Saudi Arabia Tube Packaging Market Size, Share, Trends and Forecast by Type, Material Type, Application, and Region, 2026-2034

Saudi Arabia Tube Packaging Market Summary:

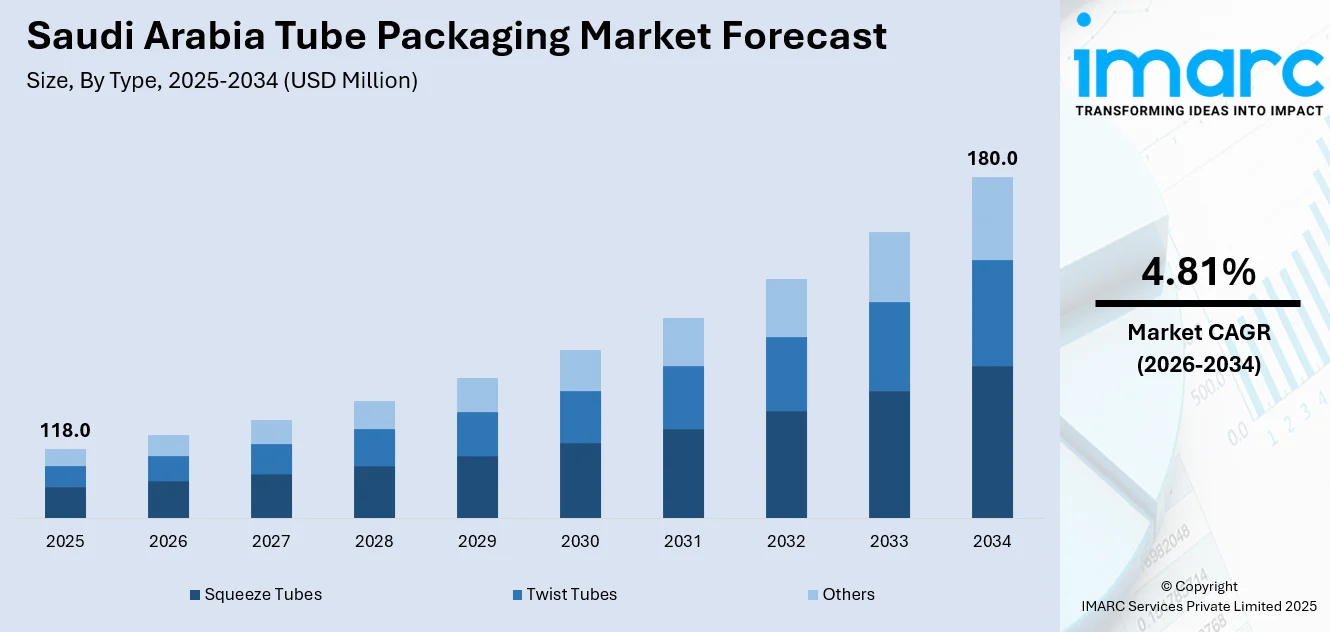

The Saudi Arabia tube packaging market size was valued at USD 118.0 Million in 2025 and is projected to reach USD 180.0 Million by 2034, growing at a compound annual growth rate of 4.81% from 2026-2034.

The market expansion is primarily driven by the heightened demand for effective cosmetics and personal care products, the government's focus on sustainable and eco-friendly packaging solutions under Vision 2030, and the rising need for hygienic packaging in the pharmaceutical and healthcare sectors. The growing urbanization rates, increasing disposable incomes, and shifting consumer preferences towards convenient and portable packaging formats are further propelling the Saudi Arabia tube packaging market share.

Key Takeaways and Insights:

- By Type: Squeeze Tubes dominate the market with a share of 48% in 2025, driven by their widespread adoption across cosmetics, personal care, and pharmaceutical applications due to ease of dispensing and portability.

- By Material Type: Plastics lead the market with a share of 60% in 2025, owing to its lightweight properties, cost-effectiveness, and versatility in various packaging applications across multiple end-use sectors.

