Saudi Arabia Shrimp Market Size, Share, Trends and Forecast by Environment, Species, Shrimp Size, Distribution Channel, and Region, 2026-2034

Saudi Arabia Shrimp Market Summary:

The Saudi Arabia shrimp market size was valued at USD 277.77 Million in 2025 and is projected to reach USD 384.76 Million by 2034, growing at a compound annual growth rate of 3.69% from 2026-2034.

The market's expansion is driven by the Kingdom's strategic emphasis on aquaculture development under Vision 2030, rising consumer preference for protein-rich seafood options, and substantial investments in sustainable farming infrastructure. Government-backed initiatives have catalyzed technological adoption in shrimp cultivation, while the flourishing tourism and hospitality sectors continue to amplify demand for premium seafood products across restaurants, hotels, and catering establishments. The integration of advanced farming practices, including recirculating aquaculture systems and precision feeding technologies, has strengthened production capabilities while ensuring environmental sustainability, thereby expanding the Saudi Arabia shrimp market share.

Key Takeaways and Insights:

-

By Environment: Farmed shrimp dominates the market with a share of 61.52% in 2025, benefiting from controlled production environments and consistent quality standards.

-

By Species: Penaeus vannamei leads the market with a share of 72.15% in 2025, valued for its adaptability to intensive farming and strong export demand.

-

By Shrimp Size: 41-50 represents the largest segment with a market share of 21.84% in 2025, preferred for its versatility across culinary applications and easy availability in the country.

-

By Distribution Channel: Hotels and restaurants lead the market with a share of 32.33% in 2025, driven by expanding dining culture and tourism growth, along with the rise in number of restaurants offering high-quality seafood options.

