Saudi Arabia Wind Energy Market Size, Share, Trends and Forecast by Component, Rating, Installation, Turbine Type, Application, and Region 2026-2034

Saudi Arabia Wind Energy Market Summary:

The Saudi Arabia wind energy market size was valued at USD 2.21 Billion in 2025 and is projected to reach USD 3.89 Billion by 2034, growing at a compound annual growth rate of 6.46% from 2026-2034.

The Saudi Arabia wind energy market is experiencing growth driven by the Kingdom's strategic commitment to energy diversification under Vision 2030. Ambitious renewable energy targets, favorable wind conditions across northern and coastal regions, and supportive government policies are accelerating market development. The convergence of international investment, technological advancements in turbine efficiency, and structured procurement frameworks through the National Renewable Energy Program is reshaping the competitive landscape and positioning Saudi Arabia as a regional leader in wind power generation.

Key Takeaways and Insights:

- By Component: Turbine dominates the market with a share of 46% in 2025, driven by substantial investments in advanced wind turbine technologies designed for desert environments and the deployment of high-capacity units across utility-scale projects.

- By Rating: >5 ≤ 8 MW leads the market with a share of 26% in 2025, owing to optimal balance between power output efficiency and cost-effectiveness for Saudi Arabia's large-scale wind farm developments.

- By Installation: Onshore represents the largest segment with a market share of 69% in 2025. This dominance is influenced by lower capital expenditure requirements, vast uninhabited desert landscapes with favorable wind conditions, and proven project viability.

- By Turbine Type: Horizontal axis dominates the market with a share of 83% in 2025, reflecting its superior efficiency in capturing wind energy and widespread adoption in utility-scale installations.

- By Application: Utility leads the market with a share of 50% in 2025, underpinned by government-backed grid-scale projects and long-term power purchase agreements facilitating large-scale renewable energy integration.

- By Region: Northern and Central Region represent the largest segment with a market share of 32% in 2025, benefiting from optimal wind speeds, existing operational projects, and strategic importance in the national renewable energy infrastructure.

- Key Players: The Saudi Arabia wind energy market exhibits moderate competitive intensity, with international energy corporations partnering alongside government entities and regional developers to deliver utility-scale wind projects across strategic locations.

Saudi Arabia wind energy market is driven by strong government commitment to renewable diversification, declining generation costs, and structured procurement under the National Renewable Energy Program. Vision 2030 places wind power as a strategic component of energy security, emissions reduction, and long-term economic resilience. Competitive bidding mechanisms, long-term power purchase agreements, and regulatory clarity are improving project bankability and attracting global developers. Cost competitiveness is a major catalyst, demonstrated in 2025, when the Ministry of Energy awarded five renewable projects totaling 4,500 MW, including the Dawadmi Wind Project, which set a global record for the lowest wind energy cost, while the Najran Solar Project achieved the second-lowest solar tariff. These sixth-phase NREP awards involved investments exceeding USD 2.4 billion. Besides this, abundant land availability, favorable wind resources, and expanding transmission infrastructure further support deployment. Together, policy stability, record-low tariffs, large-scale investments, and grid readiness are accelerating wind capacity additions and reinforcing Saudi Arabia’s position as a competitive renewable energy producer.

Saudi Arabia Wind Energy Market Trends:

Vision 2030 and National Renewable Energy Targets

Saudi Arabia’s wind energy market is strongly driven by Vision 2030, which positions renewable energy as a strategic pillar of economic diversification and energy security. National targets aim to significantly increase the share of renewables in the power mix, reducing reliance on hydrocarbons. Wind energy plays a critical role due to its scalability and cost competitiveness. Reflecting this commitment in 2025, when Goldwind signed a contract for the Saudi PIF5 Wind Power Project, a 3 GW onshore wind farm expected to generate 11.3 billion kWh annually and reduce carbon emissions by 9.3 million tons. It marked a significant step in Saudi Arabia’s renewable energy goals under Vision 2030. These measures provide regulatory certainty, encourage private investment, and support large-scale project development, creating a stable foundation for sustained wind energy market growth.