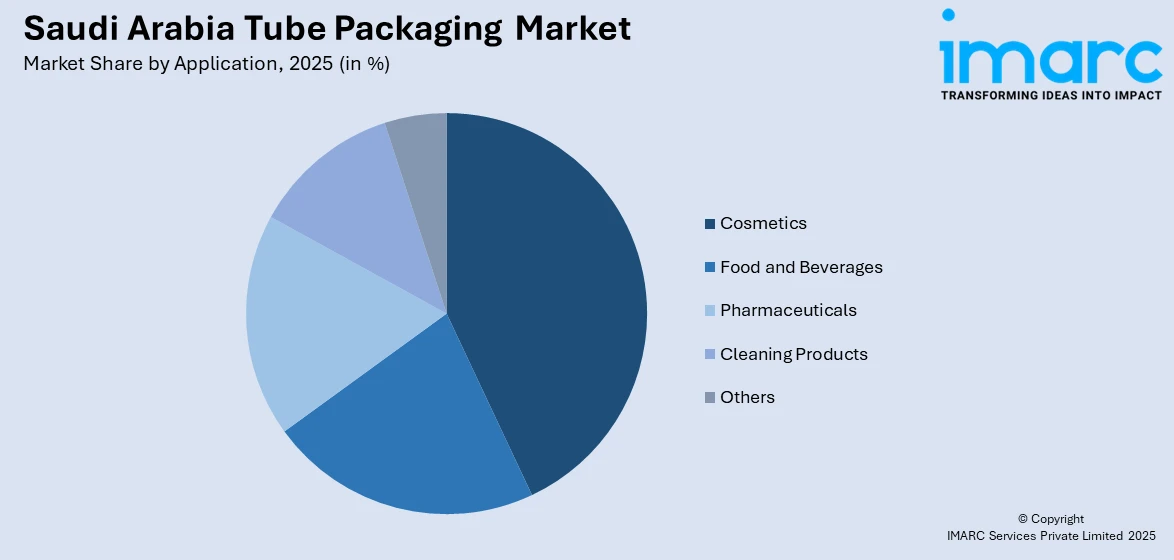

- By Application: Cosmetics represent the largest segment with a market share of 32% in 2025, supported by the growing beauty and personal care industry and rising consumer preference for premium skincare products.

- By Region: Northern and Central region dominate the market with a share of 30% in 2025, driven by the concentration of manufacturing facilities, retail networks, and consumer base in Riyadh and surrounding areas.

- Key Players: The Saudi Arabia tube packaging market exhibits moderate competitive intensity, with multinational packaging corporations competing alongside regional manufacturers across various application segments and material categories.

To get more information on this market Request Sample

The Saudi Arabia tube packaging market is experiencing robust growth driven by the convergence of multiple favorable factors. The Kingdom's young population, with over 63% under the age of 30, coupled with rising disposable incomes and increasing female workforce participation, is driving demand for cosmetics and personal care products that predominantly utilize tube packaging. The government's Vision 2030 initiative has catalyzed significant investments across the beauty, pharmaceutical, and food sectors, creating substantial opportunities for packaging manufacturers. The Saudi Food and Drug Authority's updated guidelines for cosmetic products listing in September 2024 have further streamlined regulatory procedures, enhancing market accessibility for both domestic and international brands. Additionally, the pharmaceutical sector's expansion, with the government allocating SAR 54.7 billion to healthcare development, is generating sustained demand for hygienic and tamper-evident tube packaging solutions.

Saudi Arabia Tube Packaging Market Trends:

Expanding Personal Care and Cosmetics Sector

The heightened demand for cosmetics and personal care products is significantly contributing to market growth in Saudi Arabia. Grooming and hygiene have become major concerns among the population, driven by increasing disposable incomes and expanding consciousness about global beauty trends. Domestic and international brands are introducing a broad range of products including face creams, serums, hair gels, and body lotions, predominantly packaged in tubes for convenience and hygiene. For instance, in July 2024, Henkel AG & Co. KGaA opened a new beauty care production plant in Riyadh, manufacturing Pert-branded products such as shampoos and conditioners specifically designed for the Middle Eastern market, highlighting the ongoing growth and development within the region’s personal care industry.

Increasing Focus on Sustainable and Eco-Friendly Packaging

Growing environmental consciousness among both consumers and manufacturers is driving stronger demand for sustainable tube packaging solutions in Saudi Arabia. National frameworks such as Vision 2030 and the Saudi Green Initiative are reinforcing sustainability priorities, encouraging companies to shift toward environmentally responsible packaging formats. As a result, manufacturers are increasingly adopting biodegradable and recyclable materials, including plant-based polymers, recycled plastics, and aluminum, to reduce environmental impact. These efforts reflect a broader industry transition toward circular economy principles, with packaging players prioritizing lower carbon footprints and long-term resource efficiency.

