Saudi Arabia Sports Utility Vehicle Market Size, Share, Trends and Forecast by Type, Fuel Type, Seating Capacity, and Region, 2026-2034

Saudi Arabia Sports Utility Vehicle Market Overview:

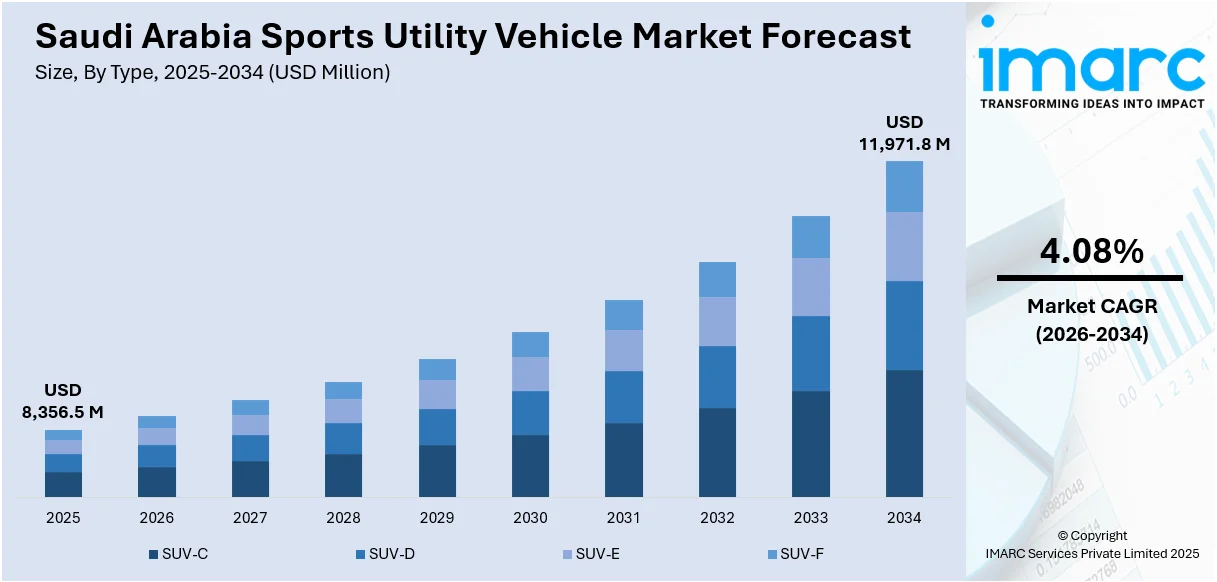

The Saudi Arabia sports utility vehicle market size reached USD 8,356.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 11,971.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.08% during 2026-2034. The market is experiencing significant growth due to growing consumer preference for spacious and high-performance vehicles, favorable road infrastructure, and rising disposable incomes. The popularity of off-road and luxury SUVs is also increasing, supported by strong demand from both families and young drivers. Automakers are introducing new models tailored to regional needs, which is further contributing to the rising Saudi Arabia sports utility vehicle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8,356.5 Million |

| Market Forecast in 2034 | USD 11,971.8 Million |

| Market Growth Rate 2026-2034 | 4.08% |

Saudi Arabia Sports Utility Vehicle Market Trends:

Rise in Off-Road and Adventure Vehicle Popularity

Demand for off-road and adventure-capable SUVs is increasing fast in Saudi Arabia fueled by the nation's geographic and cultural predisposition towards desert wandering, overland driving, and weekend excursions. Buyers are looking more and more for vehicles that balance toughness with comfort leading to features such as four-wheel drive, improved ground clearance, and all-terrain capabilities being extremely desirable. Automakers are reacting by introducing models tailored specifically for desert driving and off-road use, like the Toyota Land Cruiser, Nissan Patrol, and Ford Bronco. For instance, in February 2025, JETOUR announced its plans to launch the T1, its lite off-road SUV, in Riyadh, Saudi Arabia. Featuring a 2.0T engine, advanced driving modes, and high-strength steel construction, the T1 combines urban comfort with off-road capability, marking a significant step in JETOUR's global expansion. These vehicles are popular among outdoor enthusiasts and also appeal to families looking for versatile, durable options. Additionally, the government's push for domestic tourism and the development of desert resorts and adventure destinations are contributing to this trend. As a result, off-road-ready SUVs are playing a key role in shaping consumer preferences across Saudi Arabia’s SUV market.

To get more information on this market Request Sample

Electrification of SUV Models

The electrification of SUV models is emerging as a key trend in Saudi Arabia, with global and regional automakers introducing hybrid and fully electric variants to meet growing environmental and regulatory expectations. For instance, in March 2025, Ceer, Saudi Arabia's first electric vehicle manufacturer, announced its plans to launch its debut SUV by late 2026. Backed by agreements worth SAR 5.5 billion, Ceer aims for 240,000 vehicles annually and a 45% localization rate, contributing $8 billion to the GDP by 2034 while fostering domestic economic growth. With the Kingdom’s Vision 2030 emphasizing sustainable mobility and reduced carbon emissions, consumer interest in eco-friendly vehicles is steadily rising. Brands such as Toyota, Hyundai, and Lucid Motors now operating a production facility in Saudi Arabia are expanding their electric SUV offerings in the region. These models provide the dual advantage of fuel efficiency and lower emissions, while still delivering the size, power, and performance features that SUV buyers expect. Charging infrastructure is also improving in urban centers, supporting the shift to electric mobility. The growing availability and acceptance of electric SUVs are playing a significant role in driving Saudi Arabia sports utility vehicle market growth.