-

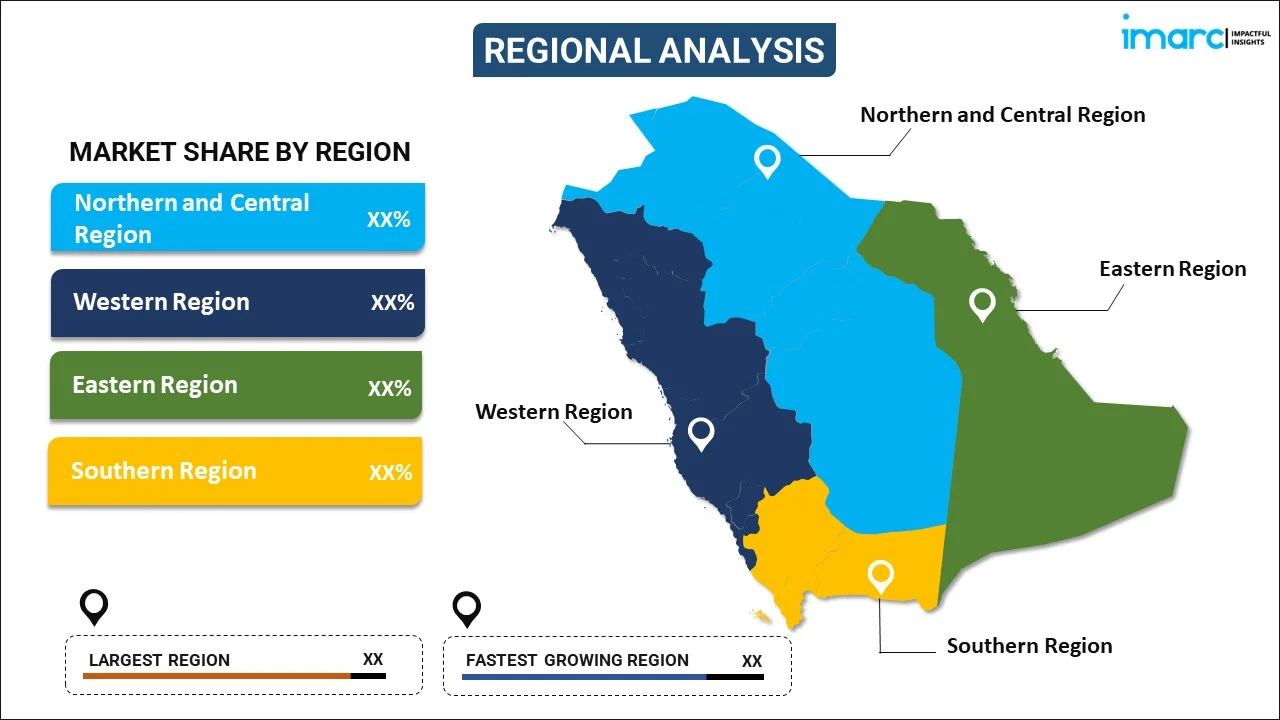

By Region: Northern and Central Region represents the largest segment with a market share of 31% in 2025, supported by Riyadh's urban consumer base, hospitality infrastructure, and rise in implementation of favorable govt policies supporting aquaculture practices.

-

Key Players: The Saudi Arabia shrimp market exhibits concentrated competitive intensity, with integrated aquaculture operations competing alongside specialized distributors and international seafood suppliers across premium and mid-market segments. Moreover, key market players are offering frozen shrimp throughout the year, thereby supporting the market growth.

The Saudi Arabia shrimp market has evolved from traditional wild-catch fisheries to sophisticated aquaculture operations, reflecting the Kingdom's commitment to food security and economic diversification. Consumer preferences have shifted toward traceable, sustainably produced shrimp, influenced by rising health awareness and exposure to international culinary trends. The market benefits from strategic geographic positioning along the Red Sea coast, where ideal water conditions support year-round production. National Aquaculture Group became the first company in the Middle East and North Africa region to attain Aquaculture Stewardship Council certification for Vannamei shrimp in 2022, placing Saudi Arabia among the top 15 countries worldwide with this prestigious sustainability certification. This achievement demonstrates the industry's alignment with global best practices in responsible aquaculture, encompassing responsible feed sourcing, water quality management, and community engagement protocols.

Saudi Arabia Shrimp Market Trends:

Adoption of Advanced Aquaculture Technologies and Certification Standards

The Saudi Arabian shrimp industry is undergoing technological transformation through the implementation of recirculating aquaculture systems, biosecure hatcheries, and automated monitoring platforms that optimize production efficiency while minimizing environmental impact. Producers are investing in genetic selection programs to develop disease-resistant shrimp varieties with enhanced growth characteristics and improved survival rates. Moreover, aquaculture facilities across the Kingdom adopted artificial intelligence-driven feeding systems that reduced feed waste and improved shrimp growth rates. Aquaculture in the Kingdom started in 1982 and has developed considerably, making the country a top exporter of white shrimp. The nation aims to achieve a goal of producing 600,000 tons of fish by 2030, while promoting local investments and creating employment opportunities. The industry's commitment to sustainability is evidenced by increasing adoption of international certification standards, with major producers securing Aquaculture Stewardship Council and Best Aquaculture Practices certifications that validate compliance with rigorous environmental and social responsibility criteria, enhancing market access to premium international buyers.

Government-Backed Expansion and Strategic Investment in Production Capacity

Saudi Arabia's aquaculture sector is experiencing unprecedented investment momentum driven by the Ministry of Environment, Water and Agriculture's ambitious production targets under the National Fisheries Development Program. The government has established comprehensive support mechanisms including subsidized financing through the Agricultural Development Fund, research partnerships with leading scientific institutions, and infrastructure development initiatives that facilitate market access for producers. In 2024, King Abdullah University of Science and Technology partnered with the Ministry to launch the Aquaculture Development Program, projecting to increase domestic seafood production from 280,000 tons in 2024 to 530,000 tons annually by 2030. This collaborative framework provides direct investment support for innovative projects while addressing challenges related to production costs, water efficiency, and environmental stewardship. The program accelerates technology transfer and knowledge exchange, positioning Saudi Arabia as an emerging aquaculture hub.