Strategic Manufacturing Localization Initiatives

Saudi Arabia is advancing strategic manufacturing localization initiatives to build domestic capabilities across the wind energy value chain and reduce reliance on imported equipment. Establishing local turbine production supports supply chain resilience, cost efficiency, and long-term industrial development. For instance, in 2024, Saudi Arabia signed agreements to localize the production of steel towers for wind energy systems with Al-Yamamah Steel Industries and Arabian International Co. The initiative, part of the National Renewable Energy Program, aimed to boost local production, create over 500 jobs, and contribute SR1.1 billion to GDP. This aligned with Vision 2030's goal of diversifying energy sources and strengthening local industries.

Grid Modernization and Transmission Infrastructure Enhancement

Saudi Arabia is making substantial investments in grid modernization to support large-scale integration of variable renewable energy, including wind power, into the national electricity network. Upgrades include advanced transmission infrastructure, smart grid systems, and energy storage deployment to improve stability and efficiency. Reflecting this effort, in 2024, the Energy Minister announced plans to automate 40% of the electricity distribution network by 2025, with 32% already completed, alongside the development of nine control centers by 2026. The Kingdom is also targeting 48 GWh of energy storage capacity by 2030, strengthening grid flexibility and enabling reliable wind energy integration.

How Vision 2030 is Transforming the Saudi Arabia Wind Energy Market:

Vision 2030 is transforming the Saudi Arabia wind energy market by positioning renewable power as a core pillar of national energy diversification. The strategy targets reduced reliance on hydrocarbons, lower carbon emissions, and increased private sector participation in clean energy development. Government-backed renewable procurement programs, long-term power purchase agreements, and regulatory reforms are improving project bankability and investor confidence. Vision 2030 also supports large-scale wind farm development, grid integration, and localization of renewable technologies. Investment in transmission infrastructure and workforce development strengthens operational capacity. Together, these initiatives are accelerating wind energy deployment, expanding installed capacity, and supporting the Kingdom’s transition toward a more balanced, sustainable, and resilient energy mix.

Market Outlook 2026-2034:

The Saudi Arabia wind energy market demonstrates robust growth potential throughout the forecast period, supported by long-term renewable energy targets, policy backing, and improving project economics. Grid expansion, competitive tendering mechanisms, and private sector participation are strengthening investor confidence. Wind power is gaining importance within the national energy mix as part of diversification efforts and emissions reduction goals. The market generated a revenue of USD 2.21 Billion in 2025 and is projected to reach a revenue of USD 3.89 Billion by 2034, growing at a compound annual growth rate of 6.46% from 2026-2034.

Saudi Arabia Wind Energy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Turbine |

46% |

|

Rating |

>5 ≤ 8 MW |

26% |

|

Installation |

Onshore |

69% |

|

Turbine Type |

Horizontal Axis |

83% |

|

Application |

Utility |

50% |

|

Region |

Northern and Central Region |

32% |

Component Insights:

To get more information on this market, Request Sample

- Turbine

- Support Structure

- Electrical Infrastructure

- Others

Turbine dominates with a market share of 46% of the total Saudi Arabia wind energy market in 2025.

Turbine holds the biggest market share, as it represents the core power-generating component and account for the largest share of project investment. High-capacity turbine is essential for maximizing energy output under variable wind conditions across utility-scale installations.

Technology upgrades and localization efforts further reinforce turbine dominance. For instance, in 2024, the Public Investment Fund formed joint ventures with Envision Energy, Jinko Solar, and TCL Zhonghuan to localize wind turbine manufacturing, supporting Vision 2030 through industrial growth, skilled jobs, and improved project economics nationwide deployment.

Rating Insights:

- ≤ 2 MW

- >2 ≤ 5 MW

- >5 ≤ 8 MW

- >8 ≤ 10 MW

- >10 ≤ 12 MW

- > 12 MW

>5 ≤ 8 MW leads with a market share of 26% of the total Saudi Arabia wind energy market in 2025.

