Scandinavia Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, End User, and Country, 2025-2033

Market Overview:

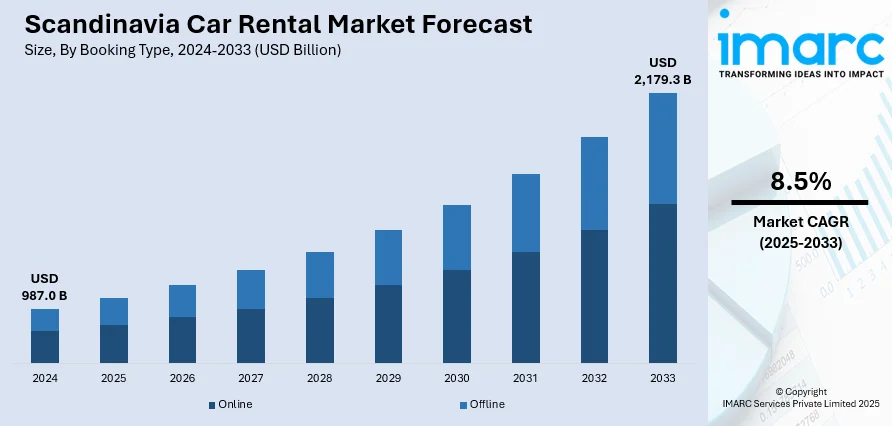

The Scandinavia car rental market size reached USD 987.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2,179.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8.5% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 987.0 Billion |

| Market Forecast in 2033 | USD 2,179.3 Billion |

| Market Growth Rate (2025-2033) | 8.5% |

Car rental refers to a vehicle that can be hired for a predefined period through online/offline channels via rental agencies. These services offer freedom of movement, low-cost traveling, and enable the evasion of high ownership costs. Furthermore, a rental car also provides numerous additional benefits for a convenient traveling experience, such as car damage repair, insurance compensation policies, entertainment systems, global positioning systems (GPS), Wi-Fi networks, etc.

To get more information on this market, Request Sample

In Scandinavia, the rising levels of urbanization coupled with the growing popularity of cost-effective modes of transportation are propelling the demand for car rental services. Additionally, with the increasing penetration of smartphones and high internet connectivity, the renting of cars through online platforms has gained prominence in the region. Several app- or website-based car rental services are offering numerous customer-centric benefits, including ease of booking, on-site pick-up, real-time location observation, economic tariffs, etc. The growing consumer awareness towards the cost-effectiveness, comfort, flexibility, and affordability of rental cars is also catalyzing the market growth. Moreover, several government bodies across Scandinavia are focusing on controlling vehicular emissions, thereby promoting several eco-friendly, carpooling transportation methods. Apart from this, numerous car rental companies are introducing electric vehicles in their fleet to reduce the adverse environmental impact of fuel-based taxis. In the coming years, the rising integration of car rental platforms with various advanced technologies, such as AI, IoT, predictive analytics, etc., will continue to drive the market for rental cars in Scandinavia.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Scandinavia car rental market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on booking type, rental length, vehicle type, application and end user.

Breakup by Booking Type:

- Online

- Offline

Breakup by Rental Length:

- Short Term

- Long Term

Breakup by Vehicle Type:

- Luxury Cars

- Executive Cars

- Economy Cars

- Sports Utility Vehicles (SUVs)

- Others

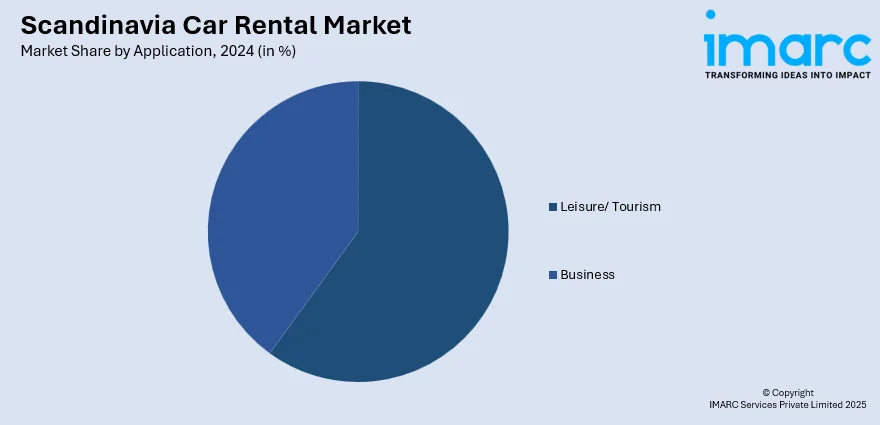

Breakup by Application:

- Leisure/ Tourism

- Business

Breakup by End User:

- Self-Driven

- Chauffeur-Driven

Breakup by Country:

- Norway

- Denmark

- Sweden

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being Alamo, Autoplan, Avis Rent A Car System, LLC., Budget Rent A Car System, Inc., Enterprise Holdings, Inc., Europcar, National Car Rental, Sixt, The Hertz Corporation and Thrifty Car Rental.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Booking Type, Rental Length, Vehicle Type, Application, End User, Country |

| Countries Covered | Norway, Denmark, Sweden |

| Companies Covered | Alamo, Autoplan, Avis Rent A Car System, LLC., Budget Rent A Car System, Inc., Enterprise Holdings, Inc., Europcar, National Car Rental, Sixt, The Hertz Corporation and Thrifty Car Rental |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Scandinavia car rental market performed so far and how will it perform in the coming years?

- What are the major countries in the Scandinavia car rental market?

- What has been the impact of COVID-19 on the Scandinavia car rental market?

- What is the breakup of the market based on the booking type?

- What is the breakup of the market based on the rental length?

- What is the breakup of the market based on the vehicle type?

- What is the breakup of the market based on the application?

- What is the breakup of the market based on the end user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the market?

- What is the structure of the Scandinavia car rental market and who are the key players?

- What is the degree of competition in the market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)