Integration of Sustainable Practices and Circular Economy Principles

Environmental consciousness is reshaping production methodologies as shrimp farmers implement water recycling systems, renewable energy integration, and waste valorization strategies that transform aquaculture byproducts into commercial co-products such as organic fertilizers and extracted minerals. The industry is transitioning toward closed-system farming that minimizes discharge impacts while conserving precious water resources in the Kingdom's arid environment. Producers are forging collaborations with feed manufacturers to obtain locally made aquafeed formulated with alternative protein sources that lessen reliance on imported fishmeal. King Abdullah University for Science and Technology (KAUST) and the Ministry of Environment, Water and Agriculture (MEWA) have achieved notable advancements in establishing a local and sustainable aquaculture sector in the Kingdom with their collaborative Aquaculture Development Program (ADP). The program's accomplishments were showcased at the 6th International Saudi Aquaculture Development Workshop, which took place at KAUST on November 14, 2024. KAUST Beacon Development (KBD), an environmental consultancy at KAUST managing the program, has made notable progress in advancements related to food security in fish production and enhancements in sustainable aquaculture.

How Vision 2030 is Transforming the Saudi Arabia Shrimp Market:

Vision 2030 is reshaping Saudi Arabia’s shrimp market by pushing food security, local production, and export growth to the forefront. Heavy investment in aquaculture has shifted shrimp farming from small coastal operations to large-scale, tech-enabled facilities, especially along the Red Sea. Government-backed programs support modern hatcheries, biosecure farms, and efficient feed systems, cutting dependence on imports. NEOM and other giga-projects have added momentum by promoting sustainable aquaculture models that limit water use and environmental stress. Regulatory reforms have shortened licensing timelines and opened doors for foreign partnerships, bringing global expertise into breeding, processing, and cold-chain logistics. Domestic consumption has risen as shrimp becomes more available and affordable, helped by retail expansion and food service growth tied to tourism. Export ambitions are also clearer, with Saudi producers targeting premium markets in Asia and the Middle East. Vision 2030 has turned shrimp from a niche seafood product into a strategic agribusiness sector with long-term commercial relevance.

Market Outlook 2026-2034:

The Saudi Arabia shrimp market is positioned for sustained expansion through the forecast period, propelled by demographic growth, urbanization trends, and evolving dietary preferences toward seafood consumption. The market generated a revenue of USD 277.77 Million in 2025 and is projected to reach a revenue of USD 384.76 Million by 2034, growing at a compound annual growth rate of 3.69% from 2026-2034. The Kingdom's young population and substantial expatriate community create diverse demand patterns spanning traditional preparations and contemporary fusion cuisines.

Saudi Arabia Shrimp Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Environment |

Farmed Shrimp |

61.52% |

|

Species |

Penaeus Vannamei |

72.15% |

|

Shrimp Size |

41-50 |

21.84% |

|

Distribution Channel |

Hotels and Restaurants |

32.33% |

|

Region |

Northern and Central Region |

31% |

Environment Insights:

- Farmed Shrimp

- Wild Shrimp

Farmed shrimp dominates with a market share of 61.52% of the total Saudi Arabia shrimp market in 2025.

The farmed shrimp segment commands the majority of market revenue due to its ability to deliver consistent supply volumes throughout the year, independent of seasonal fishing patterns or weather-related disruptions. Aquaculture operations provide superior control over production variables including stocking density, feed optimization, growth monitoring, and harvest scheduling, resulting in standardized product quality that meets stringent specifications required by retail chains and foodservice establishments. The segment benefits from continuous technological advancement in hatchery management, disease prevention protocols, and water quality systems that enhance productivity while ensuring biosecurity. Farmed shrimp operations along the Red Sea coast leverage ideal environmental conditions including optimal water temperatures, appropriate salinity levels, and minimal pollution exposure that support healthy shrimp development and rapid growth cycles.

