Shunt Reactor Market Size, Share, Trends and Forecast by Type, End-User, Application, and Region, 2025-2033

Shunt Reactor Market Size and Share:

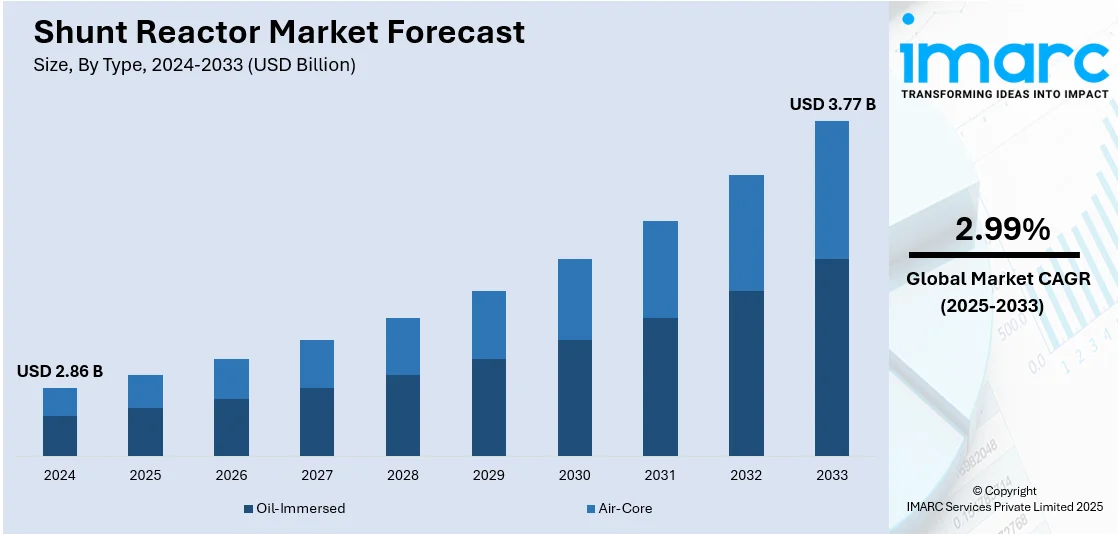

The global shunt reactor market size was valued at USD 2.86 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.77 Billion by 2033, exhibiting a CAGR of 2.99% during 2025-2033. Asia Pacific dominated the market, holding a significant market share of 40% in 2024. Growing electricity demand, grid expansion, renewable projects, and government support for modern energy infrastructure are some of the key factors contributing to the shunt reactor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.86 Billion |

|

Market Forecast in 2033

|

USD 3.77 Billion |

| Market Growth Rate (2025-2033) | 2.99% |

The market is expanding due to several practical and economic factors. With global electricity demand increasing, especially in urban and industrial zones, utilities are investing in grid stability. Shunt reactors help regulate voltage and manage reactive power, which is essential as transmission networks become more complex and widespread. The integration of renewable energy sources like wind and solar, often irregular and decentralized, has made voltage control more critical. Governments and utilities are also upgrading aging infrastructure and deploying smart grid technologies, further boosting demand. Transmission line expansions and the need to reduce power losses during long-distance delivery also make shunt reactors a cost-effective solution. In regions with large-scale industrial activity and high-voltage grids, the push for better energy efficiency and system reliability continues to support shunt reactor market growth.

In the United States, demand for high-voltage shunt reactors is increasing as grid operators seek to stabilize voltage and integrate large-scale renewable energy. These devices are becoming critical in transmission projects, especially in regions expanding clean energy capacity. Their role in supporting reliable, long-distance power flow is driving wider deployment across power infrastructure upgrades. For instance, in February 2025, GE Vernova was selected by Sterlite Grid 32 Limited to supply 765 kV switchgear, transformers, and shunt reactors for the Khavda Phase-IV Part C project. The technology supported voltage stability and renewable power integration into India’s national grid.

