Saudi Arabia Smart Card Market Size, Share, Trends and Forecast by Type, Component, Application, End User, and Region, 2025-2033

Saudi Arabia Smart Card Market Overview:

The Saudi Arabia smart card market size reached USD 0.32 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.45 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The Saudi Arabia smart card market share is growing due to rising digital payments, e-governance initiatives, and increasing adoption in banking, telecom, and transportation. Government projects like Vision 2030, biometric authentication demand, and cybersecurity concerns further drive adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.32 Billion |

| Market Forecast in 2033 | USD 0.45 Billion |

| Market Growth Rate (2025-2033) | 3.80% |

Saudi Arabia Smart Card Market Trends:

Increase in Government Initiatives

Saudi Arabia’s Vision 2030 is a crucial driver for the country’s smart card market, as the government focuses on digital conversion across sectors. As per the International Trade Administration, in the last six years, the Kingdom has made approximately USD 24.8 Billion in investments in digital infrastructure, which has resulted in a notable improvement in the caliber of internet services. With mobile internet speeds doubling to 215 Mbps, Saudi Arabia now boasts a 99% penetration of the internet. The National Transformation Program (NTP) mandates the embracement of secure digital identity solutions, which has accelerated the perpetration of smart cards in banking, healthcare, and public identification. The Saudi Arabian Monetary Authority (SAMA) has encouraged banks to issue EMV chip-based debit and credit cards to enhance sales security. Also, the introduction of the Saudi e-passport and the unified public ID system has increased the demand for smart cards with biometric authentication. Government-backed initiatives similar to SADAD and Mada have facilitated cashless payments, further boosting the need for smart card results in fiscal deals. Also, nonsupervisory mandates taking secure authentication in sectors like telecommunications and transport are driving investments in contactless and multi-functional smart cards, ensuring uninterrupted market growth.

Adoption of Cashless Payments

The increasing preference for cashless transactions is significantly propelling the demand for smart cards in Saudi Arabia. According to the Report on Payments Usage Study KINGDOM OF SAUDI ARABIA, cash usage has drastically decreased to 30% from 43% in 2021, card payments still make up the majority of consumer payments, making over 51% of all transactions. Moreover, the use of cards in e-commerce and PoS has sharply increased in 2023. The widespread use of NFC-enabled contactless payments, driven by SAMA’s push for digital banking, has led banks and financial institutions to replace traditional magnetic stripe cards with smart chip-based alternatives. With the rapid growth of fintech companies and mobile payment solutions like STC Pay and Apple Pay, smart cards with embedded chips are becoming essential for secure authentication and transaction efficiency. Additionally, point-of-sale (POS) terminal deployments supporting contactless technology have surged, aligning with consumer demand for faster, safer, and more convenient payment methods. The retail and e-commerce boom in the region is further amplifying the need for smart card solutions, especially for secure online transactions. As digital wallets and tokenization gain traction, the role of smart cards in financial security and fraud prevention is becoming even more crucial.

Saudi Arabia Smart Card Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, component, application, and end user.

Type Insights:

- Contact-Based

- Contactless

- Dual Interface

The report has provided a detailed breakup and analysis of the market based on the type. This includes contact-based, contactless, and dual interface.

Component Insights:

- Memory Based

- Microcontroller Based

- Magnetic Stripes

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes memory-based, microcontroller-based, and magnetic stripes.

Application Insights:

- Payment Transactions

- ID Verification

- Access Control

The report has provided a detailed breakup and analysis of the market based on the application. This includes payment transactions, ID verification, and access control.

End User Insights:

- BFSI

- Telecommunication

- Healthcare

- Government

- Transportation

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes BFSI, telecommunication, healthcare, government, transportation, and others.