>5 ≤ 8 MW represent the largest segment due to their suitability for utility-scale projects. These ratings balance high energy output with installation efficiency, supporting large-capacity wind farms across favorable wind corridors.

This capacity range reduces the number of turbines required per project, lowering land use and maintenance costs. Improved performance under moderate wind speeds and compatibility with grid infrastructure further strengthen adoption across large renewable energy developments.

Installation Insights:

- Offshore

- Onshore

Onshore exhibits a clear dominance with a 69% share of the total Saudi Arabia wind energy market in 2025.

Onshore leads the market owing to lower development costs, simpler logistics, and faster project execution compared to offshore alternatives. Abundant land availability and favorable wind conditions across inland regions support large-scale onshore deployment.

The segment also benefits from easier grid access, streamlined approvals, and established construction capabilities. This focus is reflected in Saudi Arabia’s 2025 tendering of 5.3 GW of new solar and wind projects, including onshore wind plants, supporting Vision 2030 energy diversification and near-term renewable capacity growth.

Turbine Type Insights:

- Horizontal Axis

- Vertical Axis

Horizontal axis dominates with a market share of 83% of the total Saudi Arabia wind energy market in 2025.

Horizontal axis accounts for the majority of the market share, attributed to its higher efficiency, proven performance, and suitability for large-scale power generation. These turbines capture wind more effectively at higher hub heights, maximizing energy output across utility-scale projects.

Its widespread global adoption ensures technology maturity, reliable supply chains, and availability of experienced service providers. Developers favor horizontal axis for durability, scalability, and compatibility with high-capacity installations across diverse onshore wind conditions.

Application Insights:

- Utility

- Industrial

- Commercial

- Residential

Utility leads with a market share of 50% of the total Saudi Arabia wind energy market in 2025.

Utility dominates the market because of strong government backing, large-scale renewable targets, and centralized power generation planning. Grid-connected wind farms support national electricity demand while improving energy diversification and supply security.

Utility segment benefits from long-term power purchase agreements, competitive tendering, and access to financing. Economies of scale, stable revenue visibility, and efficient grid integration encourage developers to prioritize large utility-scale wind installations.