The investment landscape for farmed shrimp has strengthened considerably following strategic partnerships between government entities and private sector operators. In 2024, the Saudi Agricultural and Livestock Investment Company acquired significant stakes in major aquaculture groups, bringing capital infusions that enable expansion of pond infrastructure, upgrading of processing facilities, and implementation of advanced farming methodologies. These developments position Saudi Arabia as an emerging exporter of premium farmed shrimp to international markets across Asia, Europe, and North America. The sector's commitment to obtaining international sustainability certifications demonstrates its alignment with global responsible aquaculture standards, creating competitive advantages in environmentally conscious markets. Producers are increasingly adopting traceability systems that document the complete value chain from larval stage through final product delivery, addressing consumer demands for transparency and quality assurance.

Species Insights:

- Penaeus Vannamei

- Penaeus Monodon

- Macrobrachium Rosenbergii

- Others

Penaeus vannamei leads with a share of 72.15% of the total Saudi Arabia shrimp market in 2025.

The Pacific whiteleg shrimp species has established dominance through its exceptional suitability for intensive farming systems, characterized by rapid growth rates, high stocking density tolerance, and superior disease resistance compared to alternative shrimp varieties. Penaeus vannamei adapts readily to the environmental conditions present in Saudi Arabian coastal and inland aquaculture facilities, demonstrating consistent performance across diverse production systems including earthen ponds, lined tanks, and recirculating aquaculture configurations. The species responds efficiently to formulated feeds, achieving favorable feed conversion ratios that optimize production economics while minimizing waste generation. Its mild flavor profile and firm texture appeal to broad consumer preferences across traditional Saudi cuisine and contemporary international preparations, supporting strong demand from both domestic markets and export channels.

Saudi Arabia has emerged as one of the world's leading producers and exporters of whiteleg shrimp, with products reaching over 40 countries globally across Asia-Pacific, Europe, Middle East, and Americas regions. The success of Penaeus vannamei cultivation has attracted substantial investment in genetics research programs focused on developing locally adapted breeding lines that exhibit enhanced performance characteristics including faster maturation, improved survival under variable conditions, and resistance to regional pathogen challenges. In Farmers benefit from established supply chains for specific pathogen-free post-larvae, specialized feed formulations, and technical support services that collectively support consistent production outcomes.

Shrimp Size Insights:

- <21

- 21-25

- 26-30

- 31-40

- 41-50

- 51-60

- 61-70

- >70

41-50 exhibits a clear dominance with a 21.84% share of the total Saudi Arabia shrimp market in 2025.

The medium-sized shrimp segment bridges the balance between affordability and perceived value, making it the preferred choice for volume-oriented foodservice operators including restaurant chains, hotel banquet facilities, and catering companies that require consistent sizing for standardized menu preparations. This size range accommodates diverse cooking methodologies from grilling and sautéing to incorporation in complex dishes like biryani, pasta, and stir-fries without overwhelming other ingredients or requiring excessive preparation time. The 41-50 count delivers optimal plate presentation while maintaining cost efficiency compared to larger premium sizes, supporting menu profitability across mid-range to upscale dining establishments. Retail consumers appreciate this size for home cooking versatility and family meal applications where multiple servings are prepared simultaneously.

The segment's market position reflects production strategies that optimize grow-out durations to achieve target weights while maximizing pond utilization efficiency and harvest frequency. Farmers can achieve 41-50 count sizing within relatively shorter cultivation cycles compared to jumbo grades, enabling more frequent crop rotations and improved annual productivity from fixed pond capacity. The size category maintains strong export demand from international markets where medium shrimp serves as the foundational offering for processed products including breaded preparations, value-added ready-to-cook items, and ingredient applications in manufactured foods. Distribution efficiency benefits from standardized packaging formats and established logistics protocols that facilitate movement through cold chain networks serving both foodservice distributors and retail channels. Consumer research indicates that this size range achieves optimal balance between visual appeal and perceived quality-price relationship.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Hotels and Restaurants

- Online Sales

- Others

Hotels and restaurants lead with a share of 32.33% of the total Saudi Arabia shrimp market in 2025.

