Self Storage Market Size, Share, Trends and Forecast by Storage Unit Size, End Use, and Region, 2026-2034

Self Storage Market Size and Share:

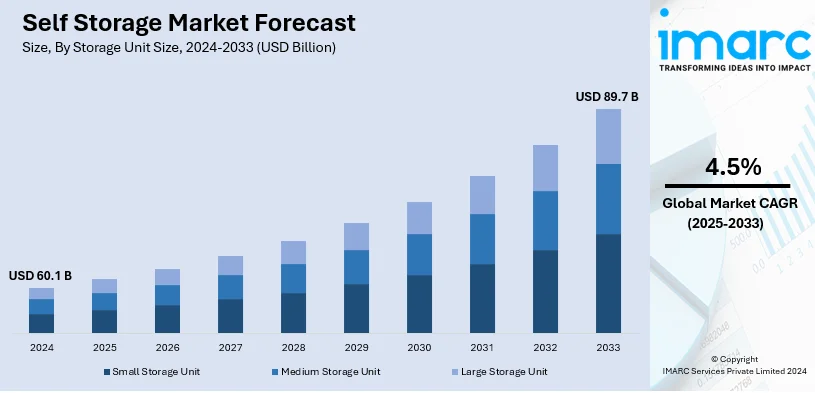

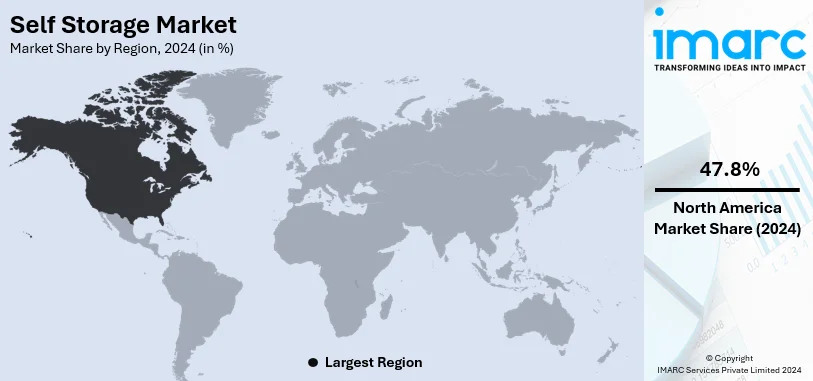

The global self storage market size reached USD 60.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 89.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.5% during 2026-2034. North America currently dominates the market, holding a market share of over 47.8% in 2024. The fast pace of urbanization and space limitations, lifestyle changes, growing use of self storage facilities by small companies and startups to keep inventory or equipment, and growing e-commerce activities are some of the key drivers driving the self storage industry in North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 60.1 Billion |

| Market Forecast in 2034 | USD 89.7 Billion |

| Market Growth Rate 2026-2034 |

4.5%

|

Self storage is a service through which people and companies are able to rent space to house possessions, typically on a month-to-month agreement. Described as flexible, accessible, and secure, self-storage provides an answer for both short-term and long-term storage requirements. Units are available in all sizes, ranging from small lockers to huge rooms, and are usually kept in a facility with security features such as surveillance cameras, coded entry systems, and on-site personnel. A number of self storage facilities include climate-controlled units, drive-up access, and online management systems, enabling customers to conveniently control their stored items. This service has become increasingly popular for its convenience, especially for those undergoing transitions like moving or decluttering.

According to the self storage market overview, the growing demand for extra space and the increase in relocation activities are fueling the industry. Similarly, the growing need for safe and easy storage space and the struggle to deal with clutter are underscoring the value of self storage solutions for both personal and business use. Self storage facilities play a critical role in offering flexible, accessible, and secure spaces, meeting the growing need for streamlined storage solutions. The expansion of facility networks and efforts to standardize security features are further fueling market growth. Additionally, factors such as evolving consumer lifestyles, a preference for cost-effective yet secure storage options, and a focus on facilities with advanced features like climate control and online management are driving the self storage market's growth across diverse sectors globally.

