Smart Agriculture Market Size, Share, Trends, and Forecast by Agriculture Type, Offering, Farm Size, and Region 2026-2034

Smart Agriculture Market Size and Share:

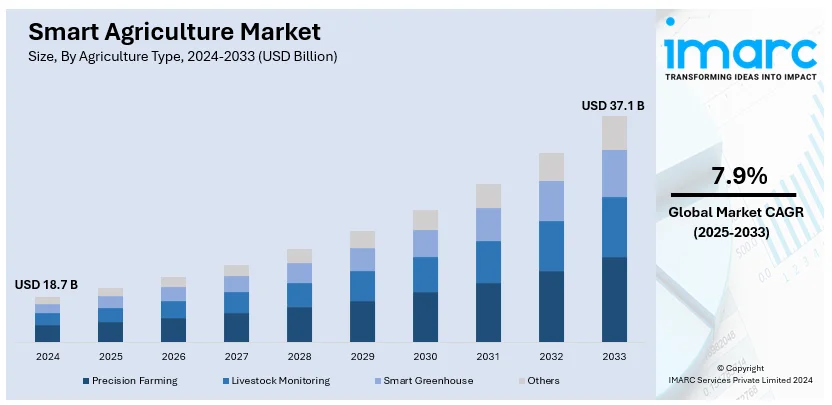

The global smart agriculture market size was valued at USD 18.7 Billion in 2025. Looking forward, the market is forecasted to reach USD 37.1 Billion by 2034, exhibiting a CAGR of 7.9% during 2026-2034. North America currently dominates the market, holding a significant market share of over 44% in 2024. The market is experiencing steady growth driven by the government support, widespread adoption of advanced technology, the increasing demand for sustainable and efficient farming practices, and rising need to cope with acute labor shortages.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 18.7 Billion |

| Market Forecast in 2034 | USD 37.1 Billion |

| Market Growth Rate (2026-2034) | 7.9% |

The widespread adoption of artificial intelligence (AI), IoT, and data analytics for precision farming represents one of the major factors driving the growth of the market. The rising need to optimize resource use, address food security concerns, and enhance productivity is acting as a major growth-inducing factor in the market. In addition to this, the increasing awareness regarding sustainable agricultural practices, coupled with the growing demand for traceability in food production is further boosting the market growth. Climate change and unpredictable weather patterns necessitate advanced solutions including smart sensors, automated irrigation, and drone monitoring, which, in turn, are facilitating the growth of the smart agriculture market across the globe.

The United States represents one of the key regional markets for smart agriculture. The market is primarily driven by the increasing demand for precision farming to optimize crop yield, improve sustainability, and reduce waste. In line with this, growing government support for smart farming initiatives is contributing to the growth of the market across the United States. For instance, the U.S. Department of Agriculture (USDA) has announced the Partnerships for Climate-Smart Commodities, an initiative aimed at enhancing the production and marketing of climate-smart agricultural products. With an investment exceeding USD 3.1 billion, it funds 141 pilot projects that support farmers, ranchers, and forest owners in implementing practices that reduce greenhouse gas emissions and sequester carbon. The program emphasizes the involvement of small and underserved producers, providing technical and financial assistance, while also developing markets for these sustainable commodities to strengthen rural economies and promote environmental benefits.

Smart Agriculture Market Trends:

Rapid Population Growth and Rising Food Security Concerns

The market is primarily influenced by the rising population, elevating standards of living, and inflating disposable incomes, which are increasing the food demand. As a result, farmers are using smart agriculture tools and techniques such as variable rate seeding and precision fertilization, which help them optimize yields and minimize wastage. According to a report, to meet the global food demand in 2050, agricultural production has to increase by 48.6% worldwide. Besides this, declining per hectare area of arable land and low availability of skilled labor are also augmenting the need for smart agriculture practices. Moreover, the elevating level of urbanization is enticing rural households to migrate to urban areas, as these areas offer a plethora of job opportunities. This shift has resulted in a shortage of farm labor in various regions. For instance, according to a survey by the Centre for Monitoring the Indian Economy (CMIE), India witnessed a drop in the number of people employed in agriculture from 158.2 million in 2022 to 147.9 million in 2023. Looking ahead, the Indian Council of Food and Agriculture anticipates a 25.7% decline in the percentage of agriculture workers in India by 2050. By adopting smart agriculture practices, farmers can optimize resource utilization, mitigate resource scarcity, and contribute to sustainable agricultural practices. This, in turn, is anticipated to propel the smart agriculture market demand in the coming years.

