Saudi Arabia Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2026-2034

Saudi Arabia Watch Market Summary:

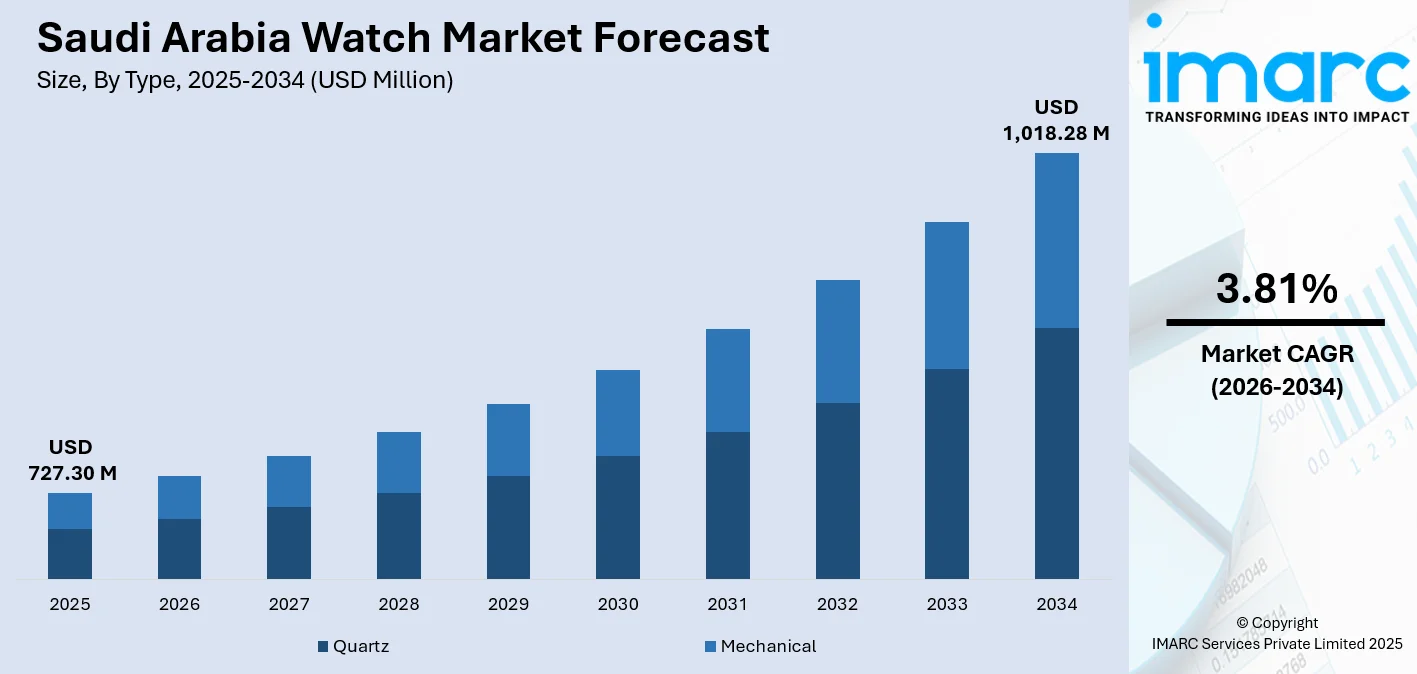

The Saudi Arabia watch market size was valued at USD 727.30 Million in 2025 and is projected to reach USD 1,018.28 Million by 2034, growing at a compound annual growth rate of 3.81% from 2026-2034.

The Saudi Arabian market is experiencing robust growth as watches represent a major segment of the luxury goods and personal accessories sector, characterized by strong user affinity for both traditional timepieces and emerging mechanical technologies. Market growth is also supported by rising disposable incomes, growing fashion consciousness among younger demographics, increasing tourism activity, and the Kingdom's economic diversification initiatives under Vision 2030 that have elevated spending patterns, thereby expanding the Saudi Arabian watch market share.

Key Takeaways and Insights:

- By Type: Quartz dominates the market with a share of 63% in 2025, reflecting widespread preference for affordable precision timepieces offering reliable performance and minimal maintenance requirements across diverse price segments.