Shunt Reactor Market Trends:

Growing Demand for Voltage Control Solutions

As electricity use rises rapidly worldwide, power grids are under increasing strain to remain stable and efficient. This has intensified the need for equipment that can manage voltage fluctuations and improve power quality. Devices that regulate reactive power, such as shunt reactors, are seeing broader adoption. Current shunt reactor market trends highlight their growing role in supporting long-distance transmission and smoothing out variable power inputs, especially in systems integrating renewable sources. Utilities and grid operators are prioritizing technologies that strengthen transmission infrastructure without major overhauls. Variable shunt reactors, in particular, are becoming preferred tools for their flexibility in adapting to shifting grid demands. With more complex energy flows and higher load requirements, these systems offer a practical solution for maintaining reliability and minimizing losses. The market is seeing wider application of such equipment to meet the evolving requirements of modern electric networks. According to a new report by the International Energy Agency, global electricity consumption is expected to grow annually at 4% between 2025 and 2027, reaching 3,500 TWh, the fastest in recent years.

Expanding Power Infrastructure Driving Demand for Grid Support Equipment

As installed power capacity continues to grow across regions, the complexity of managing large-scale transmission networks is also increasing, shaping the shunt reactor market outlook. Expansions in generation, especially from renewable and distributed sources, are pushing grid operators to invest in equipment that can ensure stability, efficiency, and power quality across long distances. Shunt reactors are gaining wider acceptance for their role in absorbing reactive power, improving voltage regulation, and supporting overall grid performance. Their ability to manage line charging currents in high-voltage networks makes them essential as new substations and transmission corridors are added. Variable types, in particular, offer adaptability to fluctuating load conditions, making them well-suited for modern grids with dynamic operating profiles. As more capacity is connected to the system, the need for flexible, space-efficient solutions that can be integrated without major redesigns is growing. These factors are contributing to the broader adoption of shunt reactors in both new installations and grid upgrade programs. As of January 2025, the total installed power capacity stands at 466.26 GW.

Increased Adoption of High-Voltage Reactive Power Equipment

As countries expand renewable capacity, the need for advanced grid-stabilizing equipment is rising. Variable shunt reactors are becoming essential for managing reactive power in high-voltage systems, especially where wind and solar sources are being integrated. These reactors help maintain voltage stability and reduce transmission losses, improving overall system performance. Their growing use reflects a shift toward flexible grid solutions that can support clean energy goals without compromising reliability or efficiency. As per the shunt reactor market forecast, adoption is also accelerating in regions with emerging renewable infrastructure, where grid modernization is a key part of national energy strategies. For example, in October 2024, Hitachi Energy delivered a 500 kV variable shunt reactor for Uzbekistan’s Dzhankeldy wind farm, supporting grid stability as the country scales up renewables. The reactor, made in China, is the first of its kind for Uzbekistan. It supports a 500 MW onshore wind facility developed by ACWA Power, expected to generate 1.65 Million MWh annually and cut carbon emissions by 750 tons, helping meet Uzbekistan’s 2030 clean energy goals.

Shunt Reactor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Shunt Reactor market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, end-user, and application.

Analysis by Type:

- Oil-Immersed

- Air-Core

Oil-immersed stood as the largest type in 2024, holding around 70.2% of the market, driven by its proven reliability in high-voltage applications. These reactors handle reactive power compensation effectively in power transmission networks, especially where long-distance lines cause voltage fluctuations. The oil insulation enhances thermal stability and extends equipment life under continuous operation, making it a preferred choice for utilities and grid operators. They also support higher ratings compared to dry-type alternatives, which suits expanding infrastructure projects and substation upgrades. With rising energy demand and increasing grid complexities, the preference for oil-immersed reactors is also influenced by their ability to operate efficiently in harsh conditions. This has led to a noticeable shift in investments and installations toward oil-immersed units across emerging and developed markets.

