Singapore Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2025-2033

Singapore Medical Tourism Market Overview:

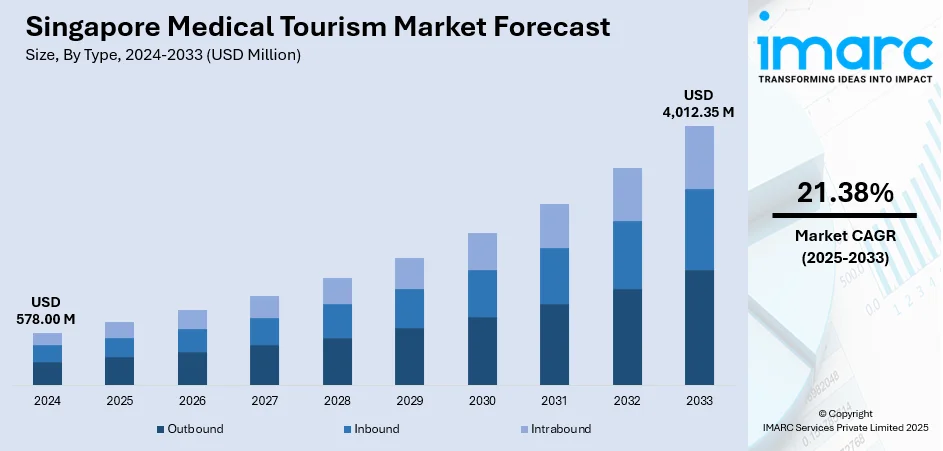

The Singapore medical tourism market size reached USD 578.00 Million in 2024. Looking forward, the market is projected to reach USD 4,012.35 Million by 2033, exhibiting a growth rate (CAGR) of 21.38% during 2025-2033. The market is driven by Singapore’s excellence in high-acuity specialties, supported by precision medicine and advanced surgical capabilities. Its integration of digital health platforms, concierge services, and AI-driven diagnostics streamlines the patient journey. Furthermore, political stability, medical ethics, and cultural inclusivity are further augmenting the Singapore medical tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 578.00 Million |

| Market Forecast in 2033 | USD 4,012.35 Million |

| Market Growth Rate 2025-2033 | 21.38% |

Singapore Medical Tourism Market Trends:

Global Leadership in Complex and High-Acuity Care

Singapore is internationally recognized for delivering exceptional outcomes in high-acuity medical specialties such as oncology, cardiology, neurology, and organ transplantation. Institutions like National University Hospital, Mount Elizabeth, and Singapore General Hospital offer advanced medical technologies—robotic surgery, precision oncology, and genomics-based diagnostics, supported by rigorous clinical protocols. Medical professionals are often dual-trained in the UK or U.S., with hospitals ranked among the best in Asia-Pacific. Foreign patients from Indonesia, Myanmar, Bangladesh, and the Middle East travel to Singapore for second opinions, high-risk surgeries, and long-term disease management. Latest projections highlight that the Southeast Asia regional market could grow from USD 51.5 Billion in 2023 to USD 172.1 Billion by 2032, positioning Singapore to reassert its role in the medical tourism sector. The city-state’s stringent quality standards, infection control, and low complication rates make it a preferred choice for complex medical travel. Singapore’s Ministry of Health mandates transparent healthcare regulations and tracks hospital performance through national audits, reinforcing accountability and patient trust. These outcomes-based systems appeal to discerning international patients seeking not only comfort, but clinical certainty. As global healthcare becomes increasingly outcomes-focused, Singapore’s credibility in managing complicated, multidisciplinary conditions continues to support Singapore medical tourism market growth and distinguish it from volume-driven destinations.

To get more information on this market, Request Sample

Seamless Integration of Technology and Patient Services

Singapore stands at the forefront of digital healthcare, offering medical tourists seamless access through integrated platforms that support virtual consultations, appointment scheduling, insurance processing, and follow-up care. Telehealth services allow international patients to consult specialists before traveling, accelerating diagnoses and streamlining clinical workflows. Upon arrival, smart hospital systems reduce wait times through automated check-ins, digital records, and personalized patient portals. English-speaking care teams, multilingual support staff, and clear service pricing simplify the experience for foreign patients. The Singapore Tourism Board collaborates with hospitals through initiatives such as the Health and Wellness Alliance to promote patient-centric hospitality—including concierge medicine, wellness lounges, and hotel-clinic partnerships for recovery. According to recent industry reports, Singapore welcomed approximately 646,000 international patients in 2024, which resulted in the generation of an estimated USD 270 Million in revenue. AI-assisted diagnostics, robotic rehabilitation, and wearable post-op monitoring devices elevate the care standard, positioning Singapore as a tech-enabled health destination. The government's push toward smart healthcare ecosystems enhances operational efficiency while ensuring personalized care delivery. These innovations not only improve outcomes but also minimize the logistical burdens of international treatment, driving higher patient satisfaction and reinforcing Singapore’s reputation as an ultra-modern medical travel hub.

Singapore Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and treatment type.

Type Insights:

- Outbound

- Inbound

- Intrabound

The report has provided a detailed breakup and analysis of the market based on the type. This includes outbound, inbound, and intrabound.

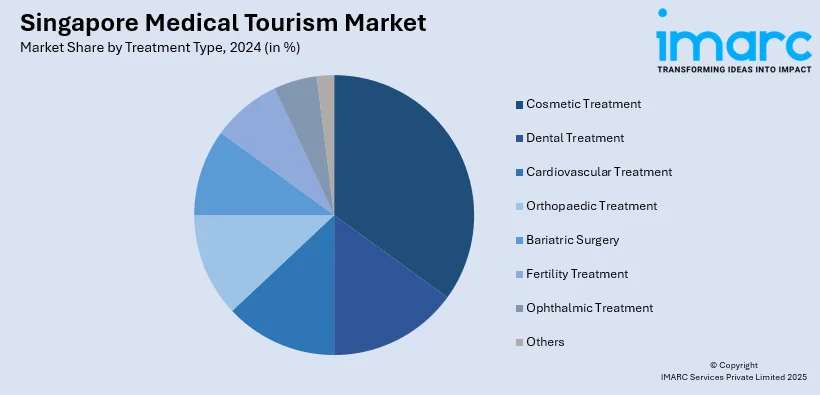

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Medical Tourism Market News:

- On May 19, 2025, Royal Healthcare Pte. Ltd., a premium healthcare provider in Singapore, was acquired by Japan-based Sojitz Corporation to strengthen its presence in Asia’s medical services sector. With over 20 specialties and a flagship “one day, one stop, one centre” model at Novena, Royal Healthcare is known for high-end diagnostic and concierge-based care. This acquisition reflects Singapore’s continued importance as a luxury medical tourism hub.

Singapore Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Outbound, Inbound, Intrabound |

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Singapore medical tourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Singapore medical tourism market on the basis of type?

- What is the breakup of the Singapore medical tourism market on the basis of treatment type?

- What is the breakup of the Singapore medical tourism market on the basis of region?

- What are the various stages in the value chain of the Singapore medical tourism market?

- What are the key driving factors and challenges in the Singapore medical tourism market?

- What is the structure of the Singapore medical tourism market and who are the key players?

- What is the degree of competition in the Singapore medical tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore medical tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)