- By Price Range: Low-range leads the market with a share of 40% in 2025, driven by mass-market accessibility, aspirational purchasing behavior among middle-income consumers, and the proliferation of fashion-forward affordable brands targeting younger buyers.

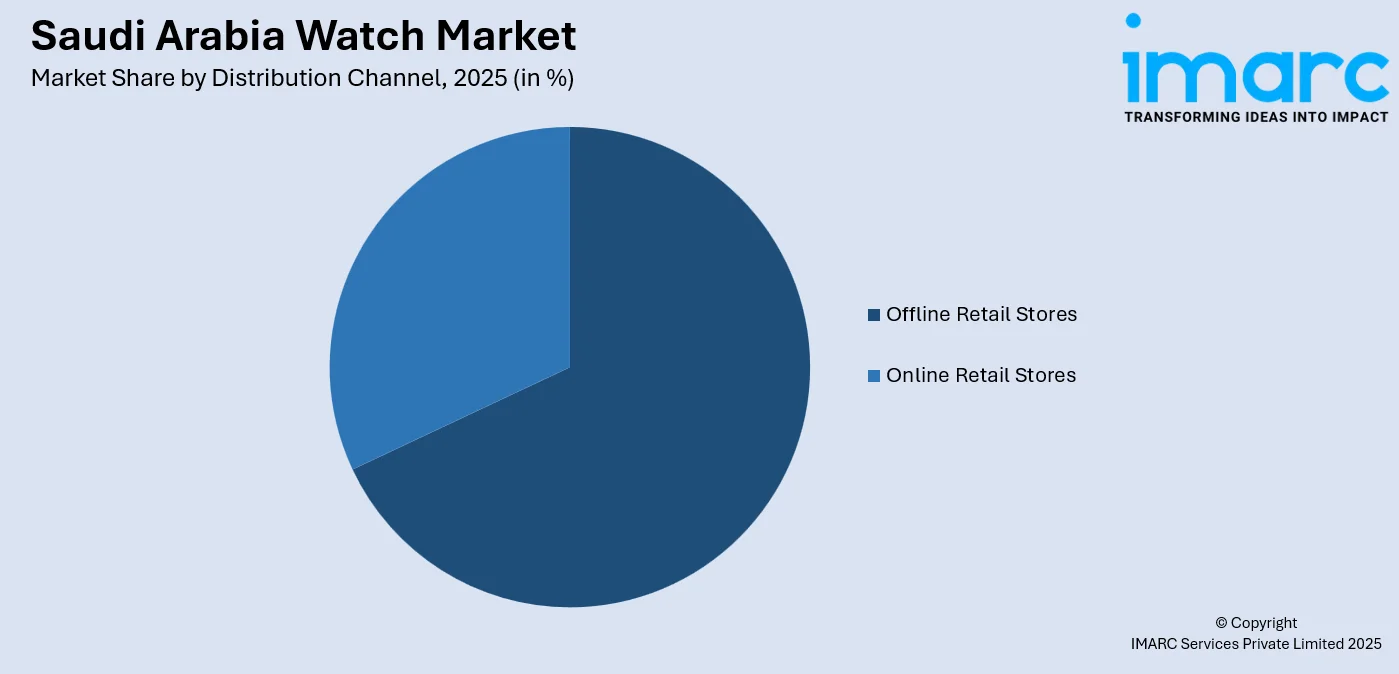

- By Distribution Channel: Offline retail stores represent the largest segment with a market share of 68% in 2025, sustained by consumer preference for tactile product examination, immediate purchase gratification, and the prestige associated with in-store luxury shopping experiences.

- By End User: Men dominate the market with a share of 51% in 2025, reflecting traditional gifting practices, professional dress code expectations, and cultural preferences that position watches as essential masculine accessories signaling status and sophistication.

- By Region: Northern and Central Region accounts for the largest market share of 30% in 2025, propelled by Riyadh's concentrated purchasing power, higher urbanization rates, extensive retail infrastructure, and the capital city's role as the Kingdom's commercial epicenter.

