Smart Grid Data Analytics Market Size, Share, Trends and Forecast by Solution, Deployment, Application, End Use Vertical, and Region, 2026-2034

Smart Grid Data Analytics Market Size and Share:

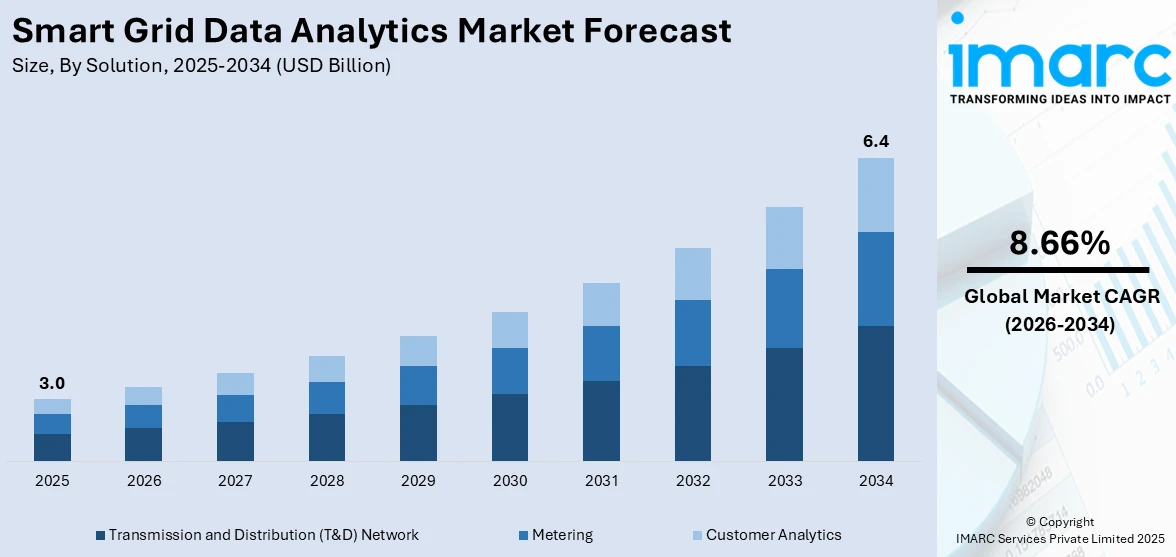

The global smart grid data analytics market size was valued at USD 3.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.4 Billion by 2034, exhibiting a CAGR of 8.66% during 2026-2034. North America currently dominates the market in 2025. Growing use of digital meters, real-time monitoring tools, and IoT devices is driving demand for advanced grid systems. In addition, supportive policies and renewable integration continue to strengthen global smart grid data analytics market share, helping utilities boost reliability and manage modern energy challenges.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.0 Billion |

|

Market Forecast in 2034

|

USD 6.4 Billion |

| Market Growth Rate 2026-2034 | 8.66% |

Utilities worldwide now rely on connected devices to keep grids stable and efficient. Real-time data from smart meters and sensors helps operators detect faults and reduce energy loss. This growing shift toward digitized networks supports market growth. Many countries see smart analytics as essential for meeting carbon goals and managing renewables. Better monitoring means fewer outages and faster fixes. Digital tools also help spot power theft and balance loads during peak hours. Cloud services handle huge data streams, giving operators clear reports and forecasts. Utilities are teaming up with software providers for systems that match local needs. Governments back these efforts through grants and pilot programs that test advanced grid models. Recent upgrades show digital substations and remote tracking cutting maintenance costs.

To get more information on this market Request Sample

In the United States, smart grid data systems have gained traction as more renewable energy feeds into local grids. Wind and solar power can change output quickly, which makes a steady supply harder to manage. Smart analytics help operators balance shifting supply with real-time demand. Many states now run programs that adjust household or industrial usage to ease strain during busy hours. These tools also guide how extra power gets stored or rerouted to where it is needed most. Recent upgrades link solar farms with advanced control centers that forecast changes in output. This means fewer gaps and less need for backup fossil fuels. Companies use real-time data to plan storage, manage electric vehicle charging, and spot weak links before they cause outages. New federal funding has encouraged utilities to modernize old lines and invest in secure data networks.

