Saudi Arabia Student Information System Market Size, Share, Trends and Forecast by Component, Deployment Type, End-User, and Region, 2026-2034

Saudi Arabia Student Information System Market Overview:

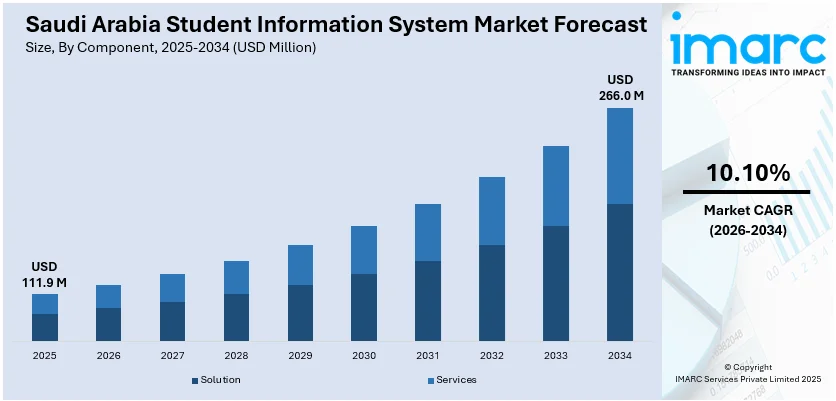

The Saudi Arabia student information system market size reached USD 111.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 266.0 Million by 2034, exhibiting a growth rate (CAGR) of 10.10% during 2026-2034. Vision 2030–aligned digital education reforms and Ministry of Education mandates, the rapid shift towards hybrid and remote learning, rising private and international school enrollments demanding bilingual, cloud-based, artificial intelligence (AI)-analytics, and enterprise resource planning (ERP)-integrated platforms, and surging edtech investments are fueling the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 111.9 Million |

| Market Forecast in 2034 | USD 266.0 Million |

| Market Growth Rate 2026-2034 | 10.10% |

Saudi Arabia Student Information System Market Trends:

Government-Led Digital Transformation and Cloud Migration

Under Vision 2030, Saudi Arabia has mobilized massive public-sector information and communication technology (ICT) investments, driving a shift from on-premises SIS to cloud-native platforms. In 2023, government ICT spending surged 20% year-on-year to approximately USD 11 billion, propelled by digital-government and education initiatives. Education remains a top fiscal priority, with an allocation of USD 50 billion, 17% of GDP, in 2023, the highest in the Gulf Cooperation Council. The Ministry of Education launched nine interactive digital platforms, including Noor, Future Gate, Rasel, Fares, and Safeer 2, to manage enrollment, grading, attendance, transportation, and student counseling. This proliferation has spurred SIS vendors to provide fully managed, cloud-hosted solutions delivering real-time reporting, automated backups, and seamless scalability across schools and universities. By migrating CapEx to OpEx, institutions can align SIS costs with user numbers, reduce total cost of ownership, and benefit from continuous feature updates, integrated mobile access, and enterprise-grade security under Saudi Arabia’s robust cyber security strategy.

To get more information on this market Request Sample

EdTech Expansion and Smart-Classroom Integration Driving Advanced SIS Capabilities

Saudi Arabia’s fast-evolving EdTech landscape is fueling demand for next-generation Student Information Systems (SIS) that integrate seamlessly with learning management systems (LMS), AI-powered analytics, and multilingual capabilities. The local EdTech market reached USD 2,322.1 million in 2024 and is projected to hit USD 6,847.8 million by 2033, growing at a CAGR of 12.77%, driven by government-led digital education initiatives and private-sector investment in interactive tools and content. The push for smart classrooms, equipped with interactive displays, IoT devices, and real-time collaboration tech, has prompted SIS vendors to embed features like synchronous learning modules, digital lesson-plan libraries, and attendance integrations into their platforms. Private-sector confidence is high, with an 86% year-on-year rise in education investment licenses in Q2 2024. March 2024 also marked the launch of the “Study in Saudi Arabia” platform, increasing the need for SIS modules that support multilingual workflows, visa tracking, and credential evaluation.

Saudi Arabia Student Information System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on component, deployment type, and end-user.

Component Insights:

- Solution

- Enrollment

- Academics

- Financial Aid

- Billing

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (enrollment, academics, financial aid, and billing) and services (professional services and managed services).

Deployment Type Insights:

- On-premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

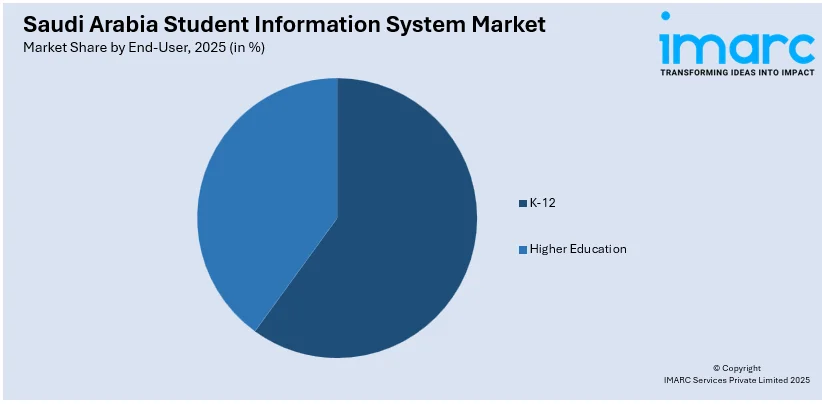

End-User Insights:

Access the comprehensive market breakdown Request Sample

- K-12

- Higher Education

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes K-12 and higher education.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Student Information System Market News:

- October 2024: Saudi Arabia's Ministry of Justice and Ministry of Education introduced a unified electronic contract system for student registration in private schools. This initiative aims to regulate the contractual relationship between schools and guardians, ensuring transparency and clarity in obligations and rights, and streamlining the enrollment process.

- October 2024: Naseej for Technology partnered with King Abdulaziz University to upgrade its campus management, implementing the Banner 9 student information system (SIS) from Ellucian. The project includes licensing and 36 months of support. This modern SIS centralizes enrollment, academic records, registration, degree auditing, and analytics, enhancing workflows, security, mobile access, and data-driven decision-making in university operations.

Saudi Arabia Student Information System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | On-premises, Cloud |

| End-Users Covered | K-12, Higher Education |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia student information system market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia student information system market on the basis of component?

- What is the breakup of the Saudi Arabia student information system market on the basis of deployment type?

- What is the breakup of the Saudi Arabia student information system market on the basis of end-user?

- What is the breakup of the Saudi Arabia student information system market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia student information system market?

- What are the key driving factors and challenges in the Saudi Arabia student information system market?

- What is the structure of the Saudi Arabia student information system market and who are the key players?

- What is the degree of competition in the Saudi Arabia student information system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia student information system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia student information system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia student information system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)