The foodservice sector has emerged as the primary consumption channel driven by Saudi Arabia's dynamic hospitality industry expansion, characterized by luxury hotel developments, international restaurant chain proliferation, and indigenous dining concepts that emphasize premium ingredient sourcing and culinary innovation. Major metropolitan centers including Riyadh, Jeddah, and Dammam host thriving restaurant scenes where seafood features prominently on menus spanning traditional Saudi preparations, Pan-Asian cuisines, Mediterranean concepts, and contemporary fusion offerings. Professional chefs demand consistent product specifications, reliable supply schedules, and quality certifications that foodservice distributors fulfill through specialized sourcing relationships with aquaculture producers and import partners.

The Saudi Arabia foodservice is experiencing robust growth trajectories that benefit shrimp consumption across quick-service restaurants, casual dining establishments, fine dining venues, and contract catering operations. Shrimp's culinary versatility enables menu developers to create signature dishes that differentiate brand positioning while appealing to health-conscious diners seeking lean protein alternatives to red meat. The expansion of international tourism under Vision 2030 initiatives including mega-destination projects amplifies demand for world-class dining experiences where premium seafood offerings serve as centerpiece attractions. Hotels and restaurants maintain direct procurement relationships with major aquaculture operations, establishing quality protocols, traceability requirements, and delivery schedules that ensure consistent availability of fresh and frozen shrimp products throughout the year, supporting menu reliability and customer satisfaction.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region exhibits a clear dominance with a 31% share of the total Saudi Arabia shrimp market in 2025.

This region encompasses the capital city Riyadh, which recorded 15.1 million tourists from within and outside Saudi Arabia by the end of the third quarter of 2025, establishing it as the Kingdom's leading travel destination. The concentration of government institutions, corporate headquarters, financial services centers, and diplomatic missions creates a sophisticated urban consumer base with elevated purchasing power and exposure to international dining trends. Riyadh's metropolitan population exceeds seven million residents, including substantial expatriate communities from Asia, Europe, and Americas that maintain diverse culinary preferences and seafood consumption habits. The region's foodservice infrastructure includes hundreds of international restaurant chains, boutique dining concepts, luxury hotels, and catering companies that collectively generate significant shrimp demand across price segments.

The Northern and Central Region benefits from advanced cold chain logistics infrastructure connecting coastal production facilities to inland urban markets through refrigerated transportation networks and temperature-controlled distribution centers that preserve product quality throughout the supply journey. Major retail chains maintain extensive supermarket and hypermarket footprints across Riyadh and secondary cities, offering consumers access to fresh, frozen, and value-added shrimp products through modern shopping environments. The region's strategic importance has attracted investment in recirculating aquaculture systems that enable inland shrimp production, reducing dependency on coastal facilities and transportation costs while providing locally produced alternatives that appeal to consumers seeking domestic sourcing.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Shrimp Market Growing?

Rapid Expansion of Foodservice Sector and Tourism Industry

Saudi Arabia's hospitality landscape is undergoing transformative growth through mega-destination projects, cultural heritage initiatives, and regulatory reforms that have opened the Kingdom to international leisure tourism. The foodservice sector has evolved into a sophisticated ecosystem encompassing global fast-food franchises, celebrity chef establishments, indigenous restaurant brands, and specialty dining concepts that emphasize premium ingredient sourcing and culinary authenticity. Shrimp features prominently across menus due to its universal appeal, preparation versatility, and health-conscious positioning as a lean protein source rich in omega-3 fatty acids and essential nutrients. Restaurant operators increasingly showcase shrimp in signature dishes that reflect Saudi culinary heritage including shrimp kabsa, machboos variations, and grilled preparations alongside contemporary interpretations spanning Asian fusion, Italian pasta, Mediterranean mezze, and Latin American ceviche. IMARC Group predicts that the Saudi Arabia foodservice market is expected to reach USD 58,310 Million by 2033, with projections indicating sustained expansion driven by demographic trends including a youthful population, growing middle class, increasing female workforce participation, and digital food delivery proliferation. Hotels across luxury, mid-scale, and economy segments recognize seafood as a differentiating amenity that enhances guest satisfaction and supports premium positioning. Tourism destinations including NEOM, Red Sea Project, and AlUla development zones are establishing culinary tourism as an experiential pillar, with shrimp-based offerings serving as authentic expressions of Red Sea coastal gastronomy that connect visitors with regional food culture.