Smart Grid Data Analytics Market Trends:

Rising Demand and Tech Integration

The steady rise in demand from utility companies worldwide is helping push the smart grid data analytics market forward. These analytics tools help providers study load patterns, run grids more efficiently, reduce blackouts, and plan better. In India, rising temperatures have made power cuts a daily struggle for many families, with a 2025 survey showing that 38% of households faced daily outages. To tackle this, more people are using smart meters to track and control their electricity use, which is boosting the market. Alongside this, new technologies like IoT are making energy delivery safer and more reliable. The rollout of advanced metering infrastructure (AMI) is also cutting costs for utilities and letting them read meters remotely, which speeds up billing and improves accuracy. Other factors include stronger investment in research, growing smart city projects, and government programs encouraging renewable energy use. Recent funding commitments—like over USD 3 Billion for smart grids, USD 84.6 Million for geothermal energy, and USD 2.15 Billion for carbon capture—are also supporting this shift to smarter, cleaner power networks.

Push for Smarter Grid Operations

The market is seeing steady progress as energy companies upgrade how they handle data and daily operations. Utilities are moving away from outdated manual checks and shifting to systems that track grid conditions instantly. This shift is helping them use data to make quicker fixes, balance loads, and run networks more smoothly. Many cities and countries now view smart grids as necessary for reliable supply and cost control. For instance, in December 2024, the Dubai Electricity and Water Authority revealed a USD 1.9 Billion plan to expand its smart grid by 2035. This plan added momentum by using automated controls and IoT tools to monitor power and water flows nonstop. When utilities have stronger data tools, they can react faster to sudden faults, stop waste, and plan for peak demand. This trend is giving regions better control over resources while meeting growing energy needs. As older grids age out, demand for smart solutions that bring clear insights and remote controls is expected to keep rising, pushing companies to invest more in smart grid data analytics year after year. Furthermore, these factors are positively contributing to the global smart grid data analytics market trends.

Stronger Grids for Weather Shifts

Weather extremes and the growth of renewables are pushing grid managers to rely more on advanced data tools that keep supply steady when conditions shift quickly. As more clean energy comes online, networks must handle sudden output changes while keeping homes and businesses connected without blackouts. Real-time monitoring and predictive checks make this balance possible, cutting risks during storms or high-demand days. Many regions now see better data systems as the answer to climate-related power problems and aging equipment. For instance, in October 2024, Schneider Electric introduced new smart grid solutions at Enlit Europe to improve grid strength and handle unpredictable demand. This rollout supported the market by adding better forecasting and smoother renewable links so operators could adjust output with less delay. By connecting live data feeds with AI models, utilities can fix weak spots early and stop faults from spreading. These steps help grids run reliably through bad weather and rising energy use. As more companies take up these upgrades, they lay the groundwork for adding more renewables while keeping supply steady, which is expected to keep boosting the global smart grid data analytics market growth in the years ahead.

Smart Grid Data Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart grid data analytics market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on solution, deployment, application, and end use vertical.

Analysis by Solution:

- Transmission and Distribution (T&D) Network

- Metering

- Customer Analytics

As per the smart grid data analytics market outlook, in 2025, the transmission and distribution (T&D) network segment led the market, driven by the growing push to upgrade aging grid systems with digital tools that improve fault detection and load balancing. Utilities focused on advanced sensors and real-time monitoring to reduce losses and improve supply efficiency. Strong government funding supported upgrades to critical infrastructure, especially in regions with frequent power cuts. Companies also used data analytics to predict demand spikes and manage peak loads, helping them maintain stable supply and avoid blackouts. Better grid performance through analytics meant faster response to faults and shorter downtime for repairs. This encouraged more utilities to invest in systems that connect smart meters, field devices, and control centers under one platform. These improvements kept operational costs under control and improved customer satisfaction, making the T&D segment a strong driver for smart grid data analytics growth.

Analysis by Deployment:

- Cloud-based

- On-premises

In 2025, the on-premises segment led the market, as many utilities and energy firms chose to keep control over their critical data. Cybersecurity concerns were a main factor, pushing operators to install in-house servers and analytic tools that run within their private networks. On-premises setups also offered better control over system upgrades and customization, which suited large utilities managing complex grid structures. Many companies with sensitive consumer usage data preferred physical control rather than depending on third-party cloud providers. Compliance with strict local regulations around data privacy added to this choice, especially in regions with tight rules on cross-border data sharing. Some utilities with legacy IT systems also found it easier to connect on-premises analytics to their existing setups. This deployment gave them reliable speed and minimized risk of downtime from external network failures, keeping service steady and customers satisfied while ensuring strong control over data flows.

