Saudi Arabia Truck Market Size, Share, Trends and Forecast by Vehicle Type, Tonnage Capacity, Fuel Type, Application, and Region, 2026-2034

Saudi Arabia Truck Market Overview:

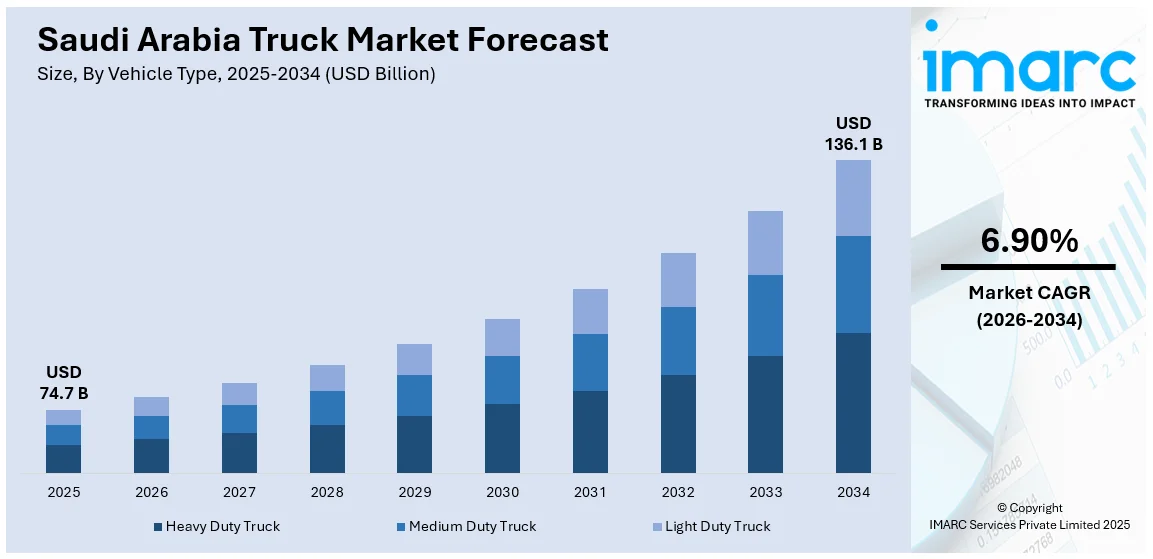

The Saudi Arabia truck market size reached USD 74.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 136.1 Billion by 2034, exhibiting a growth rate (CAGR) of 6.90% during 2026-2034. The market share is expanding, driven by rising investments in public-private partnerships and incentives for local manufacturing, along with the expansion of e-commerce sites, which is creating the need for efficient delivery systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 74.7 Billion |

| Market Forecast in 2034 | USD 136.1 Billion |

| Market Growth Rate 2026-2034 | 6.90% |

Saudi Arabia Truck Market Trends:

Expansion of Infrastructure and Construction Projects

Saudi Arabia’s large-scale infrastructure and construction initiatives under Vision 2030 are a major driver of the market growth. Knight Frank's analysis indicated that Saudi Arabia's construction expenditure is projected to reach USD 150 Billion in 2025. Initiatives, such as mega-cities, transportation systems, housing developments, and industrial centers, demand robust trucks to deliver raw materials like cement, steel, and aggregates. The need also encompasses medium-duty trucks utilized for logistics assistance in equipment and construction materials. With substantial investments in road expansions and industrial areas, trucks have become essential resources to adhere to stringent regulations. Moreover, government-backed initiatives are ensuring sustained spending on both public and private sector projects, creating consistent opportunities for truck manufacturers and rental providers. Construction companies are also adopting modern, fuel-efficient trucks with better load-bearing capacities to enhance operational efficiency.

To get more information on this market Request Sample

Growth of E-commerce and Retail Distribution

The rapid growth of the e-commerce and retail sectors in Saudi Arabia is catalyzing strong demand for trucks in logistics and last-mile delivery. According to the IMARC Group, the Saudi Arabia e-commerce market size reached USD 222.9 Billion in 2024. As online shopping is becoming mainstream, fueled by rising internet penetration and changing consumer lifestyles, companies require reliable fleets of light and medium-duty trucks for efficient distribution. Retailers and e-commerce platforms are investing in logistics networks that depend heavily on trucks to ensure timely delivery across cities and remote areas. Cold chain logistics, especially for food items, pharmaceuticals, and groceries, also rely on refrigerated trucks, adding another layer of demand. With younger populations driving digital adoption and online platforms competing for faster delivery, the need for flexible and efficient trucking services is growing.

