Seed Treatment Market Size, Share, Trends and Forecast by Type, Application Technique, Crop Type, Function, and Region, 2025-2033

Seed Treatment Market Size and Share:

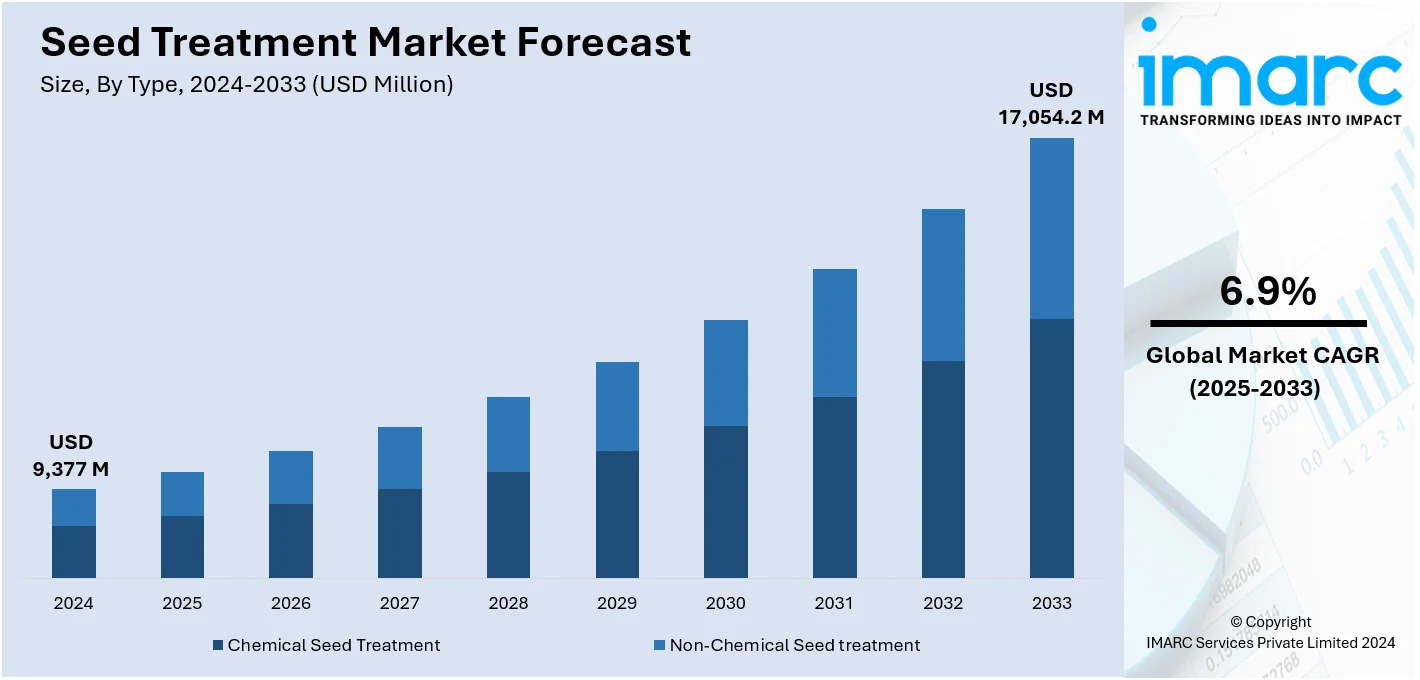

The global seed treatment market size was valued at USD 9,377 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 17,054.2 Million by 2033, exhibiting a CAGR of 6.9% from 2025-2033. North America currently dominates the market. The North American region holds a notable seed treatment market share, driven by the increasing need for efficient seed treatment among farmers, emerging advancements in treatment technologies, and the implementation of favorable regulations and government support.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9,377 Million |

| Market Forecast in 2033 | USD 17,054.2 Million |

| Market Growth Rate (2025-2033) | 6.9% |

Seed treatment is an essential part of farming as it helps farmers retain the efficiency of seeds and retain their viability. The rising adoption of biological seed treatments. Biological agents, including microbial inoculants, plant extracts, and beneficial bacteria, are gaining traction as sustainable alternatives to chemical treatments. To meet the objectives of global sustainability, farmers and other agricultural stakeholders are increasingly turning to environmentally friendly alternatives. The focus on reducing environmental impact while maintaining high agricultural productivity has positioned biological treatments as a preferred choice in many regions. Moreover, the increasing interest in organic farming practices has further driven the demand for biological seed treatment products.

