Singapore Cybersecurity Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Region, 2026-2034

Singapore Cybersecurity Market Overview:

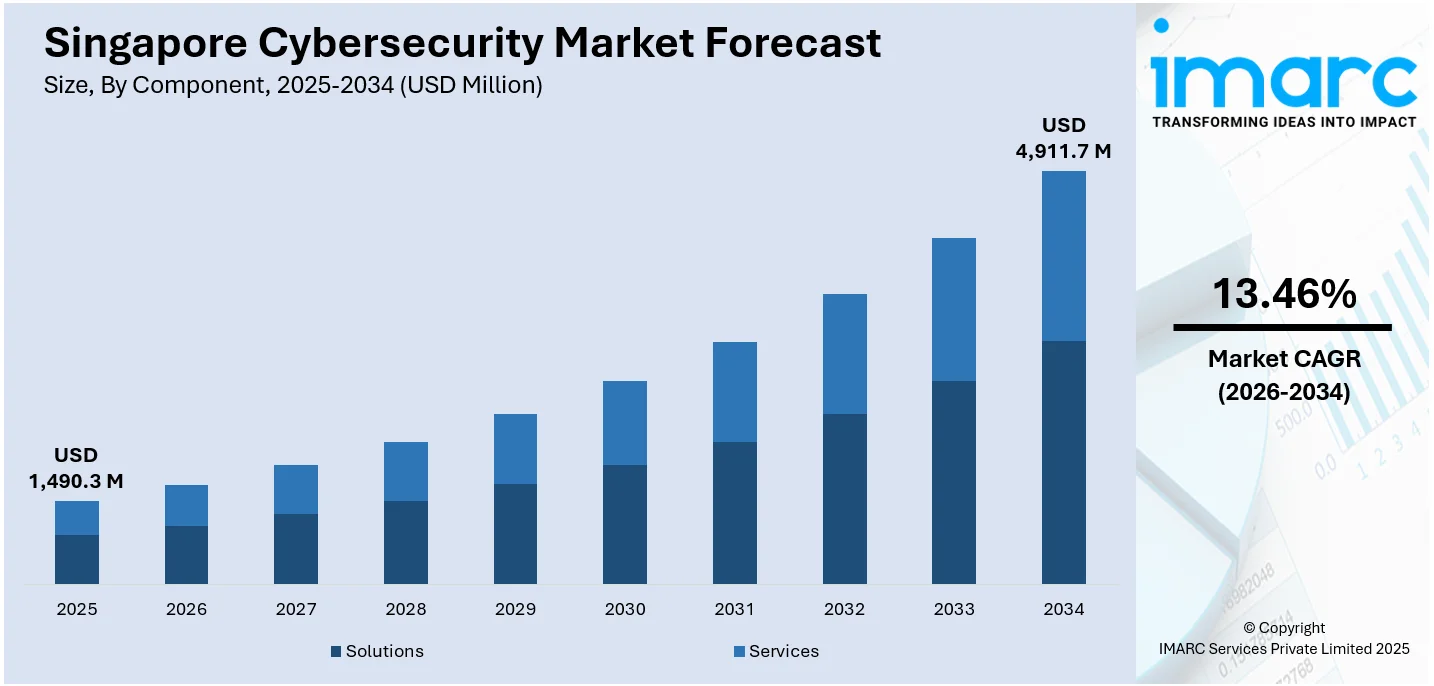

The Singapore cybersecurity market size reached USD 1,490.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 4,911.7 Million by 2034, exhibiting a growth rate (CAGR) of 13.46% during 2026-2034. The market is robust, driven by increasing digitalization and stringent regulations, deployment of check point software technologies by key players, growing threats, heightened cyberattacks on critical infrastructure, increased investments in advanced security measures, and the rising need for comprehensive threat management solutions fuel demand for solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,490.3 Million |

| Market Forecast in 2034 | USD 4,911.7 Million |

| Market Growth Rate (2026-2034) | 13.46% |

Singapore Cybersecurity Market Trends:

Rise of Threat Intelligence Solutions

Singapore's cybersecurity landscape sees a surge in the adoption of threat intelligence solutions. With the escalating sophistication of cyber threats, organizations are leveraging these solutions to proactively identify, assess, and mitigate potential risks. According to SOCRadar’s Singapore Threat Landscape Report 2024, organizations are increasingly vulnerable to critical cyber-attacks daily, making the adoption of proactive, informed, and comprehensive cybersecurity measures essential. Threat intelligence platforms offer real-time insights into emerging threats, enabling organizations to fortify their defenses and respond swiftly to cyber-attacks. As businesses recognize the importance of preemptive security measures, the demand for threat intelligence solutions continues to grow. Moreover, regulatory compliance requirements further drive the adoption of these solutions, as organizations seek to adhere to stringent data protection standards.

To get more information on this market Request Sample

Focus on Endpoint Security

Endpoint security emerges as a paramount concern in Singapore's cybersecurity market. With the proliferation of remote work and the increasing use of mobile devices, endpoints become prime targets for cyber-attacks. The IBM (International Business Machines) report indicates that modern endpoint detection and response (EDR) solutions are critical, as cybercriminals increasingly log into networks through valid accounts rather than hacking them, with 30% of incidents in 2023 attributed to this method. Consequently, organizations are prioritizing endpoint security solutions to safeguard their networks and data from evolving threats. Endpoint detection and response (EDR) solutions gain traction, offering advanced threat detection capabilities and rapid incident response functionalities. Additionally, the integration of artificial intelligence and machine learning enhances the effectiveness of endpoint security solutions, enabling proactive threat mitigation and endpoint protection.

Shift Toward Cloud Security

Singapore experiences a notable shift toward cloud security solutions, driven by the widespread adoption of cloud computing services. According to the NETSCOUT Cyber Threat Intelligence Report, the DDoS threat landscape is constantly evolving, requiring ongoing monitoring and analysis to protect cloud environments effectively. As organizations migrate their infrastructure and data to the cloud, ensuring robust security measures becomes imperative. Cloud security solutions, such as cloud access security brokers (CASBs) and cloud workload protection platforms (CWPPs), gain prominence for their ability to provide visibility, control, and compliance across cloud environments. Moreover, the adoption of hybrid and multi-cloud architectures further underscores the importance of cloud security solutions in ensuring comprehensive protection against cyber threats. With the continuous expansion of cloud adoption, the demand for cloud security solutions is expected to escalate, stimulating the trajectory of Singapore's cybersecurity market.

Singapore Cybersecurity Market News:

- In 2023, CSA announced a S$50 Million investment as part of the Cybersecurity Talent, Innovation & Growth (Cyber TIG) Plan. This initiative aims to enhance talent development, support innovation in cybersecurity solutions, and strengthen Singapore’s position as a trusted global business hub.

- In December 2023, the Cyber Security Agency of Singapore (“CSA”) held a public consultation on the draft Cybersecurity (Amendment) Bill (“Bill”) from 15 December 2023 to 15 January 2024. The Bill is the first amendment of the Cybersecurity Act since the Act was enacted in 2018. It seeks to update the Act so that it keeps pace with the developments in our cyber threat landscape and business environment. This will enable CSA to continue to secure Singapore’s cyberspace and safeguard our digital way of life.

Singapore Cybersecurity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on component, deployment type, user type, and industry vertical.

Component Insights:

- Solutions

- Identity and Access Management (IAM)

- Infrastructure Security

- Governance, Risk and Compliance

- Unified Vulnerability Management Service Offering

- Data Security and Privacy Service Offering

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions [identity and access management (IAM), infrastructure security, governance, risk and compliance, unified vulnerability management service offering, data security and privacy service offering and others] and services (professional services and managed services).

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

User Type Insights:

- Large Enterprises

- Small and Medium Enterprises

A detailed breakup and analysis of the market based on the user type have also been provided in the report. This includes large enterprises and small and medium enterprises.