The global self-storage market is being driven by urbanization, which is increasing residential and commercial space constraints, prompting individuals and businesses to seek flexible storage solutions. Rising e-commerce activities contribute to demand as retailers require storage facilities for inventory management. Lifestyle changes, including downsizing, relocation, and a growing preference for minimalist living, are boosting the need for temporary and long-term storage options. Additionally, small businesses and startups are increasingly using self-storage units to store equipment and documents, reducing the overhead of leasing commercial spaces. Advances in security technology, such as digital locks and 24/7 surveillance, are enhancing the appeal of modern facilities.

As per the self storage market report 2025, The United States has emerged as a key regional market for self storage. The United States self-storage market is experiencing steady growth driven by various factors. Urbanization and increasing population density in metropolitan areas are creating a need for additional storage space, as people face limited room in their homes and apartments. Lifestyle changes, such as downsizing by retirees and the growing trend of remote work, are also encouraging individuals to use self-storage facilities for decluttering and organizing. Rising e-commerce activities are contributing to demand from businesses seeking cost-effective storage for inventory. Additionally, a mobile workforce and frequent relocations, driven by job opportunities and lifestyle preferences, are boosting short-term and long-term storage needs. Seasonal requirements, like storing recreational equipment or holiday decorations, further support the market across the country.

Self Storage Market Trends:

Shift Toward Digital-First Experiences

The self-storage industry is witnessing a notable shift toward digital-first services aimed at improving customer convenience and operational efficiency. Operators are integrating online booking systems, virtual unit tours, automated check-in/out processes, and mobile account management tools to streamline the customer journey. These tech-driven upgrades reduce the need for in-person interactions and allow users to access, monitor, and manage their storage units independently, often 24/7. Additionally, facilities are adopting secure, app-based entry systems and digital locks to support fully contactless access. This evolution aligns with customer preferences for speed and simplicity while reflecting broader changes in consumer behavior driven by digital adoption and increased expectations for self-service convenience.

Urbanization and Space Constraints

One of the primary market drivers for the self storage industry is the rapid pace of urbanization and the resulting space constraints in densely populated areas. According to the data by World Bank, around 56% of the world’s population – 4.4 Billion inhabitants – live in cities. This trend is expected to continue, with the urban population more than doubling its current size by 2050, at which point nearly 7 of 10 people will live in cities. As more people move to cities for better job opportunities and lifestyles, the available living and working spaces often become smaller and more expensive. The need for extra space to store belongings, seasonal items, or even business inventory becomes a pressing concern. Self storage facilities offer a convenient solution by providing a variety of unit sizes to cater to different needs. For urban dwellers and businesses, these facilities act as an extended storage room, thereby eliminating the burden of clutter and enabling better space management in their primary locations.

Lifestyle Transitions and Life Events

Major life events such as marriage, relocation, and downsizing are significant market drivers for the self storage industry. These transitions often create a temporary or long-term need for storage solutions. For instance, couples merging households may have duplicate items that they're not ready to discard. Similarly, individuals going through a divorce, job change, or loss of a family member may require storage space to keep belongings until they decide the next steps. For instance, the employees of all ages in the United States change jobs on average every 4.2 years, according to a recent report on employee tenure from the Bureau of Labor Statistics. The self storage market thrives on these lifestyle transitions, offering the flexibility to choose rental periods and adapt the storage size based on evolving needs. Therefore, a significant portion of storage demand was linked to people needing temporary space during major personal transitions, particularly in urban areas with limited living space.

Growing Small Businesses and E-commerce

The surge in small businesses and e-commerce platforms also propels the demand for self storage solutions. According to industry reports, there were estimated to be approximately 358 Million small and medium-sized enterprises (SMEs) gloablly in 2023. Many small businesses operate out of homes or small offices where space is limited. Self storage facilities provide an economical option for storing inventory, records, or equipment, thereby allowing businesses to focus on growth rather than being constrained by space limitations. E-commerce companies can benefit from the flexibility to scale up or down based on seasonal demand, without the commitment of long-term leases. This makes self storage a versatile and cost-effective solution, driving its market growth among the commercial sectors.