The United States has emerged as a major region in the seed treatment market owing to many factors. As consumers and regulatory bodies push for more sustainable agricultural practices, biological treatments have gained popularity as eco-friendly alternatives to synthetic chemicals. These treatments often involve the use of beneficial microbes, plant extracts, or other natural substances that enhance seed resilience and promote healthy growth. Advancements in technology are shaping the overall industry. The effectiveness and uniformity of seed treatments are being enhanced by precision application methods, such as automated seed coating systems. By ensuring that the active chemicals are dispersed uniformly, these technologies increase their efficacy while decreasing waste. Moreover, the growing emphasis on organic and regenerative farming practices is further spurring the adoption of biological solutions, particularly among smaller and specialty crop producers. As per the predictions of the IMARC Group, the US organic food market is expected to reach US$ 158.2 billion by 2032.

Seed Treatment Market Trends:

Rising Demand for Seed Treatment Among Farmers to Improve Crop Yields

The rising demand for products designed to protect seeds from a range of pests and diseases serves as a key driver for the market. Farmers are becoming conscious about the role of healthy seeds in enhancing production, thereby resulting in the widespread adoption of the product to offer an added layer of protection to seeds, thereby ensuring healthier and more robust plant growth. Up to 30% of rice yields worldwide are lost due to fungus illnesses like rice blast, which also seriously harm the economy. The goal to shrink these losses has substantially fueled the demand for higher fungicidal seed treatments. Along with this, the adoption of modern farming practices, such as precision agriculture and sustainable farming, are also contributing the market growth. These practices emphasize the importance of optimizing resource utilization and minimizing environmental impacts which align with these principles by reducing the need for excessive pesticide applications and lowering production costs for farmers. Furthermore, the shift toward the treatment process, due to rising food production to meet the demands of the growing population with limited arable land available, thus propelling the seed treatment market growth.

Emerging Technological Advancements in Seed Treatment Technologies

The market is driven by advancements in seed treatment technologies such as precision application technologies, nanotechnology, and biological seed treatments. For instance, in May 2024, Bee Vectoring Technologies announced remarkable R&D advancements for its flagship Clonostachys rosea strain CR-7 (CR-7) biological control agent for use as a soyabean seed treatment solution. In addition, the integration of precision agriculture techniques is transforming the seed process, with automated machinery and drones employed to precisely apply treatments, minimizing waste and ensuring uniform coverage across fields, thus influencing market growth. Moreover, the introduction of nanotechnology into the treatment process to encapsulate active ingredients, allows for targeted delivery and improved efficacy which enhances the performance of seeds, representing another major growth-inducing factor. Besides this, the increasing use of biological agents, such as beneficial microorganisms and natural compounds, offer superior pest and disease protection, resulting in the escalating demand for sustainable agriculture practices, thus influencing the market growth.

Implementation of Favorable Regulations and Government Support

Governments are recognizing the importance of enhancing crop productivity and food security and allocating substantial funding to support research initiatives aimed at developing advanced treatment solutions to achieve these goals. Another significant growth-inducing aspect is the implementation of integrated pest control to lessen dependency on chemical pesticides, which can have negative impacts on ecosystems and human health. By guaranteeing that seed treatment and the resulting treated seeds fulfill the standards established by industry and lawmakers, programs such as the European Seed Treatment Assurance Scheme (ESTA), a quality assurance system, are also stimulating market growth.

Besides this, favorable policies and incentives for encouraging the adoption of IPM practices in treatment, which include educational programs, financial incentives, and regulatory frameworks that support the usage of environmentally friendly pest control methods are accelerating the sales demand. These regulations often focus on the safety and efficacy of treatment products, ensuring they meet stringent quality standards to safeguard the interests of farmers and improve consumer confidence in the safety of agricultural products.

Seed Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global seed treatment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application technique, crop type, and function.