Technological Advancements

Significant technological sensor advancements to facilitate efficient monitoring and enable timely decisions by several key market players are contributing to the market growth. Moreover, numerous farmers are increasingly adopting precision farming since it focuses on the observation, measurement, and response to crop variability between fields. Additionally, precision farming, which will overtake other advances in agriculture by the end of 2030, is predicted to propel the smart agriculture market revenue in the coming years. Furthermore, according to ETNO, the number of IoT active connections in agriculture was expected to increase in the European Union through the years 2022-2025. It was recorded at 46.92 Million connections in 2022 and is expected to reach 70.26 Million by 2025. Besides this, various technology providers are forming partnerships to offer more advanced precision farming tools and devices to farmers. For instance, in October 2023, Deere & Co partnered with 2 Sweden-based Delaval on the Milk Sustainability Center and Norway-based Yara on digital precision agriculture tools for sustainability. This partnership aims to help farmers track livestock and fertilizer data so they can make smarter business decisions that are better for the environment as well.

Implementation of Favorable Government Initiatives

Government initiatives aimed at maximizing productivity, especially in developing countries, are encouraging the use of modern farming technologies. For instance, in India, the Maharashtra government introduced a policy following the Center's clearance of the use of drones to spray pesticides in October 2022. In addition to this, the introduction of several policies, subsidies, tax incentives, and grants to incentivize agricultural activities and alleviate financial burdens on farmers is augmenting the smart agriculture market share. For example, the Canadian government introduced the 'Canadian Agricultural Loans Act,' which offers farmers a loan of up to USD 500,000 while purchasing land or a tractor. In line with this, concerned regulatory authorities are also focusing on training programs for machinery operators. Similarly, India's Ministry of Agriculture & Farmers' Welfare has undertaken several initiatives, including the National e-Governance Plan in Agriculture (NeGPA). Under this scheme, funds are provided to facilitate the use of modern technologies such as Artificial Intelligence (AI), Machine Learning (ML), robotics, drones, data analytics, and blockchain to encourage digital agriculture in the country.

Smart Agriculture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart agriculture market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on agriculture type, offering, farm size, and region.

Analysis by Agriculture Type:

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

- Others

Precision farming lead the market with around 42.6% of the market share in 2024. Precision farming leverages cutting-edge technologies, such as GPS, remote sensing, and data analytics, to provide farmers with detailed insights into their fields' conditions. This helps farmers to make informed decisions in real-time. As a result, the demand for precision farming techniques and devices is growing, which is bolstering the smart agriculture market recent price. Various farm owners are collaborating with technology providers to deploy precision farming practices. For instance, in October 2023, Zuari FarmHub, a leading agritech company in India, announced its partnership with CropX Technologies, a global agri-tech company specializing in digital agronomic solutions. The collaboration aims to revolutionize farming practices by introducing real-time monitoring technology that empowers farmers with data-driven insights for enhanced productivity and sustainability.

Analysis by Offering:

- Hardware

- Software

- Service

Hardware leads the market with around 52.1% of the market share in 2024. Smart agriculture market statistics by IMARC indicate that hardware components such as sensors, drones, GPS devices, and automated machinery serve as the foundation for gathering critical data and executing precision-based tasks. Farmers heavily rely on hardware to acquire accurate and real-time information about various parameters like soil moisture, temperature, crop health, and weather conditions. Consequently, various market leaders are providing technologically advanced devices to farmers to derive meaningful insights and make informed decisions regarding agricultural practices. For instance, Bhu-Vision was officially launched in August 2023 at AICRP (ICAR-IIRR), Hyderabad. It is a revolutionary IoT-based automated soil testing and agronomy advisory platform. This system seamlessly conducts 12 key soil parameter tests in just 30 minutes, providing quick, accurate results directly to farmers and stakeholders through a soil health card on their mobile devices. Such innovations are projected to positively impact the smart agriculture market outlook in the coming years.