Self Storage Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Self storage market report, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on storage unit size, end use, and region.

Analysis by Storage Unit Size:

- Small Storage Unit

- Medium Storage Unit

- Large Storage Unit

Medium storage unit, leads the market with around 44.6% of market share in 2024, according to self storage industry statistics. Medium storage units cater to a broader range of needs, serving both individual consumers and commercial users. These units are often chosen for storing larger belongings like appliances, furniture sets, or business inventory. They can also accommodate the needs of small- to medium-sized businesses that require more space but aren't ready to move into a larger commercial setting. Families in transition, such as those who are relocating or renovating, often choose medium storage units for their versatility and adequate space. This segment focuses on a blend of affordability, space, and security, making medium-sized units a popular choice for a wide array of storage needs.

The market for small storage units is often driven by individual consumers, small businesses, and students. For personal use, these units are ideal for storing items such as seasonal clothing, sports equipment, and small pieces of furniture. For businesses, small storage units are perfect for storing documents, excess inventory, or supplies without cluttering their primary workspace. They are also popular among students who need temporary storage during school breaks. The affordability and convenience of small storage units make them highly appealing to customers who need a quick and cost-effective storage solution without a long-term commitment. This market segment places a high value on location and ease of access.

Large storage units are geared primarily toward commercial users and individuals with extensive storage needs. Businesses that require substantial storage space for inventory, equipment, or archives form a significant portion of this market. These units can also serve individuals in special circumstances, such as those needing to store the entire contents of a home during a prolonged absence or relocation. Furthermore, they are useful for storing larger items like boats or RVs. This segment is characterized by customers who prioritize space and security and are willing to invest in a more extended rental period for a comprehensive storage solution.

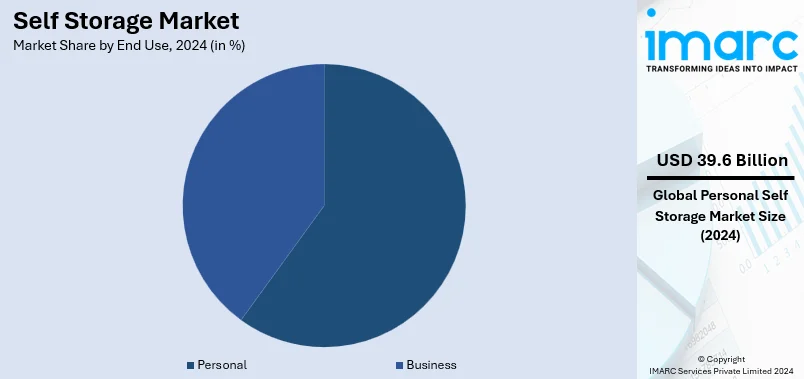

Analysis by End Use:

- Personal

- Business

Personal leads the market with around 65.8% of market share in 2024. The personal end-use segment in the market for self storage facilities is diverse and driven by various life transitions and individual needs. Common clients in this category include people moving homes, those undergoing significant life changes such as marriage, divorce, or retirement, and individuals who simply need extra space to declutter their living environment. This segment also sees demand from travelers needing temporary storage, as well as students who require storage during term breaks. Convenience, accessibility, and security are the primary considerations for consumers in this segment. Many opt for self storage units that offer 24/7 access, robust security features, and flexible leasing terms, such as month-to-month rentals. Given the varied motivations for personal storage use, this segment tends to have fluctuating seasonal demand—peaking during summer months and at the beginning and end of academic terms. Overall, the personal end-use segment significantly influences the self storage market, necessitating a customer-centric approach to meet diverse storage needs effectively.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest self storage market share of over 47.8%. In the North American market, self storage has seen considerable growth, fueled by various socio-economic factors. The region is characterized by a high level of urbanization, consumerism, and lifestyle changes, all of which contribute to the demand for additional storage space. One unique feature of this market is the prominence of 'drive-up' units, which offer consumers the convenience of driving directly to the storage space for easy loading and unloading. Small businesses also contribute to demand, using storage units for inventory or equipment, thereby increasing the commercial usage of these facilities. Additionally, the rise in housing costs and the shrinking size of living spaces, particularly in urban areas, have created a burgeoning market for storage solutions. Regulatory frameworks in North America also facilitate the ease of doing business, making it an attractive market for both local and international providers. The overall self storage market trends in this region are indicative of both a mature and still-evolving industry, offering opportunities for innovation and growth.