Analysis by Type:

- Chemical Seed Treatment

- Non-Chemical Seed treatment

Chemical treatment finds its primary application in the agriculture industry, where it is essential in enhancing crop yield and ensuring healthier plant growth. Farmers employ this method to protect seeds from pests, diseases, and fungal infections by coating seeds with specific chemicals, which create a protective shield that prevents potential threats during germination and early plant growth stages. Moreover, the increasing use of chemical treatment is due to its cost-effectiveness. This affordability makes it an attractive option for small-scale and large-scale farmers, ensuring that various agricultural operations can benefit from its use. Furthermore, the chemical product is known for its precision and efficiency which allows for targeted protection of seeds, minimizing the use of pesticides and other chemicals in the farming process which reduces the environmental impact and contributes to sustainable farming practices, aligning with modern agricultural trends, thus creating a positive market outlook.

Analysis by Application Technique:

- Seed Coating

- Seed Dressing

- Seed Pelleting

- Others

Seed dressing is primarily employed in agriculture, specifically in the cultivation of crops. It serves several purposes, such as protection by treating seeds with fungicides, insecticides, and other protective agents. In addition, it helps protect young plants against various threats, such as soil-borne diseases, pests, and pathogens. This preventive approach significantly reduces the risk of crop loss, leading to healthier and more enhanced plant growth. Furthermore, the seed dressing market is driven by its efficiency and cost-effectiveness. Also, the treatment is applied directly to the seeds, which ensures uniform distribution of the protective agents, eliminating the need for broader-scale chemical applications that reduces the use of chemicals and minimize environmental impact, making it an environmentally friendly choice. Besides this, seed dressing is easy to apply resulting in its widespread adoption among farmers to treat their seeds with minimal equipment and expertise, making it accessible to numerous agricultural practices, from large-scale commercial farms to smallholders, thus propelling the market growth.

Analysis by Crop Type:

- Corn/Maize

- Soybean

- Wheat

- Rice

- Cotton

- Others

Corn/maize is the most widely cultivated crop, with a vast global footprint. It is a staple food and a major source of feed for livestock. This widespread cultivation makes it a natural choice for seed treatment, as protecting the crop from diseases, pests, and environmental stressors is essential to ensure consistent yields. Apart from this, corn serves as a primary ingredient in various industries, including food, livestock feed, and biofuel production. Consequently, ensuring the health and productivity of corn crops is essential for sustaining these industries, resulting in the widespread adoption of seed processes which is essential in achieving this goal by safeguarding the seeds against potential threats. Moreover, corn's susceptibility to various pests and diseases makes treatment processes an indispensable practice. Along with this, farmers can mitigate the risks associated with soil-borne pathogens and insect infestations with a treatment process, that increases the chances of a successful harvest.