Analysis by Farm Size:

- Small

- Medium

- Large

Medium size leads the market with around 38.2% of the market share in 2024. Medium-sized farms hold an exceptional position, balancing scale and resources to harness the benefits of both efficiency and adaptability. Medium-sized farms often possess the resources and infrastructure necessary to adopt modern smart agriculture technologies without the complexities associated with larger operations. They can invest in precision farming equipment, such as sensors, drones, and data analytics systems, enabling them to optimize crop management and resource utilization effectively. Furthermore, medium-sized farms are well-positioned to implement technological advancements while maintaining a level of personal oversight that might be challenging for larger operations. This adaptability allows them to respond to changing conditions swiftly and make informed decisions based on real-time data.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 44%. The smart agriculture market overview indicates that the growth in the region can be attributed to the advanced infrastructure, robust technological innovation, and a strong focus on optimizing agricultural processes. Moreover, North America has a highly developed ecosystem of technology, and the presence of key market players in the region is creating a positive outlook for the market. Various farming technology providers are entering collaborations and partnerships to offer advances to the farmers. For instance, Trimble Agriculture, based in Westminster, Colorado, US, and xFarm Technologies announced a partnership in November 2022. Trimble, the global player in precision farming technology, provides farmers with more valuable and efficient solutions through integration with the xFarm app developed by tech company xFarm Technologies, which uses its digital platform to support and simplify the work of 120,000 farms spread across 1.7 million hectares in over 100 countries. Moreover, farmers in North America recognize the potential of technology to mitigate these challenges and enhance their competitiveness in a global market.

Key Regional Takeaways:

United States Smart Agriculture Market Analysis

The United States accounts for 51.2% of the smart agriculture market in North America. In the United States, the industry is propelled by the rising utilization of precision farming methods, along with advancements in agricultural technology. Sensors, drones, and Internet of Things (IoT) devices are being employed by farmers to adjust irrigation, increase harvests, and track crop health. Through grants and subsidies, the USDA promotes the use of smart agricultural solutions and helps farmers adopt new farming techniques. USDA provides farmers and ranchers with a variety of voluntary programs and financial options to help them adopt climate-smart practices. USDA's overcrowded conservation programs, such as the Agricultural Conservation Easement Program, the Conservation Stewardship Program, and the Environmental Quality Incentives Program, will get an additional USD 19.5 billion from the Inflation Reduction Act for 2023–2027.

Another important factor is the rising need for effective resource management, especially about the use of fertilizer and water. Real-time data-driven smart irrigation systems help farmers cut waste and improve sustainability. Furthermore, the widespread use of artificial intelligence (AI) and big data analytics in agriculture aids in predictive analysis for pest management and crop planning, which raises productivity even further. The use of automation and robotics in farming is becoming more popular as the American agriculture industry struggles with a workforce shortage. The use of robotic weed eaters, smart tractors, and self-sufficient harvesting equipment is growing in popularity. The industry is also expanding because of the rise in indoor agriculture and urban farming, which are aided by smart technology like vertical farming systems. Smart agriculture provides a means for farmers to successfully satisfy the growing consumer demand for sustainably and organically cultivated produce.

Europe Smart Agriculture Market Analysis

Europe's market for smart agriculture is fueled by the continent's strong emphasis on environmental preservation and sustainability. Precision farming is one of the cutting-edge technologies that farmers are encouraged to use by the European Union's Common Agricultural Policy (CAP) to increase productivity while reducing their negative environmental effects. To maximize field operations, farmers in Europe are embracing drones, IoT-based solutions, and remote sensing technology as part of the growing digital transformation in agriculture. Interest in smart agriculture techniques, such as effective water management and precise fertilization, has increased because of the region's focus on lowering greenhouse gas emissions. European efforts to further the integration of digital technologies in the European agricultural industry have a history. In order to influence the digitalization of EU agriculture, the European Commission has funded a number of research and innovation (R&I) projects (like ATLAS and DEMETER) as well as deployment initiatives (like the Common European Agricultural Data Space).