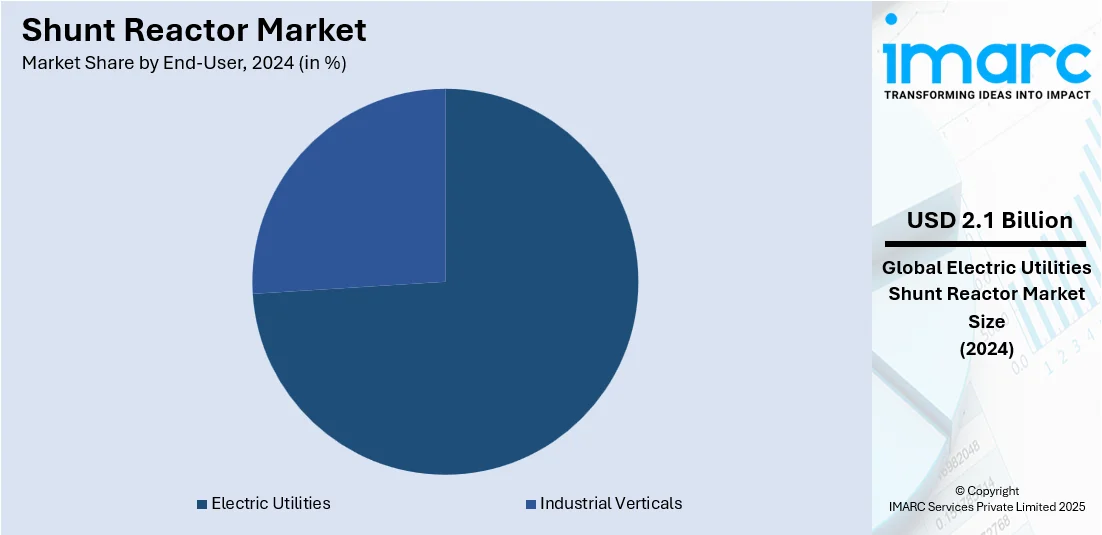

Analysis by End-User:

- Electric Utilities

- Industrial Verticals

Electric utilities led the market with around 73.7% of market share in 2024 due to the growing need for grid stability and efficient power transmission. Utilities are expanding and modernizing transmission networks to manage rising electricity demand and integrate renewable sources like wind and solar. Shunt reactors help control voltage levels and reduce losses over long distances, making them essential for utility-scale operations. As more high-voltage transmission lines are added to connect remote generation sites, the demand for reliable voltage regulation solutions has increased. Government investments and grid expansion projects further support this trend. Electric utilities are the primary buyers of shunt reactors, and their ongoing focus on grid resilience and power quality is pushing consistent demand for these components in both existing and new substations.

Analysis by Application:

- Variable Reactor

- Fixed Reactor

Fixed reactor led the market in 2024, owing to its widespread use in stable, continuous reactive power compensation applications. Fixed shunt reactors are commonly installed in substations and transmission lines to manage overvoltage caused by light load conditions, especially on long-distance, high-voltage networks. Their simpler design, lower cost, and ease of integration make them a preferred choice for utilities that require consistent voltage control without the need for variable adjustments. As power grids expand and face more load variability, fixed reactors offer a dependable solution for baseline reactive power management. Their long operational life and minimal maintenance also make them attractive for utilities seeking efficient and low-intervention equipment to support growing energy infrastructure across regions.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 40% due to rapid industrialization, urban growth, and increasing electricity consumption in countries like China, India, and Southeast Asian nations. These regions are heavily investing in expanding and upgrading their power transmission and distribution networks to support economic development and rising energy demand. The integration of large-scale renewable energy projects, particularly wind and solar, creates a greater need for voltage regulation and reactive power management, key functions of shunt reactors. Additionally, government policies promoting electrification in rural areas and infrastructure development, such as smart grids and high-voltage transmission lines, are driving adoption. Local manufacturing capabilities and lower production costs also support regional market growth. Overall, the combination of strong demand, policy backing, and infrastructure investment makes Asia Pacific a key driver in the global shunt reactor market.