Key Regional Takeaways:

United States Self Storage Market Analysis

In 2024, the United States accounts for over 71.6% of self storage market in North America. Several factors, such as shifting consumer lifestyles, rising urbanization, and the growing trend of downsizing, have contributed to the enormous rise of the self-storage business in the United States. The population's high degree of mobility—people move around a lot for job or to change their lifestyles—is one of the main causes, which makes temporary storage solutions necessary. Additionally, small firms now require additional space for inventory storage due to the growth of e-commerce.

Another significant factor has been urbanization, as more people live in smaller apartments and need off-site storage for personal possessions, furniture, and seasonal goods. The demand for self-storage also increased because of the increase in home modifications brought on by the pandemic and post-pandemic trends. The growing trend of minimalism, in which people try to simplify their living areas, is another important reason. The market's growth has been further spurred by the growth of online booking platforms for storage units and the rising demand for climate-controlled storage options. According to Storage Café, self-storage expanded to over 2 billion square feet by 2024. 279.8 Million square feet of storage space, or 14.3% of the entire inventory, have been constructed over the past five years. Nearly 57.3 Million square feet of rentable space—enough to fill Central Park—were finalized in 2023 alone. In 2023, new supply will account for 3.1% of the total inventory. An estimated 61.1 Million square feet of new self-storage space will be finished in the United States by 2024. Compared to 2023 deliveries, that is a 6.6% rise. Self-storage is currently used by one in five Americans (18%), and 14% want to rent some in the future.

Europe Self Storage Market Analysis

The self-storage market in Europe is also experiencing strong growth, driven by similar factors seen in the United States. The growing population of cities, especially in nations like the UK, Germany, and France, is one of the main factors propelling this industry. People need external storage solutions for extra goods as living areas get smaller due to urbanization. Demand is further increased by the tendency of people moving to cities more frequently for personal or professional reasons.

The need for self-storage facilities for company goods has increased because of the expansion of the e-commerce industry in Europe, especially in nations like Germany and the UK. In 2023, the total B2C European e-commerce turnover saw a modest growth of 3%, increasing from Euro 864 Billion (USD 908 Billion) to Euro 887 Billion (USD 932 Billion), as per an industrial report. Additionally, the "sharing economy" is becoming more and more popular as people and companies look to cut expenses by renting storage facilities rather than buying big storage spaces, which is also helping the self-storage sector. Additionally, the demand for self-storage facilities has increased, particularly in high-demand urban locations, as more and more people in the region are downsizing their houses in pursuit of more inexpensive housing options. In important European regions, the emergence of self-storage firms like Shurgard and Big Yellow Storage has further improved storage choices' accessibility and availability.

Asia Pacific Self Storage Market Analysis

The market for self-storage in the Asia-Pacific region is expanding quickly due to rising storage service usage in nations like China, Japan, and Australia. A primary factor contributing to this growth is the growing population density in places like Sydney, Shanghai, and Tokyo. As so many people in these cities live in tiny apartments, there is a need for off-site storage.

Self-storage is becoming increasingly popular in China as more people and families can now afford to hire extra storage space for their personal or professional needs due to the country's expanding middle class and growing disposable income. For inventory management, the expansion of the e-commerce sector in nations like China and India is also driving up demand for temporary storage options. China has the largest retail e-commerce sector followed by the US and India. According to the data by Indian Brand Equity Foundation, in 2023, social commerce significantly transformed traditional retail and e-commerce in India, with projections indicating a growth rate of 31% CAGR, reaching USD 37 Billion by 2025. Self-storage services are in greater demand in Australia because of the trend of people downsizing their residences in major cities like Sydney and Melbourne. Further expansion is also being fuelled by the growing trend of minimalism and the emergence of mobile self-storage solutions in the area.