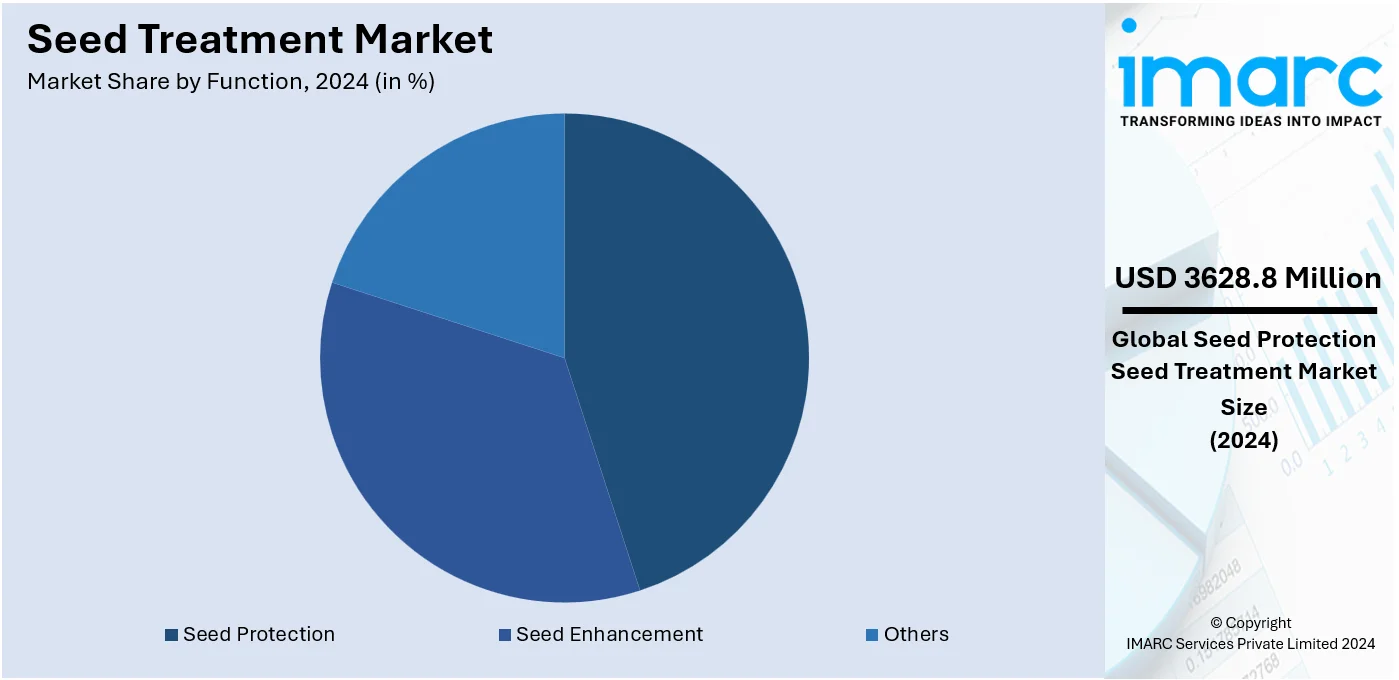

Analysis by Function:

- Seed Protection

- Seed Enhancement

- Others

Seed protection involves the application of various protective agents to seeds before planting. These agents can include fungicides, insecticides, and nematicides. The primary purpose of seed protection is to safeguard seeds from potential threats that can hamper germination and early plant development which aims to ensure that seeds have a healthy start, leading to improved crop yields. Moreover, seed protection is employed across several agricultural contexts. It finds extensive usage in conventional and modern farming methods. Small-scale and large-scale farmers are turning to seed protection to mitigate the risks posed by soilborne pathogens, pests, and nematodes, representing another major growth-inducing factor. Apart from this, it is widely employed to prevent diseases, control pests, and improve germination, and crop quality, thus propelling the market growth.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

The North American market is driven by its extensive expanse of arable land, making it a prime hub for agricultural activities. It requires efficient and effective methods of seed protection, ensuring optimal crop yields. It protects seeds against pests, diseases, and adverse environmental conditions, and is employed extensively in this region to secure agricultural productivity. Moreover, the widespread adoption of advanced treatment technologies is instrumental in elevating the region's position in the market. Also, farmers and agribusinesses in North America are investing in research and development (R&D) to enhance treatment methodologies, thus representing another major growth-inducing factor. Besides this, the implementation of stringent regulations to ensure that only high-quality, treated seeds are deployed, further propels the region's reputation for excellence in treatment practices. In 2024, UPL Corp. announced the U.S. Environmental Protection Agency registration of NIMAXXA bionematicide, the unique triple-strain bionematicide seed treatment for long lasting nematode protection in corn and soybeans.

Key Regional Takeaways:

United States Seed Treatment Market Analysis

In the United States, corn is one of the primary crops, and in 2018, about 33.1 million hectares were harvested, as per industry reports. Seed treatment market in the country is greatly driven by the widespread usage of seed treatment in corn production. About 90% of corn seeds are estimated to be treated. This is because more people are aware of the advantages seed treatments offer in terms of improving crop resistance and production.

Seed treatments protect the seeds against diseases, pests, as well as environmental stress by improving germination and all-around plant health. With challenges from pests and climate variabilities facing productivity maximization, demand for seed treatments has risen sharply. Concomitant growth of the U.S. corn industry along with progress in the science of treatment products, makes the potential for sustained growth of the market for seed treatments in the U.S. This trend is expected to extend to other key crops as well, thereby increasing demand for seed treatment solutions in the region.