Key Regional Takeaways:

United States Shunt Reactor Market Analysis

In 2024, the United States accounted for 87.3% of the market share in North America. The US is experiencing increasing adoption of shunt reactors due to growing energy demand across industrial and residential sectors. For instance, in the United States, the world’s second-largest electricity consumer after China, demand rebounded in 2024, growing by 2% to reach a new high. This followed a 1.8% decline in 2023 due to mild weather and weaker manufacturing activity. As electricity consumption rises, utilities are under pressure to enhance grid reliability and minimize losses. Shunt reactors help manage reactive power and maintain voltage stability during peak load periods, supporting an uninterrupted power supply. With growing energy demand, power utilities in the United States are integrating shunt reactors in substations to stabilize high-voltage networks and improve operational efficiency. Investments in energy infrastructure upgrades are also reinforcing the deployment of advanced grid components such as shunt reactors. Moreover, renewable energy integration into the grid adds fluctuations in voltage, which shunt reactors help mitigate. This supports more balanced power distribution and reduces the likelihood of equipment damage, aligning with efforts to meet the rising energy consumption needs.

Asia Pacific Shunt Reactor Market Analysis

Asia Pacific is witnessing growing shunt reactor adoption due to the expansion of modern transmission and distribution (T&D) networks. China plans to modernise and expand its power grids with USD 442 Billion in investments over the period 2021-2025. Rapid urbanization and industrialization are driving the need for reliable electricity, prompting utilities to upgrade T&D infrastructure. Modern T&D networks require voltage regulation solutions to ensure efficient energy delivery, and shunt reactors provide essential reactive power compensation. With expanding high-voltage lines, utilities in Asia Pacific are integrating shunt reactors to reduce voltage fluctuations and improve transmission stability. The development of smart and automated grid frameworks is further boosting demand for advanced shunt reactors. These reactors play a critical role in optimizing electricity transmission efficiency while maintaining grid performance.

Europe Shunt Reactor Market Analysis

Europe is seeing rising shunt reactor adoption driven by efforts to reduce carbon footprint and prevent voltage jumps in power systems. For instance, from 2025, an annual CO2 emission reduction target of 15% compared to 2021 values will be in application for the 2025-2029 period. As the region intensifies its transition to cleaner energy sources, maintaining voltage stability becomes increasingly important. Shunt reactors are essential for controlling voltage levels in grids that incorporate renewable power, which often introduces variability. With a strong focus on energy efficiency and sustainability, utilities in Europe are using shunt reactors to support low-carbon grid operations. Reducing carbon footprint through optimized power delivery aligns with regional environmental goals. Additionally, the risk of voltage jumps during low-load conditions or grid faults necessitates reliable voltage management, which shunt reactors effectively address.

Latin America Shunt Reactor Market Analysis

Latin America is expanding shunt reactor use as investments in smart grid technologies increase across the region. For instance, Brazil’s Copel reaches 1 Million smart meters milestone in Paraná. These smart grids require components that enhance voltage control, support system automation, and improve load management. Shunt reactors fulfil these needs by providing reactive power compensation and voltage stability. As countries in Latin America modernize power systems to reduce losses and increase efficiency, shunt reactors are being implemented more frequently within smart grid frameworks to ensure robust energy delivery and control.

Middle East and Africa Shunt Reactor Market Analysis

Middle East and Africa are strengthening shunt reactor deployment due to rising investment on power distribution and power grid infrastructure. According to International Energy Association, energy investment in the Middle East is expected to reach approximately USD 175 Billion in 2024, with clean energy accounting for around 15% of the total investment. As electricity demand grows, governments and utilities are focusing on enhancing grid reliability and transmission stability. Shunt reactors are crucial in managing voltage fluctuations and enabling effective reactive power control.