- Key Players: The Saudi Arabia watch market exhibits significant competitive diversity, with established Swiss luxury manufacturers competing alongside Japanese precision brands, emerging smartwatch innovators, and regional fashion accessory distributors across multiple price tiers and consumer segments. Some of the key market players include Apple Inc., Casio Computer Co. Ltd., Citizen Watch Co. Ltd., Movado Group Inc., Rolex SA, Samsung Electronics Co. Ltd., and Seiko Watch Corporation (Seiko Group Corporation).

To get more information on this market Request Sample

The Saudi Arabian watch market continues its steady trajectory as user preferences evolve beyond mere timekeeping functionality toward expressions of personal identity, social status, and technological sophistication. The market benefits from the Kingdom's young, digitally-engaged population that demonstrates growing appetite for both heritage craftsmanship and cutting-edge wearable technology. Moreover, traditional retail channels maintain dominance despite e-commerce growth, as physical stores provide experiential value particularly important for luxury and mid-range segments. The market landscape reflects Saudi Arabia's broader transformation, where increased female workforce participation expands the women's watch segment, while tourism initiatives and international event hosting create opportunities for duty-free and tourist-targeted retail formats that cater to both domestic and visiting consumers seeking timepieces as fashion statements and investment pieces. In 2025, Ahmed Seddiqi, the premier luxury watches and jewellery retailer in the UAE, revelaed its expansion into the Kingdom of Saudi Arabia by launching its first boutique beyond the UAE. This tactical decision represents an important achievement in the brand's 75-year history and strengthens its dedication to providing curated, refined experiences to selective customers throughout its retail presence.

Saudi Arabia Watch Market Trends:

Integration of Smart Technology with Traditional Watch Design

The Saudi market witnesses accelerating convergence between conventional watchmaking and digital innovation, as manufacturers introduce hybrid timepieces combining analog aesthetics with fitness tracking capabilities, notification features, and health monitoring sensors. This trend appeals particularly to tech-savvy millennials and Generation Z consumers who seek devices balancing traditional sophistication with contemporary functionality, creating new product categories that bridge heritage craftsmanship and modern lifestyle requirements while maintaining the cultural significance of wrist-worn accessories. In 2025, the Furlan Marri x CLÉ Sahra Edition was launched in Saudi Arabia, inspired by the extensive desert landscape of the country. Limited to just 750 units, the latest edition draws inspiration from Furlan Marri’s popular mechaquartz chronograph collection.

Growing Emphasis on Sustainability and Ethical Sourcing

Saudi consumers demonstrate increasing environmental consciousness, driving demand for watches manufactured using recycled materials, conflict-free precious metals, and transparent supply chain practices. Brands highlighting eco-friendly production methods, solar-powered movements, and ethical labor standards gain competitive advantage among younger buyers who prioritize corporate responsibility alongside product quality, reflecting broader societal shifts toward sustainable consumption patterns that align with the Kingdom's environmental goals. Moreover, the heightened launch of various limited edition watches is driving the demand among environmentally conscious buyers. In 2024, TAG Heuer launched a beautiful duo of green-dial watches coinciding with Saudi Arabia’s 94th National Day. The 41mm TAG Heuer Carrera Day Date KSA Limited Edition, restricted to 100 units, showcases a green sunray dial with Arabic numerals, a day/date indicator, and “Saudi” positioned at 6 o’clock. Equipped with the Calibre 5 movement, it features a lustrous steel case and bracelet.

Expansion of Experiential Retail and Brand Storytelling

Watch retailers increasingly invest in immersive shopping environments featuring heritage exhibitions, watchmaking demonstrations, and personalized consultation services that transform purchasing into memorable experiences. This trend responds to consumer desire for emotional connections with brands beyond transactional relationships, as retailers create destination spaces offering expert guidance, customization services, and exclusive events that strengthen brand loyalty while differentiating physical stores from digital channels. In 2025, Hublot enhanced the festivities in the Kingdom by inaugurating its first Saudi flagship at Solitaire Mall, coinciding with the 20th anniversary of the Big Bang collection. Created to reflect Hublot's essence, the new boutique covers 240 square meters and incorporates a blend of modern art, luxury artisanship, and innovation.