Strategic Government Initiatives Under Vision 2030 Framework

The Kingdom's comprehensive economic transformation blueprint has designated aquaculture as a strategic priority sector warranting substantial public investment, policy support, and institutional capacity building to achieve food security objectives, reduce import dependency, and generate employment opportunities across coastal communities. The National Fisheries Development Program, established in 2015, coordinates efforts to attract USD 4 billion in private sector investment through 2030 while developing regulatory frameworks, quality standards, and market access infrastructure that facilitate industry professionalization. Government entities provide financial assistance through the Agricultural Development Fund, which extends subsidized credit with Sharia-compliant structures and extended repayment terms that lower capital barriers for aquaculture entrepreneurs. In May 2025, Saudi Arabia formalized bilateral investment agreements totaling SAR 14 billion (USD 3.7 billion) in agriculture and fisheries development, with dedicated allocations for shrimp genetics research, hatchery technology transfer, and integrated food-security infrastructure that positions the Kingdom as a regional aquaculture leader. Government procurement policies increasingly emphasize local sourcing preferences, creating stable demand channels for domestic shrimp producers through institutional catering contracts serving military installations, educational facilities, healthcare institutions, and government offices.

Rising Health Consciousness and Shift Toward Protein-Rich Diets

Saudi Arabian consumers are demonstrating elevated awareness regarding nutrition's role in chronic disease prevention, weight management, and overall wellness, influenced by public health campaigns, medical professional guidance, and digital media exposure to international dietary trends. As per General Authority for Statistics (GASTAT), the obesity rate among population aged 15 and above is 23.1%, on the other hand 45.1% of individuals in this age group are considered as overweight. Shrimp aligns with health-conscious eating patterns as a nutrient-dense protein source delivering essential amino acids, vitamins D and B12, minerals including selenium and zinc, and omega-3 fatty acids that support cardiovascular health, cognitive function, and metabolic wellness. The product's low calorie profile relative to red meat and poultry appeals to consumers managing weight concerns while maintaining adequate protein intake for active lifestyles and physical fitness pursuits. Owing to this high demand restaurants and food joints are further focusing on providing top-quality shrimp.

Market Restraints:

What Challenges the Saudi Arabia Shrimp Market is Facing?

High Initial Capital Investment and Infrastructure Requirements

Establishing commercial-scale shrimp farming operations necessitates substantial upfront capital expenditure spanning land acquisition or lease arrangements, pond construction with specialized lining and aeration systems, water pumping infrastructure, hatchery facilities for larval production, processing equipment for cleaning and freezing, and cold storage warehousing. Small and medium enterprises face significant barriers accessing conventional financing due to perceived risk profiles associated with aquaculture ventures, which may experience production variability from disease outbreaks, environmental fluctuations, or market price volatility. The technical complexity of intensive shrimp farming requires specialized knowledge in biology, water chemistry, disease management, and nutrition, necessitating skilled personnel recruitment or extensive training programs that add operational costs. Maintenance of biosecurity protocols, equipment servicing, and energy consumption for aeration and temperature control represent ongoing expenses that affect profitability margins, particularly for operations without scale economies.

Water Scarcity and Environmental Sustainability Concerns

Saudi Arabia's arid climate and limited freshwater resources create fundamental challenges for aquaculture development, as traditional pond-based shrimp farming consumes substantial water volumes for initial filling, daily exchange requirements, and compensation for evaporation losses. Coastal aquaculture operations compete with other water users including agriculture, municipal supplies, and industrial applications, while facing regulatory scrutiny regarding discharge impacts on marine ecosystems and coastal zone management. The Kingdom's environmental protection regulations impose standards for effluent quality, mangrove conservation, and habitat preservation that require compliance investments in water treatment systems, settling ponds, and monitoring programs. Climate change projections indicating rising temperatures, altered precipitation patterns, and increased extreme weather frequency present long-term risk factors for production planning and infrastructure resilience.