Europe Seed Treatment Market Analysis

In Europe, the growth of the seed treatment market is significantly driven by its increasing use in vegetable and fruit plantations. Ongoing agricultural development projects across key countries such as Germany, France, the U.K., and Italy are fostering the adoption of advanced farming techniques, including seed treatment, to boost productivity and crop quality.

According to a study by the European Commission, the agriculture sector generated revenue of EUR 178.4 Billion (USD 185.5 Billion) in 2020, reflecting its vital role in the region’s economy. The demand for high-quality fruits and vegetables has intensified the need for efficient farming solutions that ensure healthier and more resilient crops.

Seed treatment enhances germination, protects seeds from pests and diseases, and improves tolerance to environmental stress, making it an essential component in modern agriculture. With ongoing investments in agricultural innovation, the European seed treatment market is poised for robust growth, supporting the region's commitment to sustainable and productive farming practices.

Asia Pacific Seed Treatment Market Analysis

According to the OECD-FAO Agricultural Outlook 2021-2030, by 2030, India's per capita consumption of vegetable oil will have grown to 14 kg, a robust 2.6% annual growth rate. Increasing demand calls for increased oilseed production to reduce import dependency, which is likely to grow at 3.4% per year during the same period.

With the demand in this regard on the rise, the implementation of sophisticated agricultural practices, including seed treatment, is turning into a necessity. Seed treatment presents a number of advantages. It enhances germination and protects crops from pests and diseases, which ultimately leads to increased resistance against environmental stresses. All these have a direct relation to enhanced productivity in oilseed crops like soybeans, groundnuts, and sunflower, which are very crucial for meeting India's vegetable oil requirements. The Asia Pacific seed treatment market will be poised for growth with the rise in focus of India toward sustainable agriculture, to further support the country's growing consumption of vegetable oil and curb import dependency.

Latin America Seed Treatment Market Analysis

The recent droughts and heat waves that have struck Latin America have caused serious damage to crops, leading to a greater need for resilient agricultural practices. Seed treatment has become one of the key solutions, increasing plant tolerance to adverse conditions such as drought and heatwaves, which ensures better crop yields. This growing dependence on seed treatment products has led to the market growth across the region.

In 2022, Brazil consolidated its position as the largest seed treatment market in South America, holding 91.4% of the regional market share, as per an industry report. Such dominance is due to various factors, including the growing agricultural sector in the nation, increasing demand for food security, and widespread adoption of seed treatment in key crops such as soybeans. Given Brazil's sound agricultural infrastructure and increasing concern for sustainable agriculture, Latin America's seed treatment market is poised for sustained growth in both its pursuit to combat the environmental challenge and growing demands for food.

Middle East and Africa Seed Treatment Market Analysis

The United Arab Emirates is one of the significant markets for agricultural development in the Middle East and Africa region, with one of the highest per capita food consumption rates in the Gulf Cooperation Council. According to the Food and Agriculture Organization, the overall food consumption in the UAE was 10,405.4 million metric tons in 2023, with a per capita consumption of 0.93 metric tons.

The environmental challenges of less arable land and water scarcity have made the UAE resilient in terms of agriculture development, heavily investing in superior farming technology and sustainable methods. It is evident from the increase in cereal production in the country, having surpassed 23.1 thousand metric tons in 2023. All these developments underpin the increasing demand for high-performance quality seeds with a better survival rate, therefore, enhancing the demand for seed treatment solutions. Since the UAE remains committed to innovations in agriculture, the market for seed treatment is highly likely to boom.

Competitive Landscape:

At present, key players are continually striving to strengthen their positions through numerous strategic initiatives. These efforts are pivotal in maintaining their status as thought leaders and experts in the domain of market research and consulting services. They are allocating significant resources to research and development (R&D) and investing in advanced technologies, innovative treatment formulations, and sustainable solutions that enhance the efficacy of their products. Moreover, companies are establishing a strong international presence and entering new geographical markets or strengthening their existing foothold through acquisitions, mergers, or organic growth, allowing them to tap into emerging markets with significant growth potential. Besides this, key players are emphasizing on sustainable and eco-friendly treatment solutions. Additionally, they are concentrating on growing their line of products. For example, Syngenta announced in 2024 that it had created a new seed treatment for cotton and soybeans that will be marketed as Victrato®.