How Vision 2030 is Transforming the Saudi Arabia Watch Market:

Saudi Vision 2030 is reshaping the Saudi Arabia watch market by accelerating shifts in consumer behavior, retail structure, and brand strategy. Rising disposable incomes, a growing young population, and higher workforce participation especially among women are expanding demand for both premium and mid-range watches. The government’s focus on lifestyle, tourism, and luxury retail development has strengthened the presence of global watch brands across malls, airports, and duty-free zones. E-commerce growth, supported by digital payment adoption and logistics upgrades, is also changing how watches are marketed and sold, with online-first launches and localized digital campaigns gaining traction. At the same time, Vision 2030’s emphasis on local value creation is encouraging partnerships, regional distribution hubs, and selective assembly or customization activities within the Kingdom. Together, these factors are moving the watch market beyond a niche luxury focus toward a broader, more diversified consumer base aligned with Saudi Arabia’s long-term economic diversification goals.

Market Outlook 2026-2034:

The Saudi Arabia watch market demonstrates resilient growth prospects underpinned by favorable demographic trends, sustained economic development, and evolving consumer sophistication that elevates watches from functional devices to lifestyle statements. Market expansion benefits from the Kingdom's youthful population structure, rising female economic participation, growing expatriate community, and tourism sector development that collectively broaden the consumer base while diversifying demand patterns across price points and product categories. The market generated a revenue of USD 727.30 Million in 2025 and is projected to reach a revenue of USD 1,018.28 Million by 2034, growing at a compound annual growth rate of 3.81% from 2026-2034. The market's trajectory reflects broader societal transformation where traditional gender roles evolve, entertainment options expand, social norms liberalize, and international influence reshapes consumption behaviors toward globally-aligned luxury preferences and brand consciousness that position watches as essential accessories within modern Saudi lifestyles spanning professional settings, social occasions, leisure activities, and personal expression contexts.

Saudi Arabia Watch Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Quartz | 63% |

| Price Range | Low-Range | 40% |

| Distribution Channel | Offline Retail Stores | 68% |

| End User | Men | 51% |

| Region | Northern and Central Region | 30% |

Type Insights:

- Quartz

- Mechanical

Quartz dominates with a market share of 63% of the total Saudi Arabia watch market in 2025.

Quartz watches command the Saudi market through their compelling value proposition combining accuracy, affordability, and low maintenance requirements that resonate with price-conscious consumers and practical buyers seeking reliable timekeeping without ongoing service commitments. The technology's battery-powered precision eliminates the need for regular winding or adjustment, appealing to busy professionals and younger consumers who prioritize convenience alongside performance. Manufacturing efficiencies enable competitive pricing that makes quality timepieces accessible to middle-income segments, while design versatility allows brands to offer extensive style variations catering to diverse aesthetic preferences from minimalist contemporary to ornate traditional expressions.

The segment's dominance reflects broader market democratization trends where aspirational luxury becomes attainable through accessible price points without compromising perceived quality. Quartz movements enable fashion brands and licensed manufacturers to enter the watch market with attractive designs at competitive costs, expanding consumer choice and market participation. The technology's reliability establishes watches as dependable daily accessories rather than delicate instruments requiring specialized care, reducing ownership barriers particularly for first-time buyers and gift purchasers. International brand recognition in the quartz segment provides consumer confidence, as established names leverage their reputation to capture market share across distribution channels from shopping mall retailers to duty-free airport locations serving both residents and tourists.

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

Low-range leads with a share of 40% of the total Saudi Arabia watch market in 2025.

Low-range watches thrive in the Saudi market by addressing mass-market demand from aspirational consumers, young professionals, and fashion-conscious buyers seeking affordable accessories that complement diverse wardrobes without significant financial commitment. This segment benefits from the Kingdom's substantial youth population that prioritizes trendy designs and brand variety over investment-grade timepieces, viewing watches as disposable fashion items updated frequently to match evolving style preferences. Accessible price points enable multiple-watch ownership, encouraging consumers to maintain collections for different occasions, outfits, and social contexts rather than investing in single premium pieces.

The segment's leadership position reflects changing consumer attitudes where watches transition from heirloom investments to contemporary fashion statements aligned with fast-moving style cycles and social media influence. Retail accessibility through shopping malls, department stores, and fashion chains ensures widespread product visibility and purchase convenience, while promotional activities, seasonal collections, and celebrity endorsements create continuous consumer engagement. The low-range segment serves as the market entry point, building brand familiarity and purchase habits that may evolve toward premium segments as consumers mature and incomes rise, establishing a customer acquisition pipeline that sustains long-term market growth across all price tiers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Retail Stores

- Offline Retail Stores

Offline retail stores exhibit a clear dominance with a 68% share of the total Saudi Arabia watch market in 2025.

