Sectionalizer Market Size, Share, Trends, and Forecast by Phase Type, Control Type, Voltage Rating, and Region, 2025-2033

Sectionalizer Market Size and Trends:

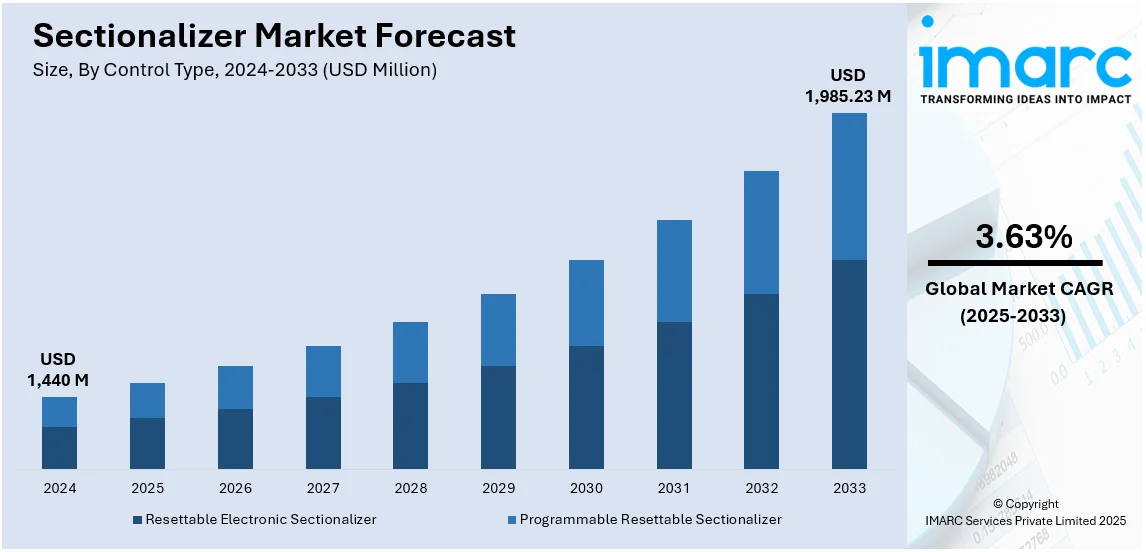

The global sectionalizer market size was valued at USD 1,440 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,985.23 Million by 2033, exhibiting a CAGR of 3.63% from 2025-2033. North America currently dominates the market, holding a market share of over 25.4% in 2024. The rising product application across the food and beverage (F&B), manufacturing, and healthcare sectors act as a key factor driving the market. Besides this, favorable government initiatives aimed at power grid modernization, the escalating demand for continuous power supply, especially in rural areas, and the expanding utilization of three-phase power systems are providing an impetus to the market growth in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,440 Million |

| Market Forecast in 2033 | USD 1,985.23 Million |

| Market Growth Rate 2025-2033 | 3.63% |

Growing investments in modernizing electrical grids and enhancing the reliability of power distribution are driving the global sectionalizer market. The growing demand for uninterrupted supply of electricity, and rising demand in residential, commercial, and industrial sectors are compelling utilities to use advanced sectionalizers to reduce outages and improve fault isolation. In line with this, the necessity of sectionalizers is also bolstered by their use in wind and solar energy sources that are integrated into power grids in order to manage variable power inputs efficiently. Moreover, the rising popularity of automation and smart sectionalizers as they provide real-time monitoring and operation through a remote interface is acting as another significant growth-inducing factor. In addition to this, supportive government initiatives for infrastructure development, especially in emerging economies have opened lucrative avenues for market growth due to the increasing focus on energy efficiency and sustainability.

The United States emerged as one of the leading market, holding 72.5% share. The U.S. electric grid is extremely complex, with more than 9,200 electric generating units boasting more than 1 million megawatts of generating capacity connected to more than 600,000 miles of transmission lines. The country’s growing requirement for a stable supply of power in healthcare, manufacturing, and residential sectors is impelling the market growth. Another factor influencing the market expansion is significant investment in smart grid projects and the upgrading of old power infrastructure to make the grid more reliable and efficient. When renewable energy sources are interfaced with the power grid, advanced sectionalizers are needed to manage fluctuations in power input accurately. Furthermore, the rise of automation and digitalization in power distribution systems is creating a demand for programmable resettable sectionalizers that have enhanced system reliability and power quality.