Oil and Gas Sector Transportation Needs

The oil and gas industry is central to Saudi Arabia’s economy, and it is creating significant demand for specialized trucks to transport fuel, crude oil, chemicals, and drilling equipment. As per the iea, Saudi Arabia's investment in upstream oil and gas is expected to hit around USD 40 Billion by 2025. Heavy-duty trucks with high safety standards are essential for moving petroleum products across vast distances from extraction sites to refineries, industrial hubs, and ports. Tanker trucks designed to handle hazardous materials are in continuous demand due to the Kingdom’s strong energy export operations. Additionally, support trucks are needed for pipeline construction, equipment movement, and maintenance tasks within oil fields. As Saudi Arabia continues investing in petrochemical projects and diversifying into renewable energy, the logistics needs of the energy sector remain robust.

Key Growth Drivers of Saudi Arabia Truck Market:

Rising Urbanization and Domestic Freight Demand

Rapid urbanization in Saudi Arabia, with the growing cities and industrial clusters, is positively influencing the market. The expansion of urban centers is creating higher requirements for transporting consumer goods, building materials, and industrial supplies within the Kingdom. Trucks serve as the backbone of the domestic supply chain, ensuring that goods move efficiently between ports, warehouses, retailers, and end consumers. Additionally, the government’s focus on boosting non-oil industries, such as food processing, manufacturing, and healthcare, is further stimulating freight activity. Urbanization also leads to increased consumption, and trucks are crucial in meeting the logistical challenges of moving perishable and non-perishable goods across large geographic distances. This sustained growth in domestic trade highlights the essential role of trucks in enabling reliable, large-scale freight operations across Saudi Arabia’s diverse economic landscape.

Advancements in Truck Technology and Fleet Modernization

Fleet operators are increasingly investing in trucks with better fuel efficiency, improved payload capacities, and enhanced safety systems. Features, such as telematics and real-time monitoring, are helping logistics companies optimize fleet performance and reduce operational costs. Furthermore, as environmental sustainability is gaining importance, the demand is rising for trucks with cleaner fuel technologies, including natural gas and electric models, particularly in urban logistics. Government policies encouraging the adoption of modern vehicles are also creating incentives for fleet modernization. This shift towards technologically advanced trucks is not only improving operational efficiency but also aligning with Saudi Arabia’s sustainability goals. As companies are competing to provide reliable logistics services, investments in advanced truck models are accelerating.

Government Support and Regulatory Framework

Government initiatives play a pivotal role in supporting the market expansion. Investments in road infrastructure, improved logistics policies, and customs reforms have strengthened transportation efficiency across the Kingdom. Regulations mandating safety standards, vehicle inspections, and emissions control have also encouraged companies to adopt newer, compliant trucks. Furthermore, rising focus on building a diversified economy is stimulating sectors, such as logistics, e-commerce, and manufacturing, driving truck demand. Incentives for foreign investment and partnerships in the transportation sector attract international truck manufacturers and fleet management companies to expand operations in Saudi Arabia. Additionally, Vision 2030’s logistics strategy aims to transform Saudi Arabia into a global trade hub, and trucking plays a central role in achieving this objective.

Saudi Arabia Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on vehicle type, tonnage capacity, fuel type, and application.

Vehicle Type Insights:

- Heavy Duty Truck

- Medium Duty Truck

- Light Duty Truck

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes heavy duty truck, medium duty truck, and light duty truck.

Tonnage Capacity Insights:

- 3.5 – 7.5 Tons

- 7.5 – 16 Tons

- 16 – 30 Tons

- Above 30 Tons

A detailed breakup and analysis of the market based on the tonnage capacity have also been provided in the report. This includes 3.5 – 7.5 tons, 7.5 – 16 tons, 16 – 30 tons, and above 30 tons.

Fuel Type Insights:

- Diesel

- Petrol

- CNG & LNG

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, petrol, and CNG & LNG.

