Saudi Arabia Vegan Chocolate Market Size, Share, Trends and Forecast by Chocolate Type, Nature, Sales Channel, and Region, 2026-2034

Saudi Arabia Vegan Chocolate Market Overview:

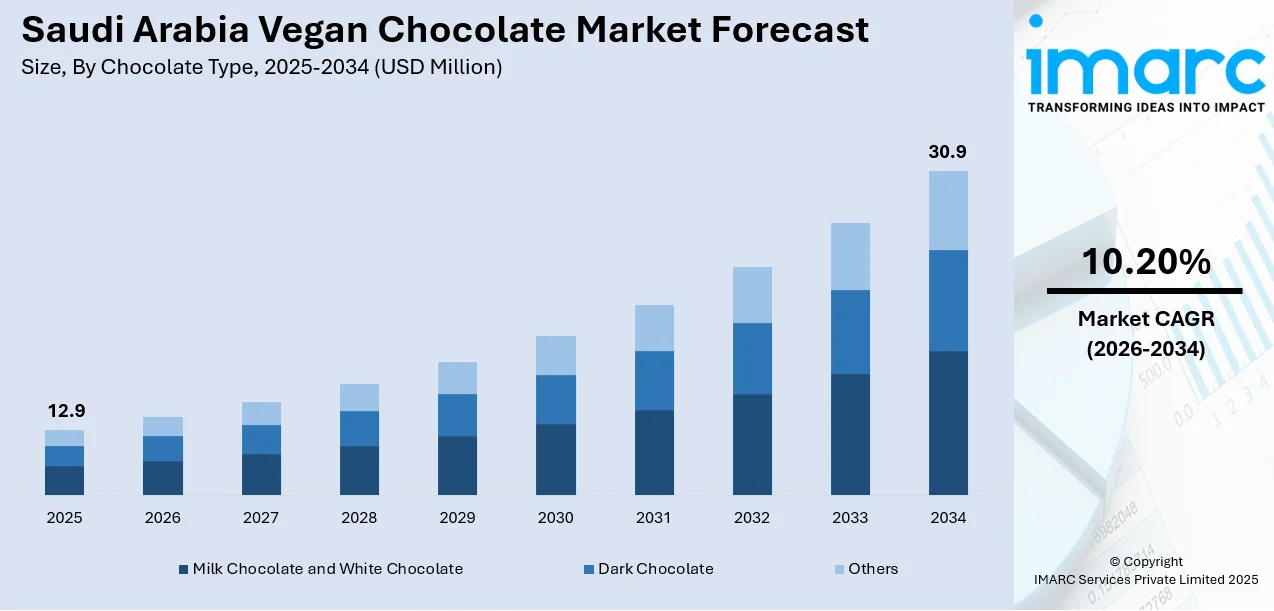

The Saudi Arabia vegan chocolate market size reached USD 12.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 30.9 Million by 2034, exhibiting a growth rate (CAGR) of 10.20% during 2026-2034. The market is driven by increasing health awareness and increasingly Saudi consumers preference for vegetarian diets in urban areas. Also, the growing prevalence of lactose intolerance and ethical issues surrounding products containing animal ingredients is further stimulating demand for dairy-free chocolate substitutes. In addition to this, continual product innovations, growing retail availability, and global wellness trends are key factors augmenting the Saudi Arabia vegan chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 12.9 Million |

| Market Forecast in 2034 | USD 30.9 Million |

| Market Growth Rate 2026-2034 | 10.20% |

Saudi Arabia Vegan Chocolate Market Trends:

Premiumization and Product Innovations

The market is undergoing significant premiumization, driven by affluent consumers seeking novel and indulgent plant-based experiences. Rather than basic dark chocolate bars, consumers are shifting toward artisanal formats, gourmet flavor profiles, and aesthetically packaged products that signal quality and exclusivity. This is prompting manufacturers to experiment with diverse ingredients such as single-origin cocoa beans, infused flavors like sea salt caramel or chili, and exotic inclusions like quinoa, turmeric, or dried berries. Besides this, the packaging of these products often mirrors luxury confectionery, with matte finishes, gold accents, and minimalist designs, appealing to image-conscious consumers. Moreover, local brands and international entrants are also leveraging advanced production techniques, such as cold-pressed processing or stone grinding, to preserve nutritional value and enhance texture. This focus on innovation expands market share in high-income urban segments, including Riyadh, Jeddah, and Dammam, where premium retail outlets are more pronounced.

To get more information on this market Request Sample

Expansion of Retail and E-Commerce Channels

The availability of vegan chocolate across diversified retail formats is significantly impacting Saudi Arabia vegan chocolate market growth. Earlier limited to niche health food stores or specialty import sections, vegan chocolate is now accessible through mainstream supermarket chains, gourmet confectionery shops, and hypermarkets. This increased shelf visibility is normalizing vegan products and positioning them as viable alternatives within the broader confectionery category. In parallel, e-commerce growth, accelerated by changing consumer behavior post-COVID-19, has made it easier for both domestic and international vegan brands to penetrate the Saudi market. Online platforms offer curated selections of plant-based chocolates, often with user reviews, ingredient transparency, and product certifications clearly displayed. Moreover, the emergence of vegan-focused local e-retailers and delivery apps is creating dedicated spaces for ethical and health-driven shopping experiences. As logistics infrastructure and payment options improve, digital retail will play an increasingly central role in market outreach, brand education, and consumer retention.