Sectionalizer Market Trends:

Rise in Product Applications Across Various Industries

The majority of modern medical devices require electricity to operate leading to the widespread adoption of smart electrical distribution systems across hospitals and clinics. As a result, there is a surge in the demand for automatic sectionalizers in healthcare facilities. Besides this, manufacturers rely on large capacity refrigerators to store and preserve food and beverage items. Therefore, the growing need for continuous power supply for refrigeration and heating purposes in the food and beverage (F&B) industry is anticipated to propel the expansion of the market. This is further augmented by the growing concerns about energy efficiency. For example, in Australia’s F&B sector, energy use accounts for about 15% of the total operational costs as such, automation players, like ABB, are incorporating new-age technologies to optimize energy-intensive processes, from fans and pumps to steam systems and refrigeration devices. Also, there is a high product demand in the manufacturing sector owing to its rising need for uninterrupted power supply and electricity transmission. Moreover, the shifting inclination from isolators toward sectionalizers will catalyse growth during the sectional market forecast period. These are essential for reducing power interruptions and enhancing reliability.

Increase in the Trend of Power Distribution Automation

Power distribution automation employs devices, such as reclosers, sectionalizer, switches, and feeder protection and control systems, as crucial components. Since sectionalizer is utilized in combination with reclosers to safeguard circuits from fault currents in a distribution network, a rise in the burden of annual economic losses suffered by utilities due to power interruptions is augmenting the expansion of the market. Innovative digital infrastructure is gaining prominence in electricity grids, both in distribution and transmission, with around 7% growth in investment in 2022 compared to 2021, as per IEA data. Further, investment in smart grids needs to more than double through to 2030 to get on track with the Net Zero Emissions by 2050 (NZE) Scenario, especially in emerging markets and developing economies (EMDEs). Furthermore, there is an increase in the trend of power distribution automation that improves power reliability and ensures cost-efficient operation of distribution networks. This technology helps power utilities enhance operational efficiency, power quality, and safety, which makes it essential for all utilities. This has also been accompanied by research into remote control of sectionalizers. For example, in March 2023, students at Goa Engineering College in India developed a mobile messaging facility to control sectionalizes and identify faulty power lines remotely. This was launched by the state’s Power Minister, which also underlines the importance of research and development of advanced sectionalizer variants.

Surge In Favorable Government Initiatives

Various initiatives undertaken by governments of numerous countries, such as the introduction of performance-based incentive schemes and guaranteed service programs. Such agencies are also adding a reliability component to these schemes wherein the distributors might face a penalty for not meeting their standards or receive a bonus for exceeding them. For instance, in May 2023, regulators in Michigan, USA, updated service quality and reliability standards for power utilities. The new rules lower the threshold for unacceptable performance during power outages and increase bill credits for power customers forced to go without electricity. Additionally, initiatives like the U.S. Department of Energy's Grid Modernization Initiative aim to enhance grid resilience and reliability, directly impacting the demand for sectionalizing technologies. These schemes and rules are offering direct control to governing bodies and regulators to improve reliability standards as most guarantees are related to outage restoration times and the provision of information about outages such as expected service restoration time. Moreover, the government of India has taken active measures on energy conversion by raising the budget for green and clean energy, from USD 22 Million in FY21 to USD 34 Million in FY22, and further increased to USD 43 Million in FY23. In June 2024, the Government of India approved a funding of USD 5.6 Million (INR 50 crore) for each of the four upcoming green hydrogen valley projects in the country. This financial support aims to promote the development and adoption of clean energy technologies in India. Such favourable government initiatives are expected to fuel the adoption of protective equipment like sectionalizers by distribution operators, thereby driving the market growth during the forecast period.

Sectionalizer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sectionalizer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on phase type, control type, voltage rating and region.