Competitive Landscape:

In the shunt reactor market, manufacturers concentrate on incremental product upgrades, adding advanced monitoring and compact designs rather than unveiling radical models. Utilities still lean on technical partnerships with OEMs and system integrators to tailor reactors for specific voltage classes and installation constraints. Consortium agreements covering engineering, procurement, and maintenance spread risk and shorten lead times, so they stay popular. Venture funding appears only occasionally because the segment is capital-heavy and dominated by established players. Government support shows up mainly through grid-modernization grants and import-duty relief, but these policies vary by country. Academic-industry research projects keep rolling, yet they seldom reach commercial scale quickly. Among all the listed activities, partnership and collaboration remain the most common routine today across global utilities and manufacturing supply chains.

The report provides a comprehensive analysis of the competitive landscape in the shunt reactor market with detailed profiles of all major companies, including:

- ABB Ltd.

- General Electric (GE) Company

- Siemens AG

- Nissin Electric Co. Ltd.

- PrJSC Zaporozhtransformator

- CG Power and Industrial Solutions Limited

- Alstom SA

- Hyundai Heavy Industries Co., Ltd.

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Toshiba Corporation

- Hilkar Electric Limited

- Fuji Electric Co., Ltd.

- TBEA Co., Ltd.

- Trench Group

Latest News and Developments:

- May 2025: GE Vernova T&D India secured a major order from Power Grid Corporation to supply over 70 high-voltage transformers and shunt reactors for critical transmission projects. The 765 kV shunt reactor units supported renewable energy evacuation under India’s Tariff-Based Competitive Bidding framework.

- April 2025: Litgrid commenced design work for the Harmony Link overland interconnector with Poland after signing a USD 2.38 Million contract with UAB Energetikos projektavimo institutas and UAB Ener-G Design. The design phase included planning a 220 kV transmission line, the Gižai substation, and preparing technical specifications for autotransformers and a shunt reactor.

- January 2025: Hitachi Energy supplied 15 shunt reactors to Transgrid for the HumeLink and VNI West projects, stabilizing voltage during load changes to enhance transmission efficiency. The company also delivered high-voltage equipment, including circuit breakers, for HumeLink’s new substations, supporting renewable energy integration and grid reliability.

Shunt Reactor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Oil-Immersed, Air-Core |

| End-Users Covered | Electric Utilities, Industrial Verticals |

| Applications Covered | Variable Reactor, Fixed Reactor |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ABB Ltd., General Electric (GE) Company, Siemens AG, Nissin Electric Co. Ltd., PrJSC Zaporozhtransformator, CG Power and Industrial Solutions Limited, Alstom SA, Hyundai Heavy Industries Co., Ltd., Mitsubishi Electric Corporation, Hitachi, Ltd., Toshiba Corporation, Hilkar Electric Limited, Fuji Electric Co., Ltd., TBEA Co., Ltd., and Trench Group |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the shunt reactor market from 2019-2033.

- The shunt reactor market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the shunt reactor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The shunt reactor market was valued at USD 2.86 Billion in 2024.

The shunt reactor market is projected to exhibit a CAGR of 2.99% during 2025-2033, reaching a value of USD 3.77 Billion by 2033.

The shunt reactor market is driven by rising electricity demand, grid modernization, and renewable energy integration. Additional factors include increasing transmission line lengths, efforts to reduce energy losses, and investments in smart grid infrastructure to ensure voltage stability and reactive power compensation across growing power networks.

Asia Pacific dominated the shunt reactor market in 2024, accounting for a share of 40% due to rapid urbanization, expanding power infrastructure, high electricity demand, renewable energy integration, and government investments in grid stability and smart energy systems.

Some of the major players in the shunt reactor market include ABB Ltd., General Electric (GE) Company, Siemens AG, Nissin Electric Co. Ltd., PrJSC Zaporozhtransformator, CG Power and Industrial Solutions Limited, Alstom SA, Hyundai Heavy Industries Co., Ltd., Mitsubishi Electric Corporation, Hitachi, Ltd., Toshiba Corporation, Hilkar Electric Limited, Fuji Electric Co., Ltd., TBEA Co., Ltd., and Trench Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)