Offline retail maintains commanding market presence through the tactile and experiential advantages inherent to watch purchasing, where consumers prefer physically examining timepieces to assess weight, fit, comfort, and visual appeal before committing to purchases. The sensory evaluation process remains crucial for watches as wrist-worn accessories where personal fit and aesthetic harmony significantly influence satisfaction, creating natural advantages for physical stores offering immediate try-on experiences, expert staff consultation, and face-to-face service that builds purchase confidence. Luxury and mid-range segments particularly benefit from in-store environments that convey brand prestige through store design, product presentation, and personalized attention that enhances perceived value.

The channel's dominance reflects Saudi Arabia's well-developed shopping mall culture where retail becomes leisure activity and social experience beyond transactional purchasing. Modern shopping centers serve as lifestyle destinations featuring luxury boutiques, brand flagship stores, and multi-brand retailers that create aspirational shopping environments attracting consumers seeking both products and experiences. Physical stores provide immediate gratification eliminating delivery waiting periods, offer after-sales services including sizing adjustments and warranty support, and enable secure high-value transactions avoiding online payment concerns. The personal relationship building between sales professionals and repeat customers fosters loyalty particularly important for luxury segments, while in-store promotions, exclusive launches, and brand events create engagement opportunities strengthening customer relationships beyond individual purchases.

End User Insights:

- Men

- Women

- Unisex

Men lead with a share of 51% of the total Saudi Arabia watch market in 2025.

Men's watches dominate through deeply embedded cultural traditions positioning timepieces as essential masculine accessories signifying professionalism, success, and social standing within Saudi society. Professional dress codes and business etiquette expectations establish watches as standard accessories for workplace environments, while gifting traditions surrounding graduations, promotions, marriages, and milestone celebrations reinforce watches as meaningful symbols of achievement and status passage. The segment benefits from male consumers' generally higher propensity for watch collecting and investment in quality timepieces viewed as portable wealth and intergenerational assets rather than disposable fashion items.

The segment's leadership reflects traditional jewelry and accessory market dynamics where men's options concentrate heavily on watches as the primary acceptable adornment category, creating focused demand concentration. Professional networking and business relationship contexts where watch choices become visible status signals drive premium segment purchases, as watches communicate success and taste to professional peers and clients. The men's segment spans broad price ranges accommodating diverse consumer needs from students seeking affordable fashion pieces to executives investing in luxury timepieces, creating market depth that sustains volume across economic cycles and demographic segments while supporting specialized retailers and brand positioning strategies tailored to masculine style preferences and purchasing behaviors.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with a 30% share of the total Saudi Arabia watch market in 2025.

The Northern and Central Region commands the largest market share through its concentration of economic activity, government institutions, corporate headquarters, and high-income professional populations centered predominantly in Riyadh, the Kingdom's capital and largest metropolitan area. Riyadh's status as the political, administrative, and financial hub attracts affluent professionals, government officials, business executives, and diplomatic communities whose purchasing power and lifestyle preferences drive premium watch consumption across luxury and mid-range segments. The region's extensive retail infrastructure includes prestigious shopping destinations that host international luxury watch boutiques, authorized dealers, and multi-brand retailers providing comprehensive product selections and premium shopping experiences that attract discerning consumers seeking quality timepieces.

The region benefits from higher urbanization rates, superior educational attainment levels, and greater exposure to international fashion trends through business travel, diplomatic presence, and expatriate communities that introduce cosmopolitan consumption patterns and brand awareness. Government employment concentration ensures stable income streams supporting discretionary luxury spending, while the region's growing private sector across finance, technology, healthcare, and professional services creates expanding middle-class and affluent segments with disposable income for fashion accessories and status-signaling products. The Northern and Central Region's demographic profile skews toward young professionals establishing careers, building families, and participating in social circles where watches serve as visible markers of professional achievement and personal style, driving both gifting occasions and self-purchase behavior across diverse price points and brand positions.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Watch Market Growing?