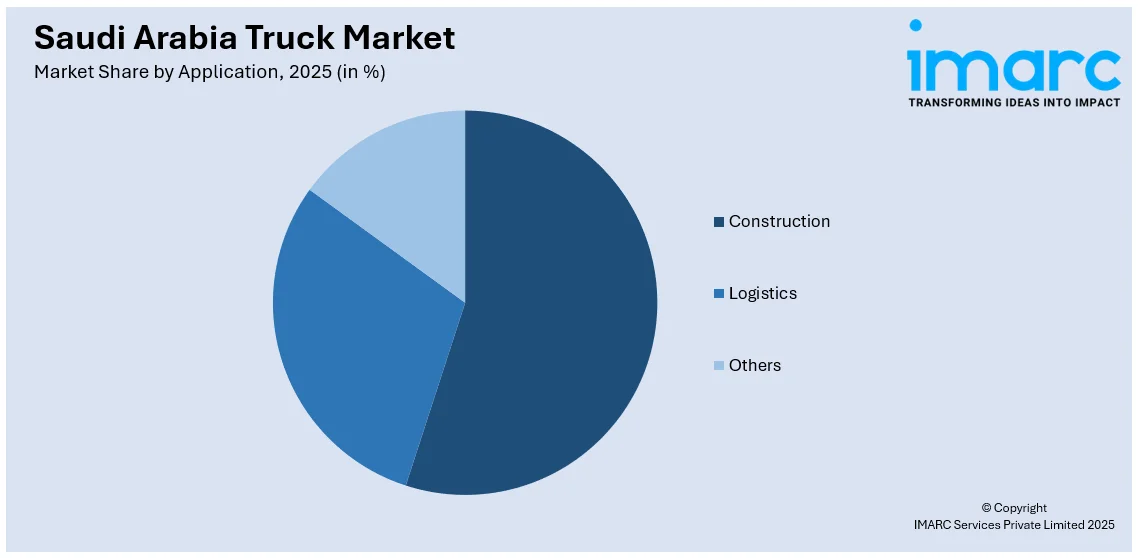

Application Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Logistics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction, logistics, and others,

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Truck Market News:

- July 2025: Al-Futtaim Auto and Machinery Company (FAMCO KSA) revealed the introduction of Dongfeng Trucks in Saudi Arabia, highlighting a significant advancement in the company’s expansion efforts and dedication to providing innovative and dependable commercial vehicle solutions. The firm aimed to provide unparalleled value and performance to its customers.

- November 2024: The Heavy Equipment and Truck (HEAT) Show was set to take place, inviting industry experts, stakeholders, and enthusiasts to the Dharan Expo in Dammam, Saudi Arabia. Centering on innovations, sustainability, and local development, the event aimed to promote the industry's expansion while generating meaningful business prospects.

- November 2024: Tata Motors introduced its inaugural Automated Manual Transmission (AMT) truck, the Prima 4440.S AMT, in Saudi Arabia. Developed on the company’s foundational Prima platform, the truck aimed to merge driver comfort, fuel efficiency, and dependable performance. It included a strong drivetrain, resilient parts, and a cozy interior to improve efficiency and profitability for clients.

Saudi Arabia Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Heavy Duty Truck, Medium Duty Truck, Light Duty Truck |

| Tonnage Capacities Covered | 3.5 – 7.5 Tons, 7.5 – 16 Tons, 16 – 30 Tons, Above 30 Tons |

| Fuel Types Covered | Diesel, Petrol, CNG & LNG |

| Applications Covered | Construction, Logistics, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia truck market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The truck market in Saudi Arabia was valued at USD 74.7 Billion in 2025.

The Saudi Arabia truck market is projected to exhibit a CAGR of 6.90% during 2026-2034, reaching a value of USD 136.1 Billion by 2034.

Saudi Arabia’s strategic role in regional trade, coupled with rising e-commerce activities, is driving the demand for trucks to ensure efficient goods transportation. Government projects under Vision 2030, including megacities and smart infrastructure, are creating the need for heavy-duty and specialized trucks. Additionally, increasing oil, gas, and mining activities are supporting the utilization of trucks for material and equipment transport.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)