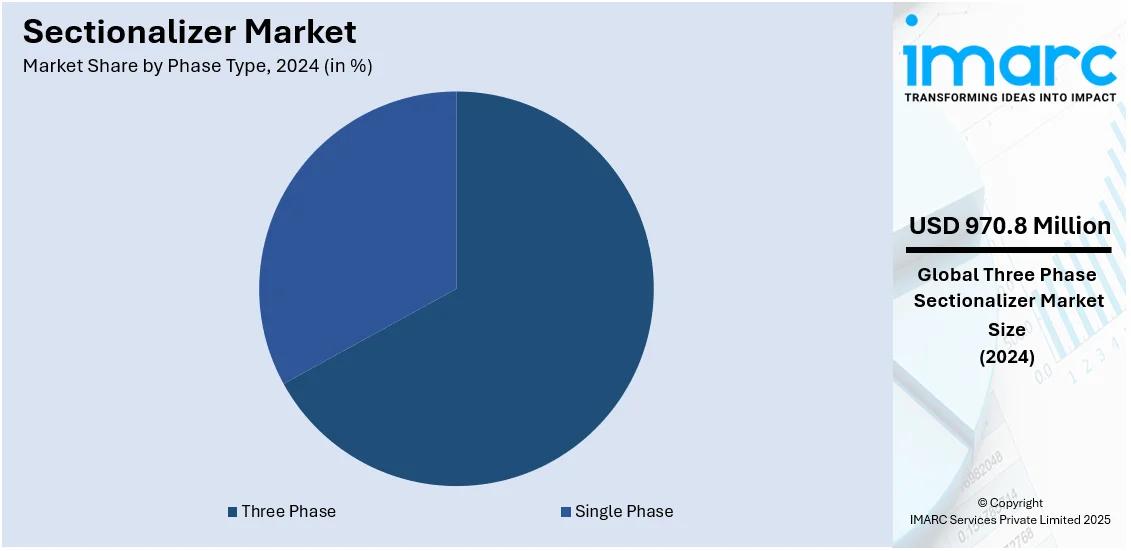

Analysis by Phase Type:

- Single Phase

- Three Phase

Three phase leads the market. These systems are known for its efficiency in power distribution, and it significantly reduces the copper or aluminum needed for electrical distribution, making it economically attractive. Given that a vast majority of the world's industrial machinery and large electrical installations operate on three-phase power, sectionalizers for these systems are naturally higher in demand. Consequently, the widespread use of three-phase power systems in industrial, commercial, and large-scale residential applications is fueling the segment growth. Furthermore, three-phase systems evenly distribute electrical loads, ensuring smoother operation of machinery and reducing wear and tear. Therefore, the reliability and operational benefits of three-phase systems catalyze the demand for three-phase sectionalizers. As more regions continue to industrialize and urbanize, the adoption of efficient and reliable power distribution systems like the three-phase becomes indispensable, further driving the growth of this segment. For example, in 2022, the Tamil Nadu Electricity Regulatory Commission (TNERC) in India directed electricity Tangedco to ensure the 24x7 supply of three-phase electric power in rural areas of the state. Such demands will invariably increase as developing countries urbanize further.

Analysis by Control Type:

- Resettable Electronic Sectionalizer

- Programmable Resettable Sectionalizer

Resettable electronic sectionalizer lead the market as they have gained immense popularity in recent years owing to their advanced features and versatility. Unlike traditional sectionalizers that may need manual intervention or replacement after the operation, resettable electronic variants offer the ability to automatically reset after isolating fault conditions, enhancing system reliability and reducing downtime. This automated resetting capability can be invaluable in scenarios where quick restoration of power is crucial. Moreover, these electronic devices come with advanced monitoring and diagnostic capabilities, enabling real-time insights into the network's health and performance. This assists in proactive maintenance and reducing operational costs. Additionally, as the world shifts toward smarter and more interconnected grids, the integration capability of resettable electronic sectionalizers with modern grid infrastructure further makes them an attractive option. Thus, the combination of reliability, operational efficiency, and compatibility with smart grid technologies is propelling the growth of the segment.

Analysis by Voltage Rating:

- Up To 15 KV

- 16-27 KV

- 28-38 KV

Up To 15 KV sectionalizers are designed to operate in systems with a voltage rating of 15 kilovolts (KV) or less. They are typically found in low voltage networks, commonly serving residential areas, small commercial establishments, and certain rural distributions. Given their voltage range, these sectionalizers are more prevalent in regions with a dense population of low-rise buildings and lower industrial presence.

Sectionalizers in the category of 16-27 KV are tailored for medium voltage networks. They are commonly used in urban and suburban power distribution, serving both residential and commercial areas. In addition, they might be found in certain light industrial settings. Their design allows them to handle a broader voltage spectrum, making them suitable for a wider range of applications compared to the lower voltage counterparts.

28-38 KV are high-end medium voltage sectionalizers mainly used in heavy industrial areas, large commercial establishments, and in portions of the grid that serve a large number of consumers or have high power demands. Due to their higher voltage capacity, these sectionalizers are crucial for ensuring consistent power delivery in regions with significant industrial activities.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 25.4%. North America held the biggest market share since the region boasts a well-established and extensive power distribution infrastructure, necessitating a robust demand for sectionalizers for maintenance, upgrade, and expansion projects. Moreover, the rising emphasis on grid modernization, particularly in the United States and Canada, has spurred investments in advanced distribution equipment, including resettable electronic sectionalizers. For example, in the third quarter of 2023, all 50 US states, as well as the District of Columbia and Puerto Rico, undertook actions related to grid modernization, with a total of 468 grid modernization actions reported during this period. This modernization aims to enhance grid reliability, accommodate renewable energy integration, and ensure resilience against natural calamities and external threats. Furthermore, the industrial and commercial sectors in the North America region are vast and continuously evolving, requiring consistent and efficient power distribution, which further escalates the product demand. Another contributing aspect is the region's regulatory framework and standards, emphasizing safety and efficiency in power distribution, which have indirectly fostered the sectionalizer market growth.