Rising Disposable Incomes and Economic Diversification

Saudi Arabia's ongoing economic transformation under Vision 2030 generates substantial wealth expansion and income growth across professional classes, creating enlarged consumer segments with discretionary spending capacity for lifestyle products beyond basic necessities. In Saudi Arabia, the GDP is expected to expand by 3.7% annually in 2025, consistently exceeding global GDP growth, which is estimated at 3.2% – a slight rise from 3.1% in 2024. At the same time, it is expected that consumer expenditure in the Kingdom will increase by 4.5%, while consumer price inflation is anticipated to hit 2%. Government employment reforms, private sector job creation, and entrepreneurial ecosystem development collectively elevate household incomes while diversifying revenue sources away from oil-dependent economic models. This economic broadening translates into enhanced purchasing power for watches across all price tiers, as middle-class expansion drives volume growth in affordable segments while high-net-worth individual proliferation sustains luxury market development. The Kingdom's improved fiscal stability and economic optimism encourage consumer confidence in discretionary purchases, reducing saving preferences and stimulating spending on fashion accessories, personal luxuries, and status-signaling products that include quality timepieces as investment pieces and everyday adornments.

Growing Fashion Consciousness and Western Lifestyle Adoption Among Youth Demographics

Saudi Arabia's predominantly young population demonstrates accelerating adoption of global fashion trends, cosmopolitan lifestyle preferences, and Western consumption patterns facilitated by social media exposure, international travel experiences, and cultural liberalization policies. Younger consumers view watches as essential fashion accessories expressing personal identity, style sophistication, and social belonging within peer groups influenced by international celebrities, fashion influencers, and luxury brand marketing. This demographic shift transforms watches from purely functional timekeeping devices into fashion statements coordinated with clothing choices, seasonal trends, and social occasions. The Kingdom's relaxed social norms, expanded entertainment options, and emerging mixed-gender social spaces create new contexts for personal presentation where watches contribute to overall aesthetic appearance, driving purchase frequency and collection building among fashion-forward consumers seeking variety to luxury watches. IMARC Group predicts that the Saudi Arabia luxury watch market is projected to attain USD 342.7 Million by 2033.

Tourism Development and International Event Hosting Expanding Consumer Base

The Kingdom's ambitious tourism sector expansion under Vision 2030 initiatives attracts growing international visitor flows through cultural heritage sites, religious pilgrimage routes, entertainment districts, and sporting events that position Saudi Arabia as emerging tourist destination. During the TOURISE Summit 2025, which took place in the Saudi capital from November 11 to 13, the Saudi Arabian Government announced a significant investment of SR 2.9 billion (around US$775 million) to boost both domestic and global tourism, reinforcing the Kingdom’s status as a competitive tourist destination. International tourists represent valuable consumer segments for watch retailers through duty-free shopping at airports, luxury retail at tourist destinations, and impulse purchases at entertainment venues. Major international events including Formula One races, concert series, cultural festivals, and business conferences bring affluent visitors seeking premium goods, luxury accessories, and branded products unavailable or more expensive in home markets. This tourism-driven demand supplements domestic consumption while encouraging retail infrastructure development, international brand entry, and service standard improvements that elevate overall market sophistication and competitive intensity benefiting consumers through expanded choice, competitive pricing, and enhanced shopping experiences.

Market Restraints:

What Challenges the Saudi Arabia Watch Market is Facing?

Smartphone Proliferation Reducing Traditional Timekeeping Functionality Necessity

Universal smartphone adoption eliminates the fundamental timekeeping function historically justifying watch ownership, as mobile devices provide superior time accuracy, multiple timezone capabilities, and alarm functionality that diminish watches' practical utility. Younger consumers particularly question traditional watch relevance when smartphones fulfill timekeeping needs alongside communication, entertainment, and productivity functions, creating psychological barriers to watch purchases viewed as redundant accessories. This functionality displacement forces the watch industry toward fashion, status, and lifestyle positioning rather than utilitarian arguments, requiring elevated marketing investment and brand building to maintain consumer relevance beyond pure timekeeping value propositions.