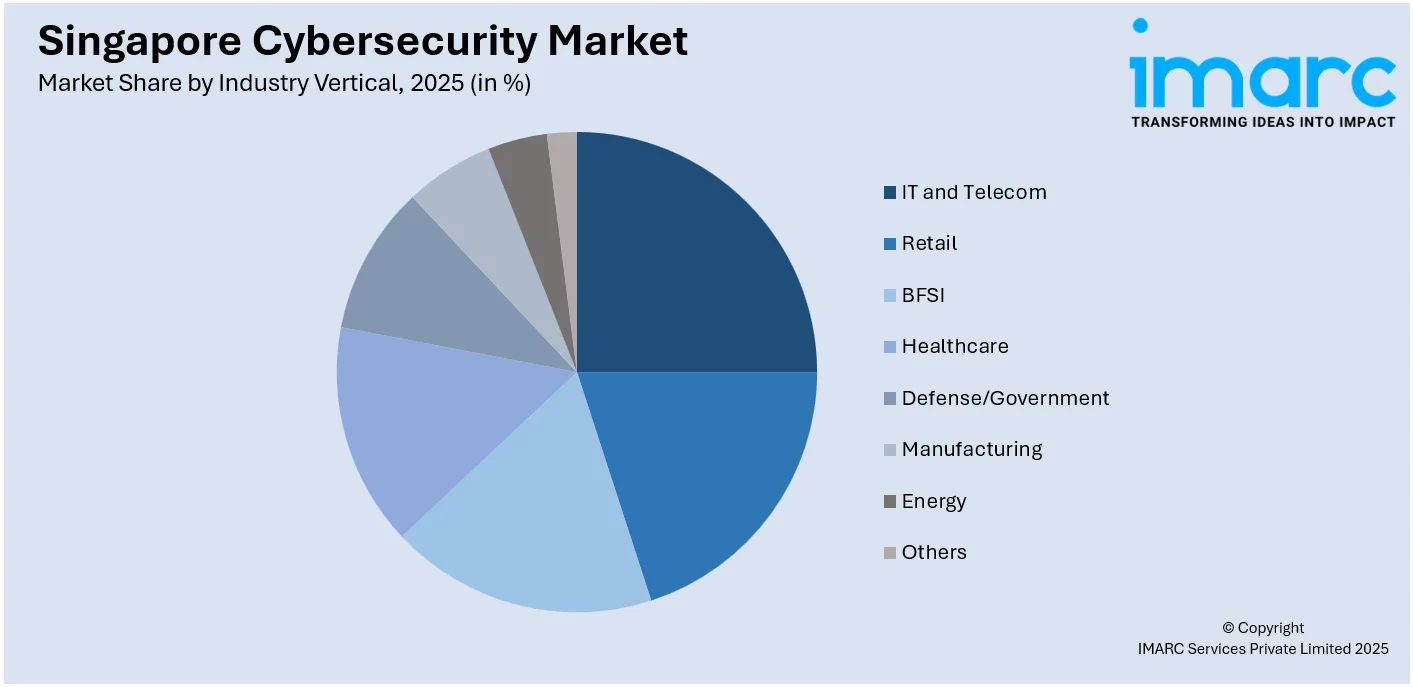

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes IT and telecom, retail, BFSI, healthcare, defense/government, manufacturing, energy, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Cybersecurity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud-based, On-premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore cybersecurity market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore cybersecurity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore cybersecurity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cybersecurity market in Singapore was valued at USD 1,490.3 Million in 2025.

The Singapore cybersecurity market is projected to exhibit a CAGR of 13.46% during 2026-2034, reaching a value of USD 4,911.7 Million by 2034.

The Singapore cybersecurity market is driven by increasing digitalization, rising cyber threats, and strong government initiatives to enhance national cyber resilience. Growing adoption of cloud services, expansion of fintech, and stricter data protection regulations are also pushing organizations to invest more in advanced cybersecurity solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)