Growing Demand in Pharmaceutical and Healthcare Industry

The increasing need for tube packaging in the pharmaceutical and healthcare sector is propelling market growth. With the Kingdom's population exceeding 36 million and the rising prevalence of chronic diseases, there is steady demand for topical medications, ointments, gels, and creams requiring hygienic and secure packaging solutions. Tube packaging is widely adopted for its ability to offer precise dosage control, barrier protection, and portability, which are essential features for medical and therapeutic products. For instance, in 2024, Gulf Pharmaceutical Industries (Julphar) revealed an investment of USD 79.9 million to establish a pharmaceutical manufacturing facility in Saudi Arabia, scheduled to begin construction in early 2025, emphasizing biologics and sterile formulations that require advanced packaging solutions.

How Vision 2030 is Transforming the Saudi Arabia Tube Packaging Market:

Vision 2030 is transforming Saudi Arabia’s tube packaging market by driving local industry growth, sustainability, and innovation. Government programs boosting manufacturing and healthcare expansion are increasing demand for tubes used in cosmetics, personal care, and pharmaceuticals. Regulatory emphasis on eco-friendly materials and recycling aligns producers with sustainability goals, leading to biodegradable, recyclable tube formats and lighter-weight designs. Incentives for localization and industrial diversification under Vision 2030 attract investment in advanced packaging infrastructure and technologies, helping manufacturers reduce import reliance and enhance domestic capabilities. Rising consumer preference for green products and regulatory standards further propel the adoption of innovative, compliant tube packaging solutions across sectors.

Market Outlook 2026-2034:

Saudi Arabia’s tube packaging market is set for significant transformation, supported by rapid technological progress, shifting consumer expectations, and strong government backing. Vision 2030’s focus on localization is accelerating the expansion of domestic manufacturing, reducing dependence on imports, and strengthening supply chains. At the same time, rising foreign direct investment in key end-use industries such as cosmetics and pharmaceuticals is boosting production activity. These factors collectively are expected to drive steady demand for advanced, high-quality, and innovative tube packaging formats across the country. The market generated a revenue of USD 118.0 Million in 2025 and is projected to reach a revenue of USD 180.0 Million by 2034, growing at a compound annual growth rate of 4.81% from 2026-2034.

Saudi Arabia Tube Packaging Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Squeeze Tubes |

48% |

|

Material Type |

Plastics |

60% |

|

Application |

Cosmetics |

32% |

|

Region |

Northern and Central Region |

30% |

Type Insights:

- Squeeze Tubes

- Twist Tubes

- Others

Squeeze tubes dominates with a market share of 48% of the total Saudi Arabia tube packaging market in 2025.

Squeeze tubes dominate the Saudi Arabia tube packaging market due to their convenience, functionality, and suitability across multiple end-use industries. Their ease of dispensing, portability, and ability to maintain product hygiene make them ideal for personal care, cosmetics, pharmaceuticals, and food products. Consumers increasingly prefer packaging that offers controlled dosing and minimal product wastage, which squeeze tubes provide effectively. In a market influenced by busy urban lifestyles and premium branding, squeeze tubes also support attractive designs and labeling, enhancing shelf appeal and brand differentiation.

Additionally, squeeze tubes align well with evolving sustainability and manufacturing trends in Saudi Arabia. They are compatible with lightweight designs and a wide range of recyclable and bio-based materials, supporting national sustainability objectives. Local manufacturers benefit from established production technologies and cost-efficient mass manufacturing, enabling scalability and faster time-to-market. Their versatility in size, material composition, and barrier properties further strengthens their dominance, making squeeze tubes a preferred packaging format for both domestic brands and multinational companies operating in the Kingdom.

Material Type Insights:

- Plastics

- Paper

- Aluminum

- Others

Plastics leads with a share of 60% of the total Saudi Arabia tube packaging market in 2025.

Plastic materials maintain their dominance in the tube packaging market due to their versatile qualities, lightweight nature, and cost-effective production characteristics. High-density polyethylene (HDPE) and polyethylene terephthalate (PET) are among the most commonly used plastics for tube manufacturing, offering excellent durability, chemical resistance, and barrier properties essential for preserving product integrity. The strong domestic resin supply from major petrochemical producers such as SABIC and Sadara provides a significant cost advantage for plastic tube manufacturers operating in Saudi Arabia.