Economic Sensitivity and Discretionary Spending Volatility Affecting Purchase Decisions

Watches occupy the discretionary luxury category vulnerable to economic uncertainty, income fluctuations, and consumer confidence variations that impact non-essential purchase decisions during economic downturns or financial instability. Oil price volatility directly influences Saudi Arabia's fiscal health and household incomes, creating cyclical demand patterns where luxury goods including watches experience demand contractions during economic stress periods. Consumer prioritization shifts toward essential spending during uncertain times, delaying or eliminating watch purchases particularly in premium segments where prices represent significant household budget commitments requiring stable financial conditions and confident economic outlooks to justify luxury expenditures.

Counterfeit Products and Gray Market Imports Undermining Brand Value and Consumer Trust

Widespread availability of counterfeit watches and unauthorized gray market imports creates pricing pressure, erodes brand equity, and undermines consumer confidence in product authenticity and after-sales service availability. Online marketplaces and unauthorized retailers distribute replica products mimicking luxury brands at fraction costs, confusing consumers about genuine product value and creating price expectations misaligned with authorized retailer offerings. Gray market channels selling authentic products through unauthorized distributors without manufacturer warranties compromise brand control over pricing, distribution, and customer experience, while counterfeit proliferation particularly affects premium segments where brand exclusivity and authenticity verification remain critical purchase considerations influencing consumer willingness to pay authorized retail premiums.

Competitive Landscape:

The Saudi Arabia watch market demonstrates sophisticated competitive dynamics characterized by clear segmentation between luxury Swiss manufacturers maintaining premium positioning through heritage craftsmanship and exclusive distribution, Japanese precision brands offering mid-range quality at accessible prices, and emerging smartwatch innovators disrupting traditional categories with technology-enabled functionality. Market structure reflects global industry patterns where established players leverage brand recognition, retailer relationships, and marketing investment to defend market positions against new entrants and category expansion from technology companies. Competitive intensity varies significantly across price segments, with luxury tiers emphasizing brand heritage and exclusivity while mass-market segments compete primarily on design variety, pricing, and distribution accessibility. The landscape continues evolving as digital natives reshape consumer expectations, omnichannel retail strategies blend physical and online experiences, and smartwatch adoption forces traditional manufacturers toward hybrid product development balancing mechanical tradition with electronic innovation. Some of the key market players include:

- Apple Inc.

- Casio Computer Co. Ltd.

- Citizen Watch Co. Ltd.

- Movado Group Inc.

- Rolex SA

- Samsung Electronics Co. Ltd.

- Seiko Watch Corporation (Seiko Group Corporation)

Recent Developments:

- In May 2025, Biver, the prestigious watchmaking maison established by industry leader Jean-Claude Biver, revealed a new retail collaboration in Riyadh, Kingdom of Saudi Arabia, with Crown & Compass, a premier destination for collectors of extraordinary independent timepieces.

Saudi Arabia Watch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Apple Inc., Casio Computer Co. Ltd., Citizen Watch Co. Ltd., Movado Group Inc., Rolex SA, Samsung Electronics Co. Ltd., Seiko Watch Corporation (Seiko Group Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia watch market size was valued at USD 727.30 Million in 2025.

The Saudi Arabia watch market is expected to grow at a compound annual growth rate of 3.81% from 2026-2034 to reach USD 1,018.28 Million by 2034.

Quartz dominated the Saudi Arabia watch market with a 63% share in 2025, driven by their superior accuracy, low maintenance requirements, affordable pricing, and design versatility that appeals to mass-market consumers seeking reliable timekeeping functionality combined with fashionable aesthetics across diverse price points and retail channels.

Key factors driving the Saudi Arabia watch market include rising disposable incomes from economic diversification initiatives, growing fashion consciousness among youth demographics adopting global lifestyle trends, increasing tourism activity bringing international consumers, and the emergence of smartwatch categories blending traditional aesthetics with modern technology.

Major challenges include smartphone proliferation reducing traditional timekeeping necessity and questioning watch relevance for younger consumers, economic sensitivity affecting discretionary luxury spending during oil price volatility and income fluctuations, counterfeit product availability undermining brand value and consumer trust, and intense competitive pressure from technology companies entering the smartwatch category with functionality-focused alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)