covered | General Cargo Ships, Bulk Cargo Carrier, Crude Oil Tankers, Chemical Tankers, Container Ships, Others |

| Applications Covered | General Services, Dockage, Hull Part, Engine Parts, Electric Works, Auxiliary Services |

| End Users Covered | Transport Companies, Military, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia ship repairing market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia ship repairing market on the basis of vessel type?

- What is the breakup of the Saudi Arabia ship repairing market on the basis of application?

- What is the breakup of the Saudi Arabia ship repairing market on the basis of end user?

- What is the breakup of the Saudi Arabia ship repairing market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia ship repairing market?

- What are the key driving factors and challenges in the Saudi Arabia ship repairing market?

- What is the structure of the Saudi Arabia ship repairing market and who are the key players?

- What is the degree of competition in the Saudi Arabia ship repairing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia ship repairing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia ship repairing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia ship repairing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)