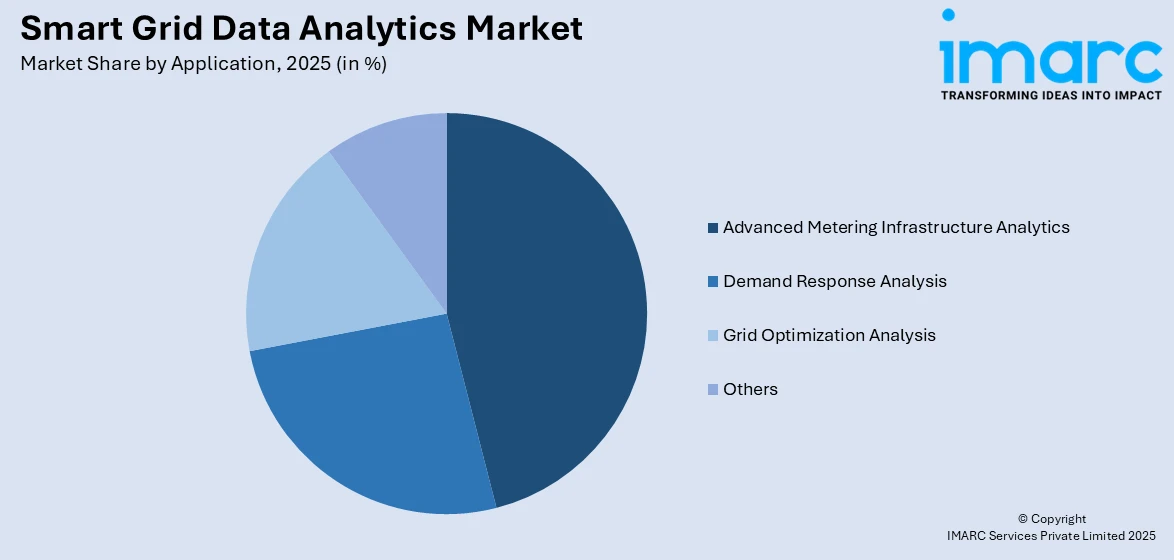

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Advanced Metering Infrastructure Analytics

- Demand Response Analysis

- Grid Optimization Analysis

- Others

Advanced metering infrastructure analytics helped the market grow by giving utilities clear, real-time details on how energy is used across households and businesses. By reading millions of smart meters at short intervals, companies could find losses, check for meter tampering, and better plan for high-demand periods. This steady flow of data also supported new pricing options, allowing providers to reward off-peak use and help people lower bills. Being able to spot unusual spikes or drops in usage early helped reduce faults and service calls. Utilities saw lower manual work costs and better customer trust.

Demand response analysis supported the market by letting energy companies react fast when demand threatened to outpace supply. By studying real-time consumption, utilities could quickly ask big users or groups to lower or shift power use during peak hours. This reduced strain on the grid without building extra capacity. Many households and industries joined these programs for rebates or bill credits. Automated demand response tools made the process smooth and reliable. Companies found this approach cost-effective for handling sudden spikes, which strengthened confidence in expanding demand response analytics and related tools.

Grid optimization analysis added value to the market by helping utilities get the most out of existing networks. Detailed monitoring and clear reports allowed operators to find weak points, balance voltage levels, and keep losses down. By spotting patterns early, companies could fix or replace parts before failures caused bigger outages. Load planning tools helped match energy flow to daily or seasonal changes, keeping supply steady. Reliable grid performance built trust with regulators and customers. Savings from fewer outages and lower losses encouraged more spending on digital grid tools and system upgrades.

Other areas, like outage tracking, asset checks, and linking clean energy, also pushed the market forward. Outage analytics gave faster ways to find faults and restore power quickly. Keeping a close watch on equipment health helped companies repair or swap parts before they failed, saving money on emergency work. Tools that balance solar or wind input with local use made adding renewables smoother. Cyber tools to monitor threats became more common, helping keep networks safe. Together, these extra uses gave grid operators practical ways to run tighter, safer, and cleaner systems.

Analysis by End Use Vertical:

- Private Sector (SMEs and Large Enterprises)