Health and Wellness-Driven Consumption

The shift toward healthier lifestyles is a core trend shaping the market development in Saudi Arabia. Consumers are increasingly scrutinizing food labels and seeking products with natural, plant-based ingredients, free from animal derivatives, artificial additives, and excessive sugars. Vegan chocolates, often perceived as cleaner alternatives to conventional options, cater to these preferences by incorporating organic cocoa, plant-based sweeteners like coconut sugar or dates, and dairy substitutes such as almond or oat milk. As per industry reports, the prevalence of diabetes in the Kingdom stands at 23.1% among adults. The increase in diet-related conditions, including obesity, diabetes, and lactose intolerance, is contributing to greater demand for functional and allergen-free confectionery products. Health-conscious consumers increasingly regard vegan chocolate as a guilt-free indulgence that fits within their dietary restrictions and wellness goals. As a result, manufacturers are increasingly reformulating their products to include added nutritional benefits such as high fiber content, antioxidant-rich superfoods, or low glycemic sweeteners, which help reinforce a health-driven value proposition.

Saudi Arabia Vegan Chocolate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on chocolate type, nature, and sales channel.

Chocolate Type Insights:

- Milk Chocolate and White Chocolate

- Dark Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the chocolate type. This includes milk chocolate and white chocolate, dark chocolate, and others.

Nature Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the nature have also been provided in the report. This includes organic and conventional.

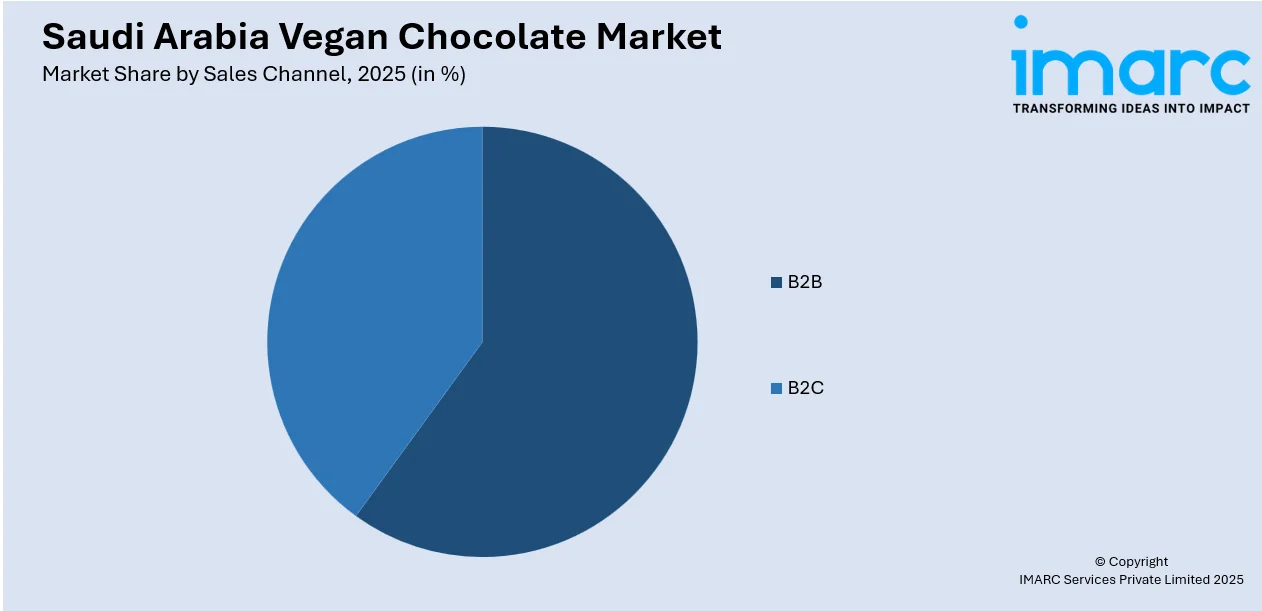

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- B2B

- B2C

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes B2B and B2C (supermarkets and hypermarkets, convenience stores, online stores, and others).

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Vegan Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chocolate Types Covered | Milk Chocolate and White Chocolate, Dark Chocolate, Others |

| Natures Covered | Organic, Conventional |

| Sales Channels Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia vegan chocolate market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia vegan chocolate market on the basis of chocolate type?

- What is the breakup of the Saudi Arabia vegan chocolate market on the basis of nature?

- What is the breakup of the Saudi Arabia vegan chocolate market on the basis of sales channel?

- What is the breakup of the Saudi Arabia vegan chocolate market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia vegan chocolate market?

- What are the key driving factors and challenges in the Saudi Arabia vegan chocolate market?

- What is the structure of the Saudi Arabia vegan chocolate market and who are the key players?

- What is the degree of competition in the Saudi Arabia vegan chocolate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia vegan chocolate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia vegan chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia vegan chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)