Key Regional Takeaways:

United States Sectionalizer Market Analysis

The adoption of smart grid technologies and rising investments in grid modernization are the main factors propelling the sectionalizer market in the US. Significant improvements are being made to the U.S. electrical grid, which consists of more than 7 million miles of transmission and distribution lines, to increase dependability and lower power outages. The grid is becoming more variable and intermittent because of the growing use of renewable energy sources like solar and wind. Sectionalizers aid in the management of these fluctuations by separating faults and preserving grid stability. Texas, a leader in wind energy, has integrated more than 30 GW of wind capacity, for example, making sophisticated grid management technologies necessary. Sectionalizers are essential tools for enhancing distribution networks' resilience because they isolate problematic areas and reduce interference. Government programs that increase demand for sectionalizers include the Infrastructure Investment and Jobs Act, which provides billions for improvements to energy infrastructure. Sectionalizers must be installed to control variations and improve grid stability, especially as renewable energy sources like solar and wind power become more widely used in areas like Arizona, Texas, and California.

Another factor is the rise in the frequency of extreme weather events, such as hurricanes and wildfires. These incidents demonstrate how modern grid infrastructure is necessary to minimize outages during natural catastrophes. Furthermore, the need for intelligent sectionalizers with the internet of things (IoT) and supervisory control and data acquisition (SCADA) integration has grown because of the move toward automated systems with real-time monitoring capabilities.

Europe Sectionalizer Market Analysis

The region's emphasis on attaining sustainability, dependability, and energy efficiency is what propels the European market. Sectionalizers and other cutting-edge grid management technologies are required to meet Europe's ambitious renewable energy targets. A new target of 42.5% of renewable energy sources by 2030 was supported by the European Parliament in September 2023, although EU nations are encouraged to go for 45%, a goal also supported by the Commission under its REPowerEU initiative. To facilitate the integration of renewable energy sources and guarantee grid stability, nations such as Germany, the United Kingdom, and France are at the forefront of grid renovations. Additionally, investments in updating distribution networks are being accelerated by the EU's Green Deal and related energy infrastructure funding programs. Sectionalizers are essential for reducing power outages, which are a major concern for homes and businesses, especially in areas with high population densities.

Furthermore, the adoption of sophisticated sectionalizers with features like automation and remote control is being fueled by Europe's robust regulatory framework, which places a heavy emphasis on grid dependability and energy efficiency.

Asia Pacific Sectionalizer Market Analysis

The market for sectionalizers in Asia-Pacific is driven by the expansion of electrical distribution networks, industrial growth, and fast urbanization. China, India, Japan, and other nations are making significant investments in grid infrastructure to meet the rising demand for electricity. According to the data by World Economic Forum, clean energy boomed in 2023, with 50% more renewables capacity added to energy systems around the world compared to the previous year. China saw the most significant growth in renewable energy, commissioning the same volumes of solar PV in 2023 as the entire world did a year earlier, while the country’s wind power additions increased by 66% year-on-year. This requires functioning grid management tools like sectionalizers. To upgrade the electrical distribution network and lower power losses, the Indian government launched the Revamped Distribution Sector Scheme (RDSS), which encourages the use of sectionalizers. In addition, the growing use of renewable energy in South Korea and Japan has made sectionalizers necessary to handle related grid issues such voltage swings and dependability issues.

Latin America Sectionalizer Market Analysis

The Latin American sectionalizer market is expanding due to the region's focus on improving electricity access and reducing transmission and distribution losses, which currently average more than 14%. Countries like Chile, Mexico, and Brazil are spending money on grid renovation projects to increase dependability and make room for the integration of renewable energy. With its growing reliance on renewable energy sources like solar and wind, Brazil, the region's largest electricity market needs sectionalizers to maintain grid stability. Demand is also being increased by government initiatives to improve distribution infrastructure in underserved and rural areas and lessen outages. Additionally, more people are using automated sectionalizers, especially in cities where energy use is higher.