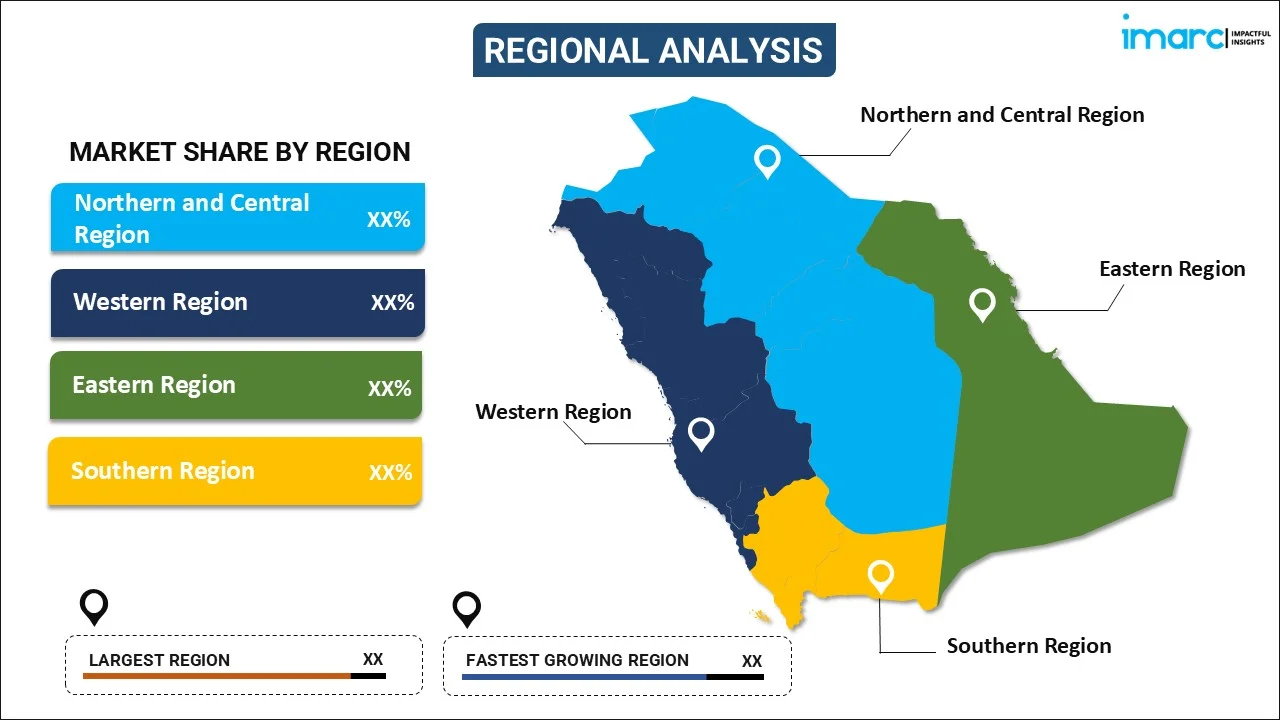

Regional Insights:

To get more information on this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region exhibits a clear dominance with a 32% share of the total Saudi Arabia wind energy market in 2025.

Northern and Central Region represent the largest segment, driven by favorable wind resources, vast available land, and proximity to major power demand centers. These advantages create ideal conditions for large-scale onshore wind projects supporting national power needs and long-term renewable expansion plans.

Robust transmission networks, nearby industrial hubs, and government-backed initiatives further attract investment. This is reflected in KEPCO securing the 1,500 MW Dawadmi wind project in 2025, USD 892 million development scheduled for completion by 2028, reinforcing regional dominance.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Wind Energy Market Growing?

Government-Backed Renewable Investments

Strong government support and large capital commitments are impelling the wind energy market growth in Saudi Arabia by accelerating project approvals, reducing investment risks, and enabling large-scale deployment aligned with Vision 2030 renewable energy targets. National targets under Vision 2030 prioritize renewable capacity expansion, grid diversification, and lower carbon intensity, creating long-term demand certainty. A key example is the ACWA/Aramco Solar & Wind Project launched in 2025, targeting 15 GW of combined capacity with an investment of USD 8.3 billion. Spread across multiple sites, the project supported job creation, emissions reduction, and local supply chain development, encouraging private participation and positioning wind power as a core pillar of the Kingdom’s energy transition.

Strengthening Project Execution, Logistics, and Cost Efficiency

Improved project execution capabilities and efficient logistics infrastructure are influencing the Saudi Arabia wind energy market by reducing development risk and lowering overall costs. The Kingdom’s ports, transport networks, and supply chain readiness support timely delivery of large turbine components for utility-scale projects. Reflecting this progress, in 2025, the 600-MW Al-Ghat wind project received its first major turbine shipment through Jubail Port under the National Renewable Energy Program. The project targeted an LCOE of USD 15.655 per MWh and was expected to power around 257,000 homes annually. Such milestones demonstrate Saudi Arabia’s capacity to deliver low-cost, grid-connected wind projects aligned with Vision 2030.

Long-Term Power Purchase Agreement (PPA)

The expansion of wind energy in Saudi Arabia is strongly supported by long-term power purchase agreement (PPA) that enhance revenue visibility and reduce financial risk for developers. These agreements provide pricing stability, improve access to project financing, and encourage participation from international and local investors. Demonstrating this trend, in 2025, Saudi Arabia signed a PPA for the 700 MW Yanbu Wind Energy Project with a consortium led by Marubeni Corporation and Ajlan & Bros. The project, located in Al-Madinah Province, aimed to supply power at a competitive tariff of 1.72 US cents per kWh. Such agreements accelerate wind capacity deployment and support Vision 2030 targets for renewable energy integration.