One of the biggest organic agricultural industries in the world, Europe, also gains from smart agriculture technologies that make crop management and monitoring more effective. With the help of government programs and a robust network of agri-tech businesses, important markets like Germany, France, and the Netherlands are spearheading the adoption of these technologies. Additionally, Europe invests heavily in R&D, which encourages innovation and propels the creation of smart agriculture solutions that are suited to local requirements.

Asia Pacific Smart Agriculture Market Analysis

The necessity to meet the demands of an expanding population and mounting strain on arable land is driving the smart agriculture industry in Asia-Pacific. To increase output and cut down on resource waste, nations like China, India, and Japan are implementing precision agricultural technologies. For instance, China is feeding one fifth of the total population on earth with only 8% of the arable land, which makes modernization of agriculture an essential issue for Chinese government. According to research by Kyushu University, with an annual growth rate of 14.3%, the potential market for smart agriculture in China has grown from USD 13.7 billion in 2015 to USD 26.8 billion in 2020. Digital farming solutions are now more accessible to small and medium-sized farmers in rural areas due to the growing use of smartphones and internet connectivity.

Through programs and incentives, regional governments are aggressively promoting smart agriculture. Adoption rates have increased because of initiatives like China's push for AI-driven farming solutions and India's Digital Agriculture Mission. In order to solve issues like labor shortages and water scarcity, the area makes extensive use of drones, autonomous tractors, and smart irrigation systems. Another factor is the quick growth of agricultural e-commerce and mobile apps, which give farmers access to real-time information on market pricing, weather, and soil conditions. As organic farming methods and sustainability gain popularity, smart agriculture is emerging as a crucial instrument for Asia-Pacific farming that is prepared for the future.

Latin America Smart Agriculture Market Analysis

Latin America's focus on raising agricultural productivity and competitiveness in international markets is fueling the region's smart agriculture market. Large-scale farming nations like Brazil and Argentina are implementing precision farming technologies including drones, satellite images, and GPS-enabled equipment. Smart irrigation systems have become more popular as a result of the increasing demand for effective water and fertilizer management, particularly in drought-prone areas. Furthermore, the development of cutting-edge technologies to guarantee quality and productivity has been prompted by the growing demand for high-value crops like coffee and soybeans. The region's embrace of smart agriculture is also being fueled by government backing and alliances with global agri-tech firms.

Middle East and Africa Smart Agriculture Market Analysis

The Middle East and Africa's efforts to solve issues like food security and water shortages are driving the market for smart agriculture in these regions. In the Middle East's dry regions, smart irrigation systems and soil moisture monitors are commonly employed to maximize water utilization. The use of IoT solutions and mobile-based platforms in Africa is facilitating smallholder farmers' access to market data, crop advice services, and weather forecasts. To improve productivity and sustainability in the area, smart agriculture technologies are being promoted by government programs and international partnerships, including those with the Food and Agriculture Organization (FAO).

Competitive Landscape:

The market is highly competitive, with key players including John Deere, Trimble, AG Leader Technology, and AGCO Corporation, alongside emerging companies like Climate Corporation and Raven Industries. These firms lead in developing advanced technologies such as GPS-guided tractors, drones, sensors, and automated irrigation systems. Established players focus on expanding product portfolios, offering end-to-end solutions, and integrating IoT, AI, and data analytics to enhance farming efficiency. New entrants and tech startups drive innovation with cutting-edge tools for precision farming, real-time data analytics, and machine learning algorithms. Strategic collaborations, acquisitions, and investments in R&D are common among market leaders to stay ahead. Additionally, regional players focus on addressing specific agricultural challenges and tailoring solutions to local climates and farming practices. The market is characterized by rapid technological advancements and increasing demand for sustainable, resource-efficient farming practices.

The report provides a comprehensive analysis of the competitive landscape in the smart agriculture market with detailed profiles of all major companies, including:

- AG Leader Technology

- AGCO Corporation

- AgJunction Inc. (Kubota Corporation)

- CLAAS KGaA mbH

- CropMetrics LLC (CropX Inc.)

- Deere & Company

- DICKEY-john

- Farmers Edge Inc.