Latin America Self Storage Market Analysis

Although still in its infancy, the self-storage business in Latin America is expanding rapidly, particularly in nations like Argentina, Brazil, and Mexico. Self-storage units and other space-saving alternatives are in high demand as cities like São Paulo and Mexico City see tremendous population increase. Self-storage options for inventory management have become more popular in Latin America due to the rising need for e-commerce, especially after the pandemic. Self-storage facilities are frequently used by small and medium-sized businesses in the area for their warehousing requirements. Growth is also being driven by the increase in expats, frequent moves, and a rising need for home storage solutions. As per world migration report data by International Organization for Migration (IOM), in 2020, the numbers of Europeans and Northern Americans living in Latin America and the Caribbean stood at around 1.4 million and 1.3 million, respectively. Meanwhile, around 11 million migrants in Latin America and the Caribbean originated from other countries in the region. The demand for self-storage facilities is further fuelled by the region's economic gains and the growing number of young professionals looking for flexible living options. Even though the industry isn't as large as it is in the US or Europe, self-storage facility investments are growing, and new companies are joining the market to meet this need.

Middle East and Africa Self Storage Market Analysis

As urbanization and disposable incomes increase, the market for self-storage is expanding across the Middle East and Africa, especially in the Gulf Cooperation Council (GCC) nations like the United Arab Emirates, Saudi Arabia, and Qatar. According to an industrial report, almost two-thirds of the population of the Middle East live in cities, and this is expected to increase further, making the region among the most urbanized in the world. The UAE's expanding expat community, frequent moves, and rise in small and medium-sized enterprises—all of which need storage solutions—are driving the self-storage sector. The demand for personal and commercial self-storage services in Saudi Arabia is being driven by the country's rapid infrastructure development and construction boom, especially in large cities like Riyadh and Jeddah. Another element driving market expansion is the growing demand for luxury and larger residences that can accommodate seasonal or surplus items. In South Africa, self-storage solutions are being increasingly used for both residential and business purposes, particularly in Johannesburg and Cape Town. The market is growing as individuals and companies seek affordable, flexible storage solutions, especially in high-rent urban areas.

Competitive Landscape:

The key players in the self storage market are actively investing in technology and innovation to enhance customer experience. Automated systems for booking and payments, as well as advanced security features like biometric access and 24/7 video surveillance, are becoming increasingly common. Many companies are also focusing on sustainability, implementing solar panels and energy-efficient designs. Partnerships with moving services and the offering of additional services such as packing supplies aim to provide a one-stop solution for customers. Geographic expansion continues to be a major strategy, with companies acquiring smaller storage units to expand their footprint. These initiatives collectively aim to meet evolving consumer needs while maintaining profitability.

The report provides a comprehensive analysis of the competitive landscape in the self storage market with detailed profiles of all major companies, including:

- Aecom

- CubeSmart

- Life Storage Inc.

- Metro Storage LLC (Find Local Storage)

- National Storage

- Public Storage

- Safestore

- Simply Self Storage

- StorageMart

- U-Haul International Inc. (AMERCO)

- Urban Self Storage

- World Class Capital Group LLC

Latest News and Developments:

- April 2025: 6Storage launched 6Storage 3.0, a completely rebuilt self-storage management software developed with Apoorva, a technology investment firm, designed for operators of all sizes globally. The new version features a modern, scalable architecture supporting single or multi-facility management, seamless third-party integrations, and rapid feature rollouts. Key tools include two-screen move-in, customizable AG Grid reporting, advanced tax settings, tiered pricing, delinquency management, and QuickBooks integration.