Market Restraints:

What Challenges the Saudi Arabia Wind Energy Market is Facing?

Grid Integration and Transmission Infrastructure Constraints

Legacy transmission infrastructure, originally designed for centralized fossil fuel generation, poses challenges for large-scale integration of variable wind energy. Grid modernization and transmission upgrades require substantial capital investment and extended implementation timelines. These structural constraints may limit the speed of new wind capacity deployment in certain regions, affecting near-term expansion plans.

Extreme Environmental Operating Conditions

Saudi Arabia’s desert climate creates operational challenges for wind energy projects due to high temperatures, frequent sandstorms, and fluctuating humidity levels. These conditions affect turbine efficiency, component wear, and maintenance frequency. Operators must implement specialized equipment and enhanced maintenance practices, increasing operational complexity and costs compared to wind installations in more moderate climates.

Limited Local Technical Workforce and Supply Chain Development

While localization initiatives are progressing, Saudi Arabia’s wind energy sector remains heavily dependent on international expertise for project development, construction, and operations. Developing domestic technical capabilities and localized supply chains requires sustained investment in workforce training, knowledge transfer, and manufacturing infrastructure, which may extend project timelines and increase near-term development costs.

Competitive Landscape:

The Saudi Arabia wind energy market exhibits moderate competitive intensity characterized by the presence of international energy corporations, regional developers, and government-backed entities collaborating across the project value chain. Market dynamics reflect strategic positioning, ranging from utility-scale project development to equipment manufacturing localization. Competition is increasingly shaped by the ability to achieve record-low electricity tariffs through technological innovation and operational efficiency. The Public Investment Fund's strategic investments in manufacturing joint ventures and project development are reshaping competitive dynamics, while international partnerships continue to drive technology transfer and supply chain development.

Recent Developments:

- January 2026: Saudi Arabia announced the qualified bidders for 5.3 GW of solar and wind projects under its National Renewable Energy Program (NREP). The projects will be spread across various regions, including major solar farms like Tabarjal II (1,400 MW) and large-scale wind projects such as Bilghah (1,300 MW). This initiative further solidifies Saudi Arabia’s commitment to clean energy and diversifying its energy mix.

- October 2025: Saudi Arabia's Power Procurement Company (SPPC) awarded 4.5 GW of solar and wind projects under the National Renewable Energy Program (NREP). The wind project in Dawadmi achieved the world's lowest LCOE for wind energy at SAR0.05/kWh. These projects, with investments exceeding $2.4 billion, marked a significant step toward Saudi Arabia’s renewable energy goals.

Saudi Arabia Wind Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Turbine, Support Structure, Electrical Infrastructure, Others |

| Ratings Covered | ≤ 2 MW, >2 ≤ 5 MW, >5 ≤ 8 MW, >8 ≤ 10 MW, >10 ≤ 12 MW, >12 MW |

| Installations Covered | Offshore, Onshore |

| Turbine Types Covered | Horizontal Axis, Vertical Axis |

| Applications Covered | Utility, Industrial, Commercial, Residential |

| Regions Covered | Northen and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia wind energy market size was valued at USD 2.21 Billion in 2025.

The Saudi Arabia wind energy market is expected to grow at a compound annual growth rate of 6.46% from 2026-2034 to reach USD 3.89 Billion by 2034.

Turbine dominates the market with 46% market share in 2025, driven by substantial investments in advanced wind turbine technologies and deployment of high-capacity units across utility-scale projects.

Key factors driving the Saudi Arabia wind energy market include Vision 2030 renewable targets, supportive regulation, and large-scale investments, highlighted by the 3 GW PIF5 onshore wind project contracted with Goldwind in 2025, expected to generate 11.3 billion kWh annually and reduce carbon emissions by 9.3 million tons.

Major challenges include grid integration and transmission infrastructure constraints, extreme environmental operating conditions including high temperatures and sandstorms, limited local technical workforce availability, and the multi-year timeframes required for supply chain localization and manufacturing capability development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)