- Gamaya

- Granular Inc. (Corteva Inc.)

- Raven Industries Inc. (CNH Industrial N.V.)

- Trimble Inc.

Latest News and Developments:

- April 2024: FMC India has launched its precision agriculture platform, Arc™ farm intelligence, in India. The platform combines real-time data and predictive modelling to help farmers monitor field conditions and pest pressure. It aids in the precise application of crop care products, aiming to optimize yields and improve returns on investment for farmers, advisers, and channel partners.

- January 2024: Precision Planting unveiled its newest product, a fully custom, factory-built planting system called CornerStone. The CornerStone Planting System comes fully built with everything but the planter bar and is integrated with Precision Planting’s technology.

- November 2023: Hungarian-based ABZ Innovation launched a new crop spraying drone that can carry 30 liters of pesticides each flight. Powered by a 25000mAh battery, the L30 is designed for farms around 80 to 100 hectares in size and can spray up to 21 hectares per hour.

- October 2023: Zuari FarmHub, a leading agritech company in India, announced its partnership with CropX Technologies, a global agri-tech company specializing in digital agronomic solutions. The collaboration aims to revolutionize farming practices by introducing real-time monitoring technology that empowers farmers with data-driven insights for enhanced productivity and sustainability.

- July 2023: Deere & Company acquired Smart Apply, Inc., a company specializing in precision spraying equipment. Smart Apply developed the Intelligent Spray Control System™, an upgrade that enhances the performance of air-blast sprayers used in agricultural applications like orchards and vineyards. The system aims to improve spraying precision, reduce chemical use, and support sustainability efforts. This acquisition expands Deere's footprint in smart agriculture, focusing on technology that increases efficiency and minimizes environmental impact.

Smart Agriculture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Agriculture Types Covered | Precision Farming, Livestock Monitoring, Smart Greenhouse, Others |

| Offerings Covered | Hardware, Software, Service |

| Farm Sizes Covered | Small, Medium, Large |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AG Leader Technology, AGCO Corporation, AgJunction Inc. (Kubota Corporation), CLAAS KGaA mbH, CropMetrics LLC (CropX inc.), Deere & Company, DICKEY-john, Farmers Edge Inc., Gamaya, Granular Inc. (Corteva Inc.), Raven Industries Inc. (CNH Industrial N.V.), Trimble Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart agriculture market from 2020-2034.

- The smart agriculture market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart agriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Smart agriculture refers to the use of advanced technologies like IoT, AI, robotics, and data analytics to enhance farming efficiency, productivity, and sustainability. It involves precision farming, automated irrigation, remote sensing, and real-time monitoring to optimize resource use, reduce waste, and adapt to environmental and market challenges effectively.

The smart agriculture market was valued at USD 18.7 Billion in 2024.

IMARC estimates the global smart agriculture market to exhibit a CAGR of 7.9% during 2025-2033.

The key factors driving the market are the rising global demand for food, the need for efficient resource utilization, and the widespread adoption of IoT and AI technologies. Factors like government support for sustainable farming, advancements in precision farming tools, labor shortages, and growing awareness of climate-resilient agricultural practices further propel market growth.

According to the report, precision farming represented the largest segment by agriculture type, driven by its ability to optimize resource use, increase crop yields, and reduce costs through data-driven decision-making and advanced technologies like sensors, GPS, and AI.

Hardware leads the market by offering owing to devices like sensors, drones, GPS systems, and automated machinery that form the backbone of data collection and implementation for precision farming and monitoring.

The medium is the leading segment by farm size, driven by their ability to balance investment in advanced technologies with scalable returns, making it financially feasible to adopt precision farming tools for improved productivity and efficiency.

North America held the largest market share of over 44% in the smart agriculture market in 2024.

Some of the major players in the global smart agriculture market include AG Leader Technology, AGCO Corporation, AgJunction Inc. (Kubota Corporation), CLAAS KGaA mbH, CropMetrics LLC (CropX inc.), Deere & Company, DICKEY-john, Farmers Edge Inc., Gamaya, Granular Inc. (Corteva Inc.), Raven Industries Inc. (CNH Industrial N.V.), Trimble Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)