Disease Management and Biosecurity Challenges

Shrimp aquaculture globally confronts recurring threats from viral, bacterial, and parasitic pathogens that can trigger rapid mortality events, production losses, and market disruptions requiring extended recovery periods. Disease outbreaks may spread between facilities through contaminated water sources, infected broodstock, carrier organisms, or inadequate quarantine procedures, making industry-wide biosecurity coordination essential for risk mitigation. The intensive nature of commercial production creates conditions favorable for pathogen transmission including high stocking densities, stress factors from handling and environmental fluctuations, and potential immunosuppression from sub-optimal nutrition or water quality.

Competitive Landscape:

The Saudi Arabia shrimp market demonstrates a concentrated competitive structure dominated by vertically integrated aquaculture groups operating large-scale production facilities along the Red Sea coast, complemented by specialized distributors, seafood processors, and import trading companies serving retail and foodservice channels. Competition extends beyond domestic producers to include import suppliers bringing frozen shrimp from India, Vietnam, Ecuador, and Thailand, where established aquaculture industries achieve scale economies and price advantages that challenge local producers. Market players differentiate through sustainability certifications, traceability systems, brand development, and value-added product innovation including marinated varieties, breaded preparations, and ready-to-cook formats that address evolving consumer convenience preferences. The competitive landscape balances cost leadership strategies emphasizing production efficiency against premium positioning based on quality differentiation, local sourcing appeals, and environmental responsibility credentials that resonate with conscientious consumers and corporate sustainability procurement policies.

Recent Developments:

- In November 2025, MHAB Food Company, the brand responsible for the well-known seafood restaurant chain Shrimp Shack, has chosen Jadarah Business Consulting to be its consulting partner for a comprehensive organizational transformation initiative. After debuting its initial Shrimp Shack restaurant in Riyadh in 2016, MHAB Food Company has grown the brand into a national chain with 13 sites throughout the Kingdom. The success of Shrimp Shack arises from its unique blend of premium seafood, a friendly dining atmosphere, and affordable prices. The menu includes shrimp, crab, mussels, and lobster, as well as an assortment of side dishes.

Saudi Arabia Shrimp Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Environments Covered | Farmed Shrimp, Wild Shrimp |

| Species Covered | Penaeus Vannamei, Penaeus Monodon, Macrobrachium Rosenbergii, Others |

| Shrimp Sizes Covered | <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, >70 |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Hotels and Restaurants, Online Sales, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Almunajem Foods, Arasco, Jazan Energy and Development Company, National Prawn Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia shrimp market size was valued at USD 277.77 Million in 2025.

The Saudi Arabia shrimp market is expected to grow at a compound annual growth rate of 3.69% from 2026-2034 to reach USD 384.76 Million by 2034.

Farmed shrimp dominates the Saudi Arabia shrimp market with a 61.52% share, driven by year-round production consistency, superior quality control capabilities, and technological advancements in intensive aquaculture systems that optimize productivity while ensuring biosecurity and environmental sustainability.

Key factors driving the Saudi Arabia shrimp market include the rapid expansion of the foodservice sector and tourism industry creating substantial demand across hotels and restaurants, strategic government initiatives under Vision 2030 providing investment support and infrastructure development, and rising health consciousness among consumers shifting dietary preferences toward protein-rich seafood options.

Major challenges include high initial capital investment requirements for establishing commercial-scale aquaculture facilities, water scarcity concerns in the Kingdom's arid environment necessitating sustainable production technologies, disease management complexities requiring robust biosecurity protocols, and competition from established international suppliers achieving scale economies in major exporting countries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)