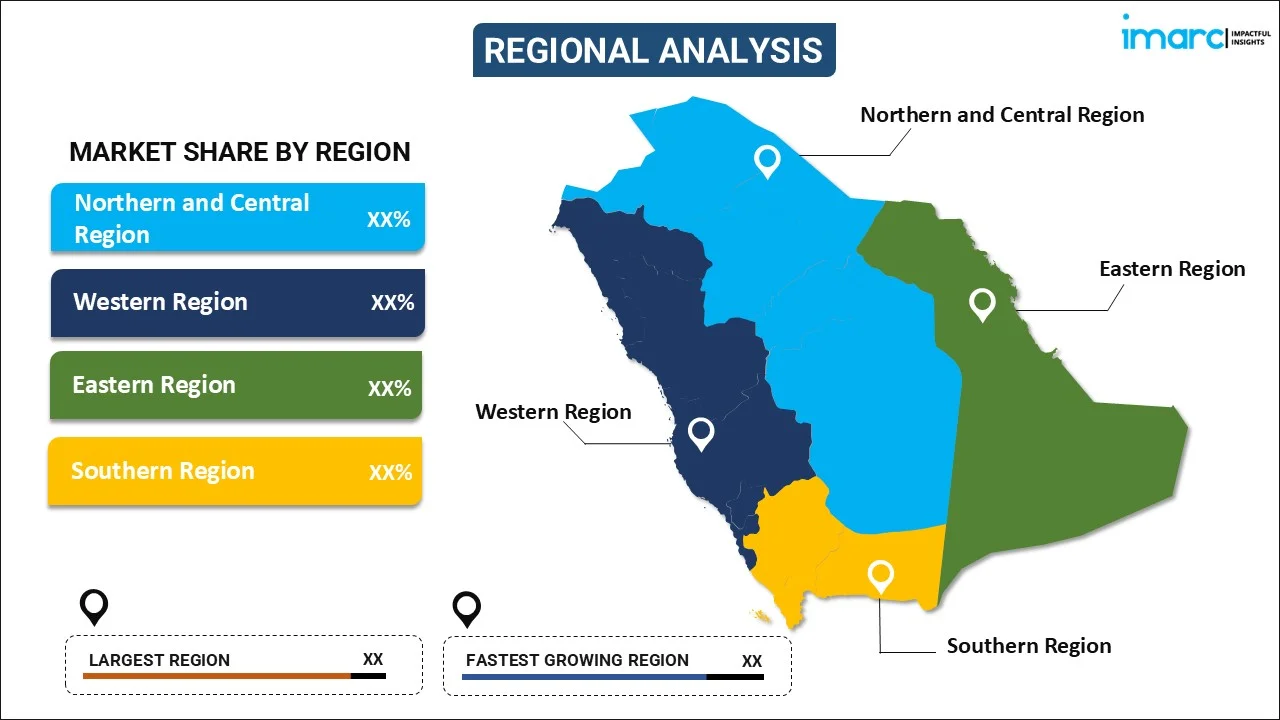

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Smart Card Market News:

- In October 2024, Mastercard announced the opening of top-notch technological infrastructure in Saudi Arabia to support the acceleration of digital commerce. This infrastructure allowed e-commerce transactions to be processed locally and offered both Mastercard partners and customers a smooth and secure payment experience.

- In May 2024, through the "Nusuk" smart card, the Saudi Ministry of Hajj and Umrah made it possible for regular pilgrims to assess the quality of services offered by Hajj businesses, campaigns, hotels, and other services this year. Among other things, pilgrims used the card's digital and printed versions to file complaints and remarks. They said that the "Nusuk" card, which was introduced during the recent visit of Hajj and Umrah Minister Tawfiq bin Fawzan Al-Rabiah to the Republic of Indonesia, had a number of features to help pilgrims. These features facilitated their mobility and offered crucial notifications, such as grouping information.

Saudi Arabia Smart Card Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Contact-Based, Contactless, Dual Interface |

| Components Covered | Memory-Based, Microcontroller-Based, Magnetic Stripes |

| Applications Covered | Payment Transactions, ID Verification, Access Control |

| End Users Covered | BFSI, Telecommunication, Healthcare, Government, Transportation, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia smart card market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia smart card market on the basis of type?

- What is the breakup of the Saudi Arabia smart card market on the basis of component?

- What is the breakup of the Saudi Arabia smart card market on the basis of application?

- What is the breakup of the Saudi Arabia smart card market on the basis of end user?

- What are the various stages in the value chain of the Saudi Arabia smart card market?

- What are the key driving factors and challenges in the Saudi Arabia smart card market?

- What is the structure of the Saudi Arabia smart card market and who are the key players?

- What is the degree of competition in the Saudi Arabia smart card market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia smart card market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia smart card market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia smart card industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)