Middle East and Africa Sectionalizer Market Analysis

Growing power infrastructure and the increasing integration of renewable energy sources are driving the sectionalizer market in the Middle East and Africa. In the Middle East, as part of their Vision 2030 plans, nations like the United Arab Emirates and Saudi Arabia are making significant investments in grid upgrading. In addition to improving energy efficiency, these projects will help meet the region's rising electricity demand, which is predicted to rise by more than 3% a year. The desire to increase access to power, particularly in rural regions, is a major motivator in Africa. Sectionalizer deployment is made possible by nations like South Africa, Nigeria, and Kenya that are concentrating on lowering transmission losses and enhancing dependability.

Competitive Landscape:

The market is experiencing stable growth due to a substantial rise in demand and new product launches. Various key players are implementing strategic initiatives and engaging in merger and acquisition (M&A) activities to expand their geographical footprint and customer base across the globe. The market is witnessing an increase in research-related efforts and investments by the leading manufacturers resulting in technological advancements, improved supply chain as well as the optimum utilization of raw materials for making high-quality products at lower costs. The market is expected to witness new entrants, consolidation of product portfolios, and a rise in strategic partnerships and collaborations among key players to drive healthy competition within the sectionalizer industry during the forecast period.

The report provides a comprehensive analysis of the competitive landscape in the sectionalizer market with detailed profiles of all major companies, including:

- ABB Ltd.

- Bevins Co.

- Eaton Corporation plc

- Elektrolites (Power) Pvt. Ltd

- G&W Electric Company

- Hubbell Incorporated

- Hughes Power System AB

- Schneider Electric SE

Latest News and Developments:

- August 2024: Schneider Electric, which is into digital transformation of energy management and next generation automation, has announced the introduction of eight new innovative products and solutions which are designed to be more efficient, reliable, sustainable, and safe. The offerings were unveiled on the occasion of the company’s multi location ‘Innovation Days 2024’ which kickstarted in Mumbai. The goal behind launching those products was to equip their customers and partners with state-of-the-art solutions and technologies covering energy management and NextGen automation, thereby helping in creating a brighter, more sustainable future for India and for the world.

- December 2023: Florida-based manufacturer, Carrier Global Corporation, which specializes in intelligent climate and energy solutions, entered into a definitive agreement to sell its commercial refrigeration business to its joint venture partner Haier for an enterprise value of USD 775 Million. With more than 4,000 employees, Carrier Commercial Refrigeration has a sales and service network spanning the Asia Pacific and European regions, with brands that include Profroid, Celsior, Green & Cool, etc.

- December 2023: The United Nations Environment Programme (UNEP) called for stringent energy efficiency standards to reduce emissions from the refrigeration sector. Adopting this measure and related steps could cut the cooling sector’s greenhouse gas emissions by 60% by 2050, the agency said. Presently, this sector accounts for 20% of electricity usage. Sectionalizers can be critical in ensuring the efficiency of energy systems, and they are widely used in refrigeration systems.

- September 2023: Eurelectric, the sector association that represents the European electricity industry, called for increasing investments in the region’s aging grid infrastructures by 84% annually until 2050. The group said that existing infrastructures are not suited for accommodating renewables, electric vehicles, smart grids, etc. Sectionalizers are important components of modern grid systems.

Sectionalizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phase Types Covered | Single Phase, Three Phase |

| Control Types Covered | Resettable Electronic Sectionalizer, Programmable Resettable Sectionalizer |

| Voltage Ratings Covered | Up To 15 KV, 16-27 KV, 28-38 KV |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Bevins Co., Eaton Corporation plc, Elektrolites (Power) Pvt. Ltd, G&W Electric Company, Hubbell Incorporated, Hughes Power System AB, Schneider Electric SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sectionalizer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sectionalizer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sectionalizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A sectionalizer is a protective device used in power distribution networks to isolate faulted sections of the grid, ensuring uninterrupted power supply to unaffected areas. It operates in conjunction with reclosers to enhance system reliability and minimize outage duration.

The sectionalizer market was valued at USD 1,440 Million in 2024.

IMARC estimates the global sectionalizer market to exhibit a CAGR of 3.63% during 2025-2033.

The market growth is fueled by increasing grid modernization, rising demand for uninterrupted power supply across industries, integration of renewable energy, and advancements in automation technologies, enhancing operational efficiency and reliability.

In 2024, three-phase systems represented the largest segment by phase type, driven by their efficiency in industrial, commercial, and residential applications.

Resettable electronic sectionalizers lead the market by market share, owing to their automated resetting capabilities and compatibility with smart grid technologies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global sectionalizer market include ABB Ltd., Bevins Co., Eaton Corporation plc, Elektrolites (Power) Pvt. Ltd, G&W Electric Company, Hubbell Incorporated, Hughes Power System AB, Schneider Electric SE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)