Saudi Arabia Sports Utility Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, fuel type, and seating capacity.

Type Insights:

- SUV-C

- SUV-D

- SUV-E

- SUV-F

The report has provided a detailed breakup and analysis of the market based on the type. This includes SUV-C, SUV-D, SUV-E, and SUV-F.

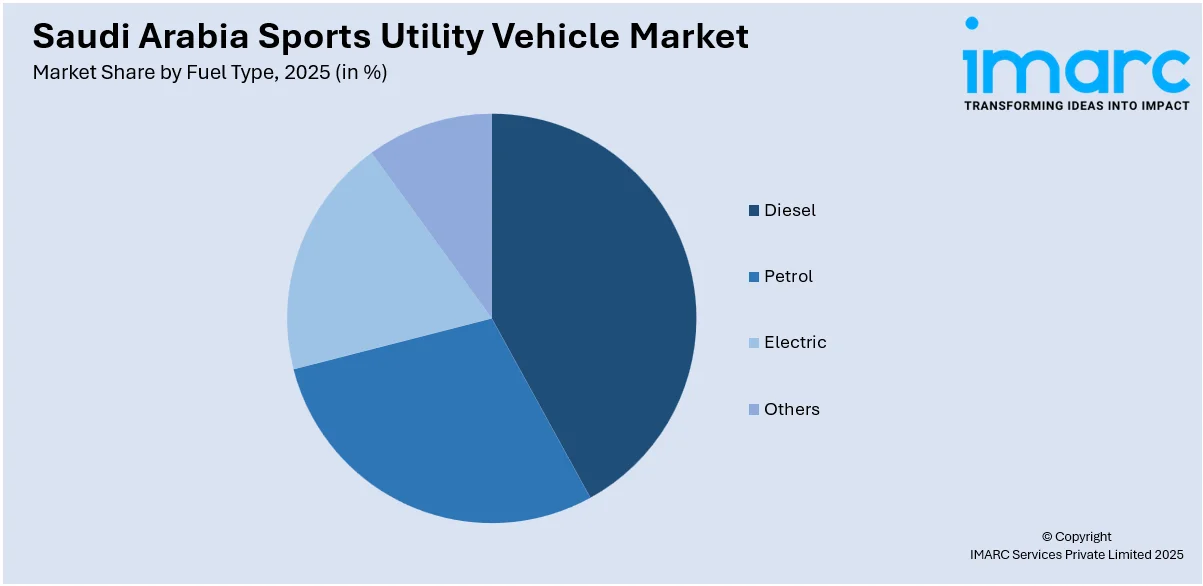

Fuel Type Insights:

Access the comprehensive market breakdown Request Sample

- Diesel

- Petrol

- Electric

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes diesel, petrol, electric, and others.

Seating Capacity Insights:

- 5-Seater

- 7-Seater

- 8-Seater and Above

A detailed breakup and analysis of the market based on the seating capacity have also been provided in the report. This includes 5-seater, 7-seater, and 8-seater and above.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Sports Utility Vehicle Market News:

- In March 2025, Nissan announced the launch of the all-new Magnite in Saudi Arabia, marking its Middle East debut as the first left-hand-drive model. This compact SUV features a striking design, advanced tech, and a turbocharged engine. It aims to meet the diverse needs of urban drivers while offering exceptional value.

- In September 2024, Nissan announced its plans to launch two new SUVs in Saudi Arabia, enhancing its presence in the Gulf's leading automotive market, following the debut of the all-new 2025 Patrol. Managing director Adib Takieddine highlighted the demand for tech-driven vehicles and the company's commitment to electrification amid changing consumer preferences.

- In October 2024, Great Wall Motor announced the launch of the new HAVAL H9 SUV in Saudi Arabia, positioning it as the ideal family off-road vehicle. With its spacious interior, advanced driving assistance, and rugged design, the H9 promises a versatile driving experience for adventure seekers and everyday users alike.

Saudi Arabia Sports Utility Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | SUV-C, SUV-D, SUV-E, SUV-F |

| Fuel Types Covered | Diesel, Petrol, Electric, Others |

| Seating Capacities Covered | 5-Seater, 7-Seater, 8-Seater and Above |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia sports utility vehicle market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia sports utility vehicle market on the basis of type?

- What is the breakup of the Saudi Arabia sports utility vehicle market on the basis of fuel type?

- What is the breakup of the Saudi Arabia sports utility vehicle market on the basis of seating capacity?

- What is the breakup of the Saudi Arabia sports utility vehicle market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia sports utility vehicle market?

- What are the key driving factors and challenges in the Saudi Arabia sports utility vehicle market?

- What is the structure of the Saudi Arabia sports utility vehicle market and who are the key players?

- What is the degree of competition in the Saudi Arabia sports utility vehicle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia sports utility vehicle market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia sports utility vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia sports utility vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)