Singapore Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End-User, and Region, 2025-2033

Singapore Online Education Market Overview:

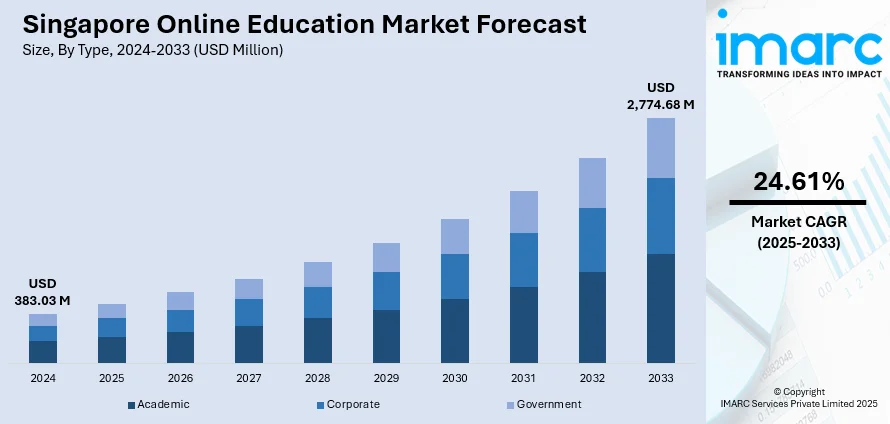

The Singapore online education market size reached USD 383.03 Million in 2024. The market is projected to reach USD 2,774.68 Million by 2033, exhibiting a growth rate (CAGR) of 24.61% during 2025-2033. The market is fueled by the country's robust digital infrastructure, government encouragement of EdTech penetration, and high levels of internet penetration, which creates a favorable ecosystem for e-learning. Further, rising demand for lifelong learning and reskilling, especially among working professionals, is driving market growth. In addition to this, collaborations between educational institutions and technology vendors are further augmenting the Singapore online education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 383.03 Million |

| Market Forecast in 2033 | USD 2,774.68 Million |

| Market Growth Rate 2025-2033 | 24.61% |

Singapore Online Education Market Trends:

Integration of Advanced Technologies in Learning Platforms

The market is experiencing rapid technological advancement, particularly through the integration of artificial intelligence (AI), machine learning (ML), and data analytics in educational platforms. For instance, "Transforming Education through Technology" Masterplan 2030, which was launched in 2023, builds upon earlier ICT plans to harness technology as a foundational tool in Singapore's education system. It aims to prepare students for a technology‑transformed world, with goals to develop digitally‑empowered, future‑ready learners and innovative teachers and digitally connected schools. One of the key strategic plans is Customized AI-powered learning via platforms like the Singapore Student Learning Space, equipped with Adaptive Learning Systems and Learning Feedback Assistants. In addition to this, EdTech firms in Singapore are leveraging natural language processing and AI chatbots to enhance learner engagement and provide real-time academic support. Moreover, augmented reality (AR) and virtual reality (VR) technologies are also utilized in specialized fields such as medical and engineering education to offer immersive and practical simulations. These tools facilitate the transition from conceptual understanding to real-world practice. Furthermore, analytics dashboards used by educators and institutions enable data-driven decision-making for curriculum refinement and learner progress monitoring. As institutions and corporate training providers increasingly adopt these innovations, the focus is shifting from content quantity to quality, personalization, and engagement, setting a new standard for educational delivery in the digital age.

To get more information on this market, Request Sample

Growth in Corporate and Professional Upskilling Programs

There is a marked expansion in demand for online education solutions tailored to corporate training and professional development in the country. This, in turn, is positively impacting the Singapore online education market growth. As industries rapidly evolve due to technological disruption and economic restructuring, businesses are prioritizing workforce reskilling to maintain competitiveness. For instance, on 7 March 2025, NTUC LearningHub launched Singapore's first " Thinking Academy" aimed at equipping Professionals, Managers, and Executives (PMEs) with critical thinking, design thinking, and creative thinking skills tailored for the Generative AI era. The Academy refreshes three core courses with GenAI integration, such as prompt engineering and AI-enhanced decision-making, and will introduce new offerings in the future. The NTUC LearningHub offers a flexible hybrid format, combining both physical and digital delivery methods. Learners can opt for classroom-based training, live virtual instruction, or asynchronous online modules. Along with this, many multinational corporations and SMEs collaborate with EdTech providers to deliver customized training programs integrated into their internal HR and development systems. This trend is also supported by government funding mechanisms that incentivize employer-sponsored training. Apart from this, certification from recognized institutions adds value to these programs, which makes them appealing for career advancement. The emphasis on measurable outcomes and return on investment in training is driving innovation in performance-tracking tools, assessment metrics, and credentialing methods within the corporate e-learning space.

Singapore Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, provider, technology, and end-user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, and k-12 education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes mobile E-learning, rapid E-learning, virtual classroom, and others.

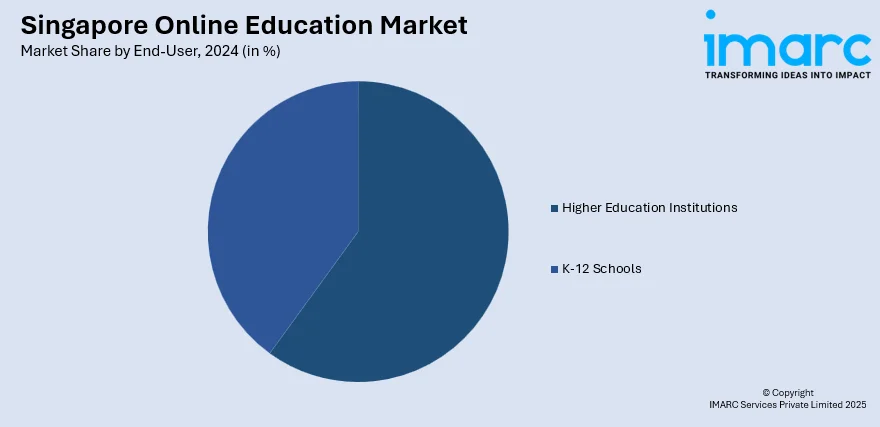

End-User Insights:

- Higher Education Institutions

- K-12 Schools

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes higher education institutions and k-12 schools.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Online Education Market News:

- On October 28, 2024, AI Singapore (AISG) launched the AIAP Foundation, a fully online course designed to equip aspiring AI engineers with foundational AI and software engineering skills. The program offers two asynchronous phases—covering exploratory data analysis, software engineering, AI fundamentals, and machine learning pipelines—followed by a project phase with real-world application support and AI-powered guidance. Upon completion, participants are eligible to progress to the intensive nine‑month AI Apprenticeship Programme (AIAP), reinforcing AISG’s commitment to nurturing local AI talent.

Singapore Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End-Users Covered | Higher Education Institutions, K-12 Schools |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The online education market in Singapore was valued at USD 383.03 Million in 2024.

The Singapore online education market is projected to exhibit a CAGR of 24.61% during 2025-2033, reaching a value of USD 2,774.68 Million by 2033.

The market is driven by high internet penetration, demand for interactive learning, and strong digital infrastructure. Schools and parents are increasingly adopting gamified content to improve student engagement. Government support for EdTech and curriculum innovation further encourages growth among young learners and institutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)