The growth of the food and personal care industries across the region is driving increased demand for polyethylene-based tube packaging. The Saudi Arabia plastics market size reached USD 6.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.9 Billion by 2034, exhibiting a growth rate (CAGR) of 2.95% during 2026-2034, and continues to support the tube packaging segment with innovations in recyclable and sustainable plastic formulations. Manufacturers are increasingly incorporating post-consumer recycled materials and ISCC+ certified polymers to meet growing sustainability requirements while maintaining performance standards.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Cosmetics

- Food and Beverages

- Pharmaceuticals

- Cleaning Products

- Others

Cosmetics exhibits clear dominance with a 32% share of the total Saudi Arabia tube packaging market in 2025.

The cosmetics application segment leads the market driven by the burgeoning beauty and personal care industry in Saudi Arabia. The Kingdom's predominantly young population, with approximately two-thirds under 35 years of age, demonstrates strong interest in personal appearance and grooming products. The Saudi Arabia cosmetics market size was valued at USD 3.97 Billion in 2025 and is projected to reach USD 4.62 Billion by 2034, growing at a compound annual growth rate of 1.71% from 2026-2034. It relies heavily on tube packaging for skincare creams, serums, sun care products, and hair care formulations. Cultural shifts, particularly increased women's workforce participation and changing beauty standards under Vision 2030, have normalized makeup application in professional and social settings.

The rising influence of social media and beauty influencers, combined with high internet penetration rates reaching 99% of the population, has transformed product discovery and purchasing patterns. Cosmetic brands are increasingly adopting innovative tube designs with airless pumps, soft-touch finishes, and premium aesthetics to appeal to sophisticated consumers. In November 2024, Kosas Cosmetics announced its official entry to the Saudi market with skincare-focused makeup products, demonstrating the continued expansion of international brands seeking localized packaging solutions.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region represents the largest share with 30% of the total Saudi Arabia tube packaging market in 2025.

The tube packaging market is dominated by the Northern and Central region, which is supported by the concentration of the manufacturing facilities, retail networks, and consumer base around the capital city of Riyadh. The dynamic economy of Riyadh, with the combination of commerce, finance, and industry, generates a huge market for tube packaging in the cosmetic, pharmaceutical, and personal care industries. The geography has the advantage of governmental investments in the non-oil industrialized areas and a major distribution centre of the packaging products within the Kingdom.

The Central region is a major player in the industrial packaging market with the growth of food processing, pharmaceutical, and consumer goods manufacturing industries. The advanced logistics and warehousing networks in Riyadh are creating the need for various packaging forms such as tubes, in cosmetics and other healthcare products. Good infrastructure, coupled with favorable government policies, still encourages packaging manufacturers who are interested in setting up or increasing the local production capacity and consolidating their grip in the regional market.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Tube Packaging Market Growing?

Expanding Beauty and Personal Care Industry

The growing beauty and personal care industry represents a primary driver of the Saudi Arabia tube packaging market. The Kingdom's youthful population, with over 60% under the age of 30 and highly connected to social media platforms, is increasingly exposed to global beauty trends and demonstrates strong demand for cosmetics and skincare products. Rising disposable incomes and increasing female workforce participation are expanding the consumer base for premium personal care products. The Saudi Arabia beauty and personal care market size was valued at USD 4.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.4 Billion by 2033, exhibiting a CAGR of 3.7% from 2025-2033., relies extensively on tube packaging for face creams, serums, moisturizers, and hair care products. For instance, in January 2025, Nice One Beauty, a leading beauty e-commerce platform in Saudi Arabia, launched an initial public offering in Riyadh, demonstrating the sector's robust growth trajectory.

Government Initiatives Promoting Healthcare Self-Sufficiency

Government initiatives under Vision 2030 are driving strong growth in Saudi Arabia’s tube packaging market by expanding pharmaceutical production and healthcare infrastructure. The development of new hospitals and medical facilities is creating sustained demand for high-quality pharmaceutical packaging solutions. Local drug manufacturing is rapidly increasing, with global and domestic companies investing in expertise transfer and local production. These efforts are enhancing the Kingdom’s capabilities in pharmaceutical packaging, supporting the production of various medical and biomedical products while promoting self-sufficiency and aligning with broader healthcare and industrial development goals.