- April 2025: Colliers launched the Stockhausen-Hernandez Self-Storage Team to serve the Mid-Atlantic and Southeast regions, enhancing its self-storage market presence. This specialized team aims to provide focused expertise in self-storage brokerage, investment sales, and advisory services. By leveraging deep regional knowledge and industry experience, the team supports clients with acquisitions, dispositions, and development opportunities.

- April 2025: Harbor Lockers, a division of Luxer One, launched the first national locker network for self-storage with 500+ locations across 80+ U.S. cities. This innovative system offers on-demand, 24/7 secure access to micro-storage, package delivery, returns, and peer-to-peer exchanges without requiring capital expenditure, power, or facility changes. Lockers install in 10 minutes, utilize underused space, and enable new revenue streams through pay-per-use and subscriptions.

- February 2025: SmartStop Self Storage REIT, Inc. launched a new mobile app to enhance customer convenience and flexibility. Available initially in select markets and expanding to all 210 U.S. and Canadian locations by March 2025, the app enables users to manage accounts, remotely open gates and doors, and rent storage units via smartphones. This technology-driven tool aims to streamline the storage experience, offering touchless access and online account management.

- January 2025: NexPoint, a Dallas-based alternative investment firm, launched NexPoint Storage VI DST, its sixth Delaware Statutory Trust offering, featuring two Generation-V, Class-A self-storage facilities in Nashville, Tennessee, and Temple Hills, Maryland (Washington DC MSA). Managed by Extra Space Storage, these properties offer climate-controlled units and enhanced security, targeting areas with strong demographics and economic growth.

- January 2025: Newmark brokered the recapitalization and joint venture between Hines and CubeSmart for a 14-property self-storage portfolio in Dallas-Fort Worth, marking one of the largest U.S. self-storage portfolio transactions of 2024. The portfolio, operating under CubeSmart, includes over 9,700 units and more than 1.25 million net rentable square feet. The assets are strategically located in high-growth submarkets, benefiting from strong population and job growth.

- November 2024: Universal Storage Containers LLC (USC), a provider of portable-storage containers for self-storage and other industries, introduced a SmartLease flexible-leasing program that allows customers to grow their business without having to make a large upfront down payment. It can be used to lease company products including cargo-air ULD (unit load devices) containers, cargo-ground containers, Green-Lite stackable containers, Polar Bear refrigerated containers, and Z-Box foldable and stackable containers.

Self Storage Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Storage Unit Sizes Covered | Small Storage Unit, Medium Storage Unit, Large Storage Unit |

| End Uses Covered | Personal, Business |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aecom, CubeSmart, Life Storage Inc., Metro Storage LLC (Find Local Storage), National Storage, Public Storage, Safestore, Simply Self Storage, StorageMart, U-Haul International Inc. (AMERCO), Urban Self Storage, World Class Capital Group LLC etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, self storage market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global self storage market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the self storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Self storage is a service that provides individuals and businesses with secure, personal storage spaces, typically in the form of rented units or lockers. These facilities are used to store belongings, inventory, or equipment temporarily or long-term, offering flexibility, convenience, and varying sizes to accommodate diverse storage needs.

The self storage market was valued at USD 60.1 Billion in 2024.

IMARC estimates the global self storage market to exhibit a CAGR of 4.5% during 2025-2033.

The self-storage market is driven by urbanization, limited residential space, lifestyle changes like downsizing and remote work, growing e-commerce requiring inventory storage, and increased mobility with frequent relocations.

According to the report, medium storage unit dominates the market due to their versatility, accommodating a wide range of personal and business storage needs, including furniture, seasonal items, and inventory, making them ideal for both individual and commercial users.

Personal leads the market by end use owing to rising urbanization, smaller living spaces, and increased demand for flexible storage solutions to manage household belongings and lifestyle transitions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Self Storage market include Aecom, CubeSmart, Life Storage Inc., Metro Storage LLC (Find Local Storage), National Storage, Public Storage, Safestore, Simply Self Storage, StorageMart, U-Haul International Inc. (AMERCO), Urban Self Storage, World Class Capital Group LLC etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)