Singapore Hospitality Market Size, Share, Trends and Forecast by Type, Segment, and Region, 2025-2033

Singapore Hospitality Market Overview:

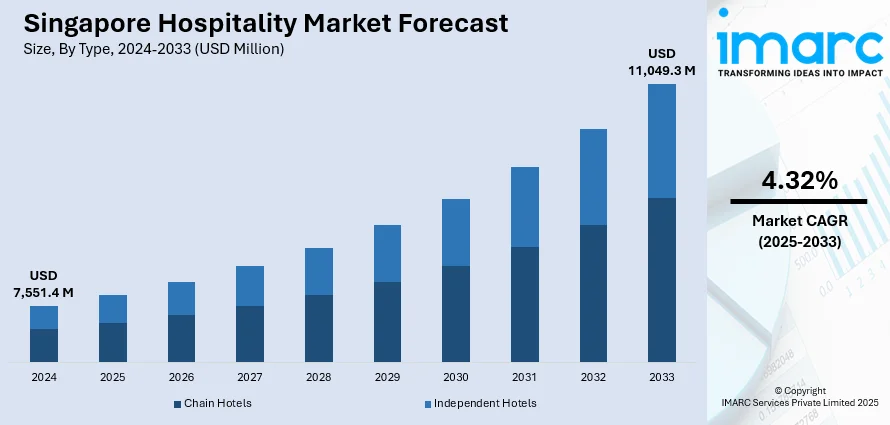

The Singapore hospitality market size reached USD 7,551.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 11,049.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.32% during 2025-2033. The market is growing rapidly, driven by the increasing emphasis on strategic location and connectivity, implementation of supportive government initiatives and policies, and the rising popularity of cultural diversity and safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7,551.4 Million |

|

Market Forecast in 2033

|

USD 11,049.3 Million |

| Market Growth Rate 2025-2033 | 4.32% |

Singapore Hospitality Market Trends:

Increasing Emphasis on Strategic Location and Connectivity

Singapore's strategic geographical location and exceptional connectivity is driving the expansion of the market. The country is positioned at the crossroads of major international trade and travel routes and serves as a vital hub for business and leisure travelers. For instance, in the first six months of 2023, tourism receipts in Singapore ballooned to SG$ 17.1 billion, which is a rise of 184.8% over the same period in 2022. The country also welcomed 11.2 million international tourists between January and October 2023. Additionally, the port facilities are contributing to cruise tourism, attracting a considerable number of international tourists. Singapore's cruise sector showed a robust recovery, with the number of international cruise passengers growing by 91.1% to 1.04 million between January and October 2023. This seamless integration of various transport systems ensures that travelers can move around the island efficiently, boosting the country's appeal as a premier destination.

To get more information on this market, Request Sample

Implementation of Government Initiatives and Policies

The proactive role of the Government of Singapore in fostering a conducive environment for the hospitality industry is another critical driver. The government has implemented various initiatives and policies that focus on boosting tourism and enhancing the country's global appeal. These include substantial investments in infrastructure, the development of iconic attractions, and hosting high-profile international events. For instance, the Tourism Department of Singapore received $300 million as part of its broader economic plan. This fund allocation led to the creation of Trifecta – the world's first snow, surf, and skate attraction in October 2023 and the year-round exclusive homeporting of Disney Cruise Line's latest cruise ship, Disney Adventure in Singapore, which will start in 2025. Furthermore, the Singapore Tourism Board (STB) runs extensive marketing campaigns to promote Singapore as a must-visit destination, targeting diverse markets across the globe.

Rising Popularity of Cultural Diversity and Safety

Singapore's cultural diversity and reputation for safety are key factors driving its hospitality market. The country's multicultural society, where diverse ethnicities and religions coexist harmoniously, enriches the cultural experiences available to visitors. This diversity is reflected in various cultural festivals, events, and the wide range of culinary offerings that make Singapore a vibrant and inclusive destination. Additionally, the country’s stringent safety measures and low crime rates reassure tourists, making it a preferred choice for families and solo travelers. Moreover, the efficient public health system, high standards of hygiene, and responsive emergency services enhance the sense of security among visitors. This reputation for safety and cultural richness attracts repeat visitors and helps in establishing long-term tourism growth, solidifying Singapore's status as a premier hospitality hub.

Singapore Hospitality Market News:

- In May 2024, The Ascott Limited, the lodging business unit wholly owned by CapitaLand Investment (CLI), together with Warees Investments Pte Ltd, announced their second strategic partnership at the signing ceremony of lyf Chinatown Singapore. It is slated to open in mid-2026 and will comprise 90 accommodation units along with social spaces such as a coworking lounge 'Connect,' social kitchen 'Bond,' launderette 'Wash & Hang,' gym 'Burn,' rooftop swimming pool 'Dip' as well as outdoor courtyard and terrace.

- In December 2023, Accor announced that in collaboration with Worldwide Hotels Group, the company is set to introduce the world’s largest Mercure hotel to Singapore – Mercure ICON Singapore City Centre. It boasts an impressive 989 keys and is scheduled to open in the first quarter of 2024.

Singapore Hospitality Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and segment.

Type Insights:

- Chain Hotels

- Independent Hotels

The report has provided a detailed breakup and analysis of the market based on the type. This includes chain hotels and independent hotels.

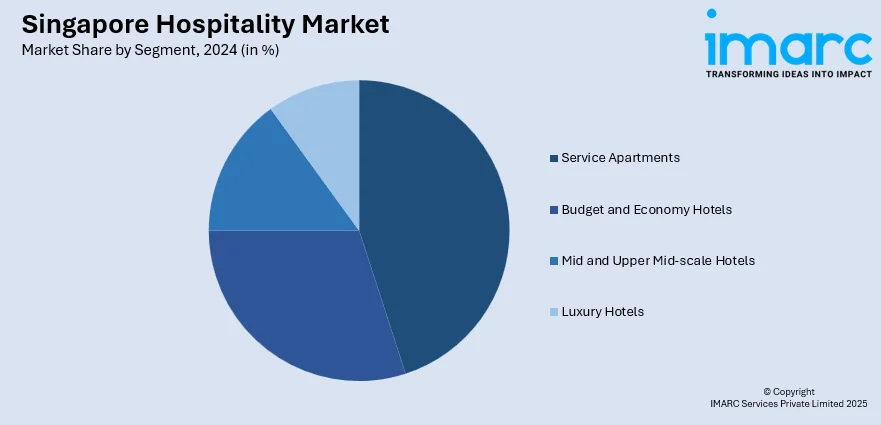

Segment Insights:

- Service Apartments

- Budget and Economy Hotels

- Mid and Upper Mid-scale Hotels

- Luxury Hotels

A detailed breakup and analysis of the market based on the segment have also been provided in the report. This includes service apartments, budget and economy hotels, mid and upper mid-scale hotels, and luxury hotels.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Hospitality Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chain Hotels, Independent Hotels |

| Segments Covered | Service Apartments, Budget and Economy Hotels, Mid and Upper Mid-scale Hotels, Luxury Hotels |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore hospitality market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore hospitality market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore hospitality industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hospitality market in Singapore was valued at USD 7,551.4 Million in 2024.

The Singapore hospitality market is projected to exhibit a CAGR of 4.32% during 2025-2033, reaching a value of USD 11,049.3 Million by 2033.

Singapore hospitality market grows through steady tourist arrivals, strong government support for tourism, and constant upgrades in infrastructure. Large-scale events, vibrant cultural attractions, and smooth transport links attract visitors year-round. Sustainability efforts, digital innovation, and luxury offerings keep Singapore competitive as a leading global destination.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)