Rising Sustainability Focus and Eco-Friendly Packaging Demand

The increasing environmental awareness among consumers and businesses is creating new opportunities for sustainable tube packaging solutions. Vision 2030's sustainability goals and the Saudi Green Initiative are pushing industries to adopt biodegradable and recyclable packaging alternatives. According to the industry report, in Saudi Arabia, 64% of consumers are concerned about environmental issues, and 63% actively sort plastic packaging for recycling. Manufacturers are increasingly adopting recyclable and bio-based materials for tube packaging to meet sustainability goals. Companies are investing in local recycling infrastructure and committing to fully sustainable raw materials, reflecting a growing industry focus on reducing environmental impact and supporting circular economy practices in Saudi Arabia.

Market Restraints:

What Challenges the Saudi Arabia Tube Packaging Market is Facing?

Volatility in Raw Material Prices

The tube packaging market faces challenges from fluctuating raw material costs, particularly for plastic resins and aluminum. Global supply chain disruptions and commodity price volatility impact production costs for tube manufacturers, affecting profit margins and pricing strategies. Despite Saudi Arabia's strong domestic petrochemical industry, international pricing dynamics and energy costs create uncertainty for packaging manufacturers seeking to maintain competitive pricing.

Stringent Regulatory Requirements

Compliance with strict regulatory standards for cosmetics and pharmaceutical packaging presents operational challenges for market participants. The Saudi Food and Drug Authority maintains rigorous quality requirements for packaging materials, particularly for products in contact with food, medicines, and cosmetics. Certification processes for biodegradable and sustainable materials remain lengthy, slowing new product introductions and limiting rapid adoption by manufacturers seeking to meet evolving sustainability regulations.

Limited Local Manufacturing Capacity

The Saudi Arabia tube packaging market continues to rely on imports for specialized materials and advanced manufacturing technologies. Despite significant investments in localization, supply chain constraints persist for food-grade recycled materials, where regional production currently fulfills only partial local requirements. The need for imported machinery and technical expertise increases operational costs and creates dependency on international supply chains, presenting challenges for manufacturers seeking to expand domestic production capabilities.

Competitive Landscape:

The Saudi Arabia tube packaging market exhibits moderate competitive intensity, characterized by the presence of multinational packaging corporations competing alongside regional manufacturers across various application segments. The market structure reflects a blend of large, integrated manufacturers with advanced production capabilities and regionally focused players serving specific end-use industries. Companies are differentiating through innovations in sustainable materials, functional design features, and customized solutions for cosmetics, pharmaceuticals, and personal care applications. Strategic partnerships between international technology providers and local manufacturers are emerging to address growing demand while meeting localization requirements under Vision 2030. Industry participants are investing in digital integration, eco-friendly materials, and capacity expansion to strengthen competitiveness and capture emerging growth opportunities.

Recent Developments:

- October 2025: FlexiTubes, the tube packaging division of UFlex Limited, India’s leading multinational in flexible packaging solutions, showcased its latest innovations in tube packaging for the beauty and personal care sector at the 29th edition of Beautyworld Middle East, which took place from October 27 to 29, 2025, at the Dubai World Trade Centre.

- May 2025: Napco National showcased sustainable packaging solutions at SustPack MENA 2025, highlighting biodegradable materials and circular economy initiatives aligned with Vision 2030 environmental targets for regional manufacturing operations.

Saudi Arabia Tube Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Squeeze Tubes, Twist Tubes, Others |

| Material Types Covered | Plastics, Paper, Aluminum, Others |

| Applications Covered | Cosmetics, Food and Beverages, Pharmaceuticals, Cleaning Products, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia tube packaging market size was valued at USD 118.0 Million in 2025.

The Saudi Arabia tube packaging market is expected to grow at a compound annual growth rate of 4.81% from 2026-2034 to reach USD 180.0 Million by 2034.

Squeeze tubes dominated the market with a 48% share in 2025, driven by their widespread adoption across cosmetics, personal care, and pharmaceutical applications due to convenience, ease of dispensing, and portability.

Key factors driving the Saudi Arabia tube packaging market include the expanding beauty and personal care industry, government investments in healthcare and pharmaceutical manufacturing under Vision 2030, and the increasing focus on sustainable and eco-friendly packaging solutions.

Major challenges include volatility in raw material prices affecting production costs, stringent regulatory requirements for cosmetics and pharmaceutical packaging, limited local manufacturing capacity for specialized materials, and lengthy certification processes for sustainable packaging solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)