The report provides a comprehensive analysis of the competitive landscape in the seed treatment market with detailed profiles of all major companies, including:

- Bayer AG

- Syngenta Group Co. Ltd.

- BASF SE

- DOW Agrosciences

- Dupont de Nemours Inc.

- Nufarm

- FMC Corporation

- Arysta Lifescience

- Sumitomo Chemical

- UPL Ltd

- Incotec

- Germains

- Advanced Biological Marketing InC

Latest News and Developments:

- January 2025: UPL Corp announced the launch of ATROFORCE bionematicide seed treatment for cotton, designed to protect against nematode pressure. The treatment uses a patented strain of Trichoderma atroviride, offering egg-killing activity that grows with the plant's roots. This solution aims to promote healthier cotton and protect yield potential for the 2025 season.

- December 2024: BioConsortia partnered with New Zealand's H&T to launch a nitrogen-fixing microbial seed treatment, FixiN 33, aimed at optimizing nitrogen fertilizer use for crops like corn, brassicas, and cereals. This innovative treatment helps reduce environmental impact while maintaining crop yields. The seed treatment boasts an impressive shelf life of over two years, benefiting New Zealand's sustainable farming efforts.

- November 2024: Lallemand introduced LalRise Shine DS, a new seed treatment for corn and dry beans that improves root vigor and nutrient availability. It enhances phosphorus uptake by up to 28% and boosts root mass by 20%. The dry treatment can be applied by commercial treaters or on-farm to optimize seed performance.

- September 2024: Indigo Ag, a Boston, Massachusetts-based agricultural technology company, launched the innovative CLIPS™ device, an automatic hands-free system designed to streamline biological seed treatment applications. This device allows for the efficient application of dry powder formulations without the need for farmer intervention during planting.

- February 2024: SaliCrop Ltd. pioneered a climate-smart technology for seed enhancement for transforming barren terrains into blooming landscapes. Harnessing its proficiency in desert technology, the company created a non-GMO and advanced approach for bolstering the resilience of seeds against abiotic stress resulting from climatic changes.

Seed Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chemical Seed Treatment, Non-Chemical Seed Treatment |

| Application Techniques Covered | Seed Coating, Seed Dressing, Seed Pelleting, Others |

| Crop Types Covered | Corn/Maize, Soybean, Wheat, Rice, Cotton, Others |

| Functions Covered | Seed Protection, Seed Enhancement, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Bayer AG, Syngenta Group Co. Ltd, BASF SE, DOW Agrosciences, Dupont de Nemours Inc, Nufarm, FMC Corporation, Arysta Lifescience, Sumitomo Chemical, UPL Ltd, Incotec, Germains, Advanced Biological Marketing Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the seed treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global seed treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the seed treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Seed treatment involves the application of biological, physical, or chemical agents to seeds to protect them from pests, diseases, and environmental stresses, enhancing their germination, viability, and overall crop yield. It is a key practice in modern agriculture to improve seed performance and ensure healthier plant growth.

The global seed treatment market was valued at USD 9,377 Million in 2024.

IMARC estimates the global seed treatment market to exhibit a CAGR of 6.9% during 2025-2033.

The market is driven by increasing demand for efficient seed protection, advancements in treatment technologies, a growing preference for sustainable farming practices, and government initiatives promoting integrated pest management and environmentally friendly agricultural methods.

In 2024, chemical seed treatment represented the largest segment by type, driven by its cost-effectiveness and targeted protection against pests and diseases.

Seed coating leads the market by application technique owing to its efficiency in providing uniform coverage and enhancing the performance of active ingredients.

Corn/maize is the leading segment by crop type, driven by its extensive cultivation and high susceptibility to pests and diseases, making seed treatment essential for yield optimization.

Seed protection is the leading segment by function, driven by its role in safeguarding seeds from pests, diseases, and environmental stresses to ensure healthy crop establishment.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global seed treatment market include Bayer AG, Syngenta Group Co. Ltd, BASF SE, DOW Agrosciences, Dupont de Nemours Inc, Nufarm, FMC Corporation, Arysta Lifescience, Sumitomo Chemical, UPL Ltd, Incotec, Germains, Advanced Biological Marketing Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)