- Public Sector

In 2025, the private sector (SMEs and large enterprises) segment led the market, driven by higher investment in modern energy management. Private firms have pushed for smart solutions to lower costs and run operations more efficiently. Large energy companies adopted analytics to monitor generation and distribution with better accuracy. Small and mid-sized players, looking to reduce overheads, used data-driven tools to spot waste and fine-tune consumption patterns. Competitive markets encouraged private operators to offer customers flexible plans based on smart meter insights. Many private utilities also invested in predictive analytics to reduce faults and plan maintenance more effectively, saving both money and time. Digital dashboards and real-time reporting tools made it easier for managers to act fast on network conditions. Strong private investment in innovation and the freedom to trial new models put this sector ahead, keeping it at the front of smart grid data analytic adoption.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the smart grid data analytics market forecast, in 2025, the North America led the market, driven by strong technology adoption and major upgrades to grid infrastructure. Utilities across the United States and Canada continued to modernize old transmission lines and distribution setups with real-time data tools. Funding support and federal policies backed projects that improved grid security and integration with renewable energy. Local governments encouraged partnerships between technology providers and power companies to roll out smart meters, IoT devices, and AI-based monitoring platforms. The region’s strong focus on digital security made it easier for utilities to handle the huge amount of usage and weather data needed for efficient grid management. High demand for reliable electricity and more renewable sources on the grid pushed operators to use analytics for load balancing and fault detection. North America’s large base of skilled tech firms and advanced research helped keep it ahead in smart grid data analytics innovation.

Key Regional Takeaways:

United States Smart Grid Data Analytics Market Analysis

The United States smart grid data analytics market is seeing strong expansion, supported by the country’s clear focus on upgrading grid systems and cutting energy waste. Rapid adoption of advanced metering infrastructure (AMI) and distributed energy resources (DERs) is raising the need for near real-time analytics to enhance how power is distributed and used. Data shows that 362 grid modernization steps were taken in Q1 2025, showing a nationwide drive toward smarter, data-led infrastructure. More spending on demand response programs and adding renewables is increasing the use of analytics tools for accurate load forecasting and improved grid performance. In addition, the push for lower emissions and transport electrification is driving utilities to apply analytics for balancing loads and improving planning. A solid digital backbone supports wide adoption of cloud-based, scalable analytics platforms. National policies promoting open data and smart infrastructure upgrades are creating good ground for technical advances. The use of artificial intelligence (AI) and machine learning (ML) in utility analytics is helping the move toward more automated, self-adjusting grid networks.

Europe Smart Grid Data Analytics Market Analysis

The Europe smart grid data analytics market is developing steadily, helped by ambitious net-zero goals and modern energy rules. The shift to a low-carbon economy is pushing utilities to make greater use of analytics to handle variable renewable sources and grid swings. According to the International Energy Agency (IEA), the Commission estimates around USD 633 Billion will be spent on grids by 2030, with about USD 184 Billion for digital work, smart meters, and automated grid systems. More electric heating use and storage solutions drive a greater need for flexible demand management with real-time data. Advances in digital twin technology allow utilities to model grid behavior and plan upkeep through predictive tools. Europe’s rising clean energy drive, growing smart home use, and cross-border energy sharing strengthen local analytics networks, producing detailed user data for utilities and boosting grid links and market efficiency.

Asia Pacific Smart Grid Data Analytics Market Analysis

In Asia Pacific, the smart grid data analytics market is gaining fast momentum, driven by growing cities and climbing electricity use. The wide rollout of smart meters is producing massive amounts of data, leading utilities to boost spending on analytics to monitor usage in real time and keep grids running well. Under India’s Smart Meter National Program, over 8.6 Million smart meters were installed by April 2024, with a goal of 250 Million by 2025. The growth of microgrids in rural and hard-to-reach places is creating new demand for local analytics that help keep power steady and quality high. Strong industrial growth is also pushing utilities to add modern analytics for better energy efficiency checks and clearer demand pattern tracking. Flexible pricing and time-based tariffs lead providers to turn to predictive analytics for better managing customer loads. Mobile apps and digital tools are helping promote better energy choices backed by data.

Latin America Smart Grid Data Analytics Market Analysis

The Latin American smart grid data analytics market is picking up pace, driven by plans to spread reliable electricity and upgrade grid systems in areas still lacking stable access. Countries across the region are bringing in smart technologies that improve spotting outages and pinpointing faults by tapping into live grid data. Current reports show Mexico aims to reach 30.2 Million smart meters by 2025, which will greatly grow the amount of detailed grid data available. Decentralized generation, especially for rural and remote areas, is raising the need for local analytics tools that manage scattered loads well. A rise in consumer awareness about energy savings is leading utilities to use customer-facing platforms backed by analytics to encourage more efficient energy habits. These changes are helping drive wider use of data-driven systems that support grid improvements and stable supply across Latin America.

Middle East and Africa Smart Grid Data Analytics Market Analysis

The smart grid data analytics market in the Middle East and Africa is growing steadily, supported by expanding smart city plans and digital upgrades throughout utilities. Stronger focus on managing the water-energy link better is leading to more use of analytics for improved resource use. Studies show Saudi Arabia’s smart infrastructure could reach USD 14,745.2 Million by 2027, showing the region’s growing reliance on smart grid solutions. Bigger renewable energy sites bring fresh data needs, and analytics help grids stay stable as more green power comes online. Governments and utilities in the region are putting data insights to work to plan grid expansion and cut energy losses during transmission, helping create a more data-based and efficient energy system that meets the area’s unique challenges and development needs.

Competitive Landscape:

Companies in the smart grid data analytics market are developing practical tools to meet new technical challenges and handle growing amounts of grid data. They are applying advanced analytics to transform raw network information into useful findings that help operators run systems more efficiently. Many are improving how separate grid software and hardware communicate, so data moves smoothly between devices and control centers without delays or gaps. Some firms are upgrading remote monitoring and control features, allowing utilities to oversee grid conditions and fix problems from a distance. Others are working closely with energy companies to shape digital plans that match business targets, helping cut downtime, manage resources wisely, and deliver steady, reliable power.

The report provides a comprehensive analysis of the competitive landscape in the smart grid data analytics market with detailed profiles of all major companies, including:

- GE Vernova

- Grid4C

- Itron Inc.

- Landis+Gyr

- Oracle Corporation

- SAP SE

- Schneider Electric

- Sentient Energy, Inc.

- Siemens AG

- Tantalus

- Xylem

Latest News and Developments:

- June 2025: Itron, Inc. signed a contract with Hellenic Electricity Distribution Network Operator S.A. (HEDNO) to enhance grid edge intelligence in Greece. Itron’s AMI and MDM solutions will enable HEDNO to offer real-time insights, improve grid efficiency, and integrate more distributed energy resources, aligning with the operator's long-term goal of net-zero emissions by 2050.

- June 2025: Tantalus Systems announced that the Indiana Municipal Power Agency (IMPA) will deploy Tantalus’ AI-powered TRUGrid Reliability and TRUGrid Transformer. This large-scale rollout marks the company’s first AI-based analytics deployment across a Joint Action Agency, aimed at enhancing reliability and efficiency for IMPA's member utilities.

- April 2025: G&W Electric invested in Safegrid to strengthen smart grid monitoring and predictive fault technologies. This move supported the smart grid data analytic market by combining wireless sensors and cloud analytics, helping utilities detect faults faster, boost reliability, and handle grid stress more effectively.

- March 2025: Grid Dynamics launched its IoT Control Tower to help industries analyze real-time data from equipment and facilities using AI and machine learning. This supported the smart grid data analytic market by improving predictive insights, cutting response times, and boosting efficiency for energy and industrial operators.

- February 2024: Itron, Inc. and GE Vernova have partnered to unify grid edge and grid operations data, providing utilities with real-time insights for a more reliable, resilient grid. This collaboration is designed to address the challenges posed by renewables, electric vehicles, capacity constraints, and increasing grid complexity.

- February 2025: AFREC launched an online smart grid training for over 60 African energy professionals. This supported the smart grid data analytic market by building local skills in data analysis, grid optimization, and modern energy management, helping African networks become more resilient and efficient.

Smart Grid Data Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Transmission and Distribution (T&D) Network, Metering, Customer Analytics |

| Deployments Covered | Cloud-based, On-premises |

| Applications Covered | Advanced Metering Infrastructure Analytics, Demand Response Analysis, Grid Optimization Analysis, Others |

| End Use Verticals Covered | Private Sector (SMEs and Large Enterprises), Public Sector |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | GE Vernova, Grid4C, Itron Inc., Landis+Gyr, Oracle Corporation, SAP SE, Schneider Electric, Sentient Energy, Inc., Siemens AG, Tantalus, Xylem, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart grid data analytics market from 2020-2034.

- The smart grid data analytics market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart grid data analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart grid data analytics market was valued at USD 3.0 Billion in 2025.

The smart grid data analytics market is projected to exhibit a CAGR of 8.66% during 2026-2034, reaching a value of USD 6.4 Billion by 2034.

The smart grid data analytics market is driven by the push for efficient energy management, growing renewable integration, and rising investment in advanced metering systems. Utilities focus on real-time monitoring and predictive tools to cut losses, prevent outages, and handle modern grid demands smoothly.

In 2025, North America dominated the smart grid data analytics market, driven by large-scale smart meter rollouts, strong government funding, and early adoption of digital grid upgrades. Regional utilities use advanced analytics to balance demand, boost reliability, and support increasing renewable power connections across urban and rural networks.

Some of the major players in the global smart grid data analytics market include GE Vernova, Grid4C, Itron Inc., Landis+Gyr, Oracle Corporation, SAP SE, Schneider Electric, Sentient Energy, Inc., Siemens AG, Tantalus, and Xylem.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)