Saudi Arabia Video Conferencing Market Size, Share, Trends and Forecast by Component, Conference Type, Deployment Mode, Enterprise Size, Application, End-Use, and Region, 2026-2034

Saudi Arabia Video Conferencing Market Summary:

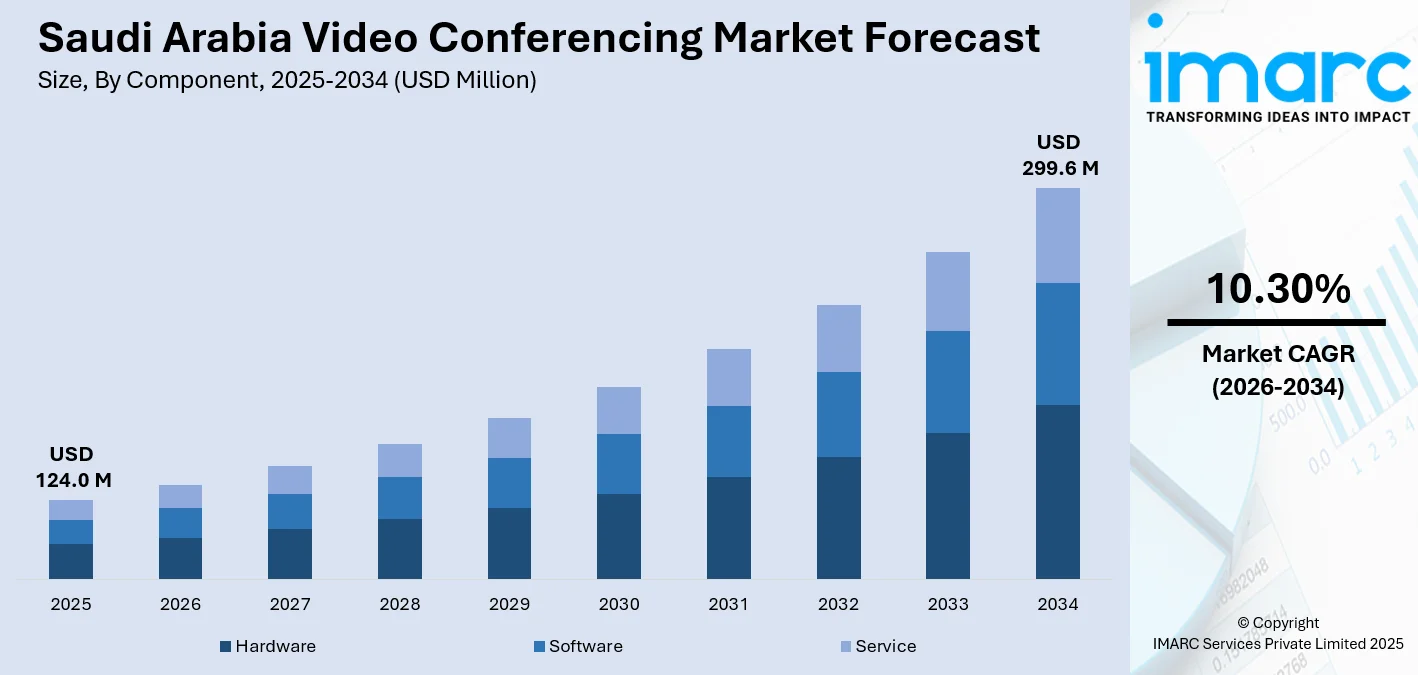

The Saudi Arabia video conferencing market size was valued at USD 124.0 Million in 2025 and is projected to reach USD 299.6 Million by 2034, growing at a compound annual growth rate of 10.30% from 2026-2034.

The Saudi Arabia video conferencing market is experiencing robust expansion as digital transformation initiatives reshape communication infrastructure across sectors. Government-led modernization efforts under Vision 2030 are driving widespread adoption of virtual collaboration tools in corporate, educational, and governmental applications. Increasing internet penetration and enhanced connectivity infrastructure support seamless deployment of advanced video communication solutions. The shift toward hybrid work models and decentralized operations is accelerating demand for reliable conferencing platforms. Growing emphasis on operational efficiency and cost reduction continues to fuel the Saudi Arabia video conferencing market share.

Key Takeaways and Insights:

- By Component: Software dominates the market with a share of 44% in 2025, driven by increasing enterprise adoption of cloud-based collaboration platforms and integrated communication suites. Organizations prefer software solutions for their scalability, regular feature updates, and seamless integration capabilities.

- By Conference Type: Desktop system leads the market with a share of 35% in 2025, owing to widespread deployment across individual workstations and home office environments. Desktop systems offer accessibility for distributed teams and support flexible work arrangements across the Kingdom.

- By Deployment Mode: Cloud-based exhibits a clear dominance with 61% share in 2025, reflecting organizational preferences for flexible, scalable solutions that minimize infrastructure investments. Cloud deployment enables rapid implementation and supports geographically dispersed operations efficiently.

- By Enterprise Size: Large enterprises represent the biggest segment with a market share of 57% in 2025, attributed to substantial technology budgets, complex communication requirements, and need for enterprise-grade security features. Large corporations drive demand for comprehensive unified communication platforms.

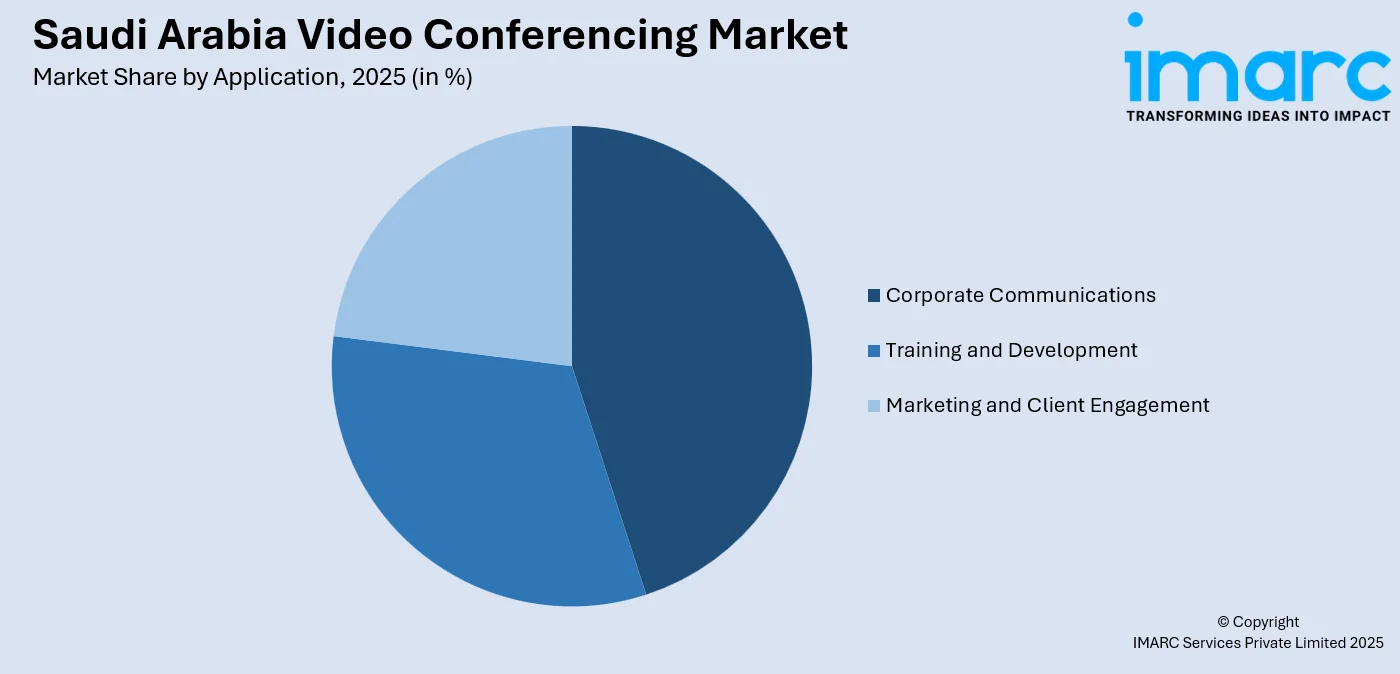

- By Application: Corporate communication dominates the market with a share of 40% in 2025, reflecting the essential role of video conferencing in facilitating internal collaboration, stakeholder engagement, and business continuity across organizational hierarchies within Saudi enterprises.

- By End-Use: Corporate is the largest segment with 26% share in 2025, driven by sustained enterprise investment in digital communication infrastructure and the widespread normalization of virtual meetings in business operations throughout the Kingdom.

- By Region: Northern and Central Region leads the market with 34% share in 2025, supported by Riyadh's concentration of corporate headquarters, government institutions, and technology infrastructure that drives adoption of advanced video conferencing solutions.

- Key Players: Leading players in the Saudi Arabia video conferencing market focus on expanding product portfolios, enhancing AI-powered features, and strengthening regional presence through data center investments. Strategic partnerships with local enterprises and compliance with data residency requirements position these players to capture growing demand across corporate, educational, and government sectors.

To get more information on this market Request Sample

The Saudi Arabia video conferencing market is witnessing accelerated growth as the Kingdom advances its digital transformation agenda under Vision 2030. Enterprise digitization initiatives are reshaping how organizations communicate and collaborate, with video conferencing becoming integral to operational workflows. The expansion of high-speed internet infrastructure and nationwide 5G rollout is enhancing connectivity quality and enabling seamless virtual interactions across urban and remote locations. In February 2025, Zoom announced a USD 75 Million investment in Saudi Arabia during the LEAP conference in Riyadh, focusing on AI-driven innovation and establishing new data centers to support local technology firms and government entities. Growing emphasis on flexible work arrangements and remote collaboration models is increasing demand for reliable conferencing platforms across corporate, educational, and healthcare sectors. The Kingdom's substantial investments in smart city development and digital infrastructure are creating favorable conditions for widespread video conferencing adoption. Increasing awareness of operational efficiency benefits and cost optimization potential further strengthens adoption momentum across diverse industry verticals throughout the region.

How Vision 2030 is Transforming the Saudi Arabia Video Conferencing Market:

Saudi Arabia's Vision 2030 framework is fundamentally reshaping the video conferencing landscape by prioritizing digital transformation across all economic sectors. The national agenda emphasizes modernizing government services, enhancing educational infrastructure, and building a knowledge-based economy, all requiring robust virtual collaboration capabilities. Government mandates for digitization in public administration have accelerated adoption of video communication platforms for interdepartmental coordination and citizen services. The transformation program's focus on workforce development and female labor participation expansion has increased demand for remote work enablement technologies. Smart city initiatives, including NEOM and other giga-projects, integrate advanced video conferencing infrastructure into their design frameworks, establishing new standards for connected communities and digital workplaces throughout the Kingdom.

Saudi Arabia Video Conferencing Market Trends:

Integration of Artificial Intelligence and Automation

Video conferencing platforms are increasingly incorporating artificial intelligence capabilities to enhance user experience and productivity. AI-powered features including automatic transcription, real-time language translation, intelligent meeting summaries, and facial recognition are becoming standard offerings. These smart functionalities enable participants to focus on discussions while automated systems handle documentation and translation tasks. Arabic language AI capabilities are gaining prominence as providers customize solutions for regional requirements. The integration of machine learning algorithms for noise cancellation, background blur, and engagement analytics is elevating meeting quality across enterprise deployments.

Expansion of Hybrid Work and Remote Collaboration Models

The normalization of hybrid work environments is fundamentally transforming organizational communication patterns across Saudi Arabia. Enterprises are adopting flexible work policies that combine in-office and remote arrangements, requiring video conferencing as the primary collaboration medium. This shift extends beyond corporate environments into education, healthcare, and government sectors where virtual engagement has become integral to operations. Organizations are investing in comprehensive unified communication platforms that bridge physical and digital workspaces seamlessly. The trend reflects broader cultural shifts toward work-life balance and the Saudi Arabia video conferencing market growth potential in distributed workforce enablement.

Rising Demand for Webinars and Virtual Events

Organizations across Saudi Arabia are increasingly leveraging video conferencing platforms to host large-scale webinars, virtual conferences, and online training programs. This trend reflects growing recognition of digital channels for marketing, professional development, and stakeholder engagement. Educational institutions utilize virtual classroom capabilities to reach geographically dispersed students and deliver flexible learning experiences. Corporate training departments adopt video platforms to deliver scalable employee development programs efficiently. The emergence of specialized features for managing large audiences, interactive polling, and registration integration supports this expanding use case across multiple sectors throughout the Kingdom.

Market Outlook 2026-2034:

The Saudi Arabia video conferencing market outlook remains highly promising as digital transformation continues accelerating across all economic sectors. Sustained government investment in technology infrastructure, coupled with private sector modernization efforts, creates favorable conditions for market expansion. The market generated a revenue of USD 124.0 Million in 2025 and is projected to reach a revenue of USD 299.6 Million by 2034, growing at a compound annual growth rate of 10.30% from 2026-2034. Advanced technological features including artificial intelligence integration, enhanced security protocols, and improved interoperability will drive platform differentiation. Increasing demand from healthcare, education, and government sectors diversifies the adoption base beyond traditional corporate applications. Local data center establishments and Arabic language capabilities strengthen regional market positioning. The continued evolution of work patterns toward flexible arrangements ensures sustained demand momentum throughout the forecast period.

Saudi Arabia Video Conferencing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Software | 44% |

| Conference Type | Desktop System | 35% |

| Deployment Mode | Cloud-Based | 61% |

| Enterprise Size | Large Enterprises | 57% |

| Application | Corporate Communication | 40% |

| End-Use | Corporate | 26% |

| Region | Northern and Central Region | 34% |

Component Insights:

- Hardware

- Camera

- Microphone/Headphone

- Others

- Software

- Service

- Professional Services

- Managed Services

Software dominates with a market share of 44% of the total Saudi Arabia video conferencing market in 2025.

The software segment's dominance reflects the increasing preference for cloud-based collaboration platforms that offer comprehensive communication capabilities without substantial hardware investments. Organizations across Saudi Arabia favor software solutions for their flexibility, regular feature enhancements, and seamless integration with existing enterprise applications. The growing sophistication of software platforms enables organizations to consolidate multiple communication functions into unified solutions, reducing operational complexity while enhancing collaboration effectiveness. In March 2024, Zoom expanded its services in Saudi Arabia by launching AI Companion, Zoom Phone, and Zoom Contact Center, demonstrating the growing demand for integrated software solutions that address diverse organizational communication requirements throughout the Kingdom.

Enterprise adoption of software-based video conferencing continues accelerating as businesses recognize the operational advantages of unified communication platforms. The software segment benefits from lower implementation barriers, enabling organizations of all sizes to deploy advanced conferencing capabilities rapidly. Continuous platform improvements incorporating artificial intelligence features, enhanced security protocols, and improved user interfaces strengthen software's competitive position. The shift toward subscription-based models provides predictable costs while ensuring access to latest functionalities and updates.

Conference Type Insights:

- Telepresence System

- Integrated System

- Desktop System

- Service-Based System

Desktop system leads with a share of 35% of the total Saudi Arabia video conferencing market in 2025.

Desktop systems maintain market leadership as organizations equip individual workstations with video conferencing capabilities to support distributed workforce communication. The proliferation of hybrid work arrangements has increased demand for personal conferencing solutions that enable professionals to participate in meetings from various locations. Saudi Arabia's expanding e-learning sector further drives desktop system adoption, with virtual classrooms requiring individual video communication capabilities across educational institutions. The growing emphasis on remote collaboration has positioned desktop systems as essential tools for maintaining productivity and engagement across geographically dispersed teams throughout the Kingdom.

The desktop segment benefits from cost-effectiveness and ease of deployment compared to room-based systems. Organizations recognize that desktop solutions provide essential conferencing functionality while minimizing infrastructure requirements. Desktop platforms integrate seamlessly with productivity applications, enabling users to transition between communication and work tasks efficiently. In 2025, stc Group announced major 5G network expansion across 75 cities using Juniper Networks solutions, enhancing connectivity that supports reliable desktop video conferencing throughout the Kingdom's diverse geographic regions and enabling seamless participation in virtual meetings.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The cloud-based exhibits a clear dominance with a 61% share of the total Saudi Arabia video conferencing market in 2025.

Cloud-based deployment dominates as organizations seek scalable, flexible solutions that reduce infrastructure investments while providing enterprise-grade capabilities. The cloud model enables rapid implementation and supports geographically distributed operations essential for Saudi Arabia's expanding business landscape. Organizations benefit from reduced capital expenditure requirements as cloud solutions eliminate the need for dedicated on-premises servers and specialized technical personnel for system maintenance. The subscription-based pricing structure allows businesses to align communication expenses with operational budgets predictably.

The segment's growth is reinforced by Saudi Arabia's substantial investments in data center infrastructure and cloud computing capabilities aligned with Vision 2030 objectives. Cloud platforms offer automatic updates, ensuring organizations always access latest features without manual intervention. Enhanced security measures implemented by major cloud providers address enterprise concerns regarding data protection and regulatory compliance. The operational flexibility of cloud deployment allows businesses to scale conferencing capacity based on actual usage requirements efficiently. Additionally, cloud solutions facilitate seamless collaboration across multiple devices and locations, supporting the mobile workforce trends prevalent across Saudi enterprises while ensuring consistent user experiences regardless of access point.

Enterprise Size Insights:

- Large Enterprises

- SME (Small and Medium-sized Enterprises)

Large enterprises represent the leading segment with a 57% share of the total Saudi Arabia video conferencing market in 2025.

Large enterprises drive market demand through substantial technology investments and complex communication requirements spanning multiple locations and business units. These organizations require enterprise-grade security features, administrative controls, and integration capabilities that sophisticated conferencing platforms provide. Major corporations in Saudi Arabia have established comprehensive digital communication strategies incorporating video conferencing as core infrastructure supporting daily operations across diverse functional areas and geographic locations. The scale of large enterprise operations necessitates robust platforms capable of handling high-volume concurrent meetings while maintaining consistent quality standards.

The segment benefits from regulatory compliance requirements that mandate secure communication channels for sensitive business discussions. Large enterprises increasingly adopt unified communication platforms consolidating video, voice, and messaging capabilities into integrated solutions. Corporate organizations prioritize vendor relationships offering dedicated support, customization options, and service level agreements that meet enterprise operational standards. Growing emphasis on digital transformation within Saudi Arabia's largest companies sustains robust demand for advanced conferencing solutions. Additionally, large enterprises leverage video conferencing for international business development, connecting with global partners and clients while reducing travel expenditures significantly.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Corporate Communications

- Training and Development

- Marketing and Client Engagement

Corporate communication dominates with a market share of 40% of the total Saudi Arabia video conferencing market in 2025.

Corporate communication applications lead market demand as organizations rely on video conferencing for internal collaboration, management meetings, and stakeholder engagement activities. The segment encompasses routine team meetings, executive communications, project coordination, and cross-departmental interactions essential to business operations. Video conferencing has become integral to corporate workflows, enabling efficient communication across organizational hierarchies without geographic constraints limiting participation. The ability to facilitate real-time discussions among dispersed team members strengthens organizational cohesion and accelerates decision-making processes throughout Saudi enterprises.

Saudi corporations have institutionalized video conferencing as standard practice for regular business communications, board meetings, and investor relations activities. The corporate sector's adoption reflects recognition of productivity benefits and cost savings compared to traditional in-person meetings requiring travel. Enterprise communication platforms now incorporate features specifically designed for corporate applications including meeting scheduling integration, attendance tracking, and compliance recording capabilities supporting governance requirements. Organizations increasingly utilize video conferencing for client presentations, vendor negotiations, and partnership discussions, expanding the scope of corporate communication applications beyond internal collaboration to external business engagement activities.

End-Use Insights:

- Corporate

- Education

- Healthcare

- Government and Defense

- BFSI

- Media and Entertainment

- Others

Corporate leads with a share of 26% of the total Saudi Arabia video conferencing market in 2025.

The corporate sector maintains market leadership through sustained investment in digital communication infrastructure supporting business operations across Saudi Arabia's diverse industry landscape. Organizations have embedded video conferencing into daily workflows, transforming communication patterns from occasional virtual meetings to regular collaboration practices. The corporate segment's adoption reflects both operational necessity and strategic recognition of video conferencing's role in enabling competitive business operations. Companies across banking, retail, manufacturing, and professional services sectors increasingly depend on video conferencing for maintaining operational continuity and workforce connectivity.

Corporate end-users increasingly demand advanced features including AI-powered meeting assistants, integrated productivity tools, and comprehensive analytics capabilities. The segment drives platform innovation as enterprises articulate sophisticated requirements that shape product development priorities. Saudi corporations are implementing organization-wide conferencing standards ensuring consistent communication experiences across departments and locations. Integration with enterprise systems including calendar applications, customer relationship management, and project management platforms enhances corporate adoption value. Furthermore, corporate users expect seamless mobile accessibility, enabling executives and employees to participate in critical meetings regardless of physical location while maintaining professional communication standards.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region dominates with a market share of 34% of the total Saudi Arabia video conferencing market in 2025.

The Northern and Central Region maintains market leadership driven by Riyadh's concentration of corporate headquarters, government ministries, and technology infrastructure. The capital serves as the Kingdom's primary business hub, housing major enterprises and public sector institutions requiring extensive video conferencing capabilities. Advanced telecommunications infrastructure and high-speed connectivity support seamless virtual communication across the region, positioning it as the focal point for video conferencing market development in Saudi Arabia. The region's economic significance attracts technology providers establishing regional operations and support centers to serve concentrated customer bases effectively.

Government digitization initiatives centered in Riyadh accelerate video conferencing adoption across public sector organizations and affiliated agencies. The presence of major financial institutions, multinational corporations, and technology companies creates substantial demand for sophisticated communication solutions meeting international business standards. Educational institutions and healthcare facilities throughout the region increasingly implement video conferencing for remote learning and telemedicine applications. The Northern and Central Region's infrastructure advantages, including reliable power supply and robust internet connectivity, ensure consistent video conferencing performance. Ongoing smart city developments and technology zone establishments further strengthen the region's position as the primary market for advanced video communication solutions.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Video Conferencing Market Growing?

Rising Demand from Healthcare and Education Sectors

The expanding adoption of video conferencing across healthcare and education sectors is significantly contributing to market growth in Saudi Arabia. Healthcare institutions are increasingly implementing telemedicine and virtual consultation services to extend medical expertise to patients in remote and underserved areas. Video conferencing enables specialists to conduct remote diagnoses, follow-up consultations, and multidisciplinary case discussions, improving healthcare accessibility and reducing patient travel requirements. Hospitals and clinics utilize virtual platforms for staff training, medical conferences, and coordination between facilities across different regions. The healthcare sector's digital transformation priorities emphasize telehealth capabilities as essential infrastructure for modern patient care delivery. Furthermore, educational institutions across the Kingdom are integrating video conferencing into teaching methodologies, supporting hybrid learning models that combine in-person and virtual instruction. Universities and schools leverage virtual classrooms for remote lectures, collaborative learning sessions, and international academic partnerships. Corporate training departments adopt video platforms for employee development programs, compliance training, and skills enhancement initiatives. The education sector's embrace of digital learning tools creates sustained demand for reliable video conferencing solutions. Professional development organizations and certification bodies increasingly deliver courses through virtual platforms, expanding educational accessibility throughout Saudi Arabia.

Expanding Technology Infrastructure and Connectivity Enhancement

Saudi Arabia's substantial investments in technology infrastructure are creating favorable conditions for video conferencing market expansion. Nationwide 5G network deployment is dramatically improving connectivity quality, enabling high-definition video communication across urban and remote locations. Data center developments throughout the Kingdom address data residency requirements while improving service delivery performance. Telecommunications operators are continuously upgrading network capacity to support growing video traffic demands from enterprise and consumer applications. Internet penetration rates approaching universal coverage ensure broad population access to video conferencing services. Infrastructure investments extend to enterprise-grade connectivity solutions enabling businesses to implement reliable conferencing capabilities. The Kingdom's focus on becoming a regional technology hub attracts international providers establishing local presence and infrastructure supporting market growth.

Shift Toward Hybrid Work and Remote Collaboration Models

The widespread adoption of hybrid and remote work arrangements is fundamentally transforming organizational communication patterns across Saudi Arabia. Enterprises are implementing flexible work policies combining in-office and remote arrangements, requiring video conferencing as the primary medium for team collaboration and business communication. This structural shift reflects broader workforce evolution toward flexibility and work-life balance considerations. Organizations recognize productivity benefits and talent acquisition advantages offered by flexible work models enabled by reliable video conferencing. The transition extends beyond traditional corporate environments into education, healthcare, and professional services where virtual engagement has become integral to service delivery. Hybrid work normalization creates sustained demand for conferencing solutions as organizations institutionalize virtual collaboration practices. Employee expectations for flexible work arrangements continue strengthening, ensuring ongoing investment in video communication infrastructure across diverse industry sectors.

Market Restraints:

What Challenges the Saudi Arabia Video Conferencing Market is Facing?

Data Security and Privacy Concerns

Organizations across Saudi Arabia face significant concerns regarding data security and privacy protection when implementing video conferencing solutions. The transmission of sensitive business discussions, confidential information, and proprietary data through virtual platforms creates vulnerability risks requiring robust security measures. Compliance with national data protection regulations and sector-specific security requirements adds complexity to platform selection and implementation processes. Security incidents involving unauthorized access and data breaches on certain platforms have heightened organizational caution regarding video conferencing adoption.

Integration Challenges with Legacy Systems

Many organizations encounter difficulties integrating modern video conferencing platforms with existing enterprise systems and legacy infrastructure. Compatibility issues between new collaboration tools and established workflows create operational disruptions and implementation delays. The requirement for seamless integration with customer relationship management, enterprise resource planning, and industry-specific applications complicates platform deployment. Organizations must invest in customization and middleware solutions to achieve desired integration outcomes, increasing implementation costs and complexity.

Digital Infrastructure Disparities in Remote Regions

Despite significant infrastructure investments, disparities in connectivity quality persist between major urban centers and remote or less developed regions across Saudi Arabia. Organizations with operations in geographically dispersed locations face inconsistent video conferencing experiences due to varying network conditions. Limited bandwidth availability in certain areas affects video quality, causes latency issues, and disrupts meeting continuity. These infrastructure gaps constrain widespread adoption and create challenges for organizations seeking consistent communication experiences across all locations.

Competitive Landscape:

The Saudi Arabia video conferencing market features intense competition among global technology providers and regional solution specialists seeking to capture growing demand. Market participants differentiate through platform capabilities, AI-powered features, security certifications, and local infrastructure investments. Strategic partnerships with system integrators and value-added resellers expand market reach across diverse customer segments. Providers are investing in Arabic language capabilities and culturally appropriate features to enhance regional relevance. Data center establishments within the Kingdom address data residency requirements and improve service delivery performance for local customers. Competitive strategies increasingly emphasize integrated unified communication offerings that combine video, voice, and messaging capabilities into comprehensive collaboration platforms. Vendors focus on vertical-specific solutions tailored to healthcare, education, government, and corporate requirements. Customer acquisition efforts target digital transformation initiatives across public and private sectors, with providers positioning as strategic partners supporting organizational modernization objectives throughout the Kingdom.

Saudi Arabia Video Conferencing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Conference Types Covered | Telepresence System, Integrated System, Desktop System, Service-Based System |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Enterprise Sizes Covered | Large Enterprises, SME (Small and Medium-Sized Enterprises) |

| Applications Covered | Corporate Communication, Training and Development, Marketing and Client Engagement |

| End-Uses Covered | Corporate, Education, Healthcare, Government and Defense, BFSI, Media and Entertainment, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia video conferencing market size was valued at USD 124.0 Million in 2025.

The Saudi Arabia video conferencing market is expected to grow at a compound annual growth rate of 10.30% from 2026-2034 to reach USD 299.6 Million by 2034.

Software dominated the market with a share of 44%, driven by enterprise preferences for cloud-based collaboration platforms offering scalability, regular feature updates, and seamless integration with existing business applications.

Key factors driving the Saudi Arabia video conferencing market include government-led digital transformation initiatives under Vision 2030, expanding technology infrastructure and 5G deployment, increasing adoption of hybrid work models, and growing demand across corporate, education, and healthcare sectors.

Major challenges include data security and privacy concerns, integration difficulties with legacy enterprise systems, digital infrastructure disparities in remote regions, and organizational readiness barriers for full video conferencing adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)