Saudi Arabia Tomato Ketchup Market Size, Share, Trends and Forecast by Type, Packaging, Distribution Channel, Application, and Region, 2026-2034

Saudi Arabia Tomato Ketchup Market Overview:

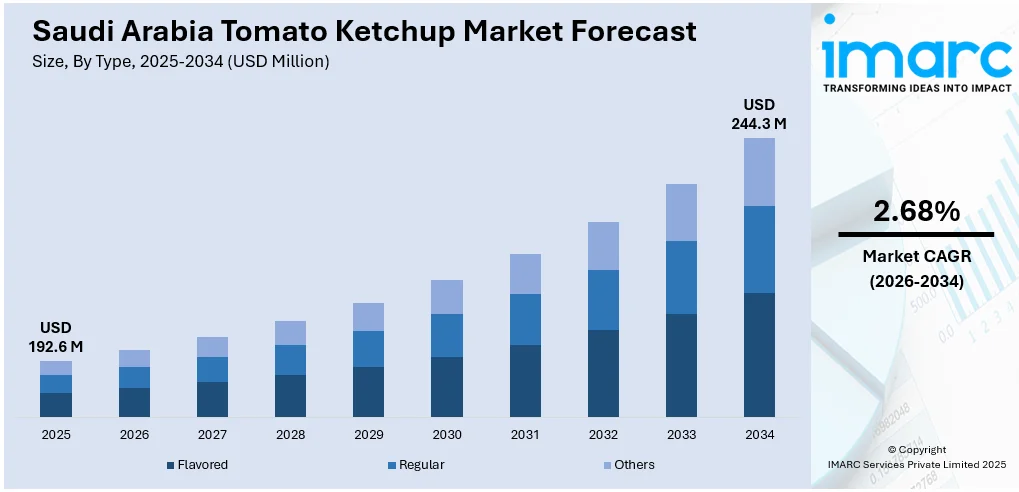

The Saudi Arabia tomato ketchup market size reached USD 192.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 244.3 Million by 2034, exhibiting a growth rate (CAGR) of 2.68% during 2026-2034. The market is experiencing steady growth due to the rise in fast-food chains and quick-service restaurants that has spurred demand for tomato ketchup as a popular condiment. The cultural adoption of Western food practices and the spread of global cuisines, and the easy product availability on online platforms are some of the other factors that contribute to the increasing Saudi Arabia tomato ketchup market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 192.6 Million |

| Market Forecast in 2034 | USD 244.3 Million |

| Market Growth Rate 2026-2034 | 2.68% |

Saudi Arabia Tomato Ketchup Market Trends:

Western Fast-Food Culture Influence

The presence of Western fast-food outlets in Saudi Arabia has had a profound impact on consumer tastes, especially when it comes to condiments such as tomato ketchup. As burgers, fries, and sandwiches in the American style become urban staples, ketchup has solidified its position as a daily necessity. This trend is complemented by the international QSR brands' localization, which have menu offerings that incorporate ketchup both in traditional and as an ingredient in signature sauces. For instance, Dine Brands International announced plans to open five new IHOP outlets in the western part of Saudi Arabia (KSA), specifically in Jeddah, Medina, Mecca and cities along the Red Sea coast, with the first location expected to debut in Jeddah in early 2023. The agreement with IHOP Franchisee Ahmed Marashde underscores IHOP's continued expansion in the Middle East, evidenced by the successful opening of an IHOP in Cairo, Egypt at the Cairo Festival City Mall and the ongoing development of ghost kitchens in the region. Hence, the fast-food culture has also conditioned consumer demand toward uniform quality and taste, which has encouraged ketchup producers to provide standardized taste profiles and consistent supply for retail and foodservice channels. In addition, the lifestyle of rapid urbanization has created a corresponding boost in demand for easy-to-use, ready-to-use condiments, increasing the popularity of ketchup. The combination of Westernization and contemporary eating practices continues to propel the Saudi Arabia tomato ketchup market growth, marking ketchup as a crossover food product enjoyed by all ages.

To get more information on this market Request Sample

Premiumization and Brand Differentiation

Another emerging trend among Saudi Arabia's tomato ketchup market is premiumization. Buyers, particularly younger and wealthier consumers, are looking for more premium products that provide experiences beyond the traditional tomato taste. This has opened up the market for richer-tasting ketchups with unusual ingredients and luxury packaging designed to take the product from being a household convenience food to a gourmet affair. Brands are investing in the narrative, such as heritage branding and stories around ingredient origin or special production techniques, to distinguish themselves in a crowded market. Limited-edition flavors, artisanal batches, and partnerships with local chefs or influencers are also being leveraged to build exclusivity and hype. This trend toward premium options is part of a larger lifestyle desire, where consumers are interested in personalization and quality. Consequently, ketchup is being repositioned from a secondary condiment to a feature ingredient that brings distinction and depth of flavor to in-home and out-of-home meals.

Digital Marketing and E-Commerce Growth

As the digital infrastructure and mobile usage in Saudi Arabia has grown at a rapid pace, e-commerce and online marketing have emerged as strong weapons for ketchup brands. As reported by the International Trade Administration, Saudi Arabia attained the second rank among G20 countries in the UN International Telecommunication Union’s ICT Development Index (IDI) for 2023, showcasing the Kingdom’s strong digital infrastructure and effective policies in advancing digital transformation. Consumers are increasingly utilizing online channels for more than just convenience but also for exposure to greater ketchup product variety than what is generally found in traditional retail stores. Such an online transformation presents an opportunity for niche brands and new entrants to challenge long-standing giants by riding social media platforms, influencer collaborations, and specific digital advertising. Brands are also leveraging online reviews and feedback to adjust product offerings and meet customer preferences more effectively. Direct-to-consumer and subscription-based models are also becoming popular, providing bundled condiments, seasonal flavors, or sampler packs. This is consistent with the country's overall digital transformation efforts and shifting consumer shopping habits. As the online grocery market evolves, ketchup product visibility, availability, and personalization will become increasingly important, driving digital interaction as a central driver of market success.

Saudi Arabia Tomato Ketchup Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, packaging, distribution channel, and application.

Type Insights:

- Flavored

- Regular

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes flavored, regular, and others.

Packaging Insights:

- Pouch

- Bottle

- Others

A detailed breakup and analysis of the market based on the packaging has also been provided in the report. This includes pouch, bottle, and others.

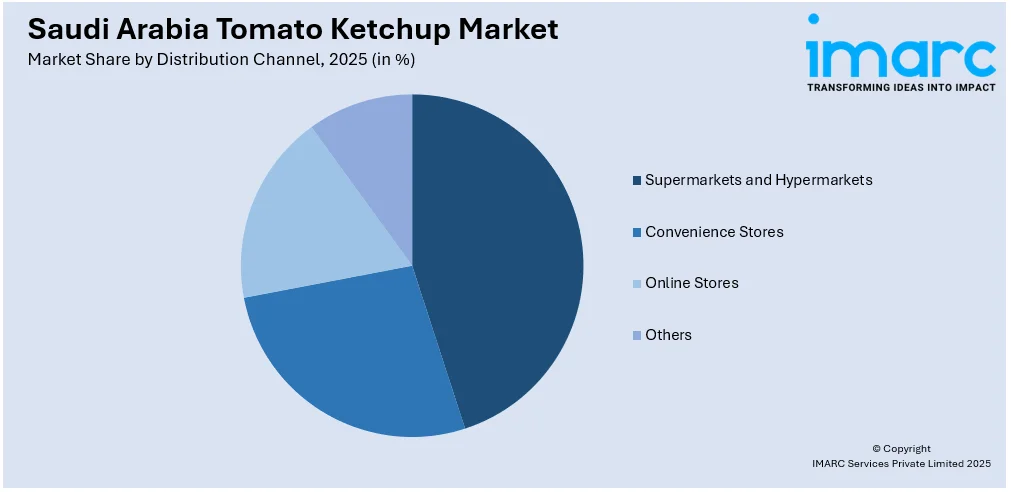

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Application Insights:

- Household

- Commercial

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes household, commercial, and others.

Regional Insights:

- Northern Saudi Arabia

- Central Saudi Arabia

- Southern Saudi Arabia

- Other

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Saudi Arabia, Central Saudi Arabia, Southern Saudi Arabia, and Other

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Tomato Ketchup Market News:

- In September 2024, Heinz made a groundbreaking choice to give up its iconic ketchup brand in honor of Saudi Arabia’s National Day. Starting on September 19, this distinctive initiative allowed people across Saudi Arabia to send their congratulatory messages to the Kingdom as Heinz showcased its support for customers in KSA. Rather than the familiar Heinz emblem, the ketchup bottles displayed a plain green keystone, allowing customers to include their own personalized celebratory messages. Additionally, people can scan a QR code displayed on billboards across Riyadh, Dammam, and Jeddah to submit their National Day messages.

Saudi Arabia Tomato Ketchup Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flavored, Regular, Others |

| Packagings Covered | Pouch, Bottle, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Applications Covered | Household, Commercial, Others |

| Regions Covered | Northern Saudi Arabia, Central Saudi Arabia, Southern Saudi Arabia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia tomato ketchup market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia tomato ketchup market on the basis of type?

- What is the breakup of the Saudi Arabia tomato ketchup market on the basis of packaging?

- What is the breakup of the Saudi Arabia tomato ketchup market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia tomato ketchup market on the basis of application?

- What is the breakup of the Saudi Arabia tomato ketchup market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia tomato ketchup market?

- What are the key driving factors and challenges in the Saudi Arabia tomato ketchup?

- What is the structure of the Saudi Arabia tomato ketchup market and who are the key players?

- What is the degree of competition in the Saudi Arabia tomato ketchup market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia tomato ketchup market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia tomato